If you want to know particular details about the EPF registration, then here you will get all the details!

Once you register with the EPF, the establishment must contribute some percentage to the fund. The country machining will get deducted from the salary of the employee concerned polestar additionally employer needs to initiate the EPF registration for the employees. The employees cannot carry out registration all by themselves. If you want to no, you can be registered for the EPF being an employer; then you have to read the steps mentioned here. Let’s see about EPF Registration eligibility criteria in this blog.

Steps to Register for EPF

If you are an employer looking forward to registering, these steps will make the process easy for you.

Registered the company for EPF

You can visit the official web portal of the EPFO – https://www.epfindia.gov.in/site_en/index.php to register the company. You can choose the option stating the establishment registration present on the homepage of the unified portal.

Download the user manual

The page should be redirected to the link by clicking the establishment registration option. You can check the manual present on the link. The manual should be read thoroughly before you enter registering if you are new to the process.

Register On The Unified Portal

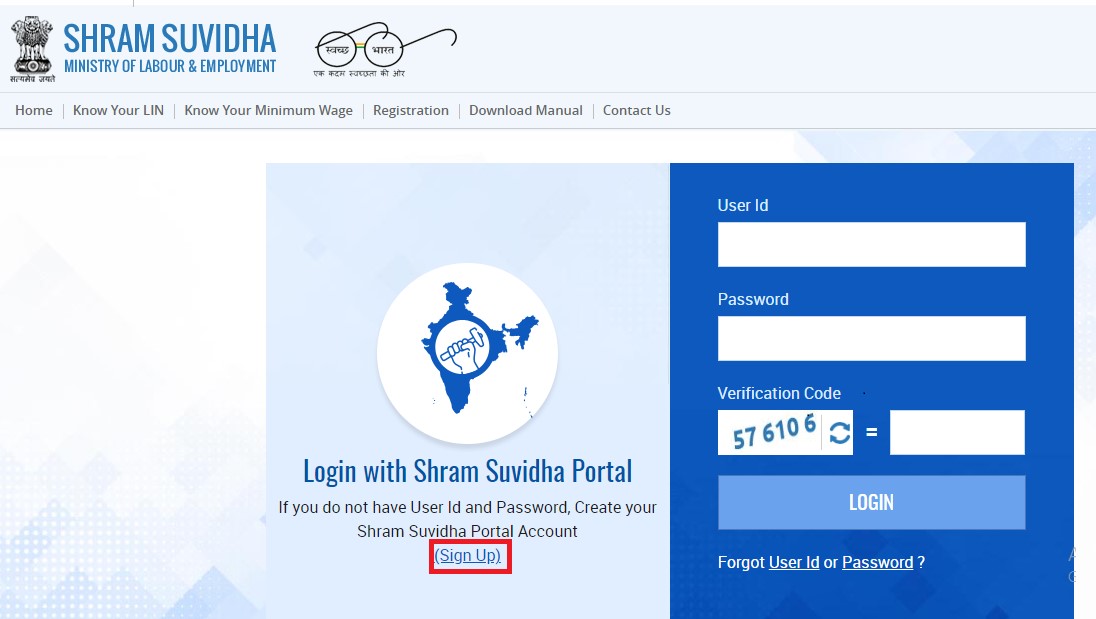

You can register yourself on the portal. The signup process is relatively easy. You have to just click on the registration tab on the home page and click on the tab marked sign up.

Fill out the registration form

You need to log in to the website and locate the tab stating registration for EPF on the screen’s left side. After this, you have to choose the option displaced as applying for a new registration on the screen right side.

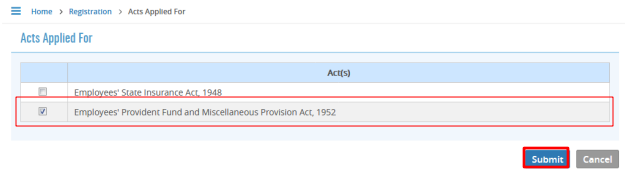

You will have 2 options, including the Provident fund and miscellaneous provisions act 1952 and the employees state Insurance Act 1948. Being an employer, you should select the option stating the employee’s Provident fund and miscellaneous provision at 19:52 and then click on the option to submit. On clicking the button submit, the page regarding the registration form for EPF would be displayed.

After filing all the registration requirements and attaching the required documents, the employer’s digital signature certificate should be uploaded and affixed to this form. The platform will then email you to confirm the EPF registration, completed successfully after uploading this digital signature.

What Do you need to know about the EPF Registration Eligibility?

The EPF registration is essential for establishments to align with the criteria.

- A factory should be engaged in an industry bearing a workforce of at least 20 or more.

- Other establishments have more than 20 employees or classes of similar establishments specified on this behalf by the central government through a notification.

The employer should have the EPF registration within one month of recruiting the 20 employees, or it might lead to some penalty.

If the employee strength of the registered organization becomes lower than the minimum threshold simultaneously, it can also remain within the range of regular act. The central government might apply some provision to the organization having an employee strength of lower than 20 after handling a notice of 2 months regarding mandatory registration.

It would be done for some companies if they have less than 20 employees to get the EPF document registration, but it comes for the voluntary organization.

If you’re an leader with a company that employs twenty individuals or more, it’s necessary for you to register under the EPF scheme. If your organization employs lower than 20 people, you’ll still favor to register under the scheme.

Documents required for EPF registration

- The bank statement or cancelled cheque of the company

- Digital signature of the partner director of the proprietor

- pan card of the partner director or proprietor.

- Aadhar card of the director partner or the proprietor

- GST certificate, shop and establishment certificate, or any other license issued by the government.

- Address proof including water bill, electricity bill, telephone bill of the registered office

Why is it essential for you to register the EPF being an employer?

As your TDs get deducted from the employees’ salary, the EPF registration plays a crucial part of the employer. Additionally, they would be required to process all the remittances after the employers generate the challan from the EPF employer portal. Above all, the process is mandatory for them.

PF and EPF withdrawal capability

EPF allows partial withdrawal for a specific purpose after completing at least 7 years of deposit. The purpose of withdrawal needs to be mentioned, like marriage education for a child or sibling.

You can withdraw at least 50% of the collected amount so far, and other purposes for which you can withdraw are the purchase and construction of a house, buying land or innovation of the house, and repayment of the home loan up to 12 months before retirement. For home loan site purchase or construction of the house, you must have completed at least 5 years before the withdrawal. The maximum you can withdraw is around 90% of the corpus amount by filling EPF form 15g. You can avail of the facility twice if you want to renew it at your house.

Tips to check the Eligibility of online PF transfer

Online transfer city is available when the employee easily transfers the Provident fund balance with the previous employer to the new employer. The employee can get a transfer claim attested by either of the employers. The EPF girls allowed transferring funds under some terms and conditions. Earlier form 13 was required to be filled out and signed by the previous employer and submitted to the new employer.

There were some issues with the misplacement and following up with the human resources of both the companies. It is revised form 13, which can be submitted to either new or old employer.

Above all, EPF is a beneficial scheme for all employees, ensuring that salaried employees set aside a good portion of their earnings in anticipation of retirement. Even though salaried people have their savings and investments, many might not have the means or the financial know-how to make the required provisions, so the EPF comes in the picture, and it’s pretty handy.

Conclusion:

Hope this blog regarding EPF registration eligibility criteria was helpful. Registering of EPF requires a legal expert, hence If you are looking for one, then you are at the right place, as Vakilsearch is the ideal solution for the same.

Read more