This article will guide you through the difference between EPF and PPF Calculator to know more about this.

EPF has greater fluidity. PPF withdrawals are only permitted five years after the account was opened. If you have been out of work for a month, you are eligible to withdraw 75% of your EPF corpus. EPF stands for Employee Provident Fund. It is another name for PF or Provident Fund. Individuals working in the corporate sector get the opportunity to invest in EPF. It is a savings scheme regulated and managed by the government for employees of the corporate sector. Here we learn about EPF vs PPF.

EPF vs PPF:

| Criteria | PPF | EPF |

| Purpose | Long-term savings and tax benefit | Retirement savings and social security |

| Eligibility | Open to all individuals (resident/citizen) | Applicable to salaried employees in organized sector |

| Contribution Limit | Maximum of Rs. 1.5 lakh per year | 12% of basic salary + dearness allowance by employer and employee |

| Tenure | 15 years (can be extended in blocks of 5 years) | Until retirement (can be withdrawn after retirement) |

| Interest Rate | Varies annually, currently around 7.1% | Varies annually, currently around 8.5% |

| Tax Benefits | EEE (Exempt, Exempt, Exempt) | EEE (Exempt, Exempt, Exempt) |

| Withdrawal Restrictions | Partial withdrawal allowed after 5 years | Partial withdrawal allowed under certain conditions |

| Loan Facility | Available against PPF balance | Available against EPF balance |

| Transferability | Portable across banks/post offices | Not portable, transferred between employers |

| Employee Contribution | Voluntary contributions | Mandatory contributions |

| Employer Contribution | Not applicable | Mandatory contributions |

| Maturity Amount | Entire corpus tax-free at maturity | Taxable if withdrawn before 5 years of service |

| Risk and Returns | Relatively lower risk and stable returns | Relatively lower risk and stable returns |

| Investment Flexibility | No flexibility once deposited | No flexibility once deposited |

EPF vs PPF: Where to Invest?

-

EPF (Employee Provident Fund):

- Job-related Retirement Benefits: EPF is specifically designed for salaried employees in the organized sector, offering a retirement-focused investment option. It provides a mandatory savings mechanism with contributions from both the employee and employer.

- Higher Interest Rates: EPF generally offers a higher interest rate compared to PPF, which can potentially lead to better returns over the long term.

- Employer Contributions: One advantage of EPF is that the employer is required to match the employee’s contributions, increasing the overall investment amount and potential growth.

- Loan Facility: EPF allows individuals to avail themselves of loans against their EPF balance, which can be helpful in times of financial need.

- Social Security Benefits: EPF provides a sense of social security by ensuring savings for retirement and serving as a safety net during challenging times.

-

PPF (Public Provident Fund):

- Flexibility and Control: EPF vs PPF – PPF offers more flexibility and control over investment decisions compared to EPF. Individuals can choose their contribution amount (within the prescribed limit) and have the freedom to manage their PPF account independently.

- Tax Benefits: PPF offers tax benefits on contributions, interest earned, and maturity amounts, making it an attractive option for tax planning. The entire corpus is tax-free at maturity.

- Longer Investment Horizon: PPF has a minimum tenure of 15 years, which suits individuals looking for long-term investments. It provides an opportunity to accumulate substantial savings over time.

- Portability: PPF accounts are portable, allowing individuals to transfer their accounts between banks or post offices, providing convenience and flexibility.

- Investment Diversity: While EPF has limited investment options, PPF offers more diverse investment avenues. This enables individuals to explore different avenues for potentially higher returns.

EPF vs PPF: Drawbacks of EPF & PPF

|

Drawbacks of PPF |

Drawbacks of EPF |

| Limited liquidity: Partial withdrawals are allowed only after 5 years of account opening, with specific restrictions. | Limited flexibility: Contributions are mandatory, and there is limited control over the investment portfolio. |

| Long lock-in period: The PPF has a minimum tenure of 15 years, which may not be suitable for individuals seeking shorter-term investments. | Lack of portability: EPF accounts are non-transferable between employers, which can be inconvenient when changing jobs. |

| Contribution limits: The maximum annual contribution limit of Rs. 1.5 lakh may restrict individuals with higher savings capacity. | Tax on early withdrawals: If EPF is withdrawn before completing 5 years of service, the withdrawal amount is taxable. |

| Dependency on interest rates: The PPF interest rate is subject to change annually and may not always match inflation, impacting real returns. | Employer influence: The employer has control over the management of EPF funds, which may limit investment options or flexibility. |

| No premature closure option: Premature closure of PPF accounts is not allowed except in specific circumstances, such as critical medical expenses. | Tax implications: While EPF contributions are tax-exempt, interest earned is taxable if withdrawn before completion of 5 years. |

| Limited investment options: PPF offers a fixed interest rate and has limited investment flexibility, which may not suit individuals seeking higher returns. | Dependency on employment: EPF is applicable only to salaried employees in the organized sector, excluding self-employed individuals. |

Understanding the Different PFs Available in India

As someone looking to save and invest money in India, you may have heard of different types of Provident Funds available in the country. These include the General Provident Fund (GPF), the Employees Provident Fund (EPF), and the Public Provident Fund (PPF). In this article, we will explore these different funds and their key features, helping you make an informed decision about which one might be right for you.

-

General Provident Fund (GPF)

The General Provident Fund, or GPF, is a savings scheme that is available to government employees. It is a long-term investment option that allows employees to contribute a portion of their salary each month towards the fund. The GPF aims to provide financial security and stability to government employees, ensuring that they have a comfortable retirement.

One of the key benefits of the GPF is that it offers a guaranteed rate of return on investment. The interest rate on the fund is set by the government each year and is typically higher than that offered by other savings schemes in India. Additionally, contributions made towards the GPF are eligible for tax deductions under Section 80C of the Income Tax Act, making it a tax-efficient investment option.

-

Employees Provident Fund (EPF)

The Employees Provident Fund, or EPF, is a savings scheme that is available to employees in companies with more than twenty workers. The EPF Registration is a mandatory contribution scheme where both the employer and the employee contribute a fixed percentage of the employee’s salary towards the fund. The EPF aims to provide financial security and stability to employees, ensuring that they have a comfortable retirement.

Similar to the GPF, the EPF offers a guaranteed rate of return on investment, which is set by the government each year. The interest rate on the fund is typically higher than that offered by other savings schemes in India. Additionally, contributions made towards the EPF are eligible for tax deductions under Section 80C of the Income Tax Act, making it a tax-efficient investment option.

-

Public Provident Fund (PPF)

The Public Provident Fund, or PPF, is a savings scheme that is available to everyone, regardless of whether they are employed, self-employed, or unemployed. The PPF is a long-term investment option that allows individuals to contribute a fixed amount towards the fund each year. The PPF aims to provide financial security and stability to individuals, ensuring that they have a comfortable retirement.

One of the key benefits of the PPF is that it offers a high rate of return on investment, which is set by the government each year. The interest rate on the fund is typically higher than that offered by other savings schemes in India. Additionally, contributions made towards the PPF are eligible for tax deductions under Section 80C of the Income Tax Act, making it a tax-efficient investment option.

The General Provident Fund is referred to by its entire name. Government employees have access to the GPF savings plan. Workers Provident Fund is the official name of this fund. Employees at companies with more than 20 employees may participate in the EPF savings programme. PPF stands for Public Provident Fund in its full form. Everyone can use PPF, whether they are employed, self-employed, or looking for work.

Under this scheme, both the employees and the employers of the organization contribute equally to the EPF. Generally, employees and employers contribute a minimum of 12% of their basic salary to the Employees’ Provident Fund. The employee receives a lump sum amount with fixed interest on top of his own investment and his employer’s contributions at the time of retirement.

The investment in these provident funds (GPF, EPF, and PPF) is comparatively low risk due to their statutory or government backing. Out of these three funds, the government directly pays interest on PPF and GPF. In the case of the EPF, the interest rate depends on the returns made by the EPF. The rate of the EPF is 8.55% while the rates of the GPF and the PPF are both 8%. The deduction of taxes according to section 80C is accessible for the GPF, the EPF, and the PPF. The interest in all these three investments is tax-free.

EPF vs PPF: Who are the Controllers of EPF?

The Controller of EPFA is the Employees’ Provident Fund Organization or EPFO. It is a statutory social security structure under the Ministry of Labor and Employment of India. The function of this administration is to regulate and supervise the provident fund, retirement benefits, pension, and insurance schemes of the citizens related to the labor and employment of the country. EPFO determines the rate of interest of EPF or PF every year as per the Employees Provident Act, of 1956 till date. The rate of interest on EPF for the current financial year is 8.50%.

How to Use the EPF Calculator?

EPF Calculator is powered by artificial intelligence. Through this tool, an employee can calculate the potential financial benefits at the time of retirement based on his current salary and contributions. It shows the lump sum amount that people are likely to receive from EPF at the time of retirement.

Master your savings journey. Use Vakilsearch’s EPF calculator now!

EPF Calculator is a system governed by a particular formula. Here a person can provide his current age, monthly salary, self, and employer’s contribution amount as basic details. After that, the person can enter his retirement age and also his EPF balance. The EPF calculator then calculates the total bulk amount that the person can get at the time of retirement.

EPF vs PPF: Definition of PPF and How It Works?

PPF or Public Provident Fund is a scheme regulated by the Government of India. The scheme is available to all service-based employees who are not eligible for EPF. Generally, people covered by this scheme have to deposit a minimum of ₹500 in PPF annually.

Individuals associated with any service sector of the country can deposit up to a maximum of ₹1,50,000 annually in the Public Provident Fund. PPF is deposited for a fixed maturity period which can be up to a maximum of 15 years. The potential maturity benefit can be calculated using the PPF calculator. Individuals can enjoy the financial benefits of these funds including interest over a specified maturity period or after retirement.

Who are the Controllers of PPF?

Public Provident Fund is a savings and tax savings instrument for citizens associated with the Indian service sector. Through this, individuals can deposit funds for a fixed period and enjoy the benefits including interest after maturity.

The National Savings Institute of the Ministry of Finance, which developed the concept and scheme of PPF, implemented it in 1968. The rate of interest of PPF is determined and regulated by banking organizations associated with specific sectors. The average rate of interest of PPF in the current fiscal year is 7.1% per annum.

How to Use the PPF Calculator?

The function of the PPF calculator is to show a particular person the result of the future benefit of the investment made by him. In this case, the person has to provide the correct information in the calculator to calculate the PPF correctly.

Investment clarity is just a click away. Calculate your PPF today using Vakilsearch’s PPF Calculator!

The PPF calculator requires the individual to provide information about his invested amount, rate of interest, and mode of investment; it can be yearly or monthly. After that, an individual can get the result of his PPF maturity benefit within seconds. The results provided by the PPF calculator are dependent on the data. However, at certain times inflation factors may cause a slight difference between EPF and PPF results.

EPF vs PPF: Difference Between EPF and PPF

| Difference | EPF | PPF |

| Eligibility | Employees of an EPF-registered company | Indian residents |

| Amount to invest |

Compulsorily 12% of salary Can be increased voluntarily |

Minimum amount- ₹ 500 Maximum amount- ₹ 1.5 lakh |

| Tenure |

Can be closed after resigning Can be transferred to other firms till retirement |

15 years Can be extended in the blocks of 5 years |

| Contributor | Employee and employer | SelfParents/guardians on behalf of their minor |

| Interest rate | 8.5% | 7.1% |

| Tax benefit |

Tax deductions are available for contributions The amount after maturity is tax-free only after five years have elapsed |

Section 80C of the Income Tax Act makes contributions tax-deductible Tax-free after maturity |

| Withdrawal |

Upon unemployment 75% of the amount can be withdrawn after unemployment Rest 25% of the amount can be withdrawn after 2 months |

Upon completion of six financial years, partial withdrawals are permitted |

| Nature of the account | Retirement-cum savings scheme | Savings scheme |

| Circumstances to withdraw the amount |

A complete withdrawal has been made Upon retirement In the event of unemployment Changing professions (duration of the job should be two months) Withdrawal in part Higher education In connection with a wedding The purchase of a house or land To repay the home loan To renovate a house property |

At maturity, Partially withdrawing due to educational or health concerns |

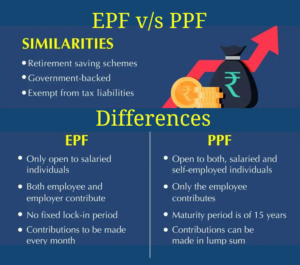

EPF vs PPF: Who Can Invest in EPF & PPF?

- Only employees working in registered companies covered by the EPF Act in India can invest in EPF and can use EPF Calculator.

- Individuals associated with any service sector in India can invest in this fund. However, Non-Resident Indians or NRIs are not eligible to avail of the PPF facility.

Mode of Investment

- EPF usually takes a monthly investment.

- Individuals can invest monthly or annually in PPF

Amount of Investment

- The investment must be 12% of the aggregate amount of basic and DA of employees and employers deposited every month in the case of EPF.

- The Monthly or annual investment in PPF can be done from a minimum of ₹ 500 to a maximum of ₹ 150,000.

Interest Rate

- The rate of interest in EPF is 8.50% per annum

- The interest rate of PPF is 7.10% per annum according to the current financial year.

General Contributor or Investor

- Both employer and employee have to contribute equally to EPF.

- The individual himself invests and in the case of minors the legal guardian contributes to PPF.

Benefits in Terms of Tax

- The amount invested in EPF is tax deductible, as it is managed by the government scheme with companies registered under the EPF Act. In this case, the maturity amount received is tax-free up to 5 years after receipt and after that, it is mandatory to pay a certain amount of tax.

- The amount contributed in PPF is tax deductible under section 80C. Also, the maturity portion of the amount contributed is treated as tax-free.

Controlling Act – Difference between EPF and PPF

- The Governing act of EPF is the Employees Provident Funds and Miscellaneous Provisions Act, 1952.

- The Public Provident Fund Act. 1968 is the controlling act of PPF.

EPF vs PPF FAQs

What is the maturity period of EPF and PPF?

The maturity period for EPF (Employee Provident Fund) is generally at retirement or 58 years of age. For PPF (Public Provident Fund), the maturity period is 15 years, which can be extended for another 5 years.

Is it possible to open a PPF account for my minor?

Yes, it is possible to open a PPF account for a minor. The account can be opened and operated by either parent or legal guardian of the minor.

Is it possible to withdraw money from the EPF account?

Yes, it is possible to withdraw money from the EPF account under certain conditions, such as retirement, resignation, disability, or other specific circumstances. However, there may be tax implications or penalties associated with early withdrawals.

What is the current interest rate on the PPF account?

The current interest rate on the PPF account is set by the government and is subject to change every quarter. As of February 2023, the interest rate for PPF is 7.1%

What is the current rate of interest on the EPF account?

The current interest rate on the EPF account is set by the government and is subject to change every year. As of 2021-22, the interest rate on the EPF account is 8.5%. The interest rate for the current financial year may be different and can be checked with the EPFO (Employees' Provident Fund Organisation) or the employer.

Does EPF or PPF have more liquidity?

EPF (Employee Provident Fund) offers limited liquidity as partial withdrawals are allowed under certain conditions, whereas PPF (Public Provident Fund) provides more liquidity options with partial withdrawals permitted after 5 years of account opening.

Is there a difference between EPF and PPF Interest Rates?

Yes, there is a difference. The interest rates for EPF and PPF are determined separately. Currently, the EPF interest rate is around 8.5% per annum, while the PPF interest rate is around 7.1% per annum.

Who contributes to the PPF scheme?

In the PPF scheme, individuals contribute to their accounts. It is open to all individuals (residents/citizens) and does not involve any contributions from employers.

Which companies have a mandatory EPF?

The EPF scheme is mandatory for employees working in the organized sector in India. It applies to companies or establishments that employ 20 or more individuals.

What is the investment period for PPF?

The investment period for PPF is a minimum of 15 years. However, individuals have the option to extend it in blocks of 5 years after the initial 15-year period.

Conclusion

EPF vs PPF – The difference between EPF and PPF are two separate schemes recognized by the government for providing retirement benefits to employees. Through this scheme, the citizens belonging to the service sector can deposit their money in the specified fund and receive its benefits after its maturity or after their retirement. Also, individuals can transfer this fund while moving from one company to another.

However, as per government regulations, the scheme may also provide tax benefits as per different criteria under two separate sections. Vakilsearch provides both EPF & PPF calculators online for free which you can use to calculate your savings and plan your finances accordingly.