In this article we will be talking about the PF scheme and how one can check the status of their PF claim.

The Employees’ Provident Fund (EPF) is a government-mandated savings scheme in India that aims to provide financial security to employees after their retirement. EPF contributions are made by both the employee and the employer, and the accumulated funds can be claimed by the employee under certain circumstances. If you have applied for a PF withdrawal or settlement, it is important to know how to check the status of your claim.

Eligibility to Apply for EPF Claim:

To be eligible for an EPF claim, certain conditions must be met. The most common circumstances under which an employee can apply for EPF withdrawal include

- Retirement: If an employee has reached the age of 58 years, they are eligible to apply for full withdrawal of their EPF amount.

- Resignation: If an employee resigns from their job and remains unemployed for a continuous period of two months, they can apply for EPF withdrawal.

- Unemployment: In case of unemployment for more than one month, an employee can apply for a partial withdrawal of their EPF funds.

- Illness: If an employee is suffering from a serious illness, they can apply for a partial withdrawal from their EPF account.

- Housing Loan Repayment: EPF funds can be utilized for the repayment of a housing loan under certain conditions.

PF Claim Offline:

In the past, EPF claims were primarily processed offline, where employees had to submit physical forms and documents to the concerned EPFO office. However, with the advancement of technology, EPFO now provides various online methods to check the status of your PF claim.

PF Claim Online Application:

EPFO has introduced an online claim facility that allows employees to submit their PF withdrawal applications electronically. This method offers convenience and faster processing times compared to the offline process. To apply online, employees need to have an active Universal Account Number (UAN) linked to their PF account.

Prerequisites to Check EPF Withdrawal Status:

Before checking your EPF withdrawal status, ensure that you have the following details:

- UAN (Universal Account Number): It is a unique identification number assigned to every EPF member. You can obtain it from your employer.

- EPF Account Number: This is the account number linked to your UAN, which can be found on your salary slip or by contacting your employer.

How to Check Your PF Withdrawal Status?

There are multiple methods available to check the status of your PF withdrawal. Let’s explore each one of them:

Using EPFO Website:

- Visit the official EPFO website

- Under the ‘For Employees’ section, click on ‘Services’ and then select ‘Know Your Claim Status.’

- Enter your UAN and the security code displayed on the screen.

- Click on ‘Submit’ to view the status of your PF withdrawal.

SMS Alerts From EPFO:

- Ensure that your UAN is registered and activated.

- Send an SMS to 7738299899 from your registered mobile number.

- The message format should be: EPFOHO UAN ENG (For the English language).

- You will receive an SMS with the details of your PF withdrawal status.

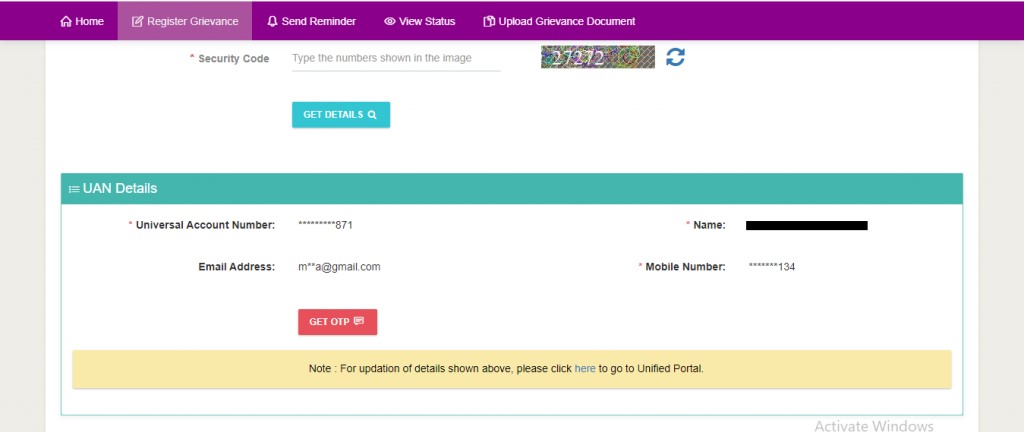

Using UAN Member Portal:

- Log in to the UAN Member Portal

- Enter your UAN, password, and captcha code.

- Navigate to the ‘Online Services’ section and click on ‘Track Claim Status’ to view your PF withdrawal status.

Using the UMANG App:

- Download and install the UMANG (Unified Mobile Application for New-age Governance) app on your smartphone.

- Register and log in to the app using your mobile number.

- Under ‘EPFO’ services, select ‘Track Claim Status.’

- Enter your UAN and click on ‘Get OTP.’

- After entering the OTP, you can view the status of your PF withdrawal.

By Giving a Missed Call:

Give a missed call to 011-22901406 from your registered mobile number.

You will receive an SMS with the details of your PF withdrawal status.

By Calling EPFO Toll-Free Number:

Dial the EPFO toll-free number 1800-118-005 from your registered mobile number.

Follow the IVR (Interactive Voice Response) instructions to check your PF withdrawal status.

Via SMS:

- Send an SMS to 7738299899 from your registered mobile number.

- The message format should be EPFOUAN STATUS (Example: EPFOUAN ABCDE12345 STATUS).

- You will receive an SMS with the details of your PF withdrawal status.

What are the types of PF Claim Status?

The PF claim status can be categorized into the following types:

- Under Process: This status indicates that your PF withdrawal application is being reviewed and processed by the EPFO.

- Approved: If your PF withdrawal application is approved, it means that your claim has been processed successfully, and the funds will be disbursed shortly.

- Rejected: If your PF withdrawal application is rejected, it means that there might be discrepancies or issues with your application. You can contact the EPFO office for further clarification and rectification.

How to Cancel EPF Withdrawal Claim?

If you have applied for PF withdrawal but wish to cancel the claim, you can do so by following these steps:

- Visit the official EPFO website or log in to the UAN Member Portal.

- Navigate to the ‘Online Services’ section and click on ‘Track Claim Status.’

- Enter your UAN and the captcha code to view the status of your PF withdrawal.

- If the claim status is still “Under Process,” you may find an option to cancel the claim.

- Click on the cancel option and follow the instructions to cancel your PF withdrawal claim.

It is essential to note that once the claim status changes to “Approved,” it may not be possible to cancel the withdrawal claim. In such cases, you can choose not to withdraw the amount from your bank account after the funds are credited.

Frequently Asked Questions:

Do I need a UAN to check my EPF claim status?

Yes, it is necessary.

What if I forgot my EPFO login password?

There is a forgot password option, below the login button Fill the required details You will get an OTP, enter it to activate your new password Can I check my PF claim status without a PF number? Yes, you can. You can check your EPF balance with UAN and password.

Is there any tax benefit on EPF contribution?

The contribution from the employer is tax-free but an employee contribution is tax-deductible.

Conclusion

Checking the status of your EPF withdrawal claim is crucial to stay informed about the progress of your application. By utilizing the online methods provided by EPFO, you can easily track your claim status and take appropriate actions if required. Remember to keep your UAN and EPF account details handy for a hassle-free experience.

Read More: