The Income Tax Authorities in India control and administer income tax Filing forms 15CA and 15CB. Forms 15CA and 15CB are requirements under Section 195 of the Income Tax Act of 1961.

Introduction

It is up to more than just individuals to make sure that all the right measures are performed and that the documentation for filing form 15CA taxes is completed. When determining the taxable amounts of non-resident Indians, the Income Tax Department would have the upper hand because banks and financial institutions are also presumed to follow predetermined guidelines. This Blog describes Income Tax filing Form 15CA, a document banks use to note down taxable payments.

What is Exactly the Form 15CA?

Income Tax Form 15CA must only be filed if the remittances are liable to tax in India. If no non-resident Indians are entitled to the remittances or payment, Form 15CA does not need to be submitted. However, a customer may supply a statement in Form 15CA instead.

Any taxpayer, authorised signatory, or representative entity may provide information on payments made to non-residents who are not businesses or foreign corporations using Form 15CA.

A Chartered Accountant kind certificate, Form 15CB, must be submitted in addition to Form 15CA. It attests to the accuracy of the tax deduction and confirms that it complies with the Double Taxation Avoidance Agreement and the Income Tax Act.

Regarding Form 15CB, the following details are available:

- Information and kind of payment

- The speed at which TDS occurred

- Section 195 of the Income Tax Act must be followed

- Adherence to the double taxation prevention agreement

For the Quarterly Statement that an authorized dealer must provide regarding overseas remittances made by him, a new form known as Form No. 15CC has also been mandated.

Form 15CA – What are the Components?

Form 15CA is made up of four parts:

Part A is applicable if a remittance, or the total of all such remittances, is taxable and does not exceed 5 lakhs throughout the financial year.

Part B: If a payment is taxable, the total of all such payments made during the financial year exceeds ₹5 lakh, and the AO has issued an order or certificate in accordance with Sections 195(2), 195(3), or 197.

If a remittance is taxable, the aggregate of all such remittances made during the financial year exceeds 5 lakh, and an accountant’s certification in Form No. 15CB has been obtained, then Part C applies.

Finally, refer to Part D if the remittance is not taxable.

Take charge of your tax strategy – Utilize our Income Tax Calculator to make well-informed and strategic financial decisions.

What is the Information that Must be Provided while Submitting Form 15CA?

- When making a payment to a non-resident or foreign company, whether taxable or not, it is mandatory to declare the transaction

- The remitter could be a resident, non-resident, domestic company, or foreign company

- According to Section 5 of the Income Tax Act, 1961 this declaration is necessary when the income accrues, arises, is received, or is deemed to accrue, arise, or be received in India

- This ensures compliance with tax regulations and facilitates accurate reporting of international transactions involving non-residents or foreign entities.

Importance of Form 15CA and Form 15C

Form 15CA and Form 15CB are mandatory documents required under the Income Tax Act, 1961, for any payments from a resident to a non-resident. Form 15CA serves as a declaration submitted by the payer, while Form 15CB is a certificate issued by a Chartered Accountant (CA) confirming compliance with the Income Tax Act and any Double Taxation Avoidance Agreement. Both forms are crucial for accurate and timely reporting of non-resident payments and tax collection.

Form 15CA

It is a declaration for remittances to non-residents, submitted online on the income tax department’s website before making the payment. Its purpose is to enable tracking of foreign remittances and ensure tax compliance.

Form 15CB

On the other hand, is a CA-issued certificate validating payments to non-residents or foreign companies, ensuring adherence to the Income Tax Act and any relevant DTAA between India and the foreign nation.

Applicability of Form 15CA and Form CB

Form 15CA and 15CB are necessary when conducting foreign remittances under India’s Income Tax Act of 1961. The requirement to fill out these forms varies based on the nature and amount of the remittance.

For Form 15CA

- It must be completed by any individual or entity planning to send money to a non-resident or foreign company, regardless of whether the remittance is taxable

- The remitter can be a resident, non-resident, domestic company, or foreign company

- This declaration is essential when income accrues, arises, is received, or is considered to have accrued, arisen, or been received in India, in accordance with Section 5 of the Income Tax Act.

For Form 15CB

- A Chartered Accountant (CA) should file Form 15CB when making the remittance

- It is mandatory when the remittance to a non-resident or foreign company is subject to taxation

- This applies when the payment exceeds ₹5,00,000

- Additionally, it’s required when an order or certificate hasn’t been received from the Assessing Officer (AO).

How to File Form 15CA?

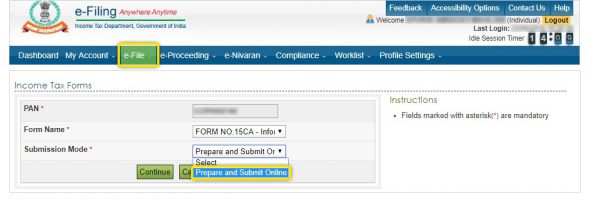

The procedures listed below must be performed when submitting Income Tax Form 15CA on the Income Tax Department’s official website:

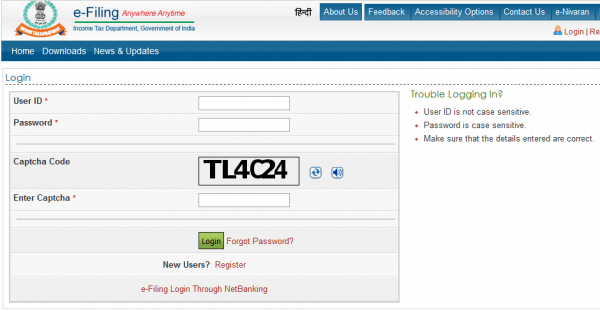

- Step 1: Visit the Income Tax Department’s website. https://www.incometax.gov.in/iec/foportal/

- Step 2: Enter the right login information to access the appropriate account.

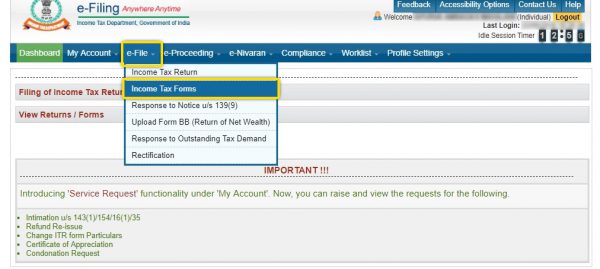

- Step 3: Select Income Tax Forms from the drop-down menu under the e-File tab.

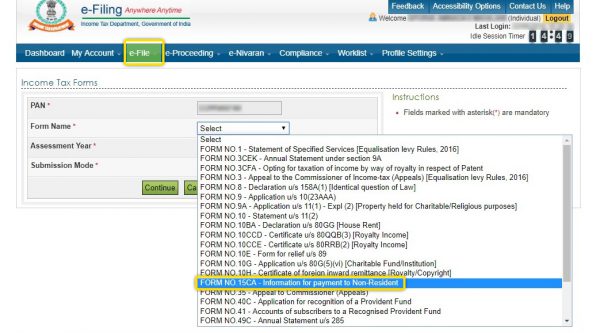

- Step 4: Select Form 15CA from the drop-down menu, then click the Continue tab.

- Step 5: From the drop-down menu, select the appropriate Form 15CA type for the user.

- Step 6: Complete form 15C.

What is the Information that Must be Provided while Submitting Form 15CA?

We have listed the requisites for your quick reference:

- Sender-specific details

- Sender’s identifier

- The sender’s registered business address

- Sender’s location

- Sender’s identity either as a firm, corporation or something similar

- PAN card information of the sender

- Contact details of the sender

- Country where the remittance has been intended to be executed

- Remitter’s postal code

- Currency involved in the transaction

- Transfer specific inputs

- Sum of money that has been compensated in Indian currency

- Invoice copy

- Tentative date of remittance

- Remitter’s bank-related details

- Bank’s BSR code.

Apart from all this preliminary information, some secondary key data are also needed to file form 15CA successfully.

These include:

- Signatory’s identification papers

- Name of the signatory’s parent

- Required documentation for the remittee

- Tax residency certification from the correct remittee/tax registration of the country in which the remittee is enrolled

- The duly completed Income Tax Form 10F from the remittee.

- A document attesting that the recipient of the remittance has no permanent establishment in India

If the money is regarded as business income and there is no permanent establishment in India, the transaction is considered mandatory and not taxable under the DTAA.

When Must One Submit Forms 15CA & 15CB?

A remitter must submit these forms, in whole or in part, in the following situations, with a few exceptions:

- When the remittance is below the designated exemption limit, use Part D of Form 15CA

- When remittance in a financial year is less than ₹5 lakh, use Part A of Form 15CA

- Forms 15CA and 15CB’s Part C when the remittance exceeds ₹5 lakh

- People must file Part B of Form 15CA when they receive a certificate under Section 195(2), 195(3), or 197 of the Income Tax Act, and the remittance exceeds ₹5 lakhs.

Under What Circumstances Do You Not Need to File Form 15CA or 15CB?

There are at least 28 different kinds of international remittances for which Form 15CA and Form 15CB are not required to be filed, according to Rule 37BB of the Income Tax Rules. among the frequent situations are:

- When an advance payment is made against an import that is less than ₹5 lakhs

- If substances are carried out to support diplomatic missions

- Payments for facilitating commerce

- Personal payments

When is Form 15CA Not Required?

