The RCMC was not a mandatory license to be procured by exporters until early this year. The DGFT had notified that going forward the RCMC license must be furnished by the exporters along with the IEC mandatorily.

When it comes to establishing a business in India, there are several legal compliances that must be adhered to. The same inference applies to trading and import-export companies. The import-export business has several procedures and regulatory compliances involved which are governed by the Foreign Trade (Development and Regulation) Act, 1992. The Act, aims to empower the government to develop guidelines for the regulation of foreign trade. The provisions related to imports and exports are constantly revamped and amended and are put together as the Foreign Trade Policy. Now lets see whether RCMC required for import along with IEC.

There are various prerequisites required to set up an import-export business in India like the IEC (Import Export Code), industrial license, insurance certificate, etc. Amongst these, the Registration-cum-Membership Certificate (RCMC) plays a vital role and is required to be obtained by these businesses. The RCMC License helps exporters and importers to become a member of the Export Promotion Council. The Federation of Indian Export Organizations (FIEO) and the Export Promotion Councils (EPC) jointly issue the RCMC. However, there arises a question as to whether the RCMC must be mandatorily procured by trading companies. To decide that, it is important to understand the significance of RCMC.

Importance of RCMC in Imports:

As the name indicates the RCMC acts both as a registration document and a membership certificate to aid exporters to become members of the EPC. An individual with a valid IEC number will be eligible for making an application for an RCMC license. Alternatively, the importers who do not have an IEC are first required to obtain one and then become certified members of the EPC before procuring the RCMC.

The RCMC license is required to avail the benefits and advantages the Government issues through the EPC. The RCMC license will be needed if the exporter:

- Needs permission to import or export restricted items

- Intends to avail the benefits scheduled by the government under the Foreign Trade Policy or those that are offered by the Customs and Central excise authorities.

The RCMC is required in circumstances where the exporter intends to export two or more products that fall within the ambit of multiple categories and therefore correspond to different EPCs.

IEC and RCMC Go Hand in Hand:

While the IEC code is mandatory for businesses that deal with exports and imports, the RCMC license aids businesses to gain membership into the EPC, especially for those that operate in the shipping industry. RCMC is mainly concerned with exports and not much with imports. Simply put, IEC is concerned with both imports and exports of goods and RCMC is related to exports. Hence both IEC and RCMC are required to carry out import and export activities in India. Although RCMC was not mandatory earlier, having the license helped the business avail several benefits put forth by the government.

Issuance of RCMC:

Various regulatory authorities under the Director General of Foreign Trade (DGFT) such as the EPCs, Export Development Authorities and the Commodity Boards issue the RCMC to the traders. Currently, there are 24 EPCs operating under the Department of Commerce and 5 Statutory Commodity Boards, that are operational in India.

Mandatory Documents to Obtain the RCMC License:

- DD for the payment of the registration fee

- Self-attested copy of the IEC Number and PAN card copy

- Further, a Self-attested copy of the Partnership Deed or Memorandum and Articles of Association

- Self-attested copy of a document that names the manufacturer/exporter

- Details regarding the products, production capacity, and equipment used for manufacturing the product

- Letter from the concerned authority proving the manufacturing unit exists

- In the case of SSI units, the SSI Certificate of Registration

- Certificate of Incorporation

- GST registration certificate.

Procedure to Obtain RCMC License:

Step 1:

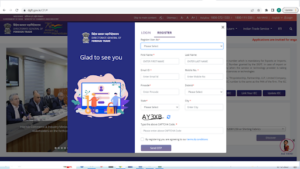

Log into the official website of DGFT and create Log in credentials

Step 2:

The applicant receives an OTP on the registered email ID and phone number and has to enter the same for verification purposes. After verification, the applicant receives the username and password on the registered email ID. Using the same, the applicant has to login into the site.

Step 3:

The applicant has to apply for IEC if not obtained earlier, and then proceed for making an application for the RCMC license. The applicant has to select ‘Services’ on the home page and select ‘e-RCMC’ option from the dropdown menu.

Step 4:

The applicant is navigated to the dashboard and the necessary details are to be filled in. The applicant will be prompted to click the Yes/No Radio button to verify if the details are filled in.

Step 5:

The applicant has to provide the details pertaining to:

- Export Promotion Council, Commodity Board and the applicable fee details.

- Products that are exported

- Details of authorised representatives and officers

- Countries to which the products are exported by the company.

Step 6:

After entering the required details, the mandatory documents should be attached in the ‘Attachment Section.’ After the documents are uploaded, Click ‘Save & Next’.

Step 7:

In the Declaration Section, after reading the information, click the checkbox for acceptance of declaration and enter the Place and click ‘Save & Next.’ The information entered and documents uploaded will be displayed under Application Summary. The Applicant will have to sign the same by clicking the ‘Sign’ button.

Step 8:

The Applicant will be directed to the payment gateway. After making the payment click ‘Submit.’ Once the payment is received, an e-receipt is generated for acknowledgment. On verifying the details and the documents thus submitted, the authorised officer will issue the RCMC to the applicant.

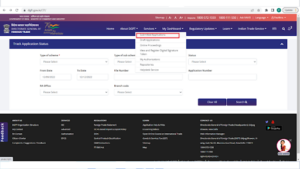

The status of the application can be verified through the ‘My Dashboard’ option on the webpage by selecting ‘Submitted Applications.’ Thereafter the applicant has to choose the Type of Scheme as RCMC to verify the status of the application. Once the RCMC is issued, the license holder will also be able to edit or amend the Issued RCMC license details.

The RCMC was not a mandatory document to be obtained by the exporters. But the DGFT notification issued in April 2022 announced that it would henceforth be mandatory for the exporters to file a Registration cum Membership Certificate (RCMC)/Registration Certificate.

Previously, the exporters would make an application for the RCMC through Form ANF 2C with the respective EPCs. Now, a Common Digital Platform (DGFT e-RCMC module) for Issuance of RCMC is in place. This is definitely an appreciable move, as the RCMC essentially helps exporters avail benefits provided by agencies that help in promoting and developing India’s export business. The RCMC certificate is valid for five years and indicates that the business has an EPC or FIEO registration.

Read more: