The insertion of 115BA, 115BAA, and 115BAB of the Income Tax Act in 1961, comes with its own set of benefits; read this blog to know more.

The Indian government introduced Amendment – Taxation Ordinance Act 2019 on 20 September 2019. In the 1961 Income Tax, multiple amendments were made via the ordinances. It was Nirmala Sitharaman who inserted both Section 115BAA and 115BAB sections into the 1961 Income Tax Act recently. One of the primary reasons the sections were inserted into the Income Tax Act 1961 was to provide benefits to domestic companies for the reduced tax rate. The domestic companies in the existing market were given an option of paying the tax at a 22% concession rate for the companies established post 1 October 2019. If they have plans to commence their manufacturing process before 31 March 2023, these companies will get an option to pay tax at the rate of 15%.

With the sections, there is a reduced rate of tax. There will be no MAT (Minimum alternate tax) applicable. Companies who do not opt for the concession tax rates can reap the benefits of incentives subjected to 15% of MAT. New options provisions, known as sections 115BA, 115BBA, and 115BAB, have recently been made available to businesses. The standard rate of taxation that applies to companies based in the same country is, if the turnover or gross receipts of the domestic company in the previous year were less than ₹400 crores, the rate is 25%. When it is determined that the taxable income determined by the provisions of the IT Act is less than 15.5% (plus surcharge and cess as applicable) of the book profit determined following the Companies Act 2013, the Alternative Minimum Tax is applied.