- When the remittance aligns with the specified payment list outlined in Rule 37BB of the Income Tax Rules

- When the individual making the remittance doesn’t require approval from the Reserve Bank of India as per Section 5 of the Foreign Exchange Management Act (FEMA), 1999

- When the remittance is exempt from tax under the Income Tax Act or a relevant tax treaty

- When an individual’s aggregate remittance amount during the financial year remains below ₹5 lakh, and the remittance isn’t intended for foreign travel or the purchase of foreign assets

- When an individual’s remittance for overseas education doesn’t exceed the limit prescribed by the RBI.

How the Form 15CA Verified by the Income Tax Department?

Filing Form 15CA is verified online using the DSC technique, or digital signature certificate, and the Chartered accountant’s DSC is entered into the e-filing website. Although there is yet to be a date for submitting filing form 15CA, it must be done before the money is remitted.

What Consequences Will Follow You Upon Failing Form 15CA Submission?

A taxpayer who is required to file Form 15CA will be subject to payment of a penalty by the requirements of the Income Tax Act, 1961 if he needs to remember to do so before sending money to a non-resident.

The punitive clause will still apply if the person provides false information.

If there is non-compliance, the assessing officer may order the assessee to pay a penalty of up to ₹1 lakh.

Conclusion

Numerous Indian taxpayers send payments to non-residents within a fiscal year. However, several taxpayers must be aware that before making the majority of these payments, they must first withhold taxes. Here at Vakilsearch, we can quickly point out certain international remittances subject to taxation by Rule 37BB of the Income Tax Rules.

Assessees or remitters must also submit Forms 15CA & 15CB to verify their tax deductions; failing to do so will result in a significant penalty. Therefore, it’s essential to learn how to submit Forms 15CA & 15CB using the above procedures.

FAQ:

What is the primary purpose of Form 15CA, and why is it necessary for certain financial transactions?

Form 15CA is a declaration form that is required to be filed with the bank before making any remittance to a non-resident individual or foreign company. It is necessary to ensure that the remittance is not taxable in India, or if it is taxable, that the appropriate taxes have been deducted and deposited with the government.

Could you explain the relationship between Form 15CA and Form 15CB, and why both are often required?

Form 15CA is a declaration form, while Form 15CB is a certificate issued by a Chartered Accountant (CA) to verify the deduction of taxes and the completion of other regulatory requirements. Form 15CB is required when the remittance exceeds ₹5 lakh during a financial year and the remitter does not have a lower rate of Tax Deduction Certificate (TRC) issued by the Income Tax Department (ITD).

What specific information needs to be included when filing Form 15CA, and how does it vary for NRIs (Non-Resident Indians)?

The following information is required to be included when filing Form 15CA: PAN/TAN of the remitter PAN/Taxpayer Identification Number (TIN) of the non-resident individual or foreign company Nature and amount of the remittance Purpose of the remittance Details of any TRC or other exemption certificate NRIs are required to provide their Permanent Account Number (PAN) in Form 15CA, even if they are not required to file income tax returns in India.

What are the potential consequences if Form 15CA is not filed for transactions that require it?

If Form 15CA is not filed for transactions that require it, the remitter may be liable to a penalty of up to ₹1 lakh. The bank may also refuse to make the remittance if Form 15CA is not filed.

Is there a specific order in which Form 15CA and Form 15CB should be filed for a financial transaction?

Form 15CA should be filed before Form 15CB. Form 15CB cannot be filed unless Form 15CA has already been filed.

How long is Form 15CA valid after it has been filed, and what happens if there are changes to the transaction details?

Form 15CA is valid for one financial year. If there are any changes to the transaction details, the remitter is required to file a revised Form 15CA.

Can you provide guidance on the process for filing Form 15CA in the income tax system?

To file Form 15CA in the income tax system, the remitter must log in to the e-filing portal and select 'File Form 15CA' under the 'File Forms' sub-menu. The remitter will then be required to provide the necessary information and submit the form.

What are the repercussions of not filing both Form 15CA and Form 15CB as required?

If the remitter does not file both Form 15CA and Form 15CB as required, they may be liable to a penalty of up to ₹1 lakh. The bank may also refuse to make the remittance if both forms are not filed.

Who is responsible for filing Form 15CA, and what role does it play in the context of foreign remittances?

The remitter is responsible for filing Form 15CA. Form 15CA plays an important role in the context of foreign remittances by ensuring that the remittances are compliant with Indian tax laws and regulations.

Are there any exemptions or specific scenarios where Form 15CA and Form 15CB may not be necessary?

There are a few exemptions where Form 15CA and Form 15CB may not be necessary. For example, Form 15CA is not required for remittances to NRIs for their personal expenses, or for remittances to foreign companies for expenses incurred in India. Form 15CB is not required for remittances to NRIs who have a lower rate of TRC issued by the ITD.

Also, Read: