Form 16 is an official document in India that is issued by an employer to its employee. It contains details about the employee's income earned during a financial year and the amount of tax deducted at source (TDS) by the employer on behalf of the employee. Form 16((incometaxindia.gov.in) has two parts, Form 16A and Form 16B and both together provide an exhaustive report about the computation of taxes applicable to the respective employee.

Form 16 is one of the most crucial documents used for filing income tax returns under the Income Tax Act of 1961. The form essentially aids the employees to understand how tax has been deducted from their income. The form clearly presents the breakup of the salary paid to the employee along with the TDS deducted by the employer.

What is Form 16?

Form 16 is a certificate issued by the employer to the employees to deduct tax at the source (TDS). It is a form issued by employers to salaried individuals in India. It mentions the tax amount deducted by the employer and is submitted to the Income Tax (IT) department.

If an individual has worked with more than one organization in the course of a financial year or worked with more than one employer at a given point in time, and tax has been deducted by all the employers, the individual has to ideally, obtain Form 16 individually from every such employer. However, if the income was below the taxable limit the employer may not issue Form 16.

Parts in Form 16

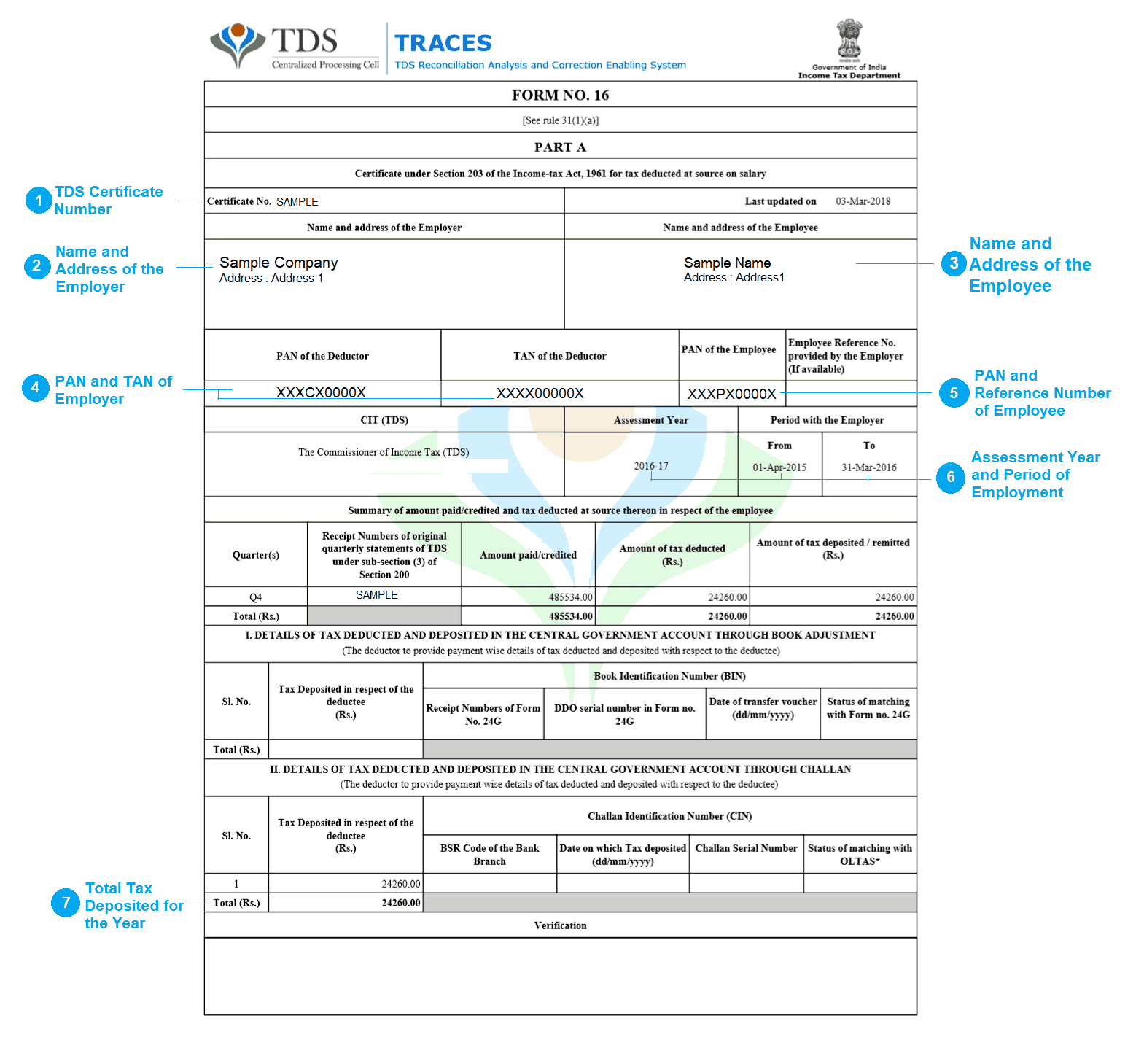

Form 16 embodies two parts, Part A and Part B. Form 16A enlists the details of the TDS deducted along with other details such as the PAN (Permanent Account Number) and TAN (Tax Deduction Account Number) of the employer. Form 16 can be downloaded through the TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal.

Part in Form 16A Encompasses the Following Details

- Details of the employer and the employee like the name and residential address

- TAN and PAN details of the employer and the employee

- Details pertaining to the tax deducted and deposited quarterly which is duly certified by the employer.

Part in Form 16A also mentions the amount of the tax deducted and the date on which it was deposited and other details such as the challan issued by the government etc.

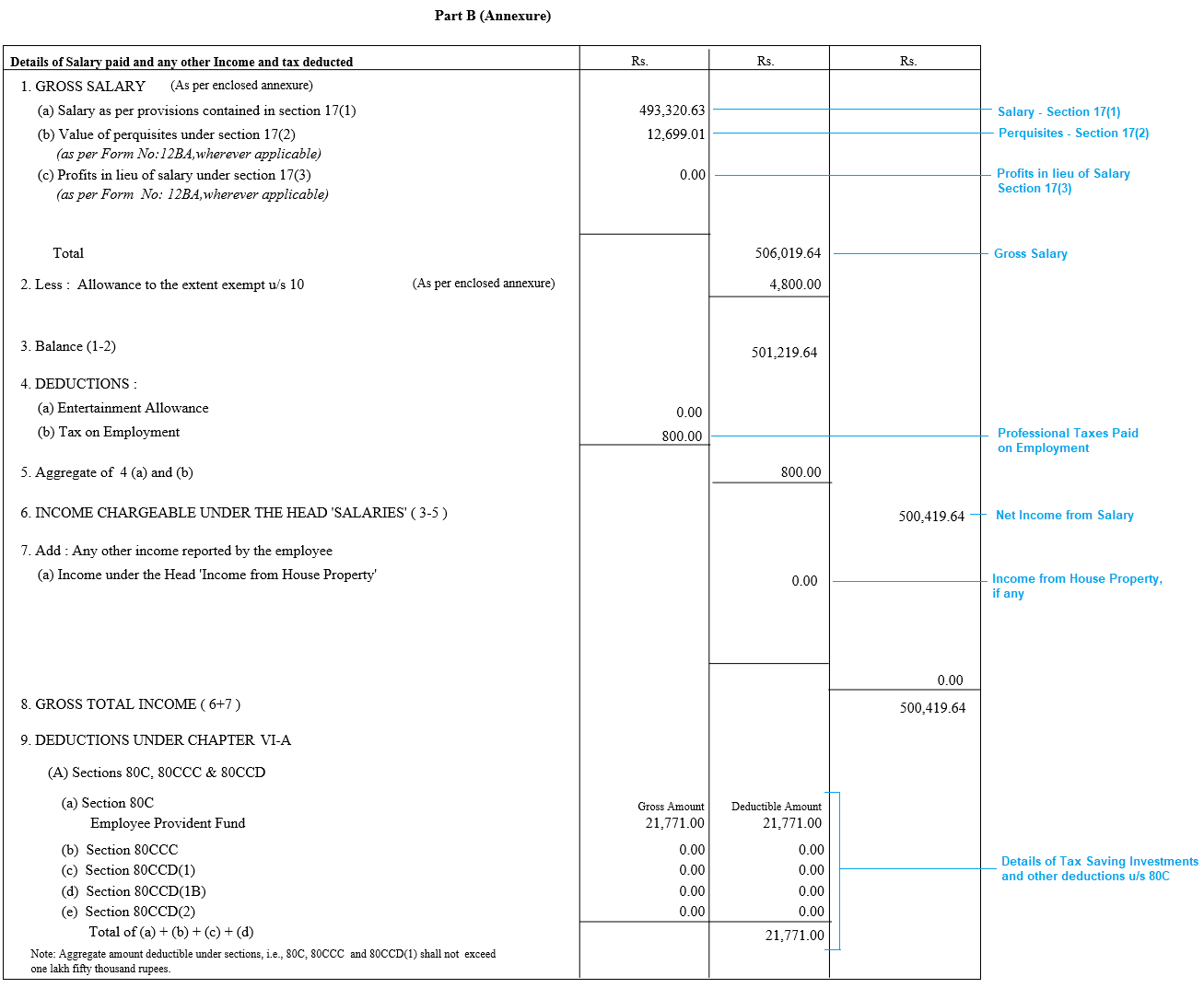

Part in Form 16B of the form is the annexure attached to Part A. Part B has to be issued by the employer and should enlist the breakup of the salary and tax deductions of the employee.

Ensure accurate tax estimations – our Tax Calculator India is your reliable companion.

Form 16B predominantly explains the computation of taxes taking into consideration the investment declaration made by the employee at the beginning of the financial year and the proof submitted to corroborate the same. Details pertaining to the allowances awarded by the employer to the employee are also enclosed in this section. Other particulars such as rent paid, medical bills, EMIs (Equated Monthly Installments) towards home loans, and other tax exemptions shall be enclosed in Part B.

Form 16B of the Form Comprises the Following Details

- Comprehensive details pertaining to the breakup of the salary

- Details pertaining to the exempted allowances under the Income Tax Act, 1965

- Deductions including PPF (Public Provident Fund), housing loans, national saving certificate, life insurance schemes, and other investments and saving schemes

- Deductions under other sections include but are not limited to NPS (National Pension Scheme), mediclaim policies, donations, etc

- Tax computed on the total income of the employee

- Cess levied if any

- Rebate on tax if any

- Surcharges, if applicable.

Form 16 Eligibility

Form 16 is a crucial document for salaried individuals in India. It is a certificate issued by an employer to their employees, which contains details of the salary paid, tax deducted at source (TDS), and other relevant information.

| Form 16 is available to a salaried individual whose employer has deducted tax at the source. Whether or not your income falls within the tax exemption limit, your employer must issue a Form 16 if they have deducted tax at source. |

Why is Form 16 Required?

Form 16 is required for filing income tax returns (ITR) by salaried individuals. It is a certificate issued by an employer to their employees, which contains details of the salary paid, tax deducted at source (TDS), and other relevant information. It is proof of the TDS deducted by the employer on behalf of the employee.

When is Form 16 Issued?

Form 16 is issued by the employer to the employee by 15th June of the financial year following the year in which the income was paid and tax deducted. For example, if you have worked for a company in the financial year 2022-23, and your employer is required to issue Form 16 to you by 15th June 2023.

Principal Differences Between Form 16A and Form 16B

While both parts discuss TDS, the difference lies in the authority that issues the respective forms. For instance, Form 16A is issued by financial institutions for interests earned on fixed deposits, insurance commissions etc. Form 16B is issued for TDS for income earned through the immovable property. It is issued by the buyer to the seller.

Advantages of Filing Form 16

The form acts as evidence for the deposition of the TDS amount by the employer with the Central government. Apart from this, there are a number of advantages Form 16 have to offer as depicted below:

- Form 16 acts as an ‘income from salary’ statement

- Acts as proof of income

- Clearly shows how the tax was computed

- Records all tax-saving investments

- Aids in loan assessment and approval

- Acts as proof for visa issuance

- While switching jobs guides the next employer to compute taxes based on how the previous employer had ascertained the same

- As the document is associated with the tax credit, employees can check if taxes are overpaid inadvertently, and can claim a refund appropriately.

Form 16 is one of the most crucial documents required to file IT returns. The form can be filed online or offline. Once Form 16 is filed online, the returns can be verified by generating the e-verification code (EVC). The form can also be verified by printing an ITR-V (Income Tax Returns – Verification) and by signing and furnishing the copy physically to the CPC (Central Processing Centre).

However, it might be interesting to note that ITR (Income Tax Returns) can also be filed without Form 16. But the respective individual has to furnish all the details mentioned in Part A and Part B separately. For instance, details pertaining to the salary, deductions, allowances, TDS, PAN, and TAN details of the employer, documents relating to investment, etc have to be submitted independently. Thus, Form 16 greatly streamlines the process of filing the ITR for salaried employees and also acts as proof of income to salaried employees.

FAQs

What is Form 16?

Form 16 is a certificate issued by an employer to their employees, which contains details of the salary paid, tax deducted at source (TDS), and other relevant information. It is proof that TDS is deducted by the employer on behalf of the employee.

Why do I need Form 16?

Form 16 is required for filing income tax returns (ITR). It can also used as proof of income for various purposes, such as applying for a loan or a credit card.

Can I download Form 16 online?

No, you cannot download Form 16 online. It is issued by the employer to the employee.

How do I get Form 16 from my employer?

Your employer is required to issue Form 16 to you by 15th June of the financial year following the year in which the income was paid and tax deducted. You can request your employer to issue Form 16 if you have not received it.

What information does Form 16 contain?

Form 16 contains details of the salary paid, tax deducted at source (TDS), and other relevant information such as PAN of the employer and employee, assessment year, etc.

When is Form 16 issued?

Form 16 is issued by the employer to the employee by 15th June of the financial year following the year in which the income was paid and tax deducted.

Is Form 16 applicable to all taxpayers?

No, Form 16 is applicable only to salaried individuals.

Can I request a duplicate Form 16 if I lose it?

Yes, you can request a duplicate Form 16 from your employer if you lose it.

How can I get Form 16 in PDF format?

You cannot get Form 16 in PDF format. It is issued by the employer in a physical format.

What should I do if there are discrepancies in my Form 16?

If there are discrepancies in your Form 16, you should bring it to the notice of your employer and get it rectified.

Read more,