In 1976, the government introduced the Employees Deposit Linked Insurance Scheme (EDLI), a form of insurance. Read this blog to know more about the EDLI Scheme in detail.

Overview

In 1976, the government introduced the EDLI full form (Employees Deposit Linked Insurance Scheme), a form of insurance. The purpose of this programme was to make social security benefits available to private sector employees for whom employers did not frequently offer them. The Employees Provident Fund Organization (EPFO) now manages and oversees the EDLI programme, which offers term life inswurance coverage on the life of the participant employee.

How Does the EDLI Programme Operate?

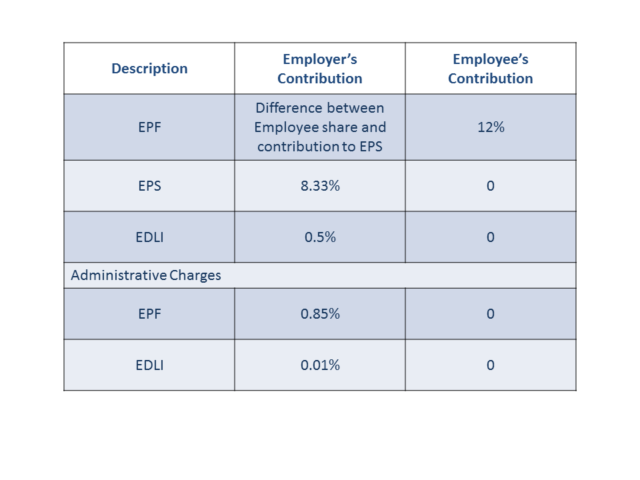

Organisations that qualify for the EPF also qualify for the EDLI. When an EPF account contribution is made, the employer also makes a monthly contribution to the EDLI scheme. The following are the EDLI charges in PF:

Employer’s contribution is 12% of the employee’s basic pay plus a dearness allowance, which is divided as follows:

3.67% will go to the EPF Account; 8.33% will go to the EPS (Employees’ Pension Scheme), up to a maximum of ₹1250; and 0.50% will go to the EDLI Account, up to a maximum of ₹75.

The business has the option of purchasing group life insurance on the lives of its employees. In that instance, the coverage offered by the group life insurance plan should be on par with or greater than what is offered by the EDLI plan. Additionally, the employer is free to reject the EDLI programme. However, the EDLI contribution ceiling can be increased if the company does not choose the group life insurance scheme. In the absence of a group life insurance plan for employees, the employer may make a monthly contribution of up to ₹15,000 to the EDLI scheme.

The danger of premature death is covered once an Employees Deposit Linked Insurance Scheme is in effect. A fixed amount of financial reward is provided to the employee’s family to make up for the monetary loss they have suffered in the event that the employee passes away while he or she is a participant of the EDLI plan.

EDLI Contribution:

The EDLI (Employees’ Deposit Linked Insurance) scheme is a life insurance scheme provided by the Employees’ Provident Fund Organization (EPFO) in India. Under this scheme, employers are required to contribute a certain percentage of the employees’ salary to the EDLI fund.

- Employee Provident Fund (EPF): The employee and the employer contribute 12% of the employee’s basic salary + dearness allowance to the EPF. Of the employer’s contribution, 8.33% goes towards the Employee Pension Scheme (EPS).

- Employee Pension Scheme (EPS): Employees contribute 0.5% of their salary towards EPS. The employer contributes 8.33% of the employee’s basic salary + dearness allowance towards EPS.

- Employees’ Deposit-Linked Insurance Scheme (EDLI): The employer contributes 0.5% of the employee’s monthly salary towards EDLI.

EDLI Form 5IF

Form 5 IF is a declaration form that the employer fills in to declare the details of the eligible employees for the EDLI scheme. This form also contains the details of the nominee or beneficiaries of the employee in case of their unfortunate demise.

EDLI Calculation

The EDLI benefit amount is calculated based on the average balance of the employee’s Provident Fund (PF) account 12 months before their death. The benefit amount is 30 times the average monthly balance subject to a maximum of ₹7 lakhs. For example, if the average monthly balance of the PF account is ₹50,000, the EDLI benefit amount will be 30 times ₹50,000, which is ₹15 lakhs. However, since the maximum benefit amount is capped at ₹7 lakhs, the employee’s nominee will receive ₹7 lakhs as the EDLI benefit amount.

Characteristics of the Employees Deposit Linked Insurance Program

The following are significant EDLI Scheme characteristics that you should be aware of:

- EDLI contributions are paid by the employer, not the employee. Thus, all employees are free to participate in the programme.

- Since the programme is a component of something like the Employees Provident Fund, it is available to all employees who hold an EPF account.

- The EDLI programme offers coverage for the insured employee’s untimely death. Anytime and everywhere a person dies would be covered.

Benefits Provided by the EDLI Scheme Programme

The coverage, which would be paid upon the death of the employee, is calculated according to the EDLI Scheme formula as follows:

- 30 * The employee’s average monthly pay for the previous 12 months, up to a maximum of ₹15,000

- Also paid with the coverage is a bonus of ₹2.5 lakhs (raised from ₹1.5 lakhs having effect from September 2020).

- So, if the pay is greater than ₹15,000, the overall benefit will be as follows:

- 30 * 15,000 + 150,000 = 7 lakhs

- The benefit payable under the EDLI insurance would be as follows if the salary is less than ₹15, 000, let’s say ₹10,000:

- (30 * 1000) + (250 000) = ₹5.5 lakhs

Salient Features of EDLI:

- Coverage: The scheme provides life insurance coverage to employees who are members of the Employees’ Provident Fund (EPF).

- Employer Contribution: Employers are required to contribute 0.5% of the employee’s salary (up to a maximum of Rs. 75) towards the EDLI fund.

- Insurance Coverage: The insurance coverage provided under the EDLI scheme is a multiple of the average balance in the employee’s account, subject to a maximum limit.

- Maximum Coverage: The maximum insurance coverage under the scheme is currently set at Rs. 7 lakh.

- Nomination: Employees can nominate their family members to receive the insurance amount in the event of their death.

- No Separate Premium: Unlike traditional life insurance plans, employees do not need to pay any separate premium for the EDLI scheme.

How Does the EDLI Scheme Work?

Under the EDLI scheme, a certain percentage of the employee’s salary is contributed by the employer towards the EDLI fund. The contribution is based on the basic wages and dearness allowance of the employee. The accumulated amount in the EDLI fund is then used to provide life insurance coverage to the employees.

In the unfortunate event of an employee’s death while being a member of the EPF, the nominee or legal heir of the deceased employee can claim the insurance amount. The claim amount is calculated based on the average balance in the employee’s account subject to the maximum coverage limit.

How do I Submit a Claim for EDLI Scheme?

The nominee or the employee’s legal heirs would get the benefits of the plan if the employee passed away while a member of EDLI.

The actions listed below should be taken in order to collect the benefit there under the Employees Deposit Linked Insurance Scheme:

- The claimant or claims must fill out and submit Form 5 IF.

- The employer must sign the form and certify that the employee participated actively in the EPF programme. However, if the employer is unavailable or not present, the form must be attested by approved parties, who may be one of the following:

- The management of the MP Bank or local MLA where the employee has a bank account

- Magistrate

- a commissioned officer

- An EPF, CBT, or another regional committee member who is a postmaster or subpostmaster

- The regional EPF Commissioners Office should receive Form 20 to withdraw an employee’s EPF, Form 10C/D to claim benefits from all employee benefit programmes, and other supporting documentation.

- The EPF commissioner would verify the provided documentation, and payment would be made within 30 days.

- In the event that the claim is delayed, interest will be due. For every day the claim is delayed up until the date it is actually paid, interest will accrue at a rate of 12% annually.

Eligibility

The following requirements must be met for employees to be enrolled in the programme and get coverage under EDLI:

- This programme is open to employees with basic salaries up to ₹15,000 per year. If the employee’s salary exceeds ₹15,000, the cover’s maximum benefit payment is capped at ₹6 lakhs.

- Employers with more than 20 employees should choose the Employees Deposit Linked Insurance programme.

Documents Required for EDLI Claim

The nomination or the employee’s legal heir must also present the following paperwork in order to file a claim, in addition to the forms that are required:

- Employee’s death certificate.

- If the legal heir is pursuing the claim, a succession certificate.

- If a claim is being submitted on behalf of a child by someone who is not the minor’s natural guardian, a copy of the cancelled check for the bank account in which the claims should be credited, along with a guardianship certificate.

5 Importance of the EDLI Scheme

Procedure: How to Claim EDLI?

- Obtain the Claim Form: The claimant, who is the nominee or legal heir of the deceased employee, needs to obtain the EDLI claim form, which is Form 5 IF. The form can be obtained from the nearest EPFO office or downloaded from the EPFO website.

- Fill the Claim Form: The claimant should carefully fill out the claim form with accurate and complete information. The form requires details about the deceased employee, the claimant, and the bank account details where the claim amount will be credited.

- Attach Required Documents: The claimant must attach the necessary documents along with the claim form. These documents typically include:

- Death certificate of the employee

- Legal proof of the claimant’s relationship with the deceased employee, such as a legal heir certificate or succession certificate

- Claimant’s identification proof, such as Aadhaar card, PAN card, or voter ID

- Cancelled cheque or bank passbook copy of the claimant’s bank account

- Submit the Claim: Once the claim form is filled and all the required documents are attached, the claimant needs to submit them to the EPFO office responsible for processing EDLI claims. The claim can be submitted in person or through post/mail, depending on the instructions provided by the EPFO office.

- Verification and Processing: The EPFO will verify the claim and the submitted documents. If all the information and documents are found to be in order, the EPFO will initiate the processing of the claim. The claim amount will be calculated based on the average balance in the employee’s account, subject to the maximum coverage limit.

- Payment of Claim Amount: After the verification and processing are completed, the EPFO will transfer the claim amount to the bank account provided by the claimant. The claimant will receive the insurance amount as per the terms and conditions of the Employees Deposit Linked Insurance scheme.

Conclusion

You can be guided through every step of knowing about the EDLI Scheme by the legal experts at Vakilsearch. Also, if you need any kind of legal assistance in India, do not forget to contact us today.

FAQ’s

Who is eligible for the EDLI scheme?

The EDLI (Employee Deposit Linked Insurance) scheme is available to all employees who are members of the Employees' Provident Fund (EPF) scheme. This includes employees in both organized and unorganized sectors as long as they contribute to the EPF scheme.

What is the EDLI scheme?

The EDLI scheme is an insurance scheme that provides life insurance coverage to EPF members in case of their untimely death. The scheme is administered by the Employees' Provident Fund Organization (EPFO) and is funded through contributions made by employers to the EPF scheme.

How is the PF EDLI amount calculated?

The Employees Deposit Linked Insurance benefit amount is calculated as a multiple of the average balance in the employee's EPF account during the preceding 12 months. The current multiple for calculating the EDLI benefit is 30, which means that the maximum benefit payable under the scheme is 30 times the employee's average monthly salary.

Is EDLI compulsory?

Yes, EDLI is compulsory for all employers contributing to the EPF scheme on behalf of their employees. Employers must contribute a fixed percentage of their employees' basic wages to the EPF scheme, which includes the premium for the EDLI scheme.

Who can benefit from the EDLI scheme?

The EDLI scheme provides a life insurance cover to the nominee of the EPF member in case of the member's untimely death. The nominee can be any member's family member, including spouse, children, or parents. The benefit is paid directly to the nominee in case of the member's death.

Is there a minimum service period for availing of EDLI?

No minimum service period is required for availing of the benefits of the EDLI scheme. The insurance coverage is available to all EPF members from their joining the scheme. However, the benefit amount payable under the scheme is subject to the balance in the member's EPF account.