Joint Declaration Form (JDF) now available. Securely update member details & streamline payroll processes.

The Employees’ Provident Fund (EPF) is a crucial safety net for Indian employees, ensuring a steady stream of income after retirement. However, navigating the intricacies of the EPF system can be a bit daunting. One crucial document in this regard is the Joint Declaration Form EPF, which plays a vital role in correcting discrepancies in your PF account details.

What is a Joint Declaration Form EPF?

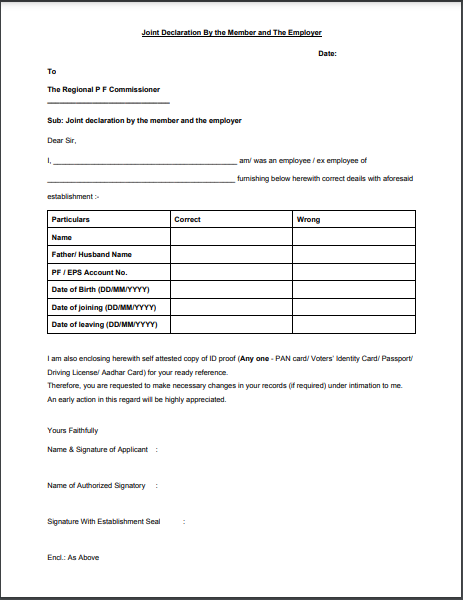

Simply put, a Joint Declaration Form EPF is a document signed and submitted by both you and your employer to request changes or corrections in your PF account details. It allows you to rectify any discrepancies in information like your name, father’s/husband’s name, PF account number, date of birth, joining date, or even date of leaving.

Why Use a Joint Declaration Form EPF?

There are several scenarios where you might need to utilize the Joint Declaration Form:

- Correction of minor errors: Typos in your name, date of birth, or address can be easily rectified using this form.

- Updating details after marriage/divorce: Change of name due to marriage or divorce necessitates updating your PF records accordingly.

- Reconciling discrepancies between employer records and EPFO data: Sometimes, discrepancies arise between the information your employer submits and the data maintained by the EPFO. The Joint Declaration Form helps bridge this gap.

- Correcting date of joining or leaving: If the dates recorded for your joining or leaving a company are incorrect, this form helps rectify them.

Get instant calculations with our PF calculator online. Our EPF calculator ensures you stay on top of your savings.

Benefits of Using a Joint Declaration Form EPF:

- Convenience: The form is readily available online on the EPFO website or through your employer’s portal.

- Time-saving: It offers a simpler and faster way to update your PF details compared to traditional methods.

- Accuracy: By involving both you and your employer, the form ensures accurate updates are made.

- Transparency: The process is transparent, with both parties involved in the modification of your records.

How to Use the Joint Declaration Form EPF:

- Gather necessary documents: You’ll need attested copies of documents supporting the changes you want to make (e.g., marriage certificate for name change).

- Download and fill the form: Access the form online and fill it out accurately with the correct details.

- Obtain signature from your employer: Once filled, get your employer to sign the form and affix the company seal.

- Submit the form: Submit the completed form, along with supporting documents, to the Regional PF Commissioner’s office or online through your employer’s portal.

Submission of Joint Declaration Form EPF

EPF members or employees must physically submit the joint declaration to the regional PF office where the company or establishment is registered. On the joint declaration form EPF, employees need to provide the following details:

- Date of form submission

- Regional PF commissioner address

- Name and company name

- Correct particulars, i.e., information that requires correction or updating in the PF member account

- Wrong particulars, i.e., information erroneously entered in the PF member account

- Signature of the applicant, name of the authorized signatory for the establishment, and signature of the establishment with its seal

Once the above details are filled in, employees should attach self-attested identity proof documents to substantiate the correction claim. Subsequently, they should submit the form to the regional EPFO office where the establishment is registered.

Documents Required For Joint Declaration Form

The PF office acknowledges the submission of self-attested documents for updating PF member account details, including:

- PAN card

- Voters’ identity card

- Passport

- Driving license

- Aadhar card

Update Details Through Member e-Sewa Portal

EPF members can log into the Member e-Sewa portal to independently correct or update only the basic details. Upon logging in, members have the capability to modify their name, date of birth, and mobile number. It’s essential to note that these details must match the information on the Aadhaar card, as the Aadhaar card is linked with the EPF member account. For changes in other details, the EPF member must submit the joint declaration form to the PF office.

Sample of Joint Declaration Form EPF

Conclusion

The Joint Declaration Form EPF serves as a vital tool for EPF members in India to rectify and update crucial details in their Provident Fund accounts efficiently. Whether correcting minor errors, updating personal information due to life events like marriage or divorce, or reconciling discrepancies between employer records and EPFO data, this form ensures accuracy and transparency in managing PF records. By requiring both the employee and employer’s involvement, it simplifies the process of updating information such as name, date of birth, and employment details.

Moreover, the convenience of accessing the form online through the EPFO portal enhances its utility, offering EPF members a straightforward means to ensure their PF records remain accurate and up-to-date. Therefore, understanding how to utilise the Joint Declaration Form EPF can empower employees to maintain their financial security and retirement planning effectively under the EPF scheme.

Frequently Asked Questions

What is a joint declaration form for EPF?

A joint declaration form (JDF) is a document used by both an employee and their employer to update or correct information in the employee's EPF account. It allows for changes like name, date of birth, address, and even contribution opt-in/opt-out options.

How do I download a joint declaration form?

You can download the JDF from the EPFO website: https://www.epfindia.gov.in/site_en/Downloads.php Look for Joint Declaration Form (JD Form) under the Downloads

What is the PF declaration form?

The PF declaration form is a specific term for the JDF. It's often used interchangeably with joint option form or just joint declaration.

How to apply for a joint option form EPFO?

You can submit the JDF online through the EPFO member portal or offline by submitting a physical copy to your employer. They will then submit it to the regional EPFO office.

Where can I get a physical joint option form?

You can get a physical copy of the JDF from your employer's HR department or directly from the nearest EPFO regional office.

Where do I send my joint option form?

If submitting physically, you need to give the signed JDF to your employer. They'll submit it to the regional EPFO office for processing. If using the online portal, you submit it directly through the member portal.