Understanding Section 115BA Under the Income Tax Act

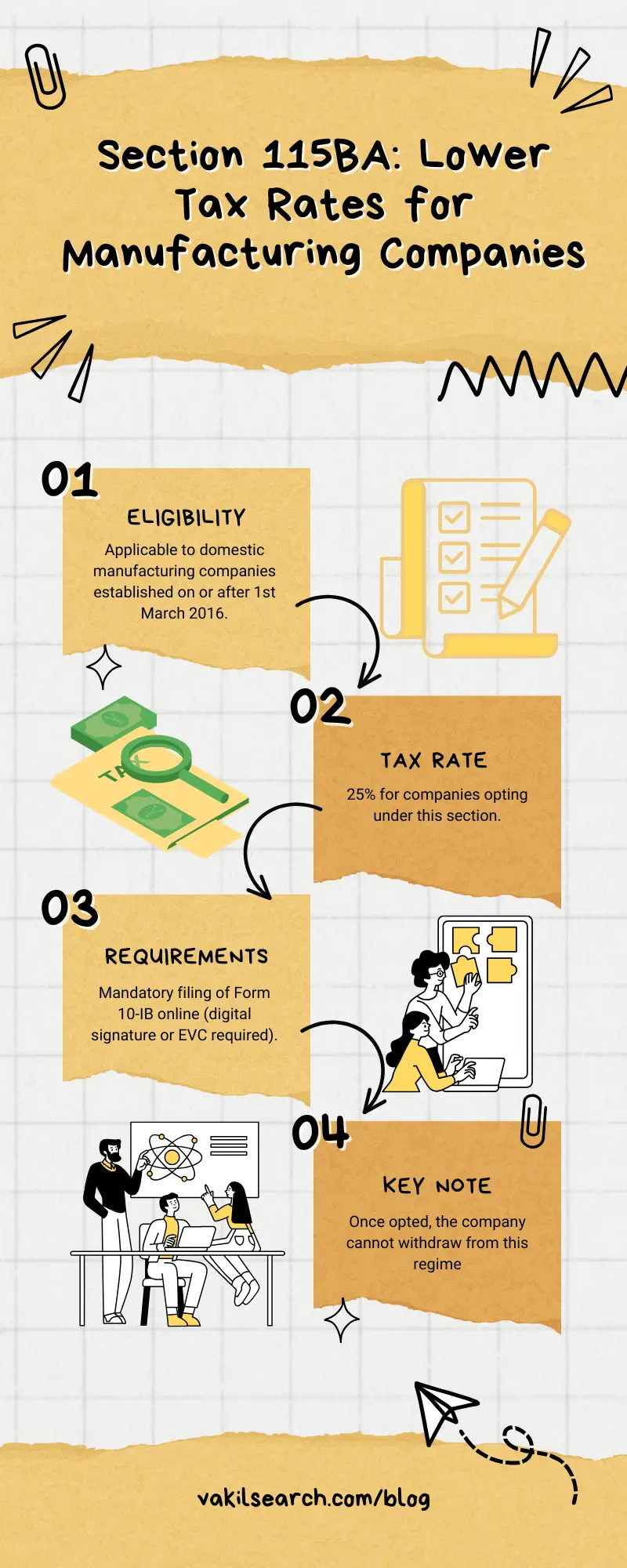

The tax rate is 25% for a few local manufacturing companies if those companies are subject to additional requirements of Chapter XII (other than Section 115BAAA and Section 115BAB). Under Section 115BAB, the domestic manufacturing company can choose to pay a lower income tax at any point in time without incurring a penalty.

- To be eligible for this particular tax rate option, the company must have been established and registered on or after 1st March 2016.

- Once a company has decided to take advantage of this option, it will no longer be able to withdraw from the agreement.

- The CBDT has informed us that the option needs to be included in Form 10-IB. It is required that the form be submitted online with either a digital signature or an electronic verification code.

LLP ITR filing is mandatory as per the Income Tax Act, 1961, and failing to do so can result in penalties and legal consequences. Click here know about LLP ITR Filing

Understanding Section 115BAA Under the Income Tax Act

This Section now includes the tax on the Income of certain Domestic Companies, from the assessment year 2024-2025. The Income Tax Act of 1961 was amended to include Section 115BAA to provide domestic corporations with the advantage of a reduced corporate tax rate. According to Sections 115BA, 115BAA, and 115BAB, domestic companies can pay taxes at a rate of 22% plus an sc of 10% and a cess of 4%. This is the highest possible tax rate.

By Sections 115BA, 115BAA, and 115BAB, a company has the option of reverting to the previous taxation system rather than paying the concessional tax. However, suppose the company will exercise its option under Section 115BAA for a particular assessment year. In that case, it will no longer be able to withdraw that option for that assessment year or any subsequent ones.

If your business is operated by a single individual then you should file a Proprietorship Tax Return Filing

These are the two things that can be done

- Using Section 35 of the Internal Revenue Code to claim a deduction for expenses incurred while conducting scientific research or for amounts paid to educational institutions, research organizations, the National Laboratory, or the IIT.

- Submitting a claim for a deduction under section 35AD for any capital expenditures incurred by a particular type of business.

Regardless of anything else in this Act, but subject to the provisions of this Section, other than those mentioned under Sections 115BA, 115BAA, and 115BAB.

Understanding Section 115BAB Under the Income Tax Act

The Taxation Laws (Amendment) Ordinance, 2019, passed on 20 September, 2019, including a new provision that introduced a tax on the income of certain manufacturing companies. It is done to encourage new manufacturing businesses to get off the ground.

If you have a basic understanding of how income tax is computed in India, you can estimate the amount of tax you will owe based on your salary. There is no such restriction on the deduction that can be taken under Section 80JJAA, in contrast to the other beliefs, such as 80C and 80G, which cannot be taken into account when computing total income for Section 115BA, 115BAA, and 115BAB.

Stay ahead of tax complexities – leverage the power of our advanced New Tax Regime Calculator.

In computing the total income of any person for any period before the installation of a plant or machinery by the person, there is no judgment on account of decline that has been permissible or is acceptable under the requirements of this Act.

Regardless of anything else in this Act, but subject to the provisions of this Section, other than those mentioned under Sections 115BA, 115BAA, and 115B, the income tax payable in respect of the total income of a person, being a domestic company, for any previous year relevant to the assessment year beginning on or after the first day of April 2020. It applies to any previous year relevant to the beginning of the assessment year.

Companies that choose to operate under this section 115BAB will be required to pay tax at a rate of 22% on any income that is not derived from or incidental to the manufacturing or production of an article or thing. Additionally, no deductions or allowances will be permitted on such income.

Conclusion

Are you looking for experts who can provide the needed information and expertise on Sections 115BA, 115BAA, and 115BAB of the Income Tax Act? Get in touch with Vakilsearch to get proper legal help. The professionals here make sure to leave no stone unturned in helping people through the legalities in every possible way. Moreover, you can get all the legal Services at affordable prices.