There are specific guidelines for measuring the amount of income tax slab for senior citizens pensioner. Let us have a look at the details.

According to the Income Tax Department, a senior citizen is a person who is 60 years old or more but less than 80 years of age. Income Tax slab for Senior Citizen primary income sources include pensions, rental income, savings, and fixed deposits. The Income Tax Act 1961 states that a certain amount of tax will be levied on each income source for a senior citizens. On the other hand, there are many tax exemptions that senior citizens enjoy as per the Government guidelines. Therefore, let us look at the Income Tax Slab for Senior and the liability structure.

How to Calculate Income Tax slab For Senior Citizens Pensioners?

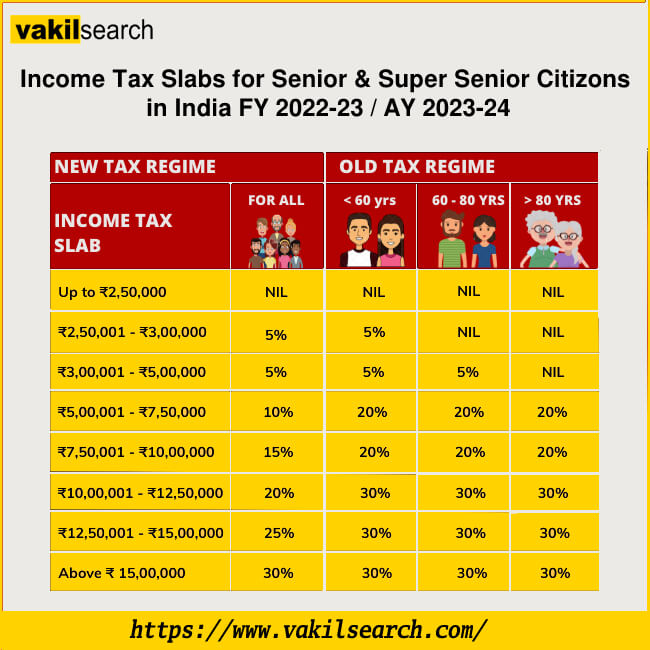

A person falls under the category of a senior citizen pensioner if he takes retirement from his current job, commonly at the age of 60. Therefore, both senior citizens, as well as super senior citizens fall under this particular category. The Union Budget of FY 22-23 has carefully laid the details of income tax slab for senior citizens above 60 year as follows:

Exemption for senior citizens from filing income tax returns per Section 194P of the Income Tax Act, 1961.

Requirements:1) Age 75+ 2) Resident in the previous year 3) Only pension and interest income from the designated bank. Effective 1 April 2021. |

Income Tax Slab For Senior Citizens above 60 years:

- Upto INR 3 lakhs- no tax.

- INR 3 lakh- INR 5 lakh- 5% on income above INR 3 lakh + 4% cess on income tax.

- INR 5 lakh- INR 10 lakh- INR 10,000 + 20% tax on income above INR 5 lakh + 4% cess on income tax.

- More than INR 10 lakh- INR 1,10,000 + 30% tax on income above INR 10 lakh +4% cess on income tax.

LLP ITR filing is mandatory as per the Income Tax Act, 1961, and failing to do so can result in penalties and legal consequences. Click here ITR FILING FOR LLP

Income Tax Slab For Super Senior Citizen age above 80 years:

- Upto INR 5 lakh- no tax.

- INR 5 lakh- INR 10 lakh- 20% tax on income above INR 5 lakh + 4% cess on income tax.

- More than INR 10 lakh- INR 1,00,000 + 30% tax on income above INR 10 lakh +4% cess on income tax.

Sources Of Income Tax slab for Senior Citizens

To calculate your income tax returns, you must know what all are considered to be your income sources. The primary sources of Income Tax slab for Senior Citizen include:

- Pensions

- Rental income

- Investment benefits

- Capital gains

- Fixed deposits, savings deposits, and more.

If your business operated by a single individual then you should file Proprietorship Tax Return Filing

Therefore, you need to consider listing the details of each of the income sources mentioned above. Section 80CCC of income tax act also strictly mentioned the guidelines for the same. No matter what, consistency is the key here, although you are not part of the fixed income group or individual taxpayers.

Limits for Income Tax slab for Senior Citizen and Benefits

As individuals approach their golden years, understanding the nuances of income tax becomes increasingly important. For Income Tax slab for Senior Citizen, specific income tax limits and benefits come into play, offering financial relief and recognizing their contributions to society.

1. Income Tax Limits: Income Tax slab for Senior Citizen, typically 60 years or older, enjoy higher income tax exemption limits than their younger counterparts. As of the latest tax regulations, the basic exemption limit is higher for individuals aged 60 to 80 years than for those below 60. It means a portion of their income is not subject to taxation, providing a welcomed financial reprieve.

2. Higher Exemption for Very Senior Citizens: An additional benefit is extended to senior Citizens 80 years or older. They are entitled to an even higher basic exemption limit. This recognition acknowledges their life experience and the financial challenges they might face during retirement.

3. Tax Slabs and Deductions: While the tax slabs remain the same, the enhanced exemption limits reduce the tax liability for senior citizens. Moreover, they can also avail deductions under various sections of the Income Tax Act, such as deductions on medical expenses and health insurance premiums. These deductions further contribute to easing their tax burden.

4. Interest Income Benefit: Income tax slab for senior citizen also enjoy a special benefit when it comes to interest income. Interest earned on savings accounts and fixed deposits in banks and post offices up to a certain limit is tax-free for them. This provision acknowledges their reliance on interest income for their financial well-being.

5. Prudent Investment Choices: To maximize these benefits, income tax slab for senior citizen can opt for investment instruments that align with their age and financial goals. They can explore options that offer regular income, such as senior citizen savings schemes, which provide a stable source of funds while catering to their tax-related requirements.

Achieve financial freedom – trust our Online Tax Calculator for precise tax estimations.

Tax-Free Incomes for Senior Citizens:

For Income Tax slab for senior citizen, certain sources of income are designated as tax-free, offering financial relief and acknowledging their contribution to society. Understanding these tax-free incomes is crucial for maximizing financial well-being during retirement.

1. Interest Income on Savings Accounts: Income tax slab for senior citizen often rely on interest income from their savings accounts. Fortunately, interest earned on savings accounts in banks and post offices up to a specified limit is tax-free for them. Recognizes their need for stable income in their retirement years.

2. Income from Reverse Mortgage: Income received from a reverse mortgage is also exempt from income tax. This benefits senior citizens who use this financial instrument to generate funds from their property without selling it.

3. Dividends from Indian Companies: Dividends received from Indian companies are tax-free for senior citizens. This encourages shared investment and aligns with their financial goals for steady income.

4. Pension Income: Pension received from a former employer or through annuity plans is eligible for a standard deduction under certain conditions. This provides some relief from tax liability.

5. Gratuity and Commuted Pension: Gratuity received by a government employee is fully exempt from tax. Additionally, the commuted pension received by a government employee is also tax-free.

6. Gifts from Relatives: Gifts received by senior citizens from relatives are not subject to tax. This recognizes the family support system and ensures that financial assistance from loved ones remains untaxed.

7. Long-Term Capital Gains: Senior citizens can enjoy tax-free long-term capital gains from selling specified assets, provided they fulfill certain conditions. This offers flexibility in managing their investments.

Things To Know: Filing Income Tax For Senior Citizens

There are numerous details that a Income Tax slab For Senior Citizen pensioner should follow while filing income taxes. For instance, the list of exemptions and deductions is more significant compared to that of individual taxpayers. In addition, it makes the process lengthy on pen and paper, where you need to provide proof of every other detail that you enumerate. Thus, it is always a better idea to shift to online methods of calculations. Here are some things to keep in mind:

- You need to assemble all your income details in one place. Make sure that you overlook none while filing your income tax. An excellent online income tax calculator will help you fill in all the details quite seamlessly.

- Check for the necessary exemptions. For instance, it can be either rebate u/s 87 (for INR 5 lakh income), pensions, reverse mortgage schemes, health insurance, and rent allowances. You also don’t need to pay advance taxes and TDS.

- Make sure that you hire a professional to enumerate your income tax on a regular basis. It will help you get a grip on online methods and maintain the process’s accuracy.

Advantages Of Income Tax For Senior Citizen Calculator For Pensioners

Filling up your ITR-1 or ITR 4 filing process has become quite simple these days with the help of online Income Tax slab for Senior Citizen calculator tools. You get not only accurate results but also receive numerous financial benefits from the online system. It has become a trustworthy system that an increasing number of people are using these days. Here are some highlighted benefits of ITR for pensioners.

- The online tools guarantee accuracy when it comes to calculating your income tax returns. Human error is a consistent problem while filing income tax on paper. In order to get rid of it, you must shift to online methods. The tools will automatically highlight errors if any.

- The process becomes easier and faster. You can autofill specific details, which remain the same for every financial year. Moreover, you can quickly calculate your net taxable income from the details with no extra effort. This is precisely why the Government is also encouraging individuals to file income taxes online.

- An online income tax calculator stores all necessary information when you complete your income tax filing. You do not need to refill all details every time you start filing your income tax annually. It is a very convenient method that can help you eliminate redundancy.

- While the tools store valid information for further use, you can ensure its confidentiality. Filing income tax on paper can prove harmful, as it can fall into the wrong hands. However, the online data gets stored in an encrypted system. So there is no chance of mishandling your documents.

- Once you calculate and complete filing the income tax details, you will get an automated completion receipt. You will also receive it via your registered email-id as proof of your accurate income tax filing.

- You can also save the data without finishing the entire process. For instance, if you are midway through the process and miss out on any crucial document, you can store the incomplete data as a draft. Once you search in the history or saved draft tab, you will immediately get your data and will be able to complete the process.

Conclusion

Things have indeed taken a positive but abrupt turn in the recent past regarding filing taxes. The Government is focusing on digitalization, with an increased focus on income taxpayers. It obviously is a big deal for Income Tax slab for Senior Citizen, who might require additional help and guidelines to know about the process in detail. If you need to consult professionals, you can contact Vakilsearch. The experts will efficiently walk you through the entire process and make it look as easy as possible. Ensure that you file your income tax as per the guidelines mentioned by the tax department and the Government from time to time.

FAQs: Income Tax slab for Senior

I come under the super senior category. My yearly earnings are less than Rs. 5 lakh without any rebate. Do I still have to file income tax for senior citizens?

No, you do not have to file income tax for senior citizens if your yearly earnings are less than Rs. 5 lakh without any rebate. This is because the income tax exemption limit for super senior citizens is Rs. 5 lakh in 2023-24.

How do I calculate my Income Tax slab For Senior Citizen?

To calculate your Income Tax slab For Senior Citizen, you will need to follow these steps: Determine your total income. This includes all your income sources: salary, pension, interest, dividends, and rental income. Subtract your deductions and exemptions. The most common assumptions for senior citizens are medical expenses, home loan interest, and donations to charity. The most common exemptions for senior citizens are the standard deduction and the Section 87A rebate. Compare your taxable income to the income tax slabs. The income tax slabs for senior citizens are as follows: Up to Rs. 3 lakh: No tax Rs. 3 lakh to Rs. 5 lakh: 5% of the amount exceeding Rs. 3 lakh Rs. 5 lakh to Rs. 10 lakh: Rs. 10,000 plus 20% of the amount exceeding Rs. 5 lakh Rs. 10 lakh to Rs. 20 lakh: Rs. 1,10,000 plus 30% of the amount exceeding Rs. 10 lakh Above Rs. 20 lakh: Rs. 2,10,000 plus 30% of the amount exceeding Rs. 20 lakh Calculate your tax liability. This is the amount of tax you owe to the government. You can use an online income tax calculator to help you calculate your tax liability. Here are some additional things to keep in mind: You may be eligible for additional deductions and exemptions. For example, if you are a senior citizen with a disability, you may qualify for a higher standard deduction. You may be required to pay TDS on your income. Your employer or other payer deducts This tax from your payment at source. You must file an income tax return if your total income exceeds the exemption limit. It is always advisable to consult with a tax advisor to determine your specific tax liability and filing requirements.

Read More: