The Employee Provident Fund, or EPF, is a private sector retirement benefits programme for salaried employees

The Employee Provident Fund, or EPF, is a private-sector retirement benefits program for salaried employees. EPF management is the responsibility of the Employees Provident Fund Organisation (EPFO). All firms and organizations with 20 or more employees are subject to the EPF.

Three programs are under the direction of the Employees Provident Fund Organisation:

- 1952’s EPF Scheme

- 1995’s Pension Scheme

- The 1976 Insurance Scheme.

EPF

A fixed percentage of 12% of their basic pay and dearness allowance is contributed to the program by employees who are covered by the EPF system. The employer must also make an equal contribution to the EPF scheme. The Central Board of Trustees of EPFO sets the EPF interest rates following consultation with the Ministry of Finance. The EPF Interest Rate has been set at 8.1% for FY2022.

The employee would get a lump sum payment upon retirement that would include interest payments, their personal contributions, and the employer’s contributions. However, the employer contribution does not account for the complete 13% of the EPF account. The employee EPF account receives 8.33% of the 12% payment, while the employee pension scheme account receives the remaining 3.67%.

All employees who receive a base salary of less than ₹15,000 per month are required to join the EPF. Once you join the EPF system, you are unable to withdraw from it. Employees are allowed to contribute extra to the voluntary provident fund, up to 100% of their base pay. The employer will not match the donation.

Use Vakilsearch’s PF Maturity Calculator to find out how much money you have left in your EPF account before you retire.

What Is an EPF Calculator?

The EPF calculator shows you a simulation of how much money will accumulate in your EPF account when you retire. Calculations can be made to determine the lump-sum amount, which includes your contribution, the employer’s contribution, and interest that has accumulated on the investment.

You can enter your present age, your basic monthly pay, the dearness allowance, your EPF contribution, and your retirement age up to 58 years in the formula box on the PF Withdrawal Calculator. If you are confident with numbers, you can also input the current EPF balance. The EPF calculator will provide the EPF funds available for retirement after you enter the necessary data.

How Does a Calculator for EPF Operate?

Let’s look at an example to better understand how the EPF calculator functions.

Employees’ basic pay plus overtime pay equals ₹14,000

Employees’ EPF contribution equals 12% times ₹14,000, or ₹1,680.

Employer’s EPF contribution equals 3.67% times ₹14,000, or ₹514.

Employers’ share of EPS equals 8.33% times ₹14,000, or ₹1,166.

Employer and employee contributions to the employee’s EPF account total ₹1,680 + ₹514, or ₹ 2,194.

The interest rate for FY 2024–2025 is 8.1%.

Therefore, the monthly interest rate is 8.1% divided by 12 to equal 0.675%.

Assuming the worker began working for Company XYZ in April 2019. For April, there would be a total EPF contribution of ₹ 2,194. The EPF program will not pay any interest in April.

The total EPF contribution for the month of May is (₹2,194 + ₹2,194). He is given interest of ₹4,388 multiplied by 0.70833%, or ₹31.08.

The calculation is performed in a comparable manner for the subsequent months.

What You Need to Understand about EPF Contributions

- EPF contributions are deducted from more than just your salary. Additionally, your employer must contribute equally each month to your EPF account

- Employees must link their bank account and Aadhaar number to their UAN

- Anyone is eligible to be nominated for an EPF account. In the event of the account holder’s passing, the nominee will pay the account balance

- By sending Form 2 to the EPF department or the finance department of your business, you can modify the candidate

- Your employer’s monthly payment to the Employee Pension Scheme will be about 8.33% of that total (up to ₹ 1,250). (EPS). When you retire and meet certain requirements, this will assist you in receiving a monthly pension

- You will only be permitted to withdraw a portion of the balance from your EPF account, depending on the reason for the withdrawal, if you choose to leave your employment and take your remaining balance with you. Unemployment, retirement, the acquisition of land, the building or renovation of a home, a wedding, schooling, the repayment of a home loan, and medical reasons are a few examples of legitimate justifications

- You may withdraw the entire amount of your EPS account if you are retired and have worked continuously for the previous ten years

- If you haven’t worked continuously for the past ten years, you can only withdraw money from your EPS account in accordance with the slabs determined by your prior salary

- When you change jobs, you are not required to withdraw your EPF contributions or close your account. Just provide the new employer with your UAN. The new PF number issued by your new employer will continue to be associated with your current UAN

- By completing Form 13, you must manually transfer the balance of your PF account from your prior workplace to the PF account set up by your new company. Alternatively, you can complete Form 11 to have the PF contributions transferred automatically to the new account

- You can monitor the balance of your EPF account, make requests for transfers, check the progress of claims, request withdrawals, and lodge grievances online via the EPFO portal.

How to Find Out PF Balance?

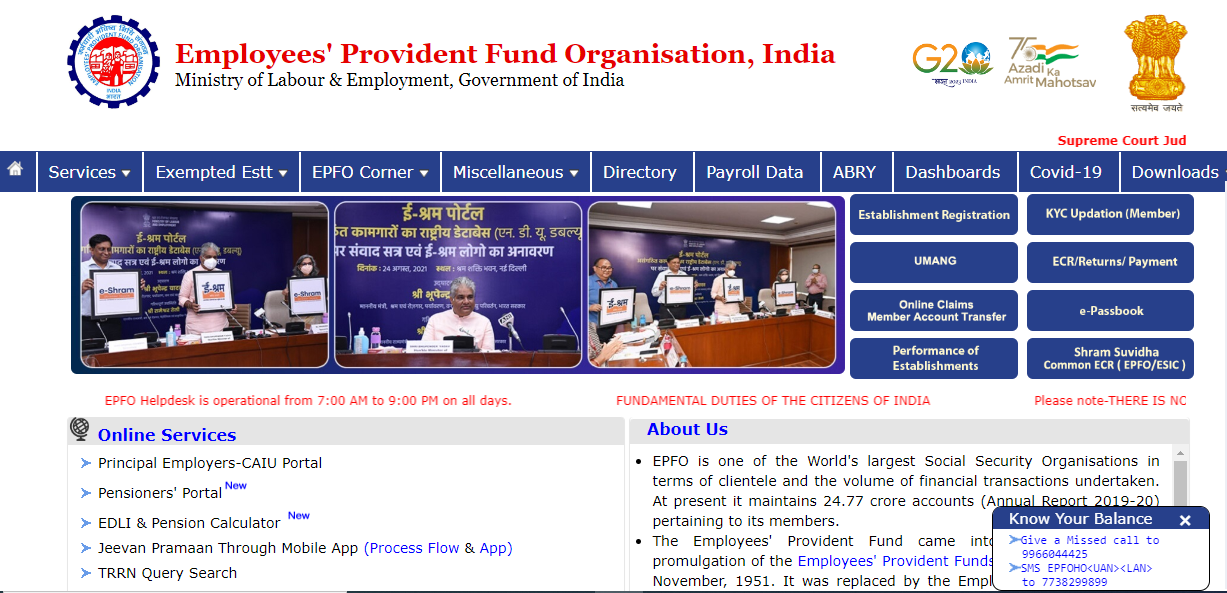

- Step 1: Go to the government’s Employee Provident Fund portal https://www.epfindia.gov.in/site en

- Step 2: Choose the location of your PF office (state, regional branch office)

- Step 3: Complete the online form by providing your contact information and the EPF account number that is displayed on your payslip.

- Step 4: After checking the information provided, submit the form.

- Step 5: If all of your paperwork is in order, you will receive an SMS with your EPF balance to your registered cellphone number.

How to Send EPF Money Online?

- Step 1: The Universal Account Number (UAN), which will not change in the event of a job change, can be used to transfer Employee Provident Fund

- Step 2: Complete the EPF registration portal’s official process

- Step 3: Log in after receiving your login information

- Step 4: Use the same login information as before to access the Online Transfer Claim Portal and request an EPF transfer

- Step 5: You can file your transfer claim online if you are qualified to do so without submitting Form 13

- Step 6: Click ‘Request for Transfer of Funds’ and follow the instructions to provide the details of your previous employment

- Step 7: Request your present or former employer to vouch for it

- Step 8: After entering the information, a PIN will be delivered to your mobile device

- Step 9: Track your application using the tracking ID that was issued for you.

