ELSS stands for Equity Linked Savings Scheme. It is a type of mutual fund that invests a major portion of its corpus in equity and equity-related instruments. Know on ELSS vs Other 80C Investments.

Introduction:

When it comes to tax planning and saving, there are various investment options available under Section 80C of the Income Tax Act. Among these, Equity Linked Savings Schemes (ELSS) have gained significant popularity due to their potential for high returns and tax-saving benefits. In this comprehensive guide, we will delve into the concept of ELSS, its benefits, and how it compares to other 80C investment options. We will also explore the process of buying ELSS online, investing through SIPs (Systematic Investment Plans), calculating returns, and making informed decisions to optimize tax savings and wealth creation.

Overview: ELSS vs Other 80C Investments

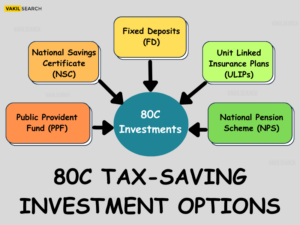

When it comes to tax-saving investments, there are several options available in India. These include traditional options like Public Provident Fund (PPF), National Savings Certificate (NSC), and Fixed Deposits (FD), as well as equity-based investments like Unit Linked Insurance Plans (ULIPs) and National Pension Scheme (NPS). Know more about ELSS vs Other 80C Investments.

However, in recent years, Equity Linked Savings Schemes (ELSS) have emerged as a popular choice among investors. In this article, we will compare ELSS with other 80C investments and explain why ELSS is the best tax-saving option. We will cover the definition of ELSS, its tax benefits, and historical returns. We will also analyse traditional and equity-based options and compare them with ELSS.

We will explore the advantages of ELSS over other options, discuss the risks and challenges of investing in Equity Linked Savings Schemes, and explain how to choose the right ELSS fund. Finally, we will summarise the key takeaways and explain why Equity Linked Savings Schemes is the best tax-saving option for investors.

What is ELSS?

ELSS stands for Equity Linked Savings Scheme, which is a tax-saving mutual fund that invests primarily in equities and equity-related instruments. ELSS funds come with a lock-in period of three years, making them one of the shortest lock-in periods among 80C investment options. They offer the potential for higher returns compared to traditional tax-saving instruments like Public Provident Fund (PPF) and National Savings Certificate (NSC).

Understanding ELSS

ELSS stands for Equity Linked Savings Scheme. It is a type of mutual fund that invests a major portion of its corpus in equity and equity-related instruments. Equity Linked Savings Schemes funds are eligible for tax benefits under Section 80C of the Income Tax Act, 1961.

The lock-in period for Equity Linked Savings Schemes funds is three years, which means that investors cannot withdraw their money before the completion of the lock-in period. ELSS funds are open-ended, which means that investors can invest in them throughout the year.

Investing in Equity Linked Savings Schemes funds offers a tax benefit of up to ₹1.5 lakh under Section 80C of the Income Tax Act. The amount invested in ELSS funds can be claimed as a deduction from taxable income.

Historically, Equity Linked Savings Schemes funds have delivered good returns compared to other tax-saving investment options. The returns of Equity Linked Savings Schemes funds are market-linked, and therefore, vary based on the performance of the equity markets.

What are ELSS Funds?

ELSS funds are a category of mutual funds where the majority of the portfolio is invested in stocks and equity-related securities. They are managed by experienced fund managers who aim to generate wealth over the long term while providing tax benefits to investors. ELSS funds are subject to market risks, but historically, they have delivered superior returns compared to other tax-saving instruments.

How to Buy ELSS Online?

Buying ELSS online is a simple and convenient process. Follow these steps to invest in ELSS online:

Step 1: Choose a reputable mutual fund platform or the website of the Asset Management Company (AMC) offering the ELSS fund.

Step 2: Complete the registration process and perform the KYC (Know Your Customer) verification.

Step 3: Browse through the list of available ELSS funds and select the one that aligns with your investment goals and risk tolerance.

Step 4: Enter the investment amount, select the mode of payment, and confirm your purchase.

Step 5: After successful payment, you will receive a confirmation of your investment.

ELSS under Which Section?

ELSS falls under Section 80C of the Income Tax Act. Investments in ELSS funds up to ₹1.5 lakh are eligible for tax deduction under this section, providing an excellent avenue for tax-saving.

Financial intelligence at your fingertips – Uncover tax-saving opportunities with our Tax Calculator.

How to Invest in ELSS through SIP?

Investing in ELSS through SIP allows you to spread your investments over regular intervals, promoting disciplined investing and rupee-cost averaging. Here’s how to invest in ELSS through SIP:

Step 1: Choose the ELSS fund and select the SIP option while making the investment.

Step 2: Decide the SIP amount and the frequency of investment (monthly, quarterly, or annually).

Step 3: Provide the necessary bank details for automatic SIP deductions.

Step 4: Your SIP will be auto-debited from your bank account on the chosen date, and units will be allocated based on the prevailing Net Asset Value (NAV).

What is ELSS SIP?

ELSS SIP is a systematic investment plan in Equity Linked Savings Scheme. It allows investors to invest a fixed amount regularly in ELSS funds, providing the twin benefits of tax savings and wealth creation through disciplined investing.

How to Open ELSS Account?

To invest in ELSS, you do not need to open a separate account. You can invest in ELSS funds through your existing mutual fund account or any online investment platform that offers ELSS as an investment option.

How Much to Invest in ELSS?

The amount to invest in ELSS depends on various factors, including your financial goals, risk tolerance, and overall investment portfolio. While the maximum tax deduction available under Section 80C is ₹1.5 lakh, it is essential to assess your financial situation and align your ELSS investment accordingly.

How to Calculate ELSS Returns?

Calculating ELSS returns can be done using the Compound Annual Growth Rate (CAGR) formula. The CAGR helps determine the average annual growth rate of your ELSS investment over a specific period. Subtract the initial investment amount from the final value, divide it by the initial investment, and then raise it to the power of 1/n (where n is the investment duration in years) to get the CAGR.

Other 80C investments

Apart from Equity Linked Savings Schemes, there are several other tax-saving investment options available under Section 80C of the Income Tax Act. These include:

- Public Provident Fund (PPF): PPF is a long-term savings scheme offered by the government. It has a lock-in period of 15 years, and the interest rate is fixed by the government every quarter. The investment in PPF is eligible for a tax deduction of up to ₹1.5 lakh.

- National Savings Certificate (NSC): NSC is a fixed income investment offered by the government. It has a lock-in period of 5 years, and the interest rate is fixed at the time of investment. The investment in NSC is eligible for a tax deduction of up to ₹1.5 lakh.

- Fixed Deposits (FD): FDs are fixed income investments offered by banks and post offices. The lock-in period for tax-saving FDs is 5 years, and the investment is eligible for a tax deduction of up to ₹1.5 lakh.

- Unit Linked Insurance Plans (ULIPs): ULIPs are market-linked insurance products that offer both life insurance coverage and investment options. The lock-in period for ULIPs is 5 years, and the investment is eligible for a tax deduction of up to ₹1.5 lakh.

- National Pension Scheme (NPS): NPS is a long-term retirement savings scheme offered by the government. The investment in NPS is eligible for a tax deduction of up to ₹1.5 lakh.

All of these investment options have their own advantages and disadvantages. While some provide fixed income, others provide an opportunity to participate in the equity markets. It is important for investors to evaluate the investment options carefully and choose the one that aligns with their investment goals and risk appetite.

Advantages of ELSS Over Other 80C Investments

ELSS has several advantages over other 80C investments. Here are some of the key advantages:

- Potentially higher returns: Equity Linked Savings Schemes funds invest a major portion of their corpus in equity and equity-related instruments, which have the potential to deliver higher returns over the long term compared to fixed income investments like PPF, FD, and NSC.

- Shorter lock-in period: Equity Linked Savings Schemes funds have a lock-in period of three years, which is shorter than other tax-saving investment options like PPF (15 years) and NSC (5 years). This means that investors can access their money relatively sooner.

- Flexibility and liquidity: ELSS funds are open-ended, which means that investors can invest in them throughout the year. Moreover, after the completion of the lock-in period, investors can redeem their investment in ELSS funds any time they want, making them more flexible and liquid than other tax-saving investments.

- Tax-efficient: ELSS funds offer tax benefits under Section 80C of the Income Tax Act. Moreover, the long-term capital gains (LTCG) from Equity Linked Savings Schemes funds are tax-free up to Rs. 1 lakh per year, making them more tax-efficient than other equity-based investments like ULIPs.

- Diversification: ELSS funds invest in a diversified portfolio of equity and equity-related instruments, which helps to spread the risk and reduce the impact of market volatility.

However, investors must keep in mind that investing in ELSS funds involves market risks and uncertainties, and therefore, it is important to choose the right fund and invest with a long-term perspective.

ELSS vs. Other 80C Investments: A Comparative Analysis

- Returns Potential: ELSS funds have the potential to offer higher returns compared to traditional 80C investment options like PPF and NSC, as they invest in equities that tend to outperform fixed-income instruments over the long term.

- Lock-in Period: ELSS funds have a lock-in period of three years, while investments in PPF have a lock-in period of 15 years. NSC, on the other hand, has a lock-in period of five years

- Tax Treatment: ELSS funds offer tax deduction benefits under Section 80C. The returns generated from ELSS funds are tax-free up to ₹1 lakh under Section 10(10D). In contrast, returns from PPF and NSC are tax-exempt, subject to certain conditions.

- Liquidity: ELSS funds have a shorter lock-in period, providing higher liquidity compared to PPF and NSC. PPF and NSC have longer lock-in periods, and premature withdrawals are subject to penalties.

- Risk Profile: ELSS funds carry a higher level of risk due to equity exposure, while PPF and NSC are considered low-risk investment options.

Risks and challenges of investing in ELSS

Market risks: As ELSS invests predominantly in equities, it is susceptible to market risks. The volatility in the stock market can lead to fluctuations in the value of your investment. The returns on your ELSS investment are directly linked to the stock market’s performance.

Performance uncertainties: The performance of an ELSS fund depends on the fund manager’s expertise in picking the right stocks and managing the portfolio. The fund manager’s performance can impact the returns of the ELSS fund. Moreover, the past performance of an ELSS fund is not guarantee future returns.

Portfolio management challenges: ELSS funds invest in a diversified portfolio of stocks. The fund manager needs to monitor and rebalance the portfolio to ensure optimal returns constantly. Portfolio management can become challenging if the fund manager fails to make the right investment decisions.

Regulatory changes: The government can change the tax laws or other regulations that may impact the benefits of investing in ELSS. Regulatory changes can lead to uncertainty and affect the returns on your ELSS investment.

Conclusion

In conclusion, Vakilsearch is an online platform that provides legal and professional services to individuals and businesses. With its user-friendly interface and a team of experienced professionals, Vakilsearch has made it easy for anyone to access legal services at an affordable cost. From business registrations to trademark filings, Vakilsearch offers a range of services that cater to the needs of its clients.

FAQs on ELSS and Other 80C Investments

1. Is ELSS better than other mutual funds?

ELSS and other mutual funds serve different purposes. ELSS funds are tax-saving mutual funds with a lock-in period of three years, offering potential for higher returns but with tax benefits under Section 80C. On the other hand, regular mutual funds have no lock-in period but do not offer specific tax benefits. The choice between ELSS and other mutual funds depends on your investment goals, risk appetite, and tax-saving requirements.

2. What is the difference between ELSS and other tax-saving options?

ELSS differs from other tax-saving options like PPF, NSC, and tax-saving fixed deposits primarily in terms of the investment vehicle and the lock-in period. ELSS invests primarily in equities, carries a lock-in period of three years, and offers the potential for higher returns. Other tax-saving options are fixed-income instruments with varying lock-in periods, offering relatively lower returns.

3. Is it better to invest in ELSS?

Investing in ELSS can be advantageous for individuals seeking tax-saving opportunities with the potential for higher returns. ELSS funds invest in equities, which historically have outperformed fixed-income instruments over the long term. However, investors should consider their risk tolerance, investment horizon, and financial goals before deciding if ELSS is the right investment choice for them.

4. Which is the best option for 80C investment?

The best 80C investment option depends on individual financial goals and risk appetite. Some popular 80C investment options include ELSS funds, Public Provident Fund (PPF), National Savings Certificate (NSC), tax-saving fixed deposits, and Unit Linked Insurance Plans (ULIPs). Investors should assess each option's features, returns, lock-in period, and tax benefits to make an informed decision.

5. Is ELSS Fund just like any equity mutual fund?

ELSS funds are a category of equity mutual funds, but with the added benefit of tax-saving under Section 80C. They invest predominantly in equities and equity-related instruments, aiming for long-term capital appreciation. The main difference between ELSS and other equity mutual funds is the lock-in period of three years for ELSS, which is not present in regular equity funds.

6. Does ELSS Fund offer any tax benefit on dividends and capital gains?

Yes, ELSS funds offer tax benefits on both dividends and capital gains. Under Section 10(34) of the Income Tax Act, dividends received from equity mutual funds, including ELSS funds, are tax-free in the hands of the investor. Additionally, long-term capital gains (if the units are held for more than one year) up to ₹1 lakh are exempt from tax under Section 10(38).

Is ELSS taxable after 3 years?

After the completion of the three-year lock-in period, ELSS funds become fully redeemable without any restrictions. However, any gains made on redemption are subject to long-term capital gains tax if the gains exceed ₹1 lakh in a financial year. As of the knowledge cutoff in September 2021, long-term capital gains on equity investments were taxed at 10% without the benefit of indexation. Investors should consult with a tax professional to understand the current tax implications at the time of redemption.

Read more,