With talks about Dearness Allowance (DA) to be raised to 50%, this blog provides a clear understanding of the importance of DA in compensation by outlining its rates, calculation techniques, categories, and criteria.

A Dearness Allowance (DA) is a cost of living adjustment paid to public sector employees and pensioners. This is calculated as a percentage of the basic salary to minimise the effect of inflation. It is paid to Central Government employees, the public sector, and pensioners of the Central Government. The dearness allowance is also paid to private sector employees and civil servant pensioners in India. The DA is calculated based on the employee’s basic salary and the respective pay scale. It is added along with other components, like the take-home amount. The dearness allowance varies from one employee to another as per their presence in the urban, semi-urban, or rural sectors. As per the provisions provided under the Income Tax Act of 1961, it is mandatory to declare the tax liability with respect to the DA when filing an ITR.

DA for Central Government Employees

The dearness allowances are the costs that the central government covers for the standard of living of its employees. It indicates that employees of the central government or any other public sector organisation will be eligible to receive dearness allowances. As per the latest updates, the union cabinet is likely to approve a 4% dearness allowance for Central Government employees. In October 2023, the cabinet increased the dearness allowance and relief by 4% to 246%. This benefited 48.67 lakh Central Government employees and 67.95 lakh pensioners. With an additional 4% hike, the DA will reach 50%.

DA is crucial to helping more than 50 lakh government employees and 60 lakh pensioners. Increased DA results in a substantial increase in the monthly income of a public sector employee. This cushions the effect of inflation.

Dearness Allowance Rate

The rate of Dearness Allowance varies and is often revised periodically by the government or employers to ensure that employees’ salaries or wages keep pace with the rising cost of living expenses. The specific DA rate can differ across regions, organisations, and government policies, and it is typically expressed as a percentage of the basic salary or wage.

How is DA Treated Under Income Tax?

Paying the relevant taxes on their Dearness Allowance is a requirement for salaried workers. Insofar as it is included in the retirement benefit salary and employees receive rent-free, unfurnished housing upon meeting all requirements, the dearness allowance is deemed to be part of the compensation. The Income Tax Act,1961 mandates that the tax liability for Dearness Allowance be declared on the forms that are submitted.

Role of Pay Commissions in DA Calculation

Each subsequent pay commission in India is tasked with reevaluating the salaries of public sector workers, considering all the diverse components that constitute their pay. The upcoming pay commission report will include an assessment of Dearness Allowance as well.

It is the responsibility of these pay commissions to comprehensively factor in all elements contributing to the compensation of public sector employees. Additionally, the pay commissions possess the authority to review and adjust the multiplication factor as deemed necessary.

Dearness Allowance for Pensioners

Every time a pay commission introduces a new compensation structure, the pension for retired public sector employees is modified. The same rules apply to Dearness Allowance; retired public sector employees’ pensions also adjust in accordance with increases in DA that occur by a certain percentage. This is applicable to family pensions as well as normal pensions.

Calculation of Dearness Allowance in India

Dearness Allowance (DA) is a component of the salary paid to employees in India, which is meant to offset the impact of inflation on their earnings. The government revises DA periodically, typically twice a year, based on changes in the Consumer Price Index (CPI).

The formula for calculating DA in India is as follows:

DA % = [(Average of CPI for the past 12 months – Base Index) / Base Index] x 100

Here, the “Base Index” is the CPI for the year 2001, which is fixed at 100. The average of the CPI for the past 12 months is used to determine the current rate of DA.

For example, if the average CPI for the past 12 months is 130, the calculation would be as follows:

DA % = [(130-100) / 100] x 100 = 30%

This means that the DA would be 30% of the employee’s basic salary.

It’s important to note that DA rates may vary depending on the type of employee and their location. The government sets different DA rates for central government employees, state government employees, and employees in the private sector. Additionally, DA rates may vary depending on the city or region in which the employee is based, due to differences in the cost of living.

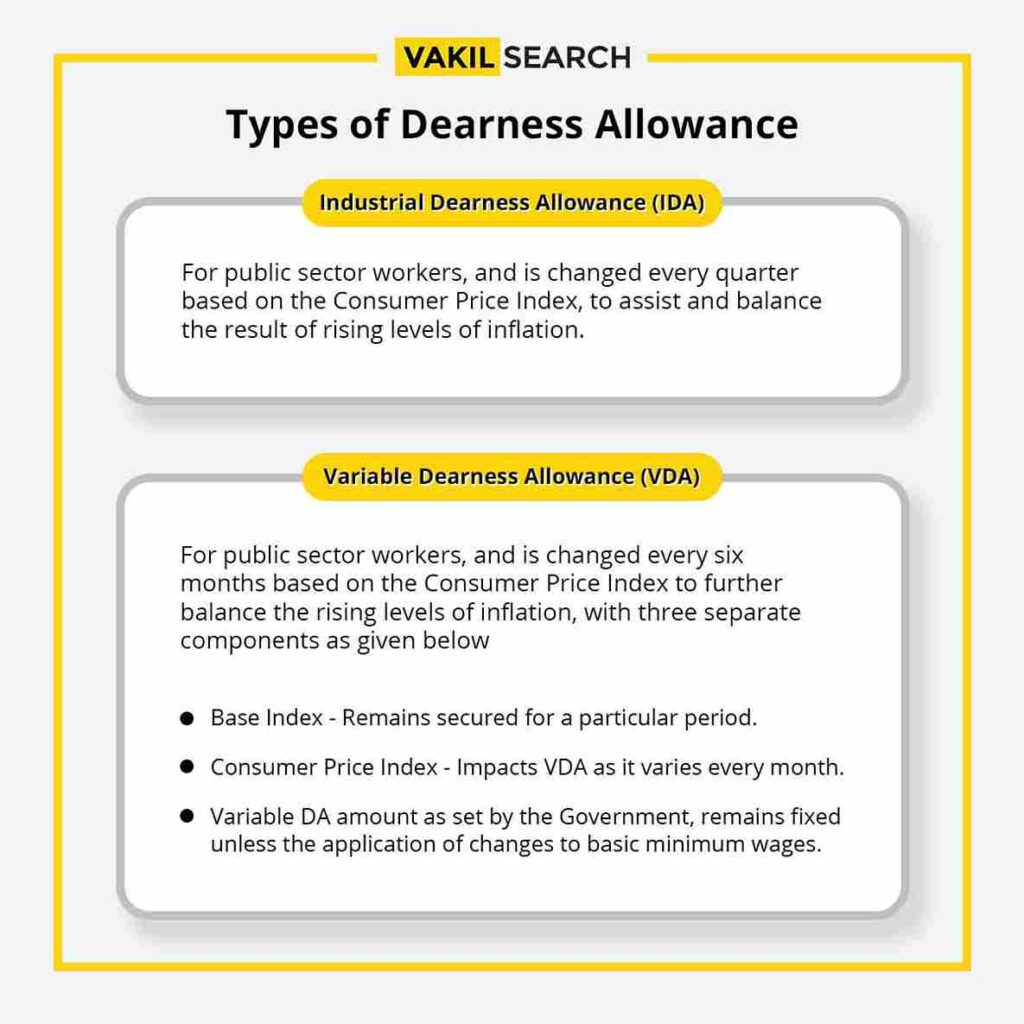

Types of Dearness Allowance

In India, there are mainly two types of Dearness Allowance (DA) that are offered to the employees:

- Industrial Dearness Allowance (IDA): The Industrial Dearness Allowance (IDA) is offered to the employees working in Public Sector Undertakings (PSUs) and is determined by the Department of Public Enterprises (DPE). The rate of IDA is revised on a quarterly basis based on the All India Consumer Price Index (AICPI). The IDA rates are different for each quarter of the financial year.

- Central Dearness Allowance (CDA): The Central Dearness Allowance (CDA) is given to employees of the Central Government and is based on the recommendations of the 7th Pay Commission. The rate of CDA is revised twice a year, in January and July, based on the AICPI. The CDA rates are the same for all employees of the Central Government, regardless of their location or type of job.

It’s important to note that while the IDA is specific to PSUs and the CDA is specific to the Central Government, some State Governments and private sector organizations may offer their own Dearness Allowance schemes that may be based on the AICPI or other inflation indices. The rates and policies of such schemes may vary depending on the respective government or organization.

7th Pay Commission’s Dearness Allowance

As per law, every 10 years, the central government creates a pay commission to update the pay scale of the employees. The 7th pay commission was established on 8 February 2014. It is mandatory to examine, review, and recommend changes in the principles governing Central Government employees.

The 7th Pay Commission consisted of Justice Shri Ashok Kumar Mathur as the chairman, Sri Vivek Roy and Dr Ratan Roy as members, and Shrimati Meena Agarwal as the secretary.

They pay commission analyses of various salary components, including dearness allowance, before bringing in changes. It takes full responsibility for considering every component involved in calculating the employee salary. The pay commission also calculates the multiplication factor for DA calculation regularly.

Minimum Payment

This Pay Commission has increased the minimum wage from ₹7,000 to ₹18,000 per month. The entry-level wages will now be ₹18,000. (for newly recruited). A newly hired class 1 officer, however, will cost 56,100. This wage structure displays a compression ratio of 1:3.12, indicating that a class 1 officer will be paid three times more than an entry-level employee.

Rates of Dearness Allowance

The DA rates are determined based on the government employee’s compensation. A portion of the compensation has covered the employee’s cost of living.

Rules for Dearness Allowances

The DA was established following World War II. After a few revisions, the rules and regulations surrounding the dearness allowance were ultimately implemented in 1972. Every service officer covered by the All India Service Act, 1951, is entitled to a specific portion of their basic salary as a dearness allowance. The rules provide that those who work for government agencies have a fixed basic wage under:

- Sub-rules 5

- 6A of the IAS rule 4

- Sub-rule 5 of the IPS rule 4

- Sub-rule 6 of the IFS rule 4 is entitled to DA at the announced rates or following central government regulations.

Dearness Compensation Eligibility

As per the regulations, individuals who are eligible for dearness allowance should be employed under the central government of India.

- Employees who work for organisation in the public sector are also eligible for Dearness Allowance

- Central government pensioners can also claim DA

- Any service member qualified under the all India Service Act of 1951 has the right or Dearness Allowance

- All The eligible employees will get a specified percentage of DA fixed by the central government

- The amount might vary based on the base salary of the employee. However the percentage remains the same

- The housing rent should be included in the dearness allowance

- Pensioners are also entitled to dearness allowance but they might not receive the same if they find a new employment within the state government.

- Pensioners reentering the workforce abroad will not receive any DA

Salary Supplement for Central Government Employees

The DA rate for central government employees is 125%, 6% more than the previous rate of 119%. The rules and fees for DA have been set since 1972. Since that time, the rates have been changing every six months. The rate for the central government was established at 113% in January 2015, and then in the second half of the same year, it increased to 119%. For central government employees this year, the rates increased by 6% in January and reached 125%. The Union Cabinet last raised the dearness allowance and dearness relief in October 2023, raising it by 4 percentage points to 46% with effect from 1 July 2023. At present it is likely to approve a 4% hike totaling it to 50%.

Fitment Element

One of the primary components of the 7th Pay Commission is the fit factor. In this case, a relevant factor of 2.57 will be used for all Pay Matrices levels. After taking DA into account, government employees’ or retirees’ salaries or pensions will increase by at least 14.29% as of 01 January 2016.

Dearness Allowance Calculator

To calculate your Dearness Allowance, you will need the following information:

- The Consumer Price Index determines the amount of the dearness allowance

- The employee’s base salary determines the allowance

- A specific % is agreed upon for the DA, and the employee receives the total amount and the housing rent allowance at the end of each month

- DA %s vary depending on the area, whether urban or rural. The current price level, or CPI, is considered when determining DA for seniors.

Bank Workers’ Dearness Allowance

DA is based on CPI points for bank employees. The DA decreased by 1% in December 2015. On the other hand, bank employee DA had increased by 2.8% the year before. The CPI readings for January, February, and March of 2016 had already been released, and the analytics predicts May’s anticipated decline in DA.

Conclusion

According to sources quoted, the Cabinet is likely to approve an increase in Dearness Allowance (DA) for central government employees of 4%. With this increase, dearness relief (DR) and DA will both reach 50%. The Central Government keeps a check on the circumstances and upgrades the rates after a complete analysis to cushion the employees adjusting with inflation. Get in touch with our tax experts for more information regarding the same.

FAQs

What is the Full Form of DA in Salary?

Full Form of DA in Salary is Dearness Allowance.

What happens if DA is 50%?

The dearness allowance (DA) will be eliminated when it reaches 50% and the funds that the employees were previously receiving as an allowance will be added to their base pay. Once the DA percentage reaches 50%, this practice is to combine the DA with basic wage.

What is the dearness allowance for January 2024?

By January 2024, it is anticipated that the Dearness Allowance (DA) rate for Central Government employees will have surpassed 50% or higher. Currently, the 7th Pay Commission's proposal determines the DA rate.

What is the latest on DA?

For Central Government workers and retirees, DA (Dearness Allowance) is anticipated to increase by 50% starting in January 2024. This is a promising development that is seen to be a good opportunity.

What is the current DA rate?

For Central Government employees, retirees, and family pensioners, the current DA rate is 42%.

What is the current DA allowance?

As of 1 January 2023, the rate of Dearness Allowance for Central Government employees, pensioners, and family pensioners is 38% + 4% = 42%. Its expected to increase to 50%

What happens when DA becomes 100?

The 7th Central Pay Commission suggested raising HRA rates in two stages: when DA exceeds 50%, it should be reviewed to 27%, 18%, and 9%; when DA exceeds 100%, it should be raised to 30%, 20%, and 10%. But the government has agreed that these rates will be increased when the respective DA surpasses 25% and 50%.

What is the basic salary?

The basic salary is the fixed portion of an employee's compensation that does not include additional benefits, bonuses, or allowances. It is the core amount paid to an employee for their services, forming the foundation of their overall salary package.

Is Dearness Allowance applicable to the employees and pensioners of the private sector?

The applicability of Dearness Allowance (DA) to employees and pensioners in the private sector depends on the company's policies and employment agreements. Unlike in the public sector, where DA is a common component to adjust salaries in response to inflation, private sector organisations may have different approaches to compensate for cost-of-living increases.

When is Dearness Allowance (DA) revised for employees?

In general it is revised every six months.

How much DA will increase in January 2024?

A proposal has been placed to implement a 4% hike in the present DA effect from January 2024. If approved the DA will raise to 50%.

What is the new dearness allowance?

It is expected that the dearness allowance will be increased by 4% on approval. In this case it will be 50%.

What happens if DA reaches 50?

As per the recommendations provided by the 7th pay commission if the DA reaches 50% there will be a hike in the house rent allowance, transport allowance and children's education allowance. As a result the take home salary of the central government staff will increase significantly.

What is the DA order from January 2023?

In March 2023 the central government increased the DA by 4% starting in January 2023. This drastically increased the DA from 38% to 42%.

When will the 8th Pay Commission come?

The 8th pay commission might be implemented in 2026. The commission will be announced in 2024.

What is the DA notification for July 2023?

In October 2023 DA Hike was provided to all the Central Government employees. In July 2023 the hike was further raised by 4% making it 46%.

What if DA reaches 100 percent?

As per the 5th CPC the 50% DA had been already merged with the basic pay. In 6 CPC the allowances have been increased by 25%. However, the commission members have not yet responded about what should be done when DA touches 100%. However the government servants receiving their pay as per the revision were not granted merging the other 50% of DA in 5 CPC scale.

Will the DA increase in July 2023?

Yes it was increased by 4% and was implemented from 1 July 2023.

Will the DA increase in January 2023?

Yes the DA has already increased in January 2023 by 4%.

What if dearness allowance is more than 50%?

Whenever the dearness allowance reaches the 50% mark it is merged with the basic salary. This will provide a major salary height for the employees.

What is the maximum DA in India?

As of March 2023 there has been discussions to increase the DA allowance by 4% totalling into 50%. It is pending for approval!

What is the maximum limit of DA?

Currently The DA stands at 46% and a High court 4% is expected post approval by the central government.