In this article, you will learn about the important things to be kept in mind during the e-filing of an ITR.

The Income Tax Return (ITR) is a form that all taxpayers in India must fill out and send to the Income Tax (I-T) Department in order to notify their income, deduct taxes, and claim refunds. Below lets have a look at Things to be kept in mind while e filing Income Tax.

E-Filing of Income Tax

You have the privilege of e filing Income Tax, which is important in the accompanying cases:

- On the off chance that your gross pay surpasses Rs 5 lakhs.

- To guarantee a claim of Income Tax.

- To document annual expense forms utilising ITR 3, ITR 4, ITR 5, ITR 6, and ITR 7.

Types of ITR forms

There are seven kinds of ITR structures. Citizens need to utilize one of these structures to document their I-T returns, contingent upon the category (Individual, Hindu Undivided Family, organization, and so on), sum and source of income.

| Form of Income Tax Return 1 | It is also known as SAHAJ and is for people with an annual income of at least Rs 50 lakhs from wage or pension, single house property, and other sources. |

| Form of Income Tax Return 2 | People with an annual income of more than Rs 50 lakhs from wage or pension, other sources, international income, more than single house property, and gain on capital. |

| Form of Income Tax Return 3 | People who are partners in a company receive income from the firm in the form of interest, wage, incentives, commission, or remuneration. |

| Form of Income Tax Return 4 | This form, also known as SUGAM, is for people whose yearly salary does not exceed Rs 50 lakhs, including income from business and profession computed on a presumptive basis u/s 44AD, 44ADA, or 44AE, salary/pension, one house property, agricultural income (up to Rs 5,000), and other sources. |

| Form of Income Tax Return 5 | For organisations, LLPs, BOIs and AOPs |

| Form of Income Tax Return 6 | For organizations that do not claim Section 11 deductions. |

| Form of Income Tax Return 7 | People and companies under sections, 139 (4B), 139 (4A), 139 (4D) 139 (4C). |

Key Documents Required to File ITR

- Permanent Account Number

- 26AS Form

- Forms 16A, 16B, and 16C

- Salary statements

- Account statements

- Certificates of Interest

- Certificate of TDS

- Evidence of tax-saving investments

Basic requirements for E Filing Income Tax

- The user must have a valid user ID and password and be registered on the e-filing portal.

- PAN that is active.

- PAN is linked to an Aadhaar card.

- The account has already been validated.

- The valid mobile number linked to the Aadhaar/e-filing portal/your bank NSDL / CDSL for e-verification.

How to file E-ITR? Step-by-Step Guide

- Step 1: Once you’ve determined which category of income taxpayer you are and which ITR form you will use, check out the official income tax e-filing portal. Enter your username and password to log in.

E filing Income Tax login

- Because only registered members can file their IT returns online through the IT Department’s website, new members must first click the ‘Register’ button at the top right of the website.

- To file an ITR, you must first register online.

- Select ‘Individual’ as the user type and tap ‘Continue.’

- Now, share the following information: Surname, PAN card, Initial and last name, birth date, and residential status, then click the ‘Continue’ button.

- Fill in the following mandatory information:

- Contact Information Current Address

- After registering, click ‘Submit.’

- Residents will receive a six-digit OTP1 and OTP2 on the mobile and e-mail IDs specified during registration. To finish the registration process, enter the OTP. You can now return to the first step for e filing Income Tax.

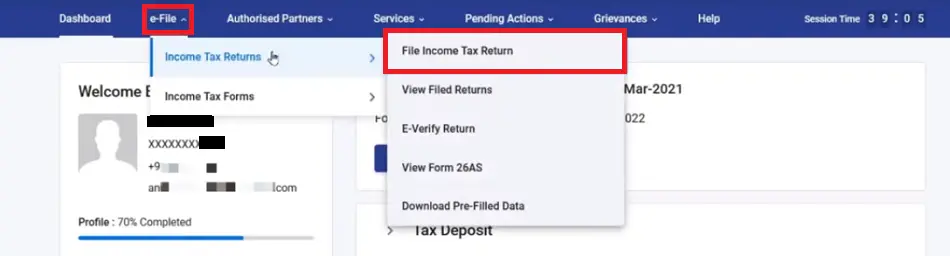

- Step 2: On the main website, under the ‘e-file’ tab, select the ‘File Income Tax Return‘ option.

- Step 3: Select the type of income taxpayer – Individual, Hindu Undivided Family, and so on.

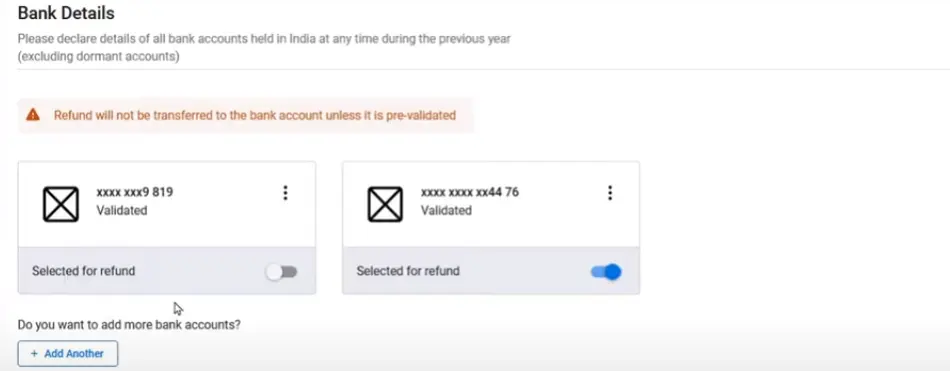

- Step 4: Select the appropriate ITR form and enter your bank account information.

- Step 5: You will be diverted to a new page with your ITR’s pre-filled details. Personal information, total gross income, total deductions, tax paid, and total tax liability are all included. Check these details, and if you are confident that all of the information in the form is correct, verify it.

- Step 6: Return to your dashboard. Select ‘Income Tax Returns’ from the e-File menu, then ‘File Income Tax Return’.

- Step 7: Choose the evaluation year and press the continue button.

ITR assessment year

- Step 8: Continue by selecting the online filing mode.

ITR mode of filing

- Step 9: If you have already completed the ITR and it is awaiting submission, select ‘Resume Filing’. Select ‘Start New Filing’ if you want to start over and delete the previously created return.

- Step 10: Choose your filing mode and ITR form, then click ‘Let’s Get Started.’

- Step 11: Check the boxes that apply to you and click ‘Continue.’

Unlock financial success with our unparalleled accounting services – your gateway to streamlined bookkeeping and prosperity.

ITR checkboxes

- Step 12: Go over your pre-filled data and make any necessary changes. If necessary, enter the remaining data and click ‘Confirm’ at the end of this part.

- Step 13: Fill in the blanks with your income and deduction information. After you have completed and confirmed all sections of the form, click ‘Proceed.’

Choose ITR form

If you have a tax liability, you will be shown a summary of your income tax computation based on the information you provided, as well as the ‘Pay Now’ and ‘Pay Later’ options at the bottom of the page. It is advised to select ‘Pay Now.’

Calculating taxes has never been easier. Try our calculate income tax online tool today. Our salary income tax calculator is here to help you.

- Step 14: After you’ve paid the tax, click ‘Preview Return.’ If you have no tax liability or are due for a refund due to your tax computation, you will be directed to the ‘Preview and Submit Your Return’ page.

- Step 15: On the ‘Preview and Submit Your Return’ page, insert the location, check the declaration box, and then click ‘Proceed to Validation.’

- Step 16: After you’ve validated your information, click ‘Proceed to Verification.’ If your return contains a list of errors, return to the form to correct the errors. If no errors are found, click ‘Proceed to Verification’ to e-verify your ITR.

- Step 17: On the ‘Complete Your Verification’ page, choose your preferred option and press the ‘Continue’ button.

- Step 18: On the e-verify page, click on the option for e-verifying the return and click ‘Continue.’ When you e-verify your return, a message with the acknowledgment number and transaction ID is displayed. You will also receive a confirmation message on the registered e-mail address and contact number.

Conclusion

In this article, we have discussed in detail the whole process of e filing Income Tax along with the documents required and points to be kept in mind while e-filing ITR online. This Step by Step guide will help you in filing the ITR accurately.