In this blog, we will discuss the benefits of using a Compound Calculator in 2023. Read on to know!

Compound Interest Calculator is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods using the compound calculator. It means that interest is earned on both the original amount invested or borrowed and on the accumulated interest from previous periods. This results in faster growth of the investment or larger debt repayment compared to simple interest, where interest is calculated only on the original amount. Lets check the Compound Calculator Benefits and Formula in the following content.

How is Compound Interest Calculated?

Compound interest is calculated by multiplying the principal amount by one plus the annual interest rate raised to the number of compound periods minus one. The total principal or loan amount is then subtracted from the resulting value.

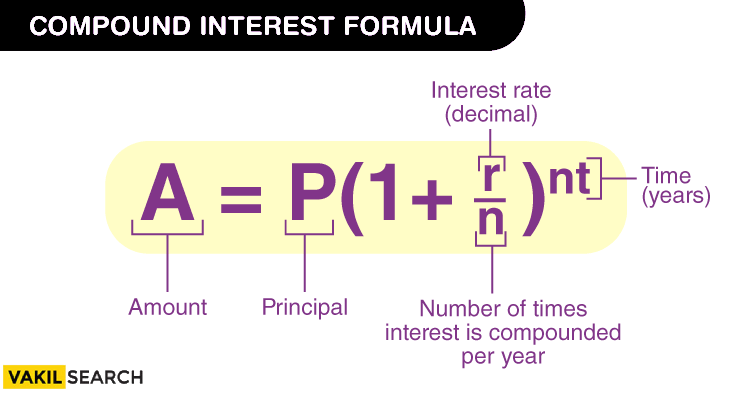

The compound interest formula is:

|

A = P(1+r/n)^nt Where:

|

Compounding with Additional Deposits

Compound interest can also be calculated on investments that receive additional deposits over time. This is known as compounding with additional deposits.

To calculate compound interest with additional deposits, you need to know the following:

- The principal amount invested

- The interest rate

- The frequency of compounding

- The amount and timing of any additional deposits

You can use a compound interest calculator to calculate the future value of your investment, taking into account additional deposits.

Compound Interest Formula:

where:

- A is the future value of the investment/loan, including interest

- P is the principal investment/loan amount

- r is the annual interest rate (decimal)

- n is the number of times that interest is compounded per year

- t is the number of years the money is invested/borrowed for

The Vakilsearch compound interest calculator calculates the compound interest by taking into account the principal amount, the interest rate, and the number of periods. The calculator then displays the investment or loan’s future worth.

5 Benefits of Using a Compound Interest Calculator

In this blog, we will discuss the benefits of using a compounding calculator in 2024.

The benefits of using a compounding Calculator in 2023 are as follows,

-

Simple to Use and Comprehend

Compound Interest Calculators are simple to use and comprehend. No matter your level of financial expertise or experience, anyone can use them. A compound calculator can be used by anyone with no special training or knowledge. Even for those without much financial knowledge, they are simple to use and comprehend.

Unfortunately, the majority of consumers view these calculators as complicated tools that are exclusively used by financial experts. They usually have both an automatic mode and a manual mode in addition. You must manually enter the figures one at a time. The automatic option, on the other hand, performs all of the calculations for you.

Consider the scenario where you need to figure out the interest on a loan with a 10% APR for two years. You will have to manually enter the numbers in that instance. But let’s say you want to estimate how much your investment will be valued in five years. The calculator will take care of the rest if you simply enter the numbers in the automated mode.

-

Facilitates Financial Decision-Making

Making wise financial decisions can be aided by compound calculators. You can use a compounding calculator to evaluate how various outcomes (such as adjustments to interest rates, investment amounts, and loan periods) would affect your financial situation in the future. This can assist you in reaching your long-term objectives and in making wiser financial decisions.

Compounding calculators can also assist you with retirement planning. For instance, let’s say you want to know how much you must set aside each month to retire with a given sum of money. If so, a compounding calculator can help you in determining that.

You can also benefit from it if you require a loan. Let’s say, for instance, that you’re thinking of borrowing money. If so, you can use a compounding calculator to determine the entire cost of the loan. This might help you in determining whether or not the loan is appropriate for you and your financial situation.

-

Offer Reliable Results

When it comes to financial calculations, accuracy is essential. Any small error could have a big effect on the outcome. When making financial judgments, you must always use reliable data.

A Compound Calculator that uses compound interest generates precise results.

By doing this, you may be confident that your calculations are as accurate as possible.

Assume, for instance, that you are thinking about buying a bond. The amount of interest you’ll earn during the bond’s lifespan can then be calculated using a compounding calculator to help you to decide if the bond is a wise investment.

-

Educate You on Difficult Financial Concepts

You can better understand difficult financial concepts by using compounding calculators. Some ideas, like compound interest, might be difficult to understand without a calculator. These ideas are simpler to comprehend because of the compound calculator, which can help you manage your money more effectively.

You can experiment with various scenarios and see how they affect your finances with a compounding calculator. This can improve your ability to comprehend complex financial ideas and help you make wise financial decisions.

You can learn how compound interest works, for instance, by using a compounding calculator. This can assist you in making wise investment decisions and ensuring that you are making the most of your money. Contact Vakilsearch for further details. Their team of legal professionals will respond to all of your questions.

-

Provide Variability

For people with various financial demands, compounding calculators’ versatility might be useful. You can use them for a variety of things because they are not limited to a certain set of computations. Compounding calculators also allow for flexible data entry. The calculator will still produce precise results regardless of the sequence in which the numbers are entered.

For instance, you can select the calculator based on your needs. You can also alter the parameters to meet your own needs. This tool can assist you in locating the ideal amount for your particular financial circumstances.

By using the Vakilsearch compound interest calculator, one can easily calculate their CI.

Where to Invest for Compound Interest?

There are many different places where you can invest for compound interest. Some common options include:

- Savings accounts

- Certificates of deposit (CDs)

- Money market accounts

- Bonds

- Stocks

- Mutual funds

- ETFs

The best place to invest for compound interest depends on your financial goals and risk tolerance.

How to Use Vakilsearch Compound Interest Formula Calculator?

The Vakilsearch compound interest formula calculator is a simple tool that you can use to calculate the future value of your investment, taking into account compound interest. Click here to use the.

To use the calculator, simply enter the following information:

- The principal amount invested

- The interest rate

- The frequency of compounding

- The number of years

The calculator will then display the future value of your investment.

Compounding Frequency in Compound Interest Calculation

The compounding frequency is the number of times that interest is compounded per year. The more frequently interest is compounded, the more your investment will grow over time.

Common compounding frequencies include:

- Annually (once per year)

- Semi-annually (twice per year)

- Quarterly (four times per year)

- Monthly (twelve times per year)

- Daily

Power of Compounding

Compounding is a powerful tool that can help you grow your money over time. The earlier you start investing, the more time your money has to grow.

For example, if you invest $1000 at a 10% interest rate compounded annually, your investment will be worth $1610 after ten years. However, if you invest the same $1000 at a 10% interest rate compounded monthly, your investment will be worth $1745 after ten years.

Difference Between Simple Interest and Compound Interest

Aspect |

Simple Interest |

Compound Interest |

| Calculation of Interest | Interest is calculated only on the principal. | Interest is calculated on both the principal and previously earned interest. |

| Interest Amount Over Time | Remains constant throughout the investment period. | Increases over time as the principal grows due to interest on interest. |

| Formula | I = P * r * t | A = P(1 + r/n)^(nt) |

| Example | Borrow $1,000 at 5% interest for 3 years: I = $150 | Invest $1,000 at 5% interest for 3 years: A ≈ $1,157.63 |

| Common Usage | Simple loans, basic savings accounts | Investments, savings accounts with compound interest, loans with compound interest |

FAQs

When is my Interest compounded?

The frequency of compounding depends on the financial product you are using. Some products, such as savings accounts, may compound interest daily, while others, such as CDs, may compound interest annually.

Can I include regular withdrawals?

Yes, you can include regular withdrawals in your compound interest calculations. However, it is important to note that regular withdrawals will reduce the amount of money that you have invested, which will reduce the amount of interest that you earn.

What is the effective annual interest rate?

The effective annual interest rate (EAR) is the annual interest rate that you would earn if interest were compounded annually. The EAR is always higher than the nominal interest rate, which is the interest rate that is quoted by the financial institution.

Can I calculate my returns on National Savings Certificates too?

Yes, you can use the compound interest formula to calculate your returns on National Savings Certificates. Simply enter the principal amount, interest rate, frequency of compounding, and number of years into the formula.

Is Compound Interest available in Banks?

Yes, compound interest is available in bank savings accounts and certificates of deposit (CDs). However, the interest rates on bank products are typically lower than the interest rates on other types of investments, such as bonds and stocks.

Why is Compound Interest so powerful?

Compound interest is powerful because it allows you to earn interest on your interest. This means that your investment can grow exponentially over time.

What Is Daily, Monthly & Yearly Compounding?

Daily, monthly, and yearly compounding are different ways of calculating compound interest. Daily compounding compounds interest every day, monthly compounding compounds interest every month, and yearly compounding compounds interest every year. The more frequently interest is compounded, the more your investment will grow over time. However, it is important to note that the difference between daily, monthly, and yearly compounding is relatively small, especially for short investment periods.

What Are Compound Interest Investments?

Compound interest investments are investments that allow you to earn interest on your interest. This means that your investment can grow exponentially over time. Some common compound interest investments include:

● Savings accounts

● Certificates of deposit (CDs)

● Money market accounts

● Bonds

● Stocks

● Mutual funds

● ETFs

The best compound interest investment for you will depend on your individual financial goals and risk tolerance.

Conclusion

For everyone who wishes to better manage their finances, a compound calculator is a need. They provide a number of advantages, including precision, adaptability, and comprehension of difficult financial concepts. Even for those who are unfamiliar with financial jargon, they are simple to use.

You may make wise financial decisions that will help you in the long term by using a compound interest calculator.