PF (Provident Fund) helps an employee accumulate retirement funds and funds for activities like higher education, marriages, or emergencies. The Indian government launched PFs in 1952 to provide financial assistance to the working-class population of India.

Provident Fund (PF) is also sometimes termed as Employees Provident Fund (EPF), as it serves the employees in accumulating money for their future. Every employee is eligible for a PF after the beginning of employment. The PF scheme is managed by the ‘Employees Provident Fund and Miscellaneous Provisions Act, 1952.’ And this Act is regulated by the ‘Employees’ Provident Fund Organisation (EPFO).’

An employer can apply for one’s establishment’s PF registration certificate when an establishment follows a set of norms given by the Government of India. The essential requirement of getting a new PF registration is that the establishment must have more than 20 employees working actively.

The employer handles the deduction of the PF amount from an employee’s salary. And the employer is responsible for his activities. Also, to apply for a new PF registration, the employer must follow specific steps and have the required documents. And with the help of the internet, registration can also be done online.

The Employee Provident Fund is regulated beneath the umbrella of workers Provident Fund Organization popularly called EPFO. All institutions that have utilized twenty or over 20 employees will apply for PF registration in India.

Who is Eligible for the PF registration?

The Indian government has made some set of rules and regulations which must be followed to apply for a PF registration. Firstly, most employees and the employer must agree to get a PF registration done, and then the other process can be carried out. The following points showcase the eligibility criteria for getting a PF certificate:

- The PF fund can be provided to the employee from the day one joins an establishment to work with.

- There must be at least 20 people working in an establishment to get a PF certificate. The government considers these employers as firms. A company with more than 20 workers is often considered a ‘compulsory registration firm.’

- For companies with less than 20 workers, voluntary registration is needed. The employer must send a notice to the Employees’ Provident Fund Organisation (EPFO), within two months, after commencing the establishment’s activities.

- Every employee in India can register for a PF certificate that works as a full-time employee, freelancer, contractor, or person working from home.

Who is not eligible for the scheme?

The following working individuals are not eligible for the PF scheme provided by the government:

- An intern

- Retired employees

- An apprentice

- Non-Resident Indians (NRIs)

- People working abroad

What is excluded from the Provident Funds (PFs)?

One cannot include every allowance in the PF. The following is a list of allowances that are excluded from the employee provident fund, as per the government norms:

- Bonus

- Food allowances

- Dearness Allowance (DA)

- House Rent Allowance (HRA)

- Overtime Allowance (OTA)

Required Documents for a new PF Registration:

One needs many documents while registering for a PF scheme. One needs to have different kinds of papers dependent upon the kind of business, industry, or company. The following is the detailed list of the required documents for PF registration as per one’s need:

Proprietorships:

- Applicant’s name

- Proprietor’s PAN card

- ID proof of proprietor such as passport, voters ID, driving license

- Address proof of establishment

- Address of proprietor

- Applicant’s details, including the mobile number, email, and residential address

Trusts or societies:

- Concerned authority’s details

- Incorporation certificate of trust

- Bye-laws and Moa of trust or society

- Trust’s PAN card

- President’s ID proof

- Members’ ID proof

Companies or LLP (Limited Liability Partnership) or partnership firms:

- Company’s or the firm’s name

- Company’s incorporation certificate

- Partnership deeds of the LLP or partnership firm

- Partners’ ID proof includes PAN card/ passport/ driving license in case of LLP. ID proof of directors in case of a company

- List of partners with address, telephone number, and other details of all the partners in the partnership firm or LLP. The notable list of the directors’ contact details for companies.

Some necessary standard documents are required for every kind of establishment:

- First purchase bill of machinery

- Bill related to the first purchase of raw materials

- First sale bill or invoice

- If the company is registered under GST, then the GST registration certificate

- Address of the bank and name of bankers

- Employees’ joining dates

- Date of birth of employees and their father’s name

- Salary details

- PF statement

- Number of employees’ monthly strength record

- Salary register

- Balance sheets from the first date of working to the current date of the interim coverage

Use Vakilsearch`s EPF calculator to determine out how a whole lot cash might be accumulated on your EPF account while you retire.

This list of documents required for a new PF registration can change in the future, depending on the government’s rules and regulations.

Online PF registration process:

With the help of the internet, one can make the registration process faster by filling out the registration form online. Hence, the employer doesn’t need to leave his home and stand in long queues. The following are the steps to follow while registering to apply for a new PF scheme:

- First visit the ‘Employees’ Provident Fund Organisation website -(https://www.epfindia.gov.in/site_en/index.php)

- Click on the ‘Establishment registration’ button, which is present on the home page itself.

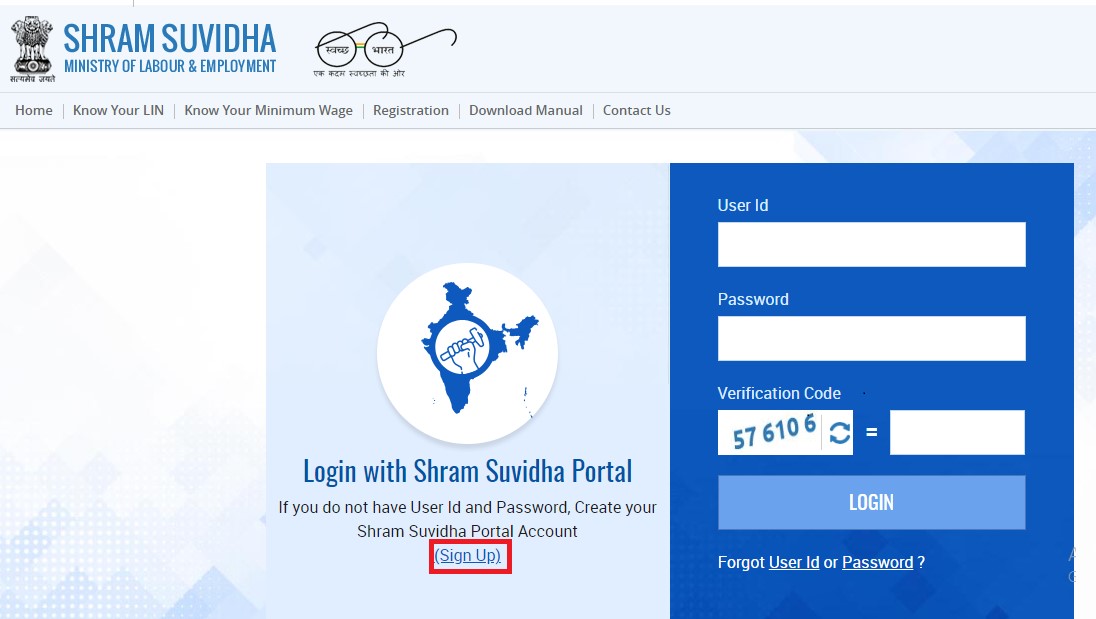

- A new window opens the home page of ‘Unified Shram Suvidha Portal (USSP).’

- Click on the sign-up button on the USSP webpage.

- Then, one has to fill in the required details at the EPFO (Employees’ Provident Fund Organisation) portal.

- Click on ‘New Registration’ and the ‘Submit’ button.

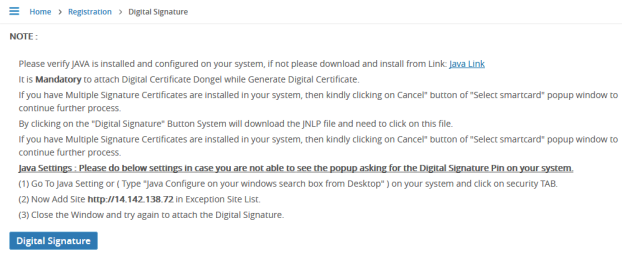

- Then submit the DSC (Digital Signature Certificate), and complete the process.

- A message of process completion is received on the registered mobile number.

- Also, an email of form confirmation is received on one’s registered email.

These were the basic steps to complete one’s PF registration.

Conclusion

Hence, all the above points can help an individual to know the basics of PF registration. Also, it can guide someone in understanding the steps while registering for PF and the documents required for the same purpose.

One can also take help from many experts in filing such forms. With the use of technology, one can find an expert online. Vakilsearch is an Indian company that helps many companies and individuals resolve legal, compliance, and taxation issues. This firm can also provide more details about a new PF registration. Their services are also recognized all over India.

They have a team of more than 300 expert lawyers and have worked with over 50,000 companies. They have registered more than 10% of the Indian companies. They provide the best services to their clients and have more than 1.5 lakh happy customers, which is constantly rising. They are also considered India’s most prominent legal services platform, a phenomenal achievement.

Read more