EPF is the acronym for the Employees’ Provident Fund, which is beneficial to the employees, as every day, all the retirement benefits start getting accumulated in the EPF account. There is a certain process to register in the EPF and get the certificate from the EPF online portal.

The Employees’ Provident Fund or EPF is a scheme for the benefits of an employee. Every month, both the employee and the employer keep some amount of money in the EPF so that future retirement benefits can be insured. The rules for EPF registration certificate point out that if in any concern or in a private or a public company, if there are more than twenty employees, then the company is liable to have the EPF facility. It is about the post-retirement future of the employee. This is a scheme operating under the Employees’ Provident Funds and also falls under the Miscellaneous Provisions Act of 1952. The EPFO manages this.

The EPFO generally consists of three different schemes including the Employees’ Provident Fund Scheme, the Employees’ Pension Scheme and the Employees’ Deposit Linked Insurance Scheme. Each has its own facility and each caters to the overall economic development of the employee in numerous ways.

There is a certain rule about drawing amounts from the EPF. All those employees whose monthly income is more than 15,000 per month are not eligible to go under the EPF scheme. Only if they have an income of less than 15,000, then they are eligible for the scheme. The employee who has less than 15,000 monthly income, mandatorily should become a part of the EPF. They must go through the EPF registration process to get their names enrolled on EPF.

How to Register to get EPF Registration Certificate online?

For EPF registration certificate, one can go through the following points:

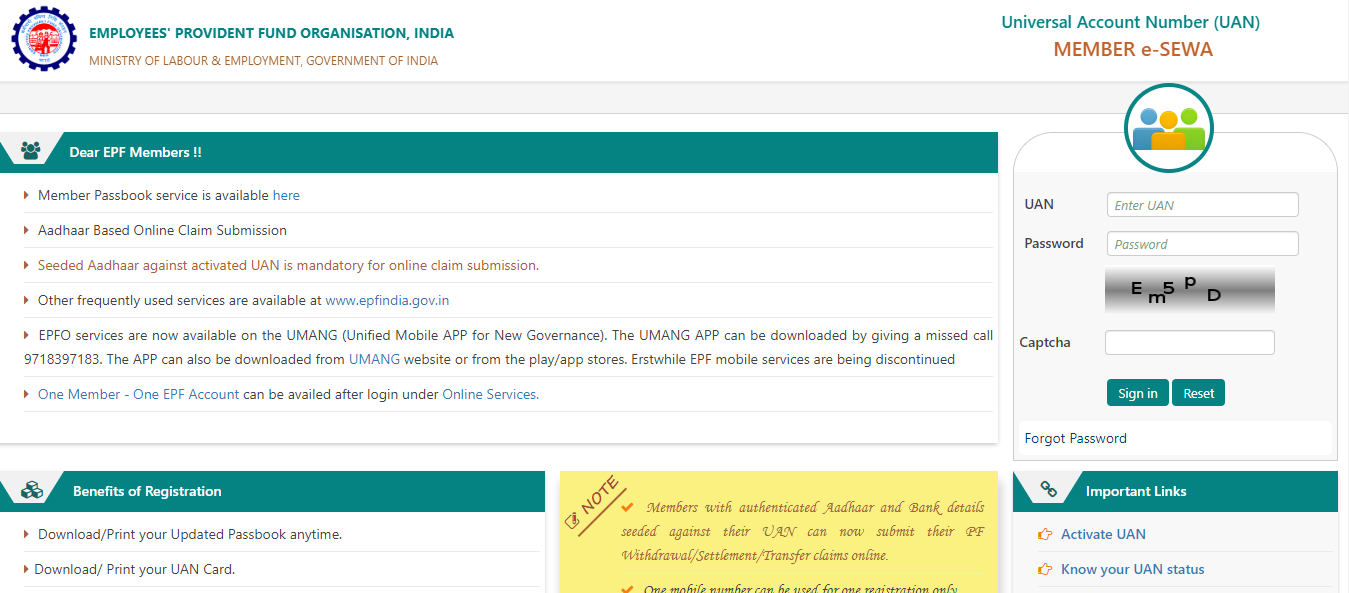

- The member should first go to the EPFO website – https://unifiedportal-mem.epfindia.gov.in/ and then check out the member portal. Go and click on the member portal listed under the ‘for employees’ part, and then do the rest of the work.

- After this, there is the ‘register’ button with which you can continue. While registering, one can go for the uploading of all the major government documents like address proof, income proof etc.

- If one is registering as a company, then one has to click on the ‘establishment registration’ and finish the rest of the processes accordingly. after this, the applicant needs to download the user manual to get guided to the further steps.

- After this, the company can register in the ‘shram suvidha portal’ related to the EPFO. After that, the signing-up process can be done. The applicant company can fill-up the form after that, go for checking the tab that is meant for ‘registration for EPFO-ESIC v1.1 and then ‘apply for the new registration.’

- While applying for this new registration, there are two options that one gets- one is the Employees’ Provident Fund and Miscellaneous Provision Act 1952’ and another is the Employees’ State Insurance Act of 1948. If one is the employer of a company, then he needs to select the first one. After this, there is the submit button that appears, and one can find the display of the page called the ‘Registration Form for EPFO’ that gets displayed. All the details about the branch and the division, employee and employment details, major contact of the professionals, all the details about when the office or the company was set up etc. Along with that, the activities of the company should also be underlined properly.

- Finally, the digital signature of the employer needs to be uploaded after this. The employer gets a notification from the Unified Shram Suvidha Platform that all the documents have been submitted along with the digital signature on them, and that the EPF registration has been successful.

- Before one applies for the EPF registration, one should check out the services that the EPFO offers. This includes the online withdrawal of EPF, helpdesk creation for those accounts that have been lying dormant for a long time, online PF payment, SMS and missed call alert systems, grievance about EPF, interest rates etc. Apart from this, the EPFO also helps numerous offices to register themselves online. You can check out the helplines to know more.

Eligibility and Ineligibility for Availing EPF and EPF Registration

You can go through the eligibility and the ineligibility criteria before you want to know more and invest a certain amount in the EPF. The EPF registration comes later, first of all, you need to check whether at all you are eligible for it:

- If any employee in an institute, company or organization draws a monthly salary that is less than 15,000, then that employee automatically falls under the category of EPF. It is mandatory for an income group like them.

- If a company or an organisation has more than 20 employees, then it is mandatory for the company to register itself for the EPF scheme.

- If organisations that have less than 20 employees also want to join the EPF scheme, they can do that voluntarily.

- The Assistant PF Commissioner has all the authority to give permission to any employee who wants to apply for EPF registration if the employee’s salary is more than 15,000 and yet he/ she wants to apply for EPF.

- In India, the domains of Jammu and Kashmir are not kept within the purview of the EPF scheme. Barring that, all other states and territories can avail the EPF benefits.

Find out how much money will be in your EPF account by the time you retire by using the EPF calculator on Vakilsearch.

Conclusion

One can find that there are multiple benefits of having an EPF account. Apart from the tax benefits under section 80C that one is entitled to, there is also the enjoying of the lifetime pension that can sustain one’s household even after one retires. From the EPF, there is always the facility of withdrawing funds through 15g PF form, as and when required during an emergency. There can be cases of employee home loans or medical issues that might allow him/ her to draw an amount from the Employees’ Provident Fund. If there is a requirement for a loan, then also the employee is entitled to take a loan from the EPF account. The rate of interest is low as compared to other sources, and the interest rate is also not quite high as compared to other schemes.

Moreover, with proper EPF registration, an employee can get around 7 lakhs of free insurance if he/she dies during his/ her working period in the office. There were multiple revisions that were made several times to the EDLI scheme. Hence, if one completes the EPF registration, one is entitled to numerous benefits as mentioned above. For more information related to EPF registration, you can get in touch with Vakilsearch.

Read more: