Tax planning is a critical aspect of personal finance, and for Indian taxpayers, Section 80C of the Income Tax Act offers an excellent opportunity to reduce tax liability. Section 80C provides deductions for various investments and expenses, allowing taxpayers to save up to ₹ 1.5 lakhs per financial year. In this comprehensive blog, we will delve into the world of 80C deductions, exploring the eligible investments, sub-sections, limitations, and strategies to make the most of this valuable tax-saving provision.

Welcome to our comprehensive guide on 80C Deductions – A tax-saving tool that can help you reduce your taxable income and save significant money. In this guide, we will take you through everything you need to know about 80C Deductions, including the basics, the benefits, the eligibility criteria, and how to claim them.

What are 80C Deductions?

80C Deductions are a set of deductions provided under Section 80C of the Income Tax Act of 1961. These deductions allow you to reduce your taxable income by up to ₹1.5 lakhs per year, which can result in significant tax savings.

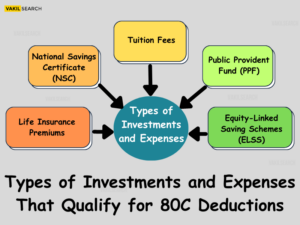

There are several types of investments and expenses that qualify for 80C Deductions, including:

- Life Insurance Premiums: You can claim a deduction for the premium paid on a life insurance policy, as long as the policy covers you, your spouse, or your children. The maximum deduction allowed is 10% of the sum assured.

- Equity-Linked Saving Schemes (ELSS): You can invest in ELSS mutual funds and claim a deduction for the amount invested. ELSS funds have a lock-in period of three years, which means you cannot withdraw your money before that time.

- Public Provident Fund (PPF): PPF is a long-term investment option that offers a high-interest rate and a tax-free return. You can claim a deduction for the amount invested in PPF, subject to a maximum of ₹1.5 lakhs per year.

- National Savings Certificate (NSC): NSC is a popular investment option offering a fixed interest rate and a tax-free return. You can claim a deduction for the amount invested in NSC, subject to a maximum of ₹1.5 lakhs per year.

- Tuition Fees: You can claim a deduction for the tuition fees paid for your children’s education, subject to a maximum of ₹1.5 lakhs per year.

Benefits of 80C Deductions

The benefits of 80C Deduction are numerous. First and foremost, they can help you reduce your taxable income and save significant money on taxes.

Eligibility for 80C Deduction

To be eligible for Deductions, you must be a resident individual or a Hindu Undivided Family (HUF). Non-resident individuals and foreign companies do not qualify for these deductions.

How to Claim 80C Deduction?

To claim 80C Deductions, you need to calculate your total taxable income for the year. Once you have done that, you can subtract the deductions you are eligible for under Section 80C. The resulting amount is your net taxable income, which you will be taxed.

Take charge of your finances – Explore our Online Tax Calculator for strategic tax management.

Section 80C Deduction List

Our journey begins with a detailed list of eligible investments and expenses under Section 80C. The most common instruments include:

Employee Provident Fund (EPF): A compulsory contribution by employees and employers to build a retirement corpus.

Public Provident Fund (PPF): A government-backed long-term investment scheme with attractive tax benefits.

Life Insurance Premiums: Premiums paid towards life insurance policies that offer financial security and tax-saving benefits.

Equity-Linked Savings Scheme (ELSS): Mutual fund investments with potential for higher returns and a lock-in period.

National Savings Certificate (NSC): Government savings scheme with fixed tenure and guaranteed returns.

5-Year Fixed Deposit (FD): Tax-saving fixed deposits offered by banks with a lock-in period of 5 years

Sukanya Samriddhi Yojana (SSY): A scheme for the girl child, aimed at securing her future education and marriage expenses.

Tuition Fees: Deductions available on tuition fees paid for up to two children’s education.

Principal Repayment on Home Loan: Deduction on the principal amount repaid on home loans.

Subsections of Section 80C: Section 80CCC and Section 80CCD

Apart from Section 80C, there are two other subsections – 80CCC and 80CCD – that offer additional tax-saving avenues:

Section 80CCC: This section provides deductions for contributions to pension plans offered by insurance companies. It encourages long-term retirement planning.

Section 80CCD: This section allows deductions for contributions to the National Pension System (NPS). Both employees and self-employed individuals can benefit from this provision.

The Limitations and Restrictions of 80C Deductions

While Section 80C offers attractive tax benefits, it comes with certain limitations and restrictions that taxpayers must be aware of:

Maximum Limit: The overall deduction limit under Section 80C, 80CCC, and 80CCD(1) cannot exceed ₹ 1.5 lakhs in a financial year.

Lock-in Period: Some investments like ELSS and 5-Year FD have a lock-in period, restricting premature withdrawals.

Partial Withdrawals: Instruments like PPF and EPF do not allow partial withdrawals before maturity, ensuring disciplined savings.

Taxation on Maturity: While investments like PPF and EPF offer tax-free returns, others like NSC and FD are taxable upon maturity.

Deduction on Home Loan Interest: While the principal repayment qualifies for an 80C deduction, the interest component falls under a separate section (Section 24).

Maximise Your Tax Savings: Strategies and Tips

To optimise tax savings under Section 80C, taxpayers can employ various strategies:

Diversify Investments: Spread investments across different instruments to balance risk and returns.

Start Early: Begin investing in tax-saving instruments at the start of the financial year to benefit from compounding.

Systematic Investment Plan (SIP): Consider investing in ELSS through SIPs to average out market fluctuations.

Employee Benefits: Utilize employee benefits like the EPF and NPS to maximize deductions.

Invest in SSY: Secure your daughter’s future by investing in the Sukanya Samriddhi Yojana.

Health Insurance Premiums: Claim deductions for health insurance premiums under Section 80D in addition to 80C deductions.

NPS for Extra Deductions: Self-employed individuals can claim an additional deduction of ₹ 50,000 under Section 80CCD(1B) for contributions to NPS

Conclusion

In conclusion, 80C Deductions are an excellent tax-saving tool that can help you reduce your taxable income and save significant money on taxes. By investing in tax-saving instruments such as ELSS, PPF, and NSC, you can save on taxes and achieve your long-term financial goals. So, take advantage of these deductions when filing your taxes this year. Get basic legal advise for more information from Vakilsearch.

Read More: