Explore the essential EPF rules for employers, distinguishing between employee and employer roles in EPF contributions, and uncover the advantages EPF offers to employers. Find answers to frequently asked questions for a comprehensive understanding.

EPF Registration for Employers: Under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1956, the employee’s provident fund organisation (EPFO) launched the employee’s provident fund (EPF) scheme. The scheme was designed to ensure the financial security of employees after retirement. Under this system, both the employer and the employee contribute an equal portion of an employee’s salary to the fund.

All companies and organisations, whose strength exceeds a total of 20 employees, have to mandatorily register for EPF. The amount contributed to EPF by the employer and the employee, in this case, is 12% of basic wages along with dearness plus retaining allowance. However, those companies with a strength of less than 20 can also voluntarily register for their employees, and in that case, the amount to be contributed to EPF is10%.

Further, this combined employee-organisation effort allows employees to put away a substantial nest egg for retirement purposes or any other unforeseen times of financial duress.

Why is It Important for an Employer to Register for EPF?

Employer registration for the Employees’ Provident Fund (EPF) holds significant importance for several reasons:

- Legal Compliance: EPF registration is a statutory requirement for employers under Indian labour laws. Registering ensures adherence to legal obligations, preventing legal repercussions and penalties.

- Employee Benefits: EPF registration allows employers to contribute to the retirement savings of their employees. This provides financial security to the workforce, contributing to their long-term well-being.

- Tax Benefits: Employers can avail tax benefits by contributing to the EPF accounts of their employees. This acts as an incentive for employers to register and participate in the EPF scheme.

- Employee Retention: Offering EPF benefits can enhance employee satisfaction and loyalty. It is a valuable employee benefit that contributes to their financial stability, potentially improving retention rates.

- Statutory Compliance Framework: EPF registration establishes a structured framework for managing employee provident fund contributions. This organized approach facilitates compliance with regulatory requirements and simplifies fund management.

Latest Updates Regarding EPF

The Employees’ Provident Fund Organisation (EPFO) has declared an interest rate of 8.15 percent for the employees’ provident fund (EPF) for 2022-23. Despite the RBI’s significant repo rate increase since May 2022, rising from 4.4 percent to 6.5 percent, this rate is only marginally higher than the 8.10 percent fixed for 2021-22. The EPF, designed to build a retirement corpus by deducting 12 percent of the monthly basic pay, remains popular for its guaranteed returns and associated tax benefits.

Applicability of EPF Registration for Employers

EPF registration is applicable to employers falling under certain criteria:

- Minimum Employee Strength: Employers with a minimum specified number of employees are required to register for EPF. The threshold may vary, and employers must determine their eligibility based on employee headcount.

- Salary Criteria: EPF registration may be mandatory for employers with employees earning salaries below a specified threshold. Understanding the salary criteria is essential to determine the applicability of registration.

- Industry and Establishment Type: Certain industries and types of establishments are explicitly covered under EPF regulations. Employers operating in these sectors need to register to comply with statutory requirements.

- Voluntary Registration: While mandatory for eligible employers, voluntary EPF registration is also an option for entities that do not meet the compulsory criteria. Voluntary registration can provide additional benefits to both employers and employees.

In summary, EPF registration is a legal requirement that offers numerous benefits to both employers and employees. Understanding the applicability criteria and the advantages associated with registration is essential for employers to make informed decisions regarding EPF participation.

Documents Required for EPFO Registration

EPF Registration for employers can be done through online and offline methods. But, before you begin the procedure, know that certain documents have to be kept handy. Additionally, the list of documents for EPFO registration for employers depending on the type of entity are as follows:

Proprietorship Firms

- Name of applicant/employer

- PAN card details

- Valid ID which includes driving license, passport, voter ID

- Address proof of the place in which the business is being carried out

- Residential address proof of proprietor

- Phone number.

Society/Trust (Co-operatives)

- Incorporation certificate

- Memorandum of Association (MoA)

- PAN card details

- Details of the president of the society and its members

- Address proof.

Partnership firms

- Certificate of registration of partnership

- Deed of partnership

- ID proof of all the partners of the firm – driving license, passport, voter ID

- Details of all the partners of the firm

- ID proof and address proof of the partners.

Limited Liability Partnership/ Company

- Incorporation certificate

- Director’s ID proof

- Director’s Digital signature certificate online (DSC)

- Details of all the directors

- Address and ID proof of the directors

- Memorandum of association (MoA) and articles of association (AOA).

Other entities

- The bill of the first sale

- The bill of the first purchase of machinery and other raw materials

- Bank details namely account number, IFSC code, name, address, and other details

- Monthly strength of employees’ record

- Salary details

- Provident fund (PF) details

- Cross cancelled cheque.

Accordingly, depending on the type of entity, you must keep the documents required for the EPFO registration ready.

Plan your future with ease using our EPF calculator. Calculate your returns with our PF interest calculator and make informed decisions.

Procedure for EPFO Registration for Employers

EPFO registration for employers can be done by following a number of steps. Further, the online EPFO registration option is by far the most preferred and convenient one. Once you have all the documents required for EPFO registration, the procedure for online EPF registration for employers is as follows:

Step 1: Visit the official EPFO portal – https://www.epfindia.gov.in/

Step 2: On the home page, click on – Establishment Registration

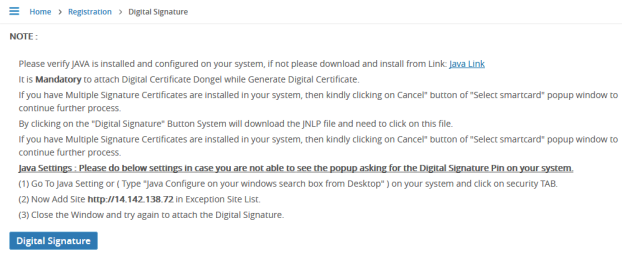

Step 3: A new page will open up through which you can download the instructions manual for EPFO registration for employers. Please note that before filing a new application, it is mandatory to get DSC registered

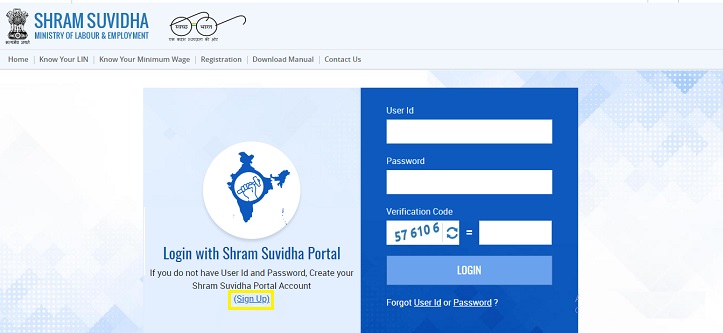

Step 4: Further, on the next page, click on the sign-up option. In case, you have already registered, log in using your credentials, i.e., your UAN and password

Step 5: On the sign-up page, enter your name, email, and other details accordingly

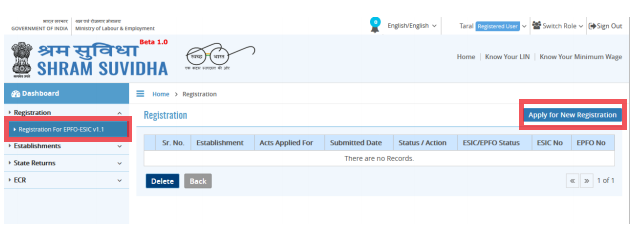

Step 6: After signing up on this page, click on the option of – Registration for EPFO-ESIC

Step 7: On the next page that opens up, click on the option of – Apply for New Registration

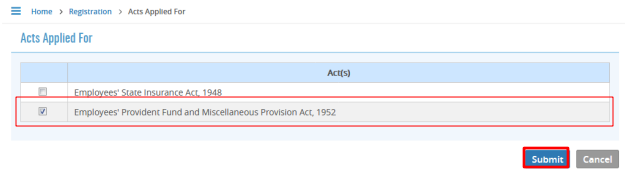

Step 8: After clicking on this, you will have two options:

- Employees’ State Insurance Act

- Employees Provident Fund and Miscellaneous Provision Act, 1956

Step 9: Choose the most suitable option, and click on the Submit option. To determine which of the two options is most suitable for your organisation, get in touch with our experts

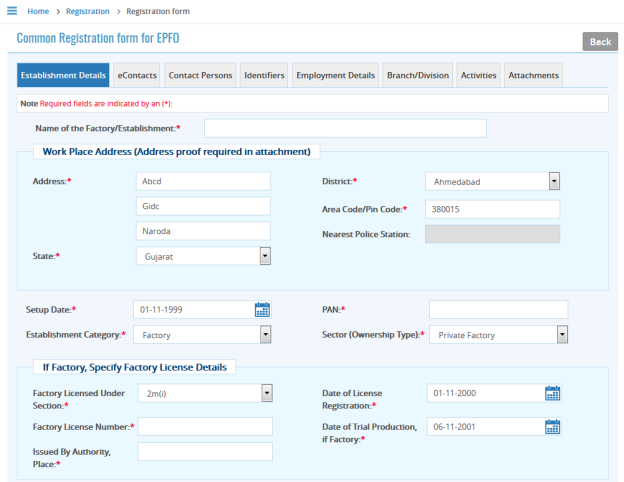

Step 10: Next, a new page opens up, where you are required to fill in certain details. These include:

-

- Details of establishment

- Employer and employee details

- Identity proofs

- Details related to work and others

Step 11: After this, you may review the summary of the document through the dashboard

Step 12: Further, click on the Submit option to complete the epfo registration

Step 13: After this, the digital signature certificate (DSC) of the employer has to be submitted. If you don’t have one, don’t worry because our team can help you get one in no time

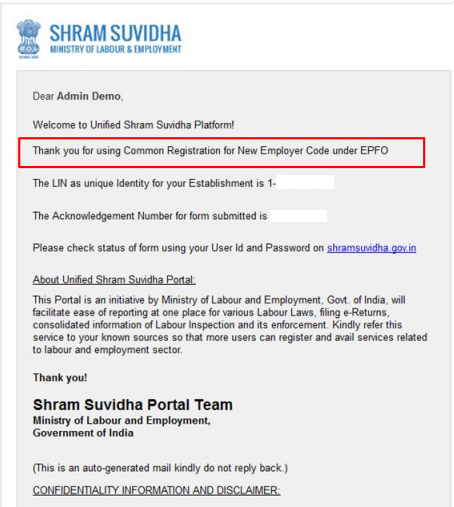

Step 14: After the completion of epfo registration, a confirmation mail is sent to the registered email address.

Conclusion

With the above-mentioned steps and requirements, you can easily undergo online EPFO registration: https://www.epfindia.gov.in/site_en/index.php for employers. However one must keep in mind that even minor omissions during the epfo registration process can prevent your employees from benefiting under the scheme and can also attract other legal issues.

In light of this, it is advisable to seek legal advice from specialists such as Vakilsearch. Hence, all you need to do is provide us with the right set of documents, and we’ll get your epfo registration done on time.

FAQs:

1. What is the EPF rule for employers?

The EPF rule for employers mandates the registration and contribution to the Employees' Provident Fund (EPF) for eligible employees. Employers are required to deduct and contribute a certain percentage of employees' basic pay towards EPF and ensure compliance with EPF regulations.

2. What is the difference between employee and employer in EPF?

In EPF, the employee refers to an individual working for an organization who contributes a portion of their salary towards the EPF account. The employer, on the other hand, is the organization responsible for deducting and contributing the employer's share to the EPF fund on behalf of the employee.

3. What is the benefit of EPF to the employer?

The benefits of EPF to the employer include legal compliance, tax benefits, and enhanced employee retention. By contributing to employees' EPF accounts, employers fulfill statutory obligations, enjoy tax incentives, and create a valuable retirement benefit for employees, promoting loyalty and satisfaction.

4. Does EPF include employer contribution?

Yes, EPF includes both employee and employer contributions. While employees contribute a percentage of their basic pay to the EPF account, employers are also required to make a matching contribution. The total contribution is then deposited into the EPF fund for the benefit of the employees during their retirement.