The cost of incorporation of a PVT Limited Company varies depending upon the number of directors, the number of members, authorized capital, and corresponding professional fees. Let us read more and understand.

Many businesses avoid incorporating a private limited company because they believe that it is an expensive process. Know more about the Cost of starting a Private Limited Company. However, with the introduction of online company registration, the cost scenario has significantly changed for the better. Nowadays, company incorporation can be completed in a short period at a significantly lower cost.

Additionally, the MCA has waived off incorporation fees for all those start-ups with an authorized capital of up to ₹15, 00,000. This drastically brings down the cost of incorporation for those looking to establish a micro business in India.

Forming a Private Limited Company

The cost of forming a PVT Ltd company in India is determined by a variety of factors, from authorised capital to the number of partners, to stamp duty.

Many young entrepreneurs are sceptical about forming a private limited company due to misconceptions about the costs involved. This misconception may have been true even five years ago, but with the advent of online company registration, new enterprises can easily form a private limited company without burning a hole in their pockets.

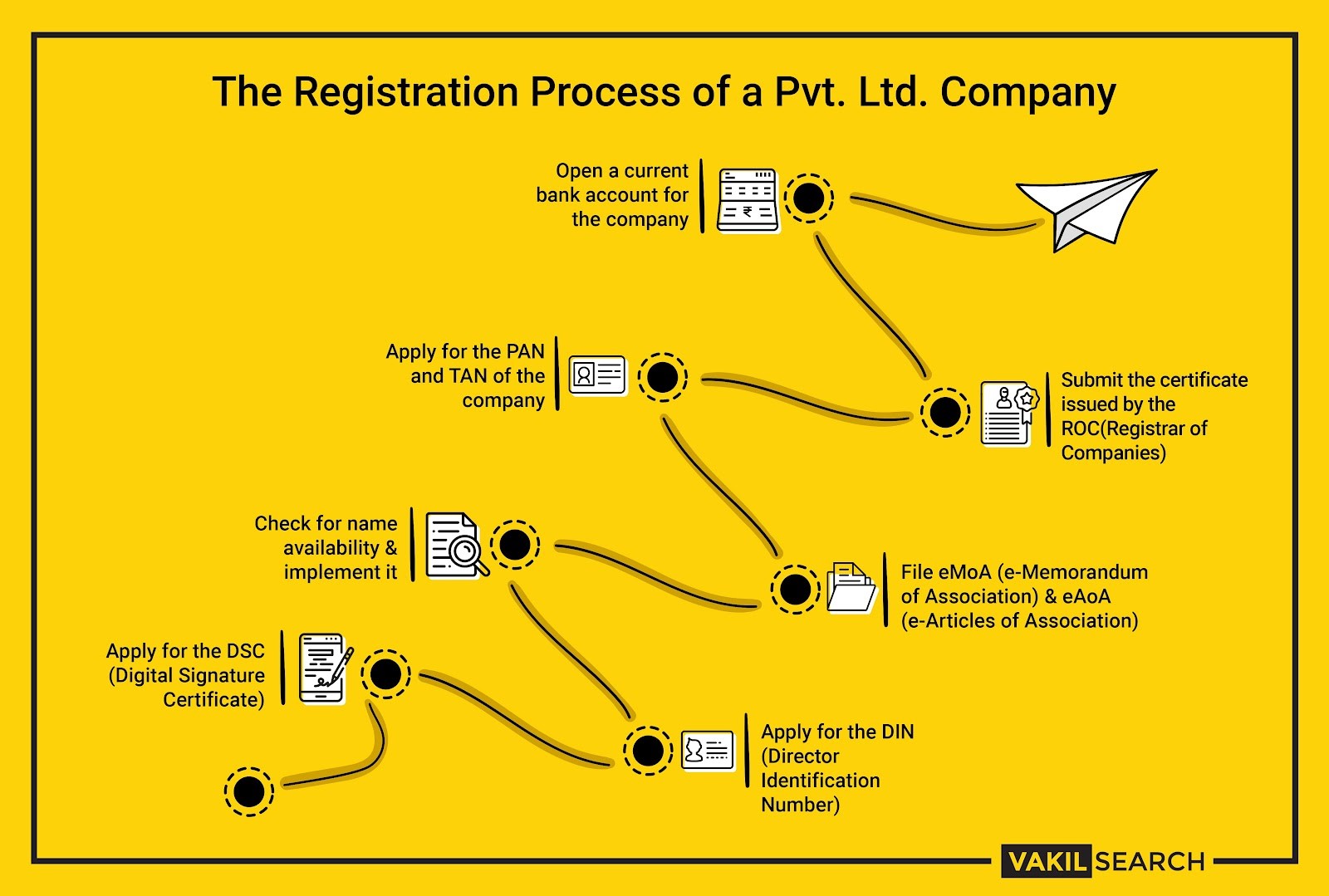

Steps Involved in PVT LTD Company Registration:

Documents Required for Private Company Registration

Some basic documents required for Company Registration include:

- Copy of applicant’s PAN card

- Passport-size photos of the applicant

- Copy of applicant’s Aadhar card

- Copy of rent agreement or property papers of the business place (if the property is rented)

- Electricity/water bill of the business place.

So, what are the costs involved in private limited company registration? Let’s find out.

Foundation Charges

Startup costs are incurred before the business even begins operations, thus they must be considered while budgeting for your business endeavour. With a little research, you should be able to make an educated guess as to what they will be. You’ll also need to budget for hiring a lawyer and a Chartered Accountant. Their charges depend on the level of expertise and experience.

GST Registrations

Businesses that operate without GST are considered illegal and are vulnerable to hefty fines and penalties. To guarantee that business operations run smoothly, GST Apply Online is required. According to the GST rules, any business that sells goods and has a turnover of ₹40 lakh or more is required to register as a normal taxable entity. Similarly, a service provider with an annual turnover of more than ₹20 lakhs must also register for GST. Additionally, a special threshold of ₹10 lakh is fixed for those businesses operating in the northeastern states.

Mandatory Compliances

A Private Limited Company Letterhead is bound by various compliances imposed by the Ministry of Corporate Affairs from the time of its establishment. Making declarations, communicating the appointment of an auditor, recording the minutes of board meetings, annual director filings, and so on, must be performed according to the MCA’s rules and regulations.

The task of ensuring mandatory compliance is usually entrusted to legal experts and CA’s. Consider engaging the services of Vakilsearch for this task as we are significantly less expensive than your local CA.

Accounting & Auditing

It is the responsibility of all businesses, large and small, to provide the Income Tax Returns Department with their accounting records. The MCA: https://www.mca.gov.in/MinistryV2/incorporation_company.html, on the other hand, mandates auditing of private limited companies. It is sufficient to say that both Accounting and Bookkeeping should not be ignored. This annual requirement for accounting and auditing will cost at least ₹15,000.

Event-Based Compliances of Private Limited Company

Event-based compliances are those that are called for when specific events occur, such as a change in directors, a change in registered office, an increasing Authorised Share Capital, and so on and so forth.

As a result, it is critical that such events are followed by timely compliance measures to deter penalties or additional fees. Professional fees for event-based compliances range between ₹2000 – ₹20,000, depending on the event and the complexity of the compliance process.

Get your dream business incorporated in no time with Vakilsearch. Focus on the more pressing aspects of your business and leave the Indian company registration and compliance worries to us. Let Vakilsearch assist you today!

Curious about setup costs in your region? Explore: