AD code, also known as Authorised Dealer code, is a unique identification number assigned to Indian exporters by their banks. It is used for carrying out foreign exchange transactions. In this blog, we will discuss the importance of AD codes for exporters, the process of finding AD code of a bank, and how to apply for it. We will also cover the registration of promo codes with customs and the documents required for uploading.

An Authorised Dealer (AD) Code, also known as the bank AD code, is a 14-digit number issued by a bank authorised by the Reserve Bank of India (RBI) to deal in foreign exchange. This code is crucial for businesses involved in import and export activities, as it is required for various compliance and regulatory processes, including the filing of shipping bills with customs authorities.

The bank AD code is linked to the Export Data Processing and Monitoring System (EDPMS) and the Import Data Processing and Monitoring System (IDPMS), which track the receipt and utilisation of foreign exchange. Having an AD Code ensures that the export earnings are routed through the banking system, thereby providing a transparent mechanism for monitoring foreign exchange transactions.

bank AD code are required by exporters seeking to conduct foreign exchange transactions. These codes are utilised for reporting and overseeing foreign exchange activities to the Reserve Bank of India (RBI). Lack of an AD code prevents exporters from receiving payments in foreign currency or repatriation of export proceeds. Exporters can obtain their bank’s AD code by contacting their bank and submitting the required documentation. It is crucial to accurately include the AD code in all export-related paperwork.

AD Codes for Exporters

AD codes for banks are mandatory for exporters who want to carry out foreign exchange transactions. It is used to report and monitor foreign exchange transactions to the Reserve Bank of India (RBI). Without an AD code, exporters cannot receive payments in foreign currency or repatriate the proceeds of exports.

How to Find the AD Code for a Bank?

To find the bank AD code, exporters can approach their bank and request the same. The bank will provide the AD code along with the necessary documents. It is essential to ensure that the AD code for a bank is mentioned correctly in all export-related documents.

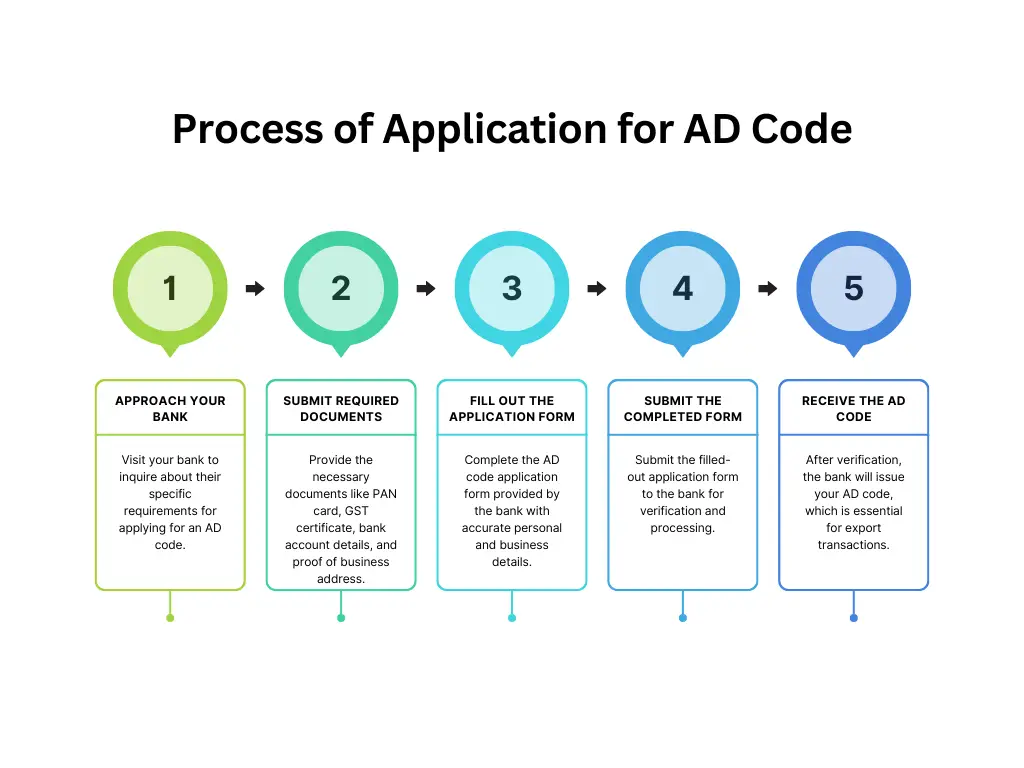

Process of Application For AD Code

To apply for an AD code, exporters must approach their bank and submit the necessary documents. The documents required may vary depending on the bank but typically include a PAN card, GST registration certificate, bank account details, and proof of business address.

Applying for an bank AD code, also known as an Authorized Dealer code, is a straightforward process. It is essential for Indian exporters who wish to carry out foreign exchange transactions. In this section, we will discuss the step-by-step process of applying for an AD code.

-

Step 1: Approach your Bank

To apply for an bank AD code, the first step is to approach your bank. Different banks have different requirements, and it is best to check with your bank for their specific requirements.

-

Step 2: Submit the Necessary Documents

The documents required for bank AD code application may vary depending on the bank. However, some of the documents that are commonly required include:

-

- PAN Card: A copy of the Permanent Account Number (PAN) card of the exporter.

- GST Registration Certificate: A copy of the Goods and Services Tax (GST) registration certificate.

- Bank Account Details: Details of the exporter’s bank account.

- Proof of Business Address: A copy of any official document such as a telephone bill, electricity bill, or rent agreement, which shows the business address.

-

Step 3: Fill Out the Bank AD Code Application Form

After submitting the necessary documents, the bank will provide an AD code application form. The exporter needs to fill in the form with accurate details such as the name of the applicant, the address of the applicant, the name of the bank, the branch of the bank, and other relevant details.

-

Step 4: Submit the Completed Application Form

Once the form is filled in accurately, the exporter must submit the completed application form to the bank. The bank will verify the details and process the application.

-

Step 5: Receive the AD Code

After the bank verifies the details and processes the application, they will provide the bank AD code to the exporter. It is essential to ensure that the AD code is mentioned correctly in all export-related documents.

Registration of Promo Code with Customs

To register a promo code with customs, exporters must log in to the ICEGATE portal and select the “Registration” option. Next, they must select “Promo Registration” and enter the required details such as the promo code, validity period, and description.

Documents Required For Uploading

Exporters must upload the following documents while applying for an bank AD code:

- PAN card

- GST registration certificate

- Bank account details

- Proof of business address

Top Bank Net Banking Support

Conclusion

In conclusion, a bank AD code is an essential requirement for exporters who wish to carry out foreign exchange transactions. It is crucial to ensure that the AD code is mentioned correctly in all export-related documents to avoid any delays or rejections. The process of finding and applying for an AD code is straightforward, and exporters can approach their banks for assistance. The registration of a promo code with customs is also a simple process that can be done through the ICEGATE portal. By following the necessary procedures and submitting the required documents, exporters can obtain their AD code for the bank and conduct their export transactions with ease.

FAQs on AD Code for Bank

Does AD code vary from one bank to another?

Yes, AD codes vary from one bank to another. Each bank assigns a unique AD code to its customers for foreign exchange transactions.

Where can I get ad code?

To check your AD code, you can approach your bank and request them to provide the code. They will be able to provide the code along with the necessary documents.

What is AD bank?

AD bank refers to a bank that assigns Authorized Dealer (AD) codes to its customers for foreign exchange transactions. These codes are used by exporters in India to carry out foreign exchange transactions and are assigned by banks.

What is ad ii in bank?

Authorized Dealer Category II (AD Category II) refers to entities authorized by the Reserve Bank of India (RBI) to undertake specified non-trade related current account transactions and activities.

How do I apply the AD Code?

To apply for an bank AD code, exporters need to approach their bank and submit necessary documents. The bank will then allocate the AD Code, which is essential for foreign exchange transactions and RBI reporting.

Where can I get AD Code?

Exporters can obtain their AD Code from their bank by requesting it directly. It is crucial to ensure the AD Code is correctly stated in all export-related documentation for compliance and transaction purposes