A first-of-its-kind web portal called Jansamarth portal connects lenders and beneficiaries directly. Four loan categories and thirteen central government programmes offer loans to citizens. Citizens can check their eligibility, apply online, and receive digital approval using the one-stop platform.

- The Jansamarth portal was introduced by the Indian government as a one-stop online resource that connects qualified recipients with loans and subsidies provided by government programmes. It is a national digital site where capable citizens can apply for government programmes with a credit component. It’s a distinctive digital platform with several government programmes that all relevant parties and recipients can easily access.

- The Jansamarth portal’s main goal is to expand various industries and promote inclusive growth by giving them access to the appropriate government incentives via straightforward digital procedures. The portal guarantees complete coverage of all credit-related government programmes. This one-stop online resource contains four loan types and 13 government credit initiatives on one platform.

- The Jansamarth Portal platform enables easy communication between lenders and recipients. The key benefit of the portal is the short application process, which enables a beneficiary to quickly check their eligibility and eligibility requirements, upload necessary documents, and complete the business loan application. This platform will make digital verifications, simplifying the financing procedure.

What Is Jan Samarth Portal?

- This article summarizes the Jan Samarth Portal, which is a one-stop-shop for all government credit-related efforts. The portal was created by the Ministry of Finance to link various government schemes and help beneficiaries find the best loan options. – The Jansamarth Portal is a one stop shop for all government credit related efforts, including subsidies, loans, and livelihood development. It is a digital platform that connects eligible beneficiaries with various ministries and nodal agencies, providing them with access to government credit and schemes. The portal also provides access to education and infrastructure resources. With the approval of various ministries, the portal has come up as a digital platform linking government agencies and lenders.

- Jansamarth Portal is a one stop gateway to access government credit and finance through thirteen credit linked, twelve central government and four other loan categories. It is a unique online resource which contains four loan categories, namely education loans, MSME loans, small business loan and general purpose loan. This digital portal offers single platform access to government schemes for the beneficiaries related stakeholders.

- Jansamarth is a platform called Jansamarth, it is a nationwide portal which gives the beneficiaries access to 13 credit schemes initiated by Indian Government. The platform offers recommendation system that helps the beneficiaries in determining their eligibility for subsidy and credit-linked government initiatives. Technologies like analytics, artificial intelligence and machine learning are used to recommend best suited schemes based on beneficiary’s requirements. Prime Minister Narendra Modi launched this platform in order to help the citizens of India access information about all the 13 credit schemes in one place.

What is Jansamarth Gateway?

A platform called JanSamarth is available to anyone looking for loans under one of India’s 13 credit schemes. The Pradhan Mantri credit-linked subsidy scheme was used to launch it. Applying online and receiving approval digitally allows beneficiaries to quickly and easily determine their eligibility.

Objective of Jansamarth Portal

The Jan Samarth portal, launched by the central government, serves as a comprehensive digital platform with the primary aim of providing citizens with easy access to various government credit-linked programs. This online portal acts as a centralized hub, encompassing all 13 credit-linked programs offered by the government. By consolidating these programs on a single platform, beneficiaries can obtain information and avail benefits without the need to visit multiple portals. This streamlined approach not only saves time and money for beneficiaries but also enhances transparency within the system.

What is the operation of the Jan Samarth portal?

To encourage inclusive development and ease of doing business, the platform brings together different players in the financial ecosystem, including applicants, Central Government Agencies, State Governments, Lenders, and Implementing Nodal Agencies like NABARD, SIDBI, etc., on a single platform.

Salient Features of the Jansamarth Portal

The following are the key characteristics of the “Jansamarth” Portal:

- It links all parties on a single platform, including beneficiaries, financial institutions, federal and state government agencies, and nodal agencies

- The portal ensures end-to-end coverage of all the linked schemes’ processes and activities

- Applicants can initially access 13 credit-linked government programmes for youth, students, entrepreneurs, and farmers, including Education Loans, Agriculture Loans, Business Activity Loans, and Livelihood Loans

- The Portal uses cutting-edge technology and clever analytics to offer benefactors clear assistance for determining subsidy eligibility. An auto-recommendation system suggests the best possible schemes per the benefactor’s qualifications and needs

- Modern technologies use digital verifications to automate the lending process, making it quick, easy, and hassle-free.

In addition to English, it is available in around six other Indian languages.

Loans Available on Jansamarth Portal

Four different loan categories relating to significant Central Government-sponsored programs can be found on the Jan Samarth webpage.

Types of loans Avail on Jansamarth Portal

- Education Loan – This loan category includes programmes that offer loans to recipients for pursuing studies in and outside of India, pursuing courses that are eligible up to and including a Ph.D., and focuses on students from economically disadvantaged parts of society

- Developmental Loans – This is for developing agricultural clinics, infrastructures, and business centres, and the mobilisation of funds for agricultural consultancy and post-harvest management is available under this category

- Company Activity Loan – This classification plan offers loans for starting and growing enterprises and provides rewards based on social category, gender, and business type

- Loan for a Livelihood – This category of government programmes offers loans to individuals and Self-Help Groups (SHGs) to help the poor in rural and urban areas find sustainable means of subsistence

- Each loan category is connected to several government programmes where eligible beneficiaries can apply for loans. The list below includes the government programmes listed under each loan category on the Jan Samarth portal.

Programmes Fall Under Education Loans:

- The Central Sector Interest Subsidy (CSIS) programme

- The Padho Pardesh plan

- The Central Sector Plan of Dr. Ambedkar.

Programmes Fall Under the Agri Infrastructure Category:

- The Agri Clinics and Agri-Business Centers (ACABC) plan is one of the programmes included in the Agri infrastructure category

- The Agriculture Infrastructure Fund (AIF) programme and the Agri Marketing Infrastructure (AMI) programme.

Programmes Fall Under the Business Activity Category:

- Prime Minister’s Employment Generation Programme (PMEGP)

- The Pradhan Mantri Mudra Yojna (PMMY)

- The PM SVANidhi (Street Vendor Aatmanirbhar Nidhi) programme

- The Standup India programme

- Mudra Weaver Scheme (WMS)

- Self Employment Scheme for Manual Scavengers’ Rehabilitation (SRMS).

Programmes Fall under Livelihood Loans:

- Deendayal Antyodaya Yojana-National Rural Livelihoods Mission (DAY-NRLM).

Eligibility for Applying on Jan Samarth Portal

On the Jansamarth portal, anyone can submit a loan application. Anyone interested in applying for a loan should determine whether they qualify under the specified loan category. If the applicant is qualified, they may submit an online loan application.

By selecting the loan type from the drop-down list and clicking on the appropriate government scheme, one can determine eligibility by clicking the “Schemes” option on the Jansamarth portal’s home page. On the screen will be information regarding eligibility for government programmes.

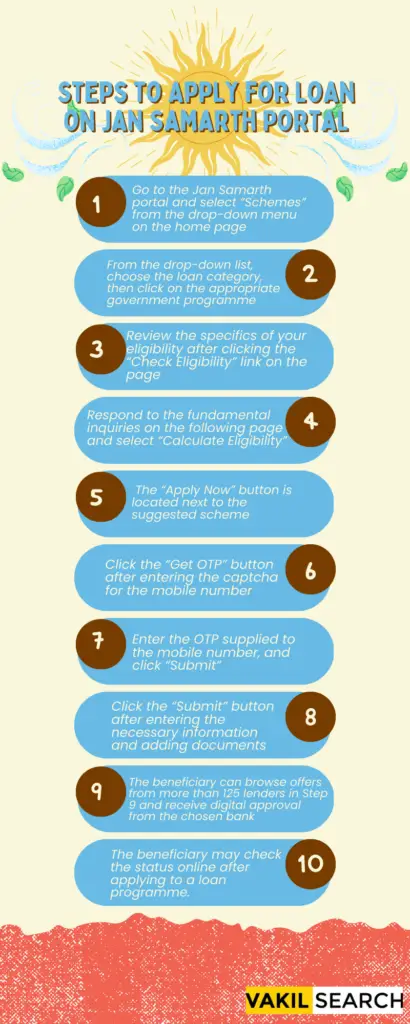

Steps to Apply for Loan on Jansamarth Portal

The following are the processes to apply for a loan online through the Jansamarth portal:

- Step 1: Go to the Jansamarth portal and select “Schemes” from the drop-down menu on the home page

- Step 2: From the drop-down list, choose the loan category, then click on the appropriate government programme

- Step 3: Review the specifics of your eligibility after clicking the “Check Eligibility” link on the page

- Step 4: Respond to the fundamental inquiries on the following page and select “Calculate Eligibility”

- Step 5: A suitable scheme will be recommended based on the beneficiary’s responses to the questions. The “Apply Now” button is located next to the suggested scheme

- Step 6: The registration page will launch in step six. Click the “Get OTP” button after entering the captcha for the mobile number

- Step 7: Enter the OTP supplied to the mobile number, and click “Submit”

- Step 8: The registration form will show up in step eight. Click the “Submit” button after entering the necessary information and adding documents

- Step 9: The beneficiary can browse offers from more than 125 lenders in Step 9 and receive digital approval from the chosen bank

- Step 10: The beneficiary may check the status online after applying to a loan programme.

Procedure to Register on Jansamarth Portal

To register on the Jansamarth Portal initiated by the Government of India, individuals interested in signing up must adhere to the following guidelines:

- Visit the official website of the Jansamarth Portal. The homepage of the website will be displayed on your screen.

- On the homepage, locate and click on the ‘Register’ option. This will redirect you to a new page.

- On the new page, provide your mobile number and enter the captcha code details. Afterward, click on the ‘Get OTP’ option.

- A One-Time Password (OTP) will be sent to your mobile number. Enter the received OTP in the designated OTP box. Then, click on the ‘Submit’ option.

- Following the OTP verification, a registration form will appear on your screen. Fill in all the necessary information as requested in the registration form.

- Next, upload all the required documents as specified. Once the documents are uploaded, click on the ‘Submit’ option.

Login Procedure on Jansamarth Portal

- Start by visiting the official website of the Jansamarth Portal. As you land on the website, the home page will be displayed on your screen.

- On the homepage, locate and click on the ‘Login’ option. This action will lead you to a new page specifically designed for login purposes.

- On the login page, provide your mobile number or email ID, whichever is applicable, in the designated field. Additionally, enter the captcha code as shown on the screen.

- After entering the required information, click on the ‘Login’ option. By doing so, you will be able to access the portal and log in to your account.

The Process to Check Application Status on Jansamarth Portal

Following the steps below, the beneficiary or applicant can monitor the progress of their loan application after applying for a loan programme on the Jan Samarth portal:

- Go to the portal for Jan Samarth

- Press the “Login” button

- Click the “Login” button after entering the captcha code, email address, and mobile number

- On the dashboard, select the ‘My Applications’ tab

- To check the status of the application, use your registration credentials.

Documents Required for Applying on Jansamarth Portal

The applicant must submit the following paperwork to apply for a loan through a government programme on the Jan Samarth portal:

- Aadhar number

- Voter ID

- PAN card

- Official bank records.

Loan Schemes Available on Jansamarth Portal

The Jansamarth portal offers four loan categories that are associated with major Central Government-sponsored schemes. These categories include:

- Education loan: This category focuses on providing loans to economically weaker sections of society for pursuing studies in India and abroad. Eligible courses range from graduation to PhD.

- Agri infrastructure loan: This category offers loan schemes for the development of agricultural clinics, infrastructure, business centers, and financial support for agricultural consulting and post-harvest management.

- Business activity loan: This category provides loans for starting and expanding businesses, with benefits based on social category, gender, and the type of business.

- Livelihood loan: Under this category, the government schemes provide loans to Self-Help Groups (SHGs) and individuals, aiming to promote livelihood opportunities for the rural and urban poor.

Each loan category is linked to various government schemes, through which eligible beneficiaries can apply for loans.

Here are the government schemes under each loan category on the Jansamarth portal:

1. Education loan category schemes:

- Central Sector Interest Subsidy (CSIS) scheme.

- Padho Pardesh scheme.

- Dr Ambedkar Central Sector scheme.

2. Agri infrastructure category schemes:

- Agri Clinics and Agri-Business Centres (ACABC) scheme.

- Agri Marketing Infrastructure (AMI) scheme.

- Agriculture Infrastructure Fund (AIF) scheme.

3. Business activity category schemes:

- Prime Minister’s Employment Generation Programme (PMEGP).

- Pradhan Mantri Mudra Yojna (PMMY).

- Pradhan Mantri Street Vendor Aatmanirbhar Nidhi (PM SVANidhi) scheme.

- Standup India scheme.

- Weaver Mudra Scheme (WMS).

- Self Employment Scheme for Rehabilitation of Manual Scavengers (SRMS).

4. Livelihood loan category schemes:

- Deendayal Antyodaya Yojana-National Rural Livelihoods Mission (DAY-NRLM).

Conclusion

The Pradhan Mantri credit-linked subsidy scheme was used to launch this Jansamarth Portal. Applying online and receiving approval digitally allows beneficiaries to quickly and easily determine their eligibility. The documents required to apply online through the portal: Aadhaar Number, Voter Id, PAN, Bank Statements, and other fundamental papers. Additionally, the candidate must fill out some basic information on the site. myscheme is a marketplace for government programmes and services. You can search for available government programmes using myScheme, determine your eligibility, and apply. On International Women’s Day in 2022, Shri Narayan Rane introduces the “SAMARTH” Special Entrepreneurship Promotion Drive for Women. Vakilsearch also provides in-depth knowledge and assistance regarding this JanSmarth portal. If you need any further help or information regarding the same, get in touch with us today.