Did you know that there are rules and regulations around how to merge PF accounts in India? In order to be able to merge two or more EPFO accounts, you must abide by specific guidelines. In this article, we will discuss the four steps you need to take in order for your process of merging two or more EPFO accounts in India to go smoothly

What Is an EPFO Account

EPFO stands for Employee Provident Fund Organisation and is India’s government-run social security and pension fund. EPFO accounts are used to manage retirement savings, provident fund contributions, and other benefits for employees. Read more to know on how to merge pf accounts.

Requisites for Merging PF Accounts

If you are considering merging your accounts, you need to consider certain things. This includes:

- Completing the Know Your Customer (KYC) process is crucial. This involves verifying your bank account, PAN, and other pertinent details.

- Ensure you possess a UAN connected to your current EPF account.

- After getting your UAN, allow 3 days for its activation before proceeding with the merge.

- Remember, there’s no urgency to consolidate immediately unless necessary. You can always choose to delay it if desired.

Process to Merge PF Accounts in India

How tp merge PF accounts in India? it is simple and can be done online. To merge your existing EPFO accounts, you will need to provide details such as account number, employer name, employee name, and net income earned. You will also need to provide the details of the accounts you want to merge into your existing account. After providing the required information, you will be provided with an account merge form which you will need to complete and submit to EPFO. Once the merged account has been created, you will need to update all your relevant contact information.

How to Merge Two or More EPFO Accounts in India?

More EPFO Merge account into a single account is important to receive the benefits and subsidies available to EPFO members.

Here Are the Steps to Merge PF Accounts:

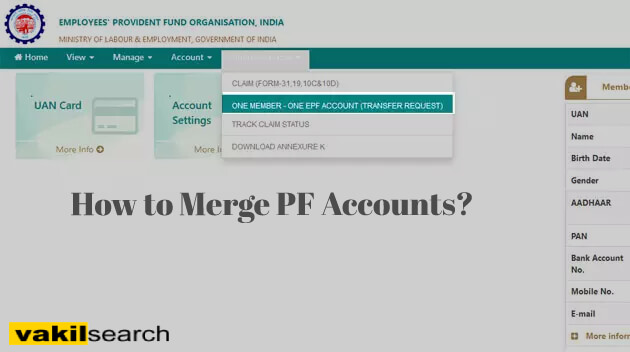

- Go to the EPFO website and sign in. https://www.epfindia.gov.in/site_en/

- On the main page, click on My Account.

- On the My Account page, under Accounts Details, select Merge Accounts.

- On the Merge Accounts page, enter the details of the accounts you want to merge into your new account.

- If you have multiple bank accounts linked with your EPFO accounts, choose which one you want to use as your new active bank account.

- Click on Save and Close.

- Your new merge EPF account will be created and will be activated immediately.

Why Must I Merge Two or More EPFO Accounts in India?

Merge EPF accounts can help you consolidate your finances and improve your organization’s efficiency. Here are some reasons why you might want to merge pf accounts:

- You can consolidate your pension and salary payments into one account, saving you money in the long run.

- You can make it easier to track your expenses and Income Tax Return.

- You can improve your organization’s financial transparency by consolidating all your data in one place.

If you’re thinking of merging your accounts with the Employees’ Provident Fund Organisation (EPFO), here are a few things to bear. First, you must decide who should be responsible for merging the accounts – you, your spouse, or a family member. Second, it’s important to remember that not all EPFO members are required to merge pf accounts. If you’re not required to merge, there’s no need to rush into it – it can wait until later if you still want to consider doing so. Third, ensure that all of the relevant paperwork is ready before starting the process – this includes copies of all your identification documents and proof of address for each account holder. Finally, don’t forget to factor in any administrative charges that may be levied for the process.

Benefits of Merging EPFO Accounts in India

Here are some advantages of merging multiple EPF accounts:

- Cost Savings: Combining two or more EPFO accounts allows for efficient management of pension and salary disbursements through a single account, leading to potential long-term cost savings.

- Simplified Financial Tracking: The process also simplifies the monitoring of expenses and facilitates the filing of income tax returns.

- Improved Financial Transparency: By centralizing all relevant data, the transparency of an organization’s financial records can be enhanced.

- Reduced Complexity: Managing multiple EPFO accounts can be burdensome due to the necessity of keeping track of numerous account numbers, login credentials, and related details.”

Things to Do After Merging

There are many things to do after merging your EPFO accounts in India. Below we have outlined the most important ones.

- Update your details in the online portal. This includes updating your name, Aadhaar number and bank account details. You will also need to update your EPF account number if it has changed.

- Verify your accounts. This will ensure that all your details match and there are no errors. EPFO will also ask for additional information, such as proof of income or residence status if required.

- Activate your insurance cover. This will ensure you are covered for employer pension benefits during the transition period.

- Elect to receive the full or partial pension benefit calculated according to your current pensionable status (full-time employee, part-time employee, casual worker, etc.). You can elect to receive the entire pension or a proportion of it depending on how long you have been with the same employer. The deadline to make this election is typically 6 months after the merger date but can vary depending on the case.

Learn about EPF Calculator.

Conclusion

If you are looking how to merge pf accounts/EPFO accounts in India, there are a few things you need to keep in mind. First, ensure that all the accounts you want to merge have been opened before starting the process. Secondly, make sure that your bank account details and EPFO account numbers match up – otherwise, the merger process will not be able to proceed. Finally, if any of your existing EPFO benefits (such as provident fund) are linked to one of your old accounts, you will need to contact EPFO and update their records before the merger can occur. For more information, contact Vakilsearch today.

FAQ:

What happens when someone has 2 UAN numbers?

Having two active UANs at the same time is against the rules. A member should have only one UAN having all his EPF accounts linked to it. EPF accounts are non-transferrable in case of having multiple UANs.

How can I know my PF account is merged or not?

You can check the status of your PF account merger by logging in to the EPFO portal with your UAN and password. After logging in, go to the 'Online Services' tab and click on 'Track Claim Status'.

What happens if we don't merge PF accounts?

If you don't merge your PF accounts, you may face difficulties in withdrawing your PF balance or transferring it to your new employer. You may also lose out on interest if your PF accounts are not merged.

Can my new employer see my old PF account?

Yes, your new employer can see your old PF account if it is linked to your UAN. They can also transfer your old PF balance to your new PF account.

How much time does it take to merge 2 PF accounts?

Generally, it takes around 20 days from the date of submission to transfer one EPF account to the other.

Do we need Form 13 mandatorily for UAN transfer?

Yes, employees working in the formal sector are required to submit Form 13 for EPF transfer to their new employer.

Can I add a photograph to the UAN card?

Yes, you can add a photograph to the UAN card by logging in to the EPFO portal with your UAN and password. After logging in, go to the 'Manage' tab and click on 'Modify Basic Details'. You can upload your photograph in the 'Upload Photo' section.

Read More: