The scheme aims to provide social security and support for elderly individuals working in the informal sector. Join Pradhan Mantri Shram Yogi Mandhan Yojana for pension benefits for unorganised workers.

Introduction:

The Pradhan Mantri Shram Yogi Mandhan Yojana is a scheme for the unorganized sector workers with an assurance of minimum pension of ₹3000 per month on attaining the age of 60 years. Under this scheme, the unorganized sector workers would get a monthly pension of ₹3000 from the age of 60 years. The scheme would provide social security to about 10 crore labourer’s in the unorganized sector and ensure their financial security in old age.

The scheme is open to all Indian citizens in the unorganized sector who are between 18 and 40 years of age, and who earn less than ₹15,000 per month. To join the scheme, participants must contribute a minimum of ₹55 per month for 20 years. The government will also contribute an equal amount to each participant’s account. After 20 years, participants will receive a minimum pension of ₹3,000 per month.

The scheme will be implemented through a dedicated Pension Fund for Unorganised Sector Workers, which will be managed by the relevant insurance providers. All contributions under the scheme will be invested in government securities and other approved instruments. Withdrawals from the fund will be allowed after completion of 10 years from joining the scheme or after attaining the age of 60 years, whichever is later.

Pradhan Mantri Shram Yogi Mandhan Yojana Details

| Scheme Name | Pradhan Mantri Shram Yogi Mandhan Yojana |

| Launched By | Finance Minister Mr. Piyush Goyal |

| Launch date | February 1st |

| Start date of scheme | 15th February |

| Beneficiary | Unrecognized sector workers |

| No of beneficiary | 10 Crore approx |

| Contribution | ₹ 55 per month to ₹ 200 per month |

| Pension Amount | ₹ 3000 per month |

| Categories | Central Govt Scheme |

| Official website | https://maandhan.in/shramyogi |

Some Important Information Related to Pradhan Mantri Shram Yogi Maandhan Yojana

Eligibility Criteria:

- Unorganised sector employees aged 18 to 40 are eligible to apply for the scheme.

- Applicants must earn a maximum monthly salary of ₹15,000.

Exclusion from Pension Schemes: Applicants should not already be availing benefits from any existing pension scheme.

Pension Provision:

- Beneficiaries will receive a pension of ₹3,000 through the scheme.

- The pension amount is contingent upon the beneficiary’s contributions.

Age-based Investment:

- Beneficiaries need to invest in the scheme between the ages of 18 to 40.

- Pension payments commence upon reaching 60 years of age.

Taxpayer Ineligibility: Individuals paying taxes are ineligible for scheme benefits.

Flexible Investment Options: Beneficiaries can invest monthly, quarterly, semi-annually, or yearly.

Pension Disbursement upon Beneficiary’s Death:

- In case of the beneficiary’s demise, 50% of the pension amount will be given to their family.

- The nominee will receive this amount.

No Educational Requirement: There’s no need for a specific educational qualification to avail the scheme’s benefits.

How Does the PM SYM Yojana Work?

The scheme aims to provide social security and support for elderly individuals working in the informal sector, often engaged in various occupations such as rickshaw pullers, street vendors, mid-day meal workers, head loaders, brick kiln workers, cobblers, rag pickers, domestic workers, washermen, home-based workers, own account workers, agricultural workers, construction workers, beedi workers, handloom workers, leather workers, audio-visual workers, and similar roles. The estimated number of such unorganised workers in the country is around 42 crore.

To be eligible for this scheme, individuals must meet the following criteria:

- Be categorised as unorganised workers (UW).

- Have an entry age between 18 and 40 years.

- Have a monthly income of ₹15,000 or less.

- Not be engaged in the organised sector, which means they should not be members of the Employees’ Provident Fund (EPF), National Pension System (NPS), or the Employees’ State Insurance Corporation (ESIC).

- Not be an income taxpayer.

- Possess an Aadhar card.

- Have a Savings Bank Account or Jan Dhan account with an associated IFSC code.

Pradhan Mantri Shram Yogi Maandhan (PM SYM) – Features

Voluntary and Contributory: This pension scheme is voluntary, meaning individuals have the choice to participate. It is not mandatory. Subscribers choose to contribute to the scheme to secure their financial future during their retirement years.

Minimum Assured Pension: Upon reaching the age of 60, subscribers of the scheme are guaranteed a minimum pension of ₹ 3,000 per month. This minimum assured pension ensures a basic level of financial support to help them meet their day-to-day expenses and maintain a reasonable standard of living during their retirement.

Survivor Benefits: In the unfortunate event of the subscriber’s demise, their spouse, if they have one, becomes eligible for benefits. Specifically, the spouse is entitled to receive 50% of the pension as a family pension. This provision is designed to provide ongoing financial support to the surviving spouse after the subscriber’s passing.

Applicability to Spouse: It’s important to note that the family pension is applicable only to the spouse of the beneficiary. This means that if the subscriber passes away, the spouse will receive the pension benefits. This feature helps ensure that the financial well-being of the family, especially the surviving spouse, is taken into consideration and supported by the scheme.

Voluntary and Contributory: This pension scheme is voluntary, meaning individuals have the choice to participate. It is not mandatory. Subscribers choose to contribute to the scheme to secure their financial future during their retirement years.

Minimum Assured Pension: Upon reaching the age of 60, subscribers of the scheme are guaranteed a minimum pension of ₹3,000 per month. This minimum assured pension ensures a basic level of financial support to help them meet their day-to-day expenses and maintain a reasonable standard of living during their retirement.

Survivor Benefits: In the unfortunate event of the subscriber’s demise, their spouse, if they have one, becomes eligible for benefits. Specifically, the spouse is entitled to receive 50% of the pension as a family pension. This provision is designed to provide ongoing financial support to the surviving spouse after the subscriber’s passing.

Applicability to Spouse: It’s important to note that the family pension is applicable only to the spouse of the beneficiary. This means that if the subscriber passes away, the spouse will receive the pension benefits. This feature helps ensure that the financial well-being of the family, especially the surviving spouse, is taken into consideration and supported by the scheme.

Benefits of Shram Yogi Mandhan Yojana Withdrawal

Early Withdrawal:

- Within 10 years: Refund of contribution with interest at savings bank rate.

- After 10 years but before 60: Refund of contribution with accumulated interest.

Continuation After Death: If beneficiary contributes regularly and passes away, spouse can continue by paying contributions.

Post-Subscriber’s Death: Fund credited back after subscriber’s and spouse’s death.

Main Facts of Pradhan Mantri Shram Yogi Mandhan Yojana 2024

- Nodal Agency: LIC oversees scheme implementation.

- Premium and Pension: Beneficiary deposits premium, receives pension via LIC.

- Direct Transfer: Monthly pension sent directly to beneficiary’s bank account.

- Information Access: Contact LIC offices or visit website for details.

- Enrollment Statistics: Over 64.5 lakh registrations by May 6.

Benefits of Pradhanmantri Shram Yogi Mandhan Yojana

- Unorganised Sector Workers: Tailors, laborers, domestic workers, etc.

- Monthly Pension: ₹ 3000 after age 60.

- Equal Contribution: Government matches individual contributions.

- Spouse Benefit: After death, spouse receives half pension for life.

- Direct Transfers: ₹ 3000 auto-debited to beneficiaries’ accounts.

Beneficiaries of Pradhan Mantri Shram Yogi Maandhan Yojana

- small and marginal farmers

- landless agricultural laborer

- fishermen

- animal keeper

- labelers and packers in brick kilns and stone quarries

- construction and infrastructure workers

- leather craftsman

- weaver

- sweeper

- domestic workers

- vegetable and fruit seller

- migrant laborers etc.

Exit and Petrol under Pradhan Mantri Shram Yogi Mandhan Yojana

- Early Exit: Before 10 years, contribution refunded at savings bank rate.

- Post-Death: Spouse can continue after subscriber’s death.

- 10 Years or More but Pre-60 Exit: Get contribution with higher of accumulated interest or savings bank rate.

- Early Retirement: Spouse can continue if subscriber retires before 60.

- Further exit provisions determined by Government on NSSB advice.

Eligibility of PM Shram Yogi Mandhan Yojana

- Unorganised sector worker with monthly income < Rs. 15000.

- Age 18 to 40.

- Not an income tax payer.

- Not covered by EPFO, NPS, or ESIC.

- Possess Aadhaar, mobile phone, and savings bank account.

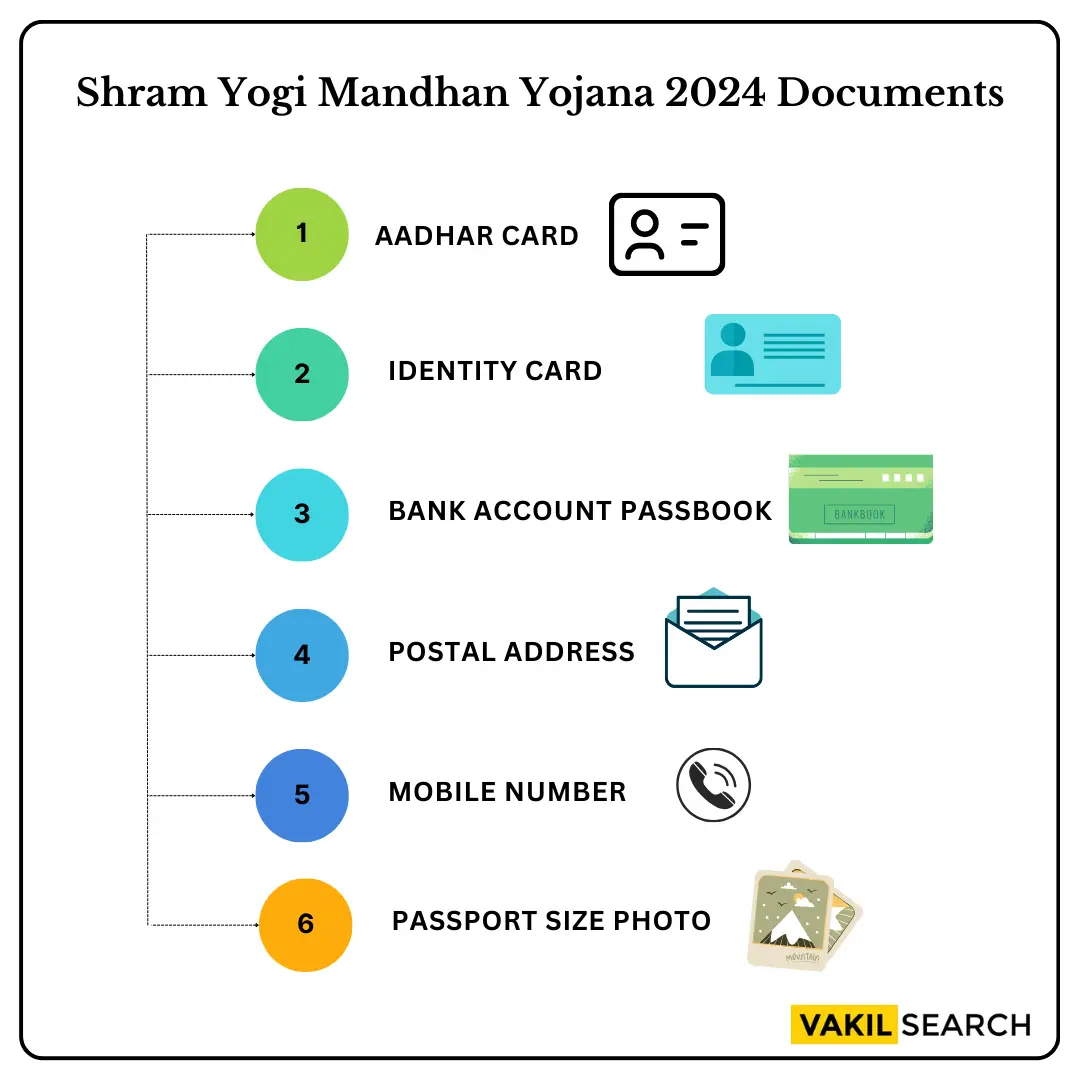

Shram Yogi Mandhan Yojana 2024 Documents

- Aadhar card

- identity card

- bank account passbook

- Postal address

- mobile number

- passport size photo

How to Apply for Pradhan Mantri Shram Yogi Maandhan Yojana ?

- If beneficiaries are interested in applying for the Shram Yogi Mandhan Yojana, the initial step involves visiting the nearest public service center. All essential documents like Aadhar Card, Bank Passbook, Mobile Number, etc., need to be carried along.

- Upon reaching the center, the applicant is required to submit these documents to the CSC officer. The CSC Agent will then assist in filling out the form and provide a printed copy of the Application Form.

- Ensure to retain a printed copy of the application form for reference. This completes the application process for the PMSYM Scheme.

Pradhan Mantri Shram Yogi Mandhan Yojana Self Enrollment

- Begin by visiting the official website of Shram Yogi Mandhan Yojana.

- The homepage will appear, where you’ll find the “Click Here To Apply Now” link.

- Click on the mentioned link, leading you to another page.

- Locate the “Self Enrollment” option on this page and click it.

- Enter your mobile number and click “Proceed.”

- Fill in your name, email, and captcha, then click “Generate OTP.”

- Verify the OTP and proceed to complete the application form.

- Upload necessary documents in JPEG format, review, and submit the form.

- Print and save the submitted application.

Pradhan Mantri Shram Yogi Mandhan Yojana through CSC VLE

- Visit the official website.

- Click “Click Here to Apply Now” and then select “CSC VLE.”

- Enter your Username and Password on the subsequent page.

- Sign in and navigate to “Schemes,” then choose “Shram Yogi Mandhan Yojana.”

- Fill in required information in the application form.

- Upload essential documents.

- Click “Submit” to complete the application.

Sign in Process

- Visit the official website.

- Click “Sign In” on the homepage.

- Choose the relevant option based on your need.

- Provide your Username, Password, and Captcha.

- Click “Sign In” to access your account.

Process to donate PM Shram Yogi Mandhan Yojana pension

- Visit the official website.

- Click “Donate a Pension” on the homepage.

- Select “Self Login” or “CSC VLE.”

- Login and choose “Donate Pension.”

- Enter payment details and proceed to make payment.

Contact Us – Pradhan Mantri Shram Yogi Mandhan Yojana

Why Vakilsearch

Vakilsearch is the best choice to know about this scheme because:

- We provide comprehensive and up-to-date information about the scheme.

- Our team of business consulting expertscan help you understand the scheme and its benefits in detail.

- We can help you compare different schemes and choose the one that best suits your needs.

FAQs

What is Pradhan Mantri Shram Yogi Mandhan Yojana?

Pradhan Mantri Shram Yogi Mandhan Yojana (PM-SYM) is a voluntary and contributory pension scheme for unorganised workers announced by the Government of India. The scheme aims to provide social security cover to around 42 crore unorganised workers in the country who do not have any formal pension provision.

Who is eligible for Pradhan Mantri Shram Yogi Mandhan Yojana?

All unorganised workers who are between 18 and 40 years of age and have a monthly income of up to ₹ 15,000 are eligible for PM-SYM. This includes daily wage earners, agricultural workers, construction workers, beedi rollers, handloom weavers, home-based workers, leather workers, etc.

How does Pradhan Mantri Shram Yogi Mandhan Yojana work?

Contributions from both the worker and the government will be deposited in a pension account every month. Upon reaching the age of 60, the worker will receive a minimum monthly pension of ₹ 3,000 from the government. The amount of contribution and the resulting monthly pension will depend on the age of entry into the scheme. For example, someone who joins PM-SYM at the age of 25 will have to contribute only ₹ 55.

What is the Pradhan Mantri Shram Yogi Maan-dhan (PMSYM) scheme, and what is its objective?

The Pradhan Mantri Shram Yogi Maan-Dhan is a choice-based pension plan. Its goal is to offer financial safety to people who work informally and those who are elderly. This plan aims to help approximately 42 crore workers in India's unorganised sector.

Who is eligible to enrol in the PMSYM scheme, and what are the criteria for eligibility?

The Pradhan Mantri Shram Yogi Maandhan is a pension scheme for unorganised workers between the ages of 18 and 40 who earn a monthly income of ₹115,000 or lower. It's a choice you can make to save for your retirement if you work in the unorganised sector.

What is the process for applying to the PMSYM scheme, and where can I apply?

Unorganised workers can go to the nearest CSC (Common Service Center). They can register for the Scheme there. They need to pay the first month's contribution in cash, and they will receive a receipt for it.

What is the monthly contribution amount required to benefit from the PMSYM scheme?

Individuals aged 18 to 40 years who apply for this scheme will need to regularly contribute a monthly amount, which can vary from ₹55 to ₹200 until they reach the age of 60.

How is the monthly pension calculated under PMSYM, and what factors influence the pension amount?

This is a pension program where people choose to participate and contribute. When they turn 60, they are guaranteed a monthly pension of at least ₹3,000.

Can existing pensioners or individuals with other pensions also join the PMSYM scheme?

Workers must have jobs in the unorganised sector. Their monthly income should not exceed ₹15,000. They should be between 18 and 40 years old. They should not already be part of the New Pension Scheme (NPS), Employees’ State Insurance Corporation (ESIC) scheme, or Employees’ Provident Fund Organisation (EPFO). They should not be paying income tax. In summary, if you already receive a pension or are part of other pension schemes like NPS, ESIC, or EPFO, you can't participate in the PM-SYM scheme.

What documents are needed to apply for the PMSYM scheme, and how do I prove my eligibility?

Unorganised workers can go to their nearest CSC (Common Service Center) with their Aadhaar Card and either a Savings Bank account passbook or a Jandhan account. They can then sign up for the scheme. For the first month, they need to pay the contribution amount in cash and will receive a receipt for it.

Is there an age limit for enrolling in the PMSYM scheme, and does it vary for different categories of workers?

When someone becomes part of the scheme between the ages of 18 and 40, they need to keep contributing until they turn 60. Once they reach 60, they will receive a guaranteed monthly pension of ₹3,000, and if applicable, their family may also receive pension benefits.