PF registration for contractors and employees is easy if you know what is required and where to register. This article guides you on how to register for PF.

There is no country or place where you may do business the way you please. Different jurisdictions have varying guidelines and laws for contractors and organisations to follow while they carry out their operations. In the case of India, it is mandatory for all contractors who employ 20 or more employees to register with the employee provident fund (EPF) scheme. PF registration is for contractors and any organisation with 20 or more employees. However, organisations with few workers (under 20) are allowed to be fund members voluntarily.

EPFO, as it is popularly known, is a statutory body under the ministry of labour and employment of the government of India. EPFO came into effect after the 1951 providence funds ordinance. In 1952, the Employees’ provident funds Act was enacted, and it superseded the employees’ provident funds ordinance.

What is PF?

It is the dream of every hardworking man or woman to retire and never have to worry about how to get money to pay critical bills. Although people generally save for retirement, low-income earners struggle because they only have enough to cater for basic needs.

To secure the financial future of less privileged citizens, the government of India created mandatory provident funds for employees. When employed by a company or nonprofit organisation, you start making monthly contributions to the provident fund. Since it is mandatory, it gets automatically deducted from your remuneration by the employer.

Employees must remit 12% of their monthly wages to the provident fund. Employers are also required to match the same—however, entities who employ under 20 employees pay only10%. The same applies to companies that are proven to be in financial distress, and Companies from specific industries are also allowed to pay only 10% of the employees’ wages.

When an employee contributing to the Provident fund retires, they receive a lump sum of what they contributed over many years plus some interest.

Who is Eligible to Register with the Fund?

Any employee in India who earns under 15,000 INR must register with the fund. It is mandatory for such employees. Their contributions are automatically deducted from their wages and remitted to the fund monthly.

People who earn over 15,000 INR per month can register if they wish. However, they must get approvals from the assistant commissioner of the provident fund and their respective employers.

An employee who earns over 15,000 INR monthly must file Form 11 with the Employees’ provident fund organisation (EPFO) to opt out of the scheme.

What Are the Eligibility Criteria for Contractors to Register for PF?

Although contributions to the provident fund are mandatory, some companies or organisations are exempted.

By law, contractors who employ 20 or more people are required for PF registration with EPFO. If you fail to do so, you risk getting penalised by relevant government authorities. Contractors who employ less than 20 people have the option to register voluntarily.

What Are the Benefits of PF for Contractors and Employees?

Employees can now retire in peace. You can retire at just the right time when you have enough money. There are many old and tired people who continue working because they have no other way to get money to pay bills. Employee contributions to the provident fund accrue interests over time. It is one of the best ways for employees to save money for their future. There are provisions for early withdrawal of the provident fund contributions. It can be helpful in case of emergencies like sudden hospitalisation, accidents, or loss of jobs.

If a contributor to the fund dies, their lump sum is paid to legal heirs, next of kin, or court nominee. As of this article’s writing, the income under the provident fund is tax-free. Contractors have the opportunity to contribute towards the retirement benefits of their employees. It is one of the best ways to thank employees for their work for your company. Since it is a government requirement, contractors who register fulfil or comply with established laws. There are penalties for eligible contractors who fail to do so.

What are the Requirements for PF registration?

Any contractor who wants to register for the employees’ provident fund must provide specific requirements, including:

Use Vakilsearch`s EPF calculator to determine out how a whole lot cash might be gathered to your EPF account whilst you retire.

- The contractor is required to provide PAN (permanent Account Number). It is a ten-digit number used to identify taxpayers by the Income Tax department of India. Every registered taxpayer is presented with a laminated plastic card containing these numbers. You’ll also be asked to provide working telephone numbers. Since registration is done online, the contractor should have an email address.

- Contractors are also asked to provide details of the trading license. In most jurisdictions, you cannot do business as a contractor without a trading license. After filling in your details, you must sign the form. Your digital signature will be the final requirement before submitting the form. Some of the documents required for Employees’ provident fund registration

- Contractors are required to attach a copy of their PAN card.

- You must also provide your address and attach proof that it is yours. The proof must be issued by government authorities, such as postpaid company telephone bills.

- Contractors may be required to present a copy of the lease or rental agreement where applicable.

What are the Steps for PF Registration?

- The employee provident fund organisation (EPFO) registration process is simple. You can submit all forms online without sending documents back and forth.

- The government of India decided to shift the entire registration process online.

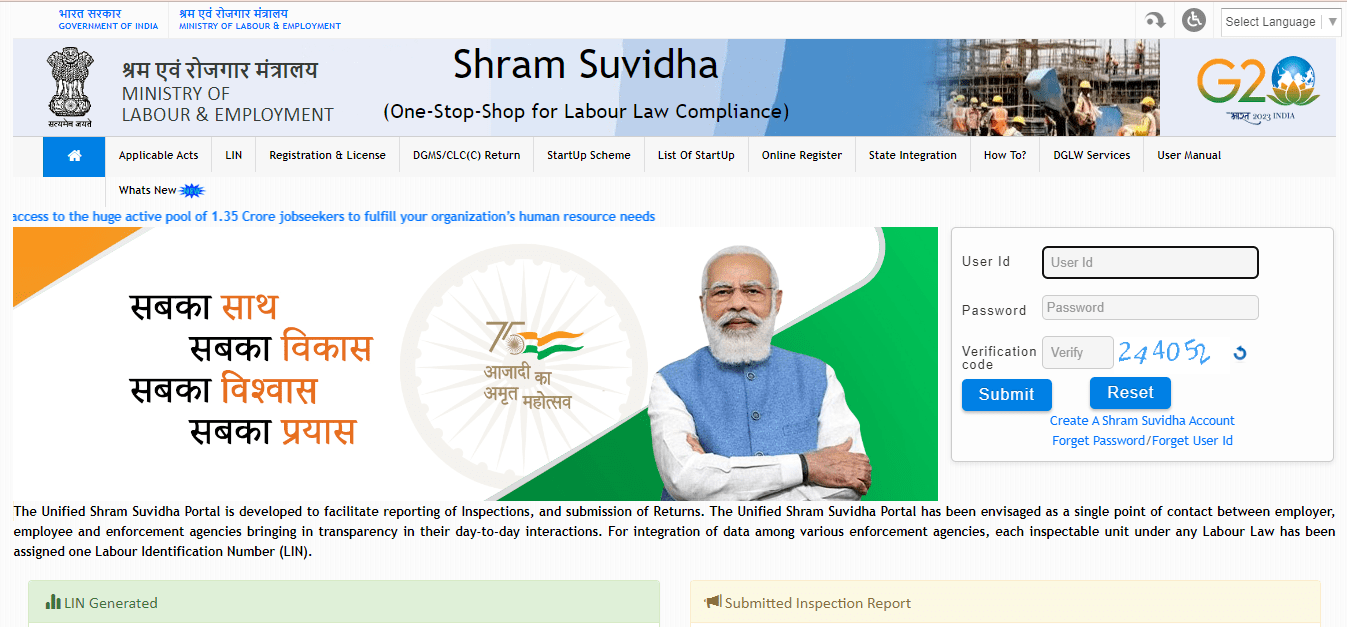

- The Shram Suvidha portal was launched to facilitate online registration for EPF. To register, log onto the registration portal- https://shramsuvidha.gov.in/home.

- You’ll be prompted to sign up or log in with your user ID and password when you get there. If it is your first time on the website, you’ll be required to sign up and create a user ID and password.

- Once you are signed in, click the registration button and wait for the page to load.

- Fill in required details like name, phone number etc. You’ll also be required to upload essential business documents.

- The final step is to provide your digital signature.-the good news is that contractors are not charged any fees to register with the employees’ provident fund organisation.

Conclusion

The employees’ provident fund was set up to help people who earn less than ₹15,000 monthly income to save for retirement. The government requires all contractors to register with the scheme and pay necessary contributions. If you are a contractor looking for how to register for pf, get all answers at Vakilsearch.

Read More: