Mutual funds are a popular investment option for those who are looking to invest in the stock market but do not want to invest directly in individual stocks. When investing in mutual funds, it's important to consider when you should do Mutual Fund Withdrawal Online. This decision can have a significant impact on your investment returns and your overall financial situation.

When to Do Mutual Fund Withdrawal Online?

The decision to Mutual Fund Withdrawal Online depends on your financial goals and circumstances. You should consider withdrawing from a mutual fund if you need the money to meet your financial obligations or if you have reached your financial goal.

However, you should also consider the potential tax implications and any fees associated with the withdrawal, as well as the current state of the market and the performance of the fund. It’s best to consult with a financial advisor to determine the best course of action for your specific situation.

What Are the Points to Consider for Mutual Fund Withdrawal?

First, it’s important to consider your financial goals and circumstances. Why did you invest in the mutual fund in the first place? Are you saving for a long-term goal, such as retirement, or do you need the money for a more immediate expense, such as a down payment on a house or a child’s college tuition? If you are investing for a long-term goal, it may not be necessary to withdraw your funds in the short term, as you have time for the investments to grow and potentially recover from any dips in the market.

On the other hand, if you need the money for a more immediate expense, it may be necessary to withdraw from the mutual fund.

However, it’s important to consider the potential tax implications of doing so. When you withdraw from a mutual fund, you may be subject to capital gains taxes on any gains you have realized. Depending on your tax bracket and the amount of your gains, this could result in a significant tax bill. If you are in a high tax bracket or have significant gains, it may be wise to consult with a tax professional to determine the best course of action.

Additionally, if you have a financial advisor who helped you select the mutual fund, they may charge a fee for the withdrawal. Be sure to understand all fees associated with withdrawing from the mutual fund before making any decisions.

Another factor to consider is the current state of the market and the performance of the mutual fund. If the market is experiencing a downturn or the mutual fund is underperforming, you may want to hold off on withdrawing your funds until the market or the mutual fund has recovered. Selling your shares during a downturn could result in a loss, and it may be wise to wait for the market to recover before selling.

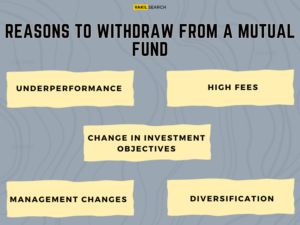

Reasons to Withdraw from a Mutual Fund

Here are some possible reasons to withdraw from a mutual fund:

- Underperformance: If the mutual fund has consistently underperformed its benchmark or other comparable funds, you may want to withdraw your investment and consider a different fund that has better potential for returns.

- High fees: Mutual funds typically charge fees for managing your money, and some funds have higher fees than others. If the fees are eating into your returns and you can find a similar fund with lower fees, it may make sense to switch.

- Change in investment objectives: If your investment goals or risk tolerance have changed, the mutual fund you’re invested in may no longer be a good fit. You may want to withdraw your money and reinvest in a fund that aligns better with your new objectives.

- Management changes: If the fund’s portfolio manager or other key personnel have left, or if the fund has undergone significant management changes, it could be a red flag that the fund may not perform as well going forward.

- Diversification: If you have a large portion of your portfolio invested in one mutual fund, you may want to withdraw some of your money to diversify your holdings and spread your risk across different asset classes and funds.

Conclusion

Overall, the decision to withdraw from a mutual fund is a personal one that should be based on your financial goals and circumstances. It’s important to consider the potential tax implications and any fees associated with the withdrawal, as well as the current state of the market and the performance of the mutual fund. If you are unsure about whether to withdraw from a mutual fund, it may be wise to consult with a financial or legal advisor or tax professional to determine the best course of action. At Vakilsearch, we provide legal assistance when it comes to withdrawing or investing in mutual funds.

Read More: