If you're unsure of how to start a crypto company in India, you've come to the right place, because we'll discuss how to do it. Read on to know!

Overview: Crypto Company in India

Investors who are thinking about launching a crypto company in India should be aware that the nation only acknowledges blockchain operations. According to the local authorities, cryptocurrency is not regarded as legal cash in India, as stated in the Indian Budget 2018. Regardless of the present perception of cryptocurrency activities,

It is crucial to realize that India has seen an increase in the number of individuals working in this field. In the final six months of 2017, there was a 290% growth in the percentage of people engaged in crypto-related activities. Vakilsearch experts can offer guidance on this issue. Investors who wish to apply for an Indian cryptocurrency license can also contact us.

In this blog, we will discuss how one can start a cryptocurrency business in India.

Indian Cryptocurrency Market’s Current Situation

Although the Indian government has stated that crypto is not recognised as legal cash within the nation. But this does not imply that such actions are prohibited. As there is currently no legislation addressing this emerging market. Holding assets like Bitcoin and other comparable virtual currencies is currently not against the law in India. Also, it is important to be aware that virtual currencies cannot be used in India as a payment system,

Even though the government there is quite interested in supporting blockchain operations. Blockchain is regarded as a reliable mechanism. The best place to start building a digital economy,

According to Indian representatives, maybe with blockchain technology. The major benefits of investing in blockchain technologies can be further explained by our team of experts. Buying a virtual office in India and using it as a legal address is the first step in starting a crypto business.

Crypto Regulations In India

The Banning of Crypto and Regulation of Official Digital Currency Bill, the first draft of which was produced in 2019, was released. Sadly, it forbade any cryptocurrency-related transactions at all. By doing this, only operations like mining would have been allowed for crypto enterprises to be established in India. A new draft bill, though, was made possible in 2021,

And it offered improved opportunities for anyone who wanted to work in this industry. RBI would be able to create an official virtual token by issuing it under the terms of the Crypto and Regulation of Official Digital Currency Bill.

It is also very likely that businesses will be able to seek bitcoin exchange licenses in India. The law has not yet been passed, although it is anticipated that it will. On February 1st of 2022, the govt recognised crypto as “virtual digital assets” and offered particular tax arrangements.

Vakilsearch consultants can assist you if you decide to open a crypto business in India.

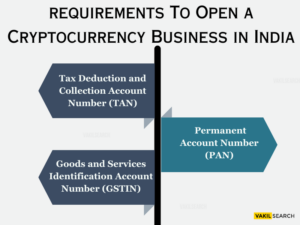

How One Can Open a Cryptocurrency Business in India?

There are no specific requirements to follow to launch a crypto firm in India until the law is passed. No matter if you are a domestic or international business owner, You must first adhere to the 2013 Companies Law. In addition to this, you must additionally fulfill several requirements such as:

- Apply for a Tax Deduction and Collection Account Number (TAN),

- Get a Permanent Account Number (PAN)

- Get a Goods and Services Identification Account Number (GSTIN).

Obtaining a crypto license in India may be necessary for some activities, including the issuing and trading of different VDAs.

Indian Crypto Exchange Requirements

It is feasible to establish virtual currency exchanges in India after getting a crypto license,

but these entities must publish information about their earnings and losses,

The sums are stored in cryptocurrencies, as well as client deposits. In addition to these

requirements, all Indian cryptocurrency exchanges must create KYC standards. Also, they need to maintain records of the traders and clients using their platforms. The most recent information on crypto businesses in India was released in March 2022 but until that time,

There were no regulations about acquiring a license for a cryptocurrency exchange. Despite this, it is anticipated that platforms will eventually need to apply for these licenses due to the abundance of laws in existence. For more information, you can always get in touch with Vakilserch.

India’s Employment Rate Is Rising

Entrepreneurs who want to set up a business in this emerging industry in India should also hire employees. India, as previously indicated, adopts the international trend in this area. Specialists that can comprehend the processes involved in cryptocurrency,

Blockchain, and initial coin offering activities are in high demand. Jobs that are pertinent to blockchain-related activities are of special relevance to anyone looking for a job in this emerging industry. India benefits from a large labour pool that offers a lot of IT and related industry experience to blockchain businesses.

Indian Cryptocurrency Taxation

The following has reportedly already been determined on the taxation of crypto:

- As of April 2022, revenues from cryptocurrency transactions are subject to a 30% tax;

- In addition, these businesses will likely be required to pay the Goods and Services Tax at a rate of 28%;

- Any transaction carried out by such businesses will likewise be eligible for a 1% tax deduction at source.

Conclusion

Opening a crypto company in India can be a challenging but potentially rewarding endeavor. While the legal status of cryptocurrencies in India is currently uncertain. Also, The RBI has not explicitly banned the use of these assets. Potential cryptocurrency companies in India will need to obtain the necessary licenses

And approvals from the RBI and other relevant authorities and compliance with AML and KYC regulations. They will also need to carefully assess the risks and challenges they may face,

including regulatory uncertainty, market volatility, and the risk of cyber attacks. By thoroughly researching and planning for these challenges,

It is possible for entrepreneurs to successfully launch and operate a cryptocurrency company in India.

Did you know?

Read More,