Advantages of EPF

- You can name a loved one as your nominee so that they will be eligible to receive the pension or corpus in the case of your passing

- Once you retire, you’ll receive a fixed income

- You are able to invest more than 12% of your monthly basic pay through EPF’s Voluntary Provident Fund

- The Employee Provident Fund also covers life insurance for you

- Both the EPS and the EPF are available when you withdraw from the EPF after retirement

- Under certain clearly defined circumstances, such as a job loss, a wedding, the repayment of a debt, etc., you may withdraw early in the event of an emergency.

Conditions for PF Withdrawal

| Advance Type | Eligibility Required for Withdrawal |

| Housing Loan / Purchase of Property / House Construction | 60 months of service |

| Lockout or Closure of Factory | Not Required |

| Illness of Family Member | Not Required |

| Marriage (Self/Son/Daughter/Brother/Sister) | 84 months of service |

| Post-Matriculation Education of Children | 84 months of service |

| Natural Calamity or Disaster | Not Required |

| Electricity Cut | Not Required |

| Purchasing Equipment by Physically Handicapped | Not Required |

| One Year Before Retirement | Minimum Age – 54 years |

| Investment in Varistha Pension Bima Yojana | Minimum Age – 55 years |

Conclusion

Contact our Vakilsearch experts to get out more information regarding PF, withdrawal, and other programs. We connect you with reputable experts and work together with them to meet all of your legal requirements.

FAQs for PF Withdrawal Calculator

How is the PF withdrawal amount calculated, and what factors influence the final settlement?

The PF withdrawal amount is calculated based on accumulated employee and employer contributions, along with accrued interest. Factors such as the duration of employment, contributions made, and interest rates influence the final settlement.

What contributions are considered in the PF withdrawal calculation, including both the employee and employer contributions?

Both the employee and employer's contributions, made throughout the employment tenure, are considered in the PF Withdrawal Calculator. This cumulative amount, along with interest, forms the basis for settlement.

Is the interest earned on the PF amount included in the withdrawal calculation, and how is it determined?

Yes, the interest earned on the PF amount is a crucial component of the withdrawal calculation. The interest rate, declared annually by the government, determines the accrued interest on the total contributions.

Are there specific formulas or methods employed to calculate the PF withdrawal amount, or is it a straightforward sum of contributions and interest?

The PF withdrawal amount involves a straightforward sum of the accumulated employee and employer contributions, along with the interest earned over the employment period.

How does the duration of employment impact the PF withdrawal calculation, and are there different rules for short-term and long-term employees?

The duration of employment significantly influences the PF Withdrawal Calculator. Long-term employees may see higher accumulations due to extended contributions, while short-term employees receive settlements based on their tenure.

What documents are required for the PF withdrawal process, and how do they factor into the calculation?

Documents such as the PF withdrawal application, bank details, and the employee's UAN play a vital role. They facilitate a smooth process, ensuring accurate calculation and timely disbursement of the withdrawal amount.

Can individuals choose between different withdrawal options, such as a lump sum payment or a pension, and how does this choice affect the calculated amount?

Individuals have withdrawal options, including a lump sum or pension. The choice impacts the calculated amount, with different disbursement methods having varied implications on the final settlement.

Are there tax implications for the PF withdrawal amount, and how is taxation handled in the calculation process?

Tax implications exist, and the taxation process is subject to specific conditions. Generally, if the employee has completed five years of continuous service, the PF withdrawal amount is tax-free; otherwise, it may be taxable.

Is there a specific timeline or process for initiating the PF withdrawal, and how long does it typically take to receive the calculated amount after the application?

The PF withdrawal process involves submitting the withdrawal application online. The timeline for receiving the calculated amount varies, but it typically takes a few weeks after the application is processed by the EPFO.