A professional who has been authorised by the Income Tax Department to assist taxpayers in filing income tax returns is known as an income tax return preparer.

A professional who has been authorised by the Income Tax Department to assist taxpayers in filing income tax returns is known as an income tax return preparer. Taxpayers should be aware that tax return preparers’ duties essentially control how individual and HUF assessees file their taxes. The services of tax return preparers shouldn’t be used by assessees who are corporations, have business income, or are subject to the obligation for a tax audit. In order to assist taxpayers with the filing of their income tax returns, the Income Tax Department has established a unique program under which it has recognised certain individuals as Income Tax Return Preparers. An income tax return preparer’s services are mostly available to individual taxpayers who are not needed to seek a tax audit or any other audit in order to submit an income tax return.

For any person who needs their income tax return to be submitted in accordance with Section 139 of the Income Tax Act, tax return preparers are permitted to prepare and file the return on their behalf. The Income Tax Act’s Section 44AB prohibits TRPs from preparing the Income tax returns of anyone who is engaged in a trade or profession and whose accounts must be audited.

Tax Return Preparer Scheme (TRPS)

The Income Tax Department started the Tax Return Preparer Scheme (TRPS) as a service to make filing taxes more effective. Because TRPS delivers these services right at the taxpayer’s door, the procedure of filing taxes has become more convenient and generally straightforward for the taxpayer since its debut. In order to help small and marginal taxpayers prepare and file their tax returns for a modest price or, occasionally, for no charge, the plan utilises qualified experts who have been trained by the Income Tax Department. The Tax Return Preparer Scheme (TRPS) is discussed in detail, along with some of its key components.

The main aim of the Scheme

- To give graduates in India who are unemployed or only part-time employed a job.

- To lower small taxpayers’ compliance expenses.

- To broaden the base of taxpayers.

- To educate the general public about tax laws.

- With the purpose of promoting community involvement.

Eligibility Income Tax Return Preparer

Anyone who has earned a graduate degree in business administration, management, commerce, economics, law, mathematics, or statistics from an accredited Indian university is eligible to work as an income tax return preparer.

Who Can Use an Income Tax Return Preparer to File Income Tax Returns?

- According to the Income Tax Act, the taxpayer carried on a business or practised a profession during the prior year, and the accounts for that prior year must be audited.

- During the preceding year, the taxpayer was not a resident of India.

- In response to a notification issued under Section 142(1)(i), Section 148, or Section 153A, the taxpayer is obligated to file an income tax return.

What are the Responsibilities of a Tax Preparer

The tasks that a tax return preparer should carry out are listed below.

- A taxpayer’s return needs to be prepared with appropriate diligence in mind.

- The concerned TRP’s signature is required on every prepared return for a taxpayer.

- A TRP is required to deliver the returns to the appropriate Assessing Officer or to a suitable organisation that has been approved by the Resource Center.

- TRPs should get an acknowledgment copy since it provides evidence that the return was submitted.

- It is a TRP’s duty to keep a record of all the precise information pertaining to the returns they produce.

- Every month, by the seventh, a statement of particulars must be delivered to the Resource Center.

Take control of your financial destiny – Our Online Tax Calculator is your companion for strategic tax planning and savings.

It should be mentioned that the concerned professional should make sure the following details are included in the record while maintaining a record of precise details with regard to all the returns submitted by them:

- The person’s name for whom the TRP compiled the results.

- The assessee’s PAN.

- The assessment’s year

- The day on which the return was delivered or filed.

- The quantity is written on the acknowledgment sheet.

- The evaluating officer’s authority.

- The entire income amount is reported on the tax return.

- The entire amount of tax that the taxpayer owes.

- Every sum pertaining to any fees or charges that the TRP is obligated to pay under the terms of the Scheme.

Income Tax Return Preparer Fees

For the submitted income tax returns, income tax return preparers may get a fee and commission. A commission of 3% of the tax paid by the assessee, up to a maximum of ₹ 1000, will be given in the case of the filing of an income tax return for the first year. A commission of 2% of the tax paid by the assessee, up to a maximum of ₹ 1000, will be given in the event that a second-year income tax return is filed. If a third-year income tax return is filed, a commission of 1% of the tax paid by the assessee, up to a maximum of ₹ 1000, would be given.

Obtain TRP Services

To use a tax return preparer’s services, a taxpayer must complete the steps outlined below.

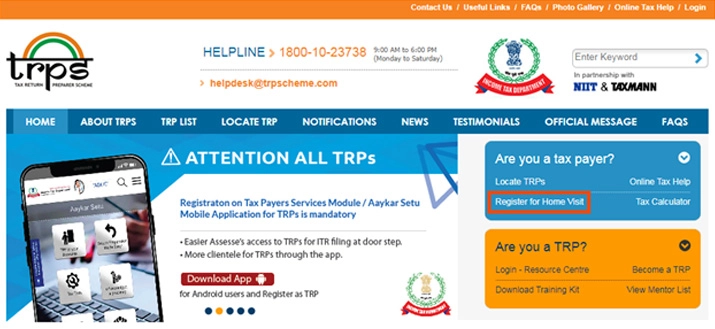

Step 1: Go to the Tax Return Preparer Scheme’s official website (TRPS).

Step 2: On the right side of the page, click the Register for Home Visit button. This project calls for a TRP to go to the taxpayer’s home and help them with tax return preparation.

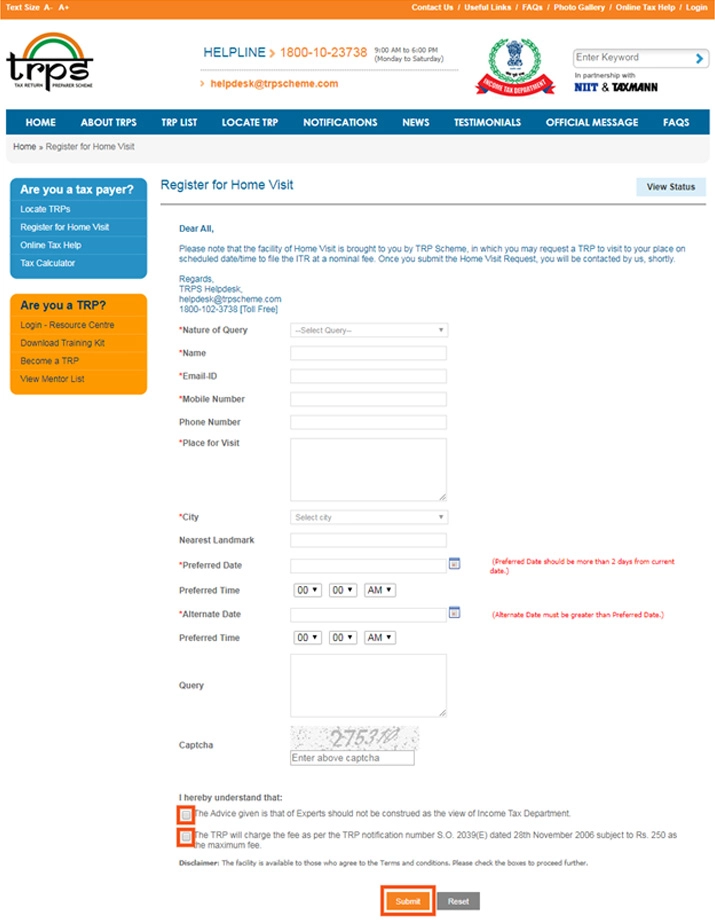

Step 3: Carefully fill out the fields on the next page. The taxpayer would next be required to describe the type of help they require along with the day and time the TRP is scheduled to visit on this website.

Step 4: Finish the captcha and choose the checkboxes underneath the form. To finish the submission, click the Submit button.

Step 5: After the paperwork is filed, the assistance desk will locate the nearest TRP to the taxpayer’s house and make a phone appointment. The meeting would be verified.

TRP-related charges

TRPs often help taxpayers file their taxes for a nominal fee because they are immediately compensated by the Income Tax Department. The amount of tax that the taxpayer or a TRP assistant must pay determines how much they are paid.

TRPs would be accorded:

- 3% of the tax paid on the first-year returns that every new assessee prepared and submitted. The maximum amount of compensation for each assessee is INR 1000.

- For the second year, each assessee will get 2%.

- For the third year, 1% for each assessee.

- INR 250 for each assessment starting in the fourth year.

Conclusion

The income tax department established the tax return preparation program to facilitate and expedite the filing of tax returns. According to this plan, the income tax agency trains persons to help taxpayers prepare and file their income tax returns for a little charge or for free because TRPs are paid directly by the income tax department. Vakilsearch provides significant and important information in the context of the same, so if you want to know more about this, connect with this platform.

Also, Read: