Crypto Tax India 2024 – Indians, by the millions, have invested in cryptocurrency. The value of Bitcoin has rapidly increased, which is to blame. During the COVID-19 outbreak, millions of Indians expressed interest in cryptocurrency to achieve their financial goals. Their revenue grew greatly. The Indian Income Tax Department, RBI (Reserve Bank of India), and the Central Government noticed this. The government has implemented a taxation strategy to control cryptocurrencies. Taxes of all stripes have been imposed. The whole cryptocurrency community in India is working hard to discover ways around this severe financial crackdown(Avoid Tax on Cryptocurrency) on their earnings. A few crucial ideas are required knowledge that is outlined below.

What is Cryptocurrency?

Cryptocurrency is a type of digital money that does not rely on banks to verify transactions. With peer-to-peer technology, anybody, anywhere, may give and receive money. Payments made with cryptocurrencies only exist as digital records to an online database that lists specific transactions, not as genuine physical coins that can be carried and swapped. All Bitcoin operations that include money transfers are recorded on a public ledger. The place where Bitcoin is held is in digital wallets. Continue this to know more about avoid tax on Cryptocurrency.

Cryptocurrency has acquired its name because transactions are validated through encryption. This suggests that complex programming is required to store, transport, and preserve Bitcoin data in public ledgers. The purpose of encryption is to provide security and protection.

The first avoid tax on Cryptocurrency, one of the most well-known today, was invented in 2009: Bitcoin. Trading for financial gain accounts for a sizable percentage of interest in cryptocurrencies, with speculators periodically driving prices over the roof.

Save Tax India: Process of Investing in Cryptocurrency

A distributed public ledger known as the blockchain, updated and maintained by currency holders, is the foundation of cryptocurrencies. Through a process known as mining, which employs computer power to solve challenging mathematical problems, units of Bitcoin are generated. Additionally, users can purchase the currencies from brokers, then store and spend them in digital wallets.

When you hold cryptocurrencies, you don’t own anything. What you possess is a key that enables you to transfer a record or a measurement unit between people without using a reliable third party. Even though Bitcoin has been available since 2009, the financial applications of cryptocurrencies and blockchain technology are constantly developing, and more are anticipated in the future. The technology could be used to trade bonds, equities, and other financial assets.

Crypto Tax India: Cryptocurrency Taxes

1. Cryptocurrency Sales and Purchases.

2. The Exchange of Cryptocurrency.

3. Advantages of Cryptocurrencies.

4. The Cryptocurrency that was given to you.

5. Spending or Compensation.

6. Your earnings from the transfer of VDA (Virtual Decentralised Asset).

7. Exchange of Cryptocurrencies.

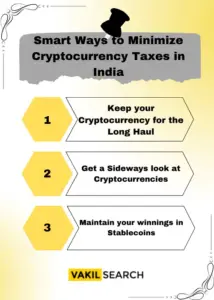

Avoid Tax on Cryptocurrency: Tips to Save Crypto Tax India

The following is some of the greatest advice to avoid tax on Crypto:

1. Keep your Cryptocurrency for the Long Haul

In the case of cryptocurrencies, you should always aim for a long-term capital gain rather than a quick one. You can reduce your tax liability as a result. On the other hand, if you sell your investments in less than a year, you will have made a short-term financial gain. According to the experts of Vakilsearch. After a year, sell your avoid Tax on Cryptocurrency if you want to. You will save more money on taxes because of the low tax rate.

2. Get a Sideways look at Cryptocurrencies

Getting indirect exposure to cryptocurrencies is one of the best ways to lower crypto taxes. Interestingly, several newly introduced portfolios by different international investment platforms enable Indian cryptocurrency investors to have exposure to a specific digital currency without purchasing it or directly investing in it.

3. Maintain your winnings in Stablecoins

Investing in them makes you less likely to suffer a long-term capital loss. One US Dollar is equivalent to one USD Coin, for instance. Therefore, investing your cryptocurrency in such a stablecoin might be a smart move given the US dollar’s rise. With the right approach, you may maximize your tax savings while complying with income tax regulations.

How to Avoid Tax on Cryptocurrency in India?

India’s crypto enthusiasts are all interested in learning more. Searches concerning it are continuously saturating Google and other search engines. All earnings from the sale of VDAs are subject to a flat 30% tax, implemented by India’s Finance Minister Nirmala Sitharaman (Virtual Decentralised Assets). This also applies to cryptocurrencies. During the 2022 Union Budget Session, she made the announcement. The government also proclaimed a 1% TDS (Tax Deducted At Source) for all bitcoin transactions.

The avoid Tax on Cryptocurrency community in India has identified a few gaps in the legislation. P2P (Peer-to-Peer) transactions and DEX (Decentralised Exchanges) like PanCakeSwap and Uniswap can assist in avoiding taxes on cryptocurrencies in India. Will this work? Are the techniques risk-free? These are questions worth two million dollars. Decentralized Exchanges is the acronym for them. KYC is not necessary for decentralized cryptocurrency exchanges. It takes time to get through the intricacy that lies at the foundation of these decentralized tools and exchanges. The investor alone is responsible for any risk.

What if you Try to Exchange your Cryptocurrency Earnings for FIAT?

Your portion of the tax will still be due. Indian income tax authorities are already aware of the potential for these scams. For a while, the scam may benefit traders and investors. But sooner or later, the Indian government will stop this scam. Financially speaking, this might be a hazardous ruse. Even if a pertinent taxation program has been introduced, using DEX may not be successful in the long term because cryptocurrency is not considered legal cash.

Avoid Tax on Cryptocurrency: Report Cryptocurrency on your Indian Taxes

You can use one of the methods listed below to declare cryptocurrency revenue on your taxes:

The following documents are required for this purpose:

1. The proof of income.

2. Form 26AS.

3. Form 16A.

4. PAN Card.

6. Capital Gains Statement.

7. Bank Account Details.

Remember to record your exemptions and losses. The Indian government doesn’t appear inclined to compensate for your avoid Tax on Cryptocurrency losses. You might not be able to make up for your losses.

What will Happen if I Don’t Pay Income Tax in India?

Avoid making this error. Be clever to earn the respect of your government and the Indian tax authority. Failure to submit an ITR and failure to disclose any income earned in India carries several penalties. The following is on the list:

1. Severe financial sanctions.

2. Legal action was taken against you.

3. The interest of 1% each month.

4. Filing late fee

5. Certain losses could not be eligible for carryover or offset.

6. Two months to two years in prison.

What Are Some Common Mistakes to Avoid When Trying to Save On Crypto Taxes?

While there are various approaches to save on crypto taxes, it’s crucial for investors to be cautious about common mistakes that could lead to potential tax liabilities. Some of these pitfalls include:

Not Reporting All Cryptocurrency Transactions:

Some investors may be tempted to omit reporting certain cryptocurrency transactions, especially if the profits or losses are small. However, the IRS requires the reporting of all crypto transactions, regardless of the amount involved. Failure to report all transactions may result in penalties and interest charges.

Lack of Understanding of Tax Laws:

The tax laws related to cryptocurrency investments are complex and constantly evolving. Investors should take the time to comprehend these tax laws and seek advice from a tax professional if needed. Ignorance of the tax laws may lead to higher tax liabilities or potential legal issues.

Using Unreliable Tax Software:

Reliable tax software can assist investors in saving on crypto taxes by accurately calculating gains and losses and generating tax forms. However, using unreliable or untested tax software may lead to inaccurate calculations and potential legal complications. It is essential for investors to research and select reputable tax software specifically designed for Avoid Tax on Cryptocurrency investments.

Neglecting Tax Implications of Mining and Staking:

Mining and staking are popular methods for earning cryptocurrency, but they also have tax implications. Investors involved in mining or staking crypto may be required to report their earnings as income and pay taxes accordingly. Overlooking the tax implications of these activities can result in higher tax liabilities.

Conclusion

Cryptocurrency is still not a recognized form of payment. Vakilsearch experts advise you to act sensibly and disclose your cryptocurrency income. We encourage you to get in touch with us since we have a seasoned tax planner(Avoid Tax on Cryptocurrency) versed in Bitcoin and tax laws who can assist you in making the best choices and moving forward.

FAQs

How do I save 30% tax on crypto?

Saving 30% tax on crypto can be achieved through long-term capital gains. If you hold your cryptocurrencies for more than two years, you may qualify for the long-term capital gains tax rate, which is generally lower than the short-term capital gains tax rate. Consult with a tax professional to explore specific strategies for your situation.

How do you avoid TDS in crypto?

To avoid TDS (Tax Deducted at Source) on crypto transactions, you can consider opting for the 'no TDS deduction' option when withdrawing funds from crypto exchanges. Additionally, you should maintain proper documentation and accurately report your transactions to comply with tax regulations.

How can I buy crypto in India without tax?

Buying crypto in India may attract taxes like GST and capital gains tax. However, you can minimize the tax burden through strategies like long-term investments, claiming deductions, and ensuring accurate tax reporting. Consult with a tax advisor for personalized advice.

Will India reduce crypto tax?

Tax policies are subject to change based on government regulations and policies. As of now, there is no specific information about a reduction in crypto taxes in India. Stay updated with official announcements and news for any changes in tax rates related to cryptocurrencies in India.