It is important to learn Net Banking and if you have an account in SBI, this article will help you understand how to register for Net Banking. Read on to know more!

Net banking has grown significantly over the past decade as more people are turning to digital banking solutions to manage their finances. Many banks and financial institutions have invested heavily in developing secure and user-friendly online banking platforms in order to provide customers with a convenient, secure, and efficient banking experience. In this blog know more about SBI Net Banking services.

The growth of net banking is driven by several factors, including the increasing use of smartphones and the Internet, the availability of new and improved banking products, and the growing preference for digital banking solutions.

As a result, more and more customers are now opting for online banking solutions for their financial management needs. In this article, we’ve talked about How you can register for SBI Net Banking and use the services provided by it.

SBI Net Banking Services

The basic features of net banking are similar for almost all banks but the services provided by different banks might differ. It is very important that you understand the online net banking services provided by your bank so that you can continue net banking smoothly. If you have an account in SBI the service that you will get by net banking or

- You can easily transfer funds between accounts without visiting the bank.

- Transfer of funds is a very complicated process when you have to visit the bank. Especially when you have a busy schedule. If you have an online net banking account you can do this conveniently and in a faster way.

- You can also do interbank transfers with an SBI net banking account.

- If you have a Net banking account with SBI you can request an issue of demand draft.

- If you want to open a new account you can also apply for it with your SBI online banking account.

- In case you need a cheque book you can request for its issue with your online net banking account.

- Net banking with SBI also gives you some reward points during transactions.

How to update KYC in SBI

SBI offers several ways for customers to update their KYC information online. You can log into your SBI net banking account or use the YONO app to complete the KYC update. Detailed instructions are provided in the sections below.

How to Update SBI KYC through Internet Banking?

- Step 1: Log in to your SBI net banking account using your credentials

- Step 2: Click on the ‘My Accounts & Profile’ tab

- Step 3: Select the ‘Update KYC’ option, enter your profile password, and click ‘Submit’

- Step 4: Choose your account from the drop-down menu and click ‘Submit’

- Step 5: Fill out the information to be updated, upload the relevant documents, and submit

- Step 6: Enter the OTP sent to your registered mobile number to complete the KYC update.

Updating your KYC details will apply to all bank accounts under your Customer Identification File/Form (CIF).

How to Update SBI KYC Through YONO?

YONO is SBI’s integrated digital banking platform that provides convenient financial services to its account holders. You can update your State Bank of India KYC documents through the YONO app by following these simple steps:

- Step 1: Open the SBI YONO application and log in using your MPIN

- Step 2: Click on the menu at the top left of the home screen and select ‘Service Request’

- Step 3: Choose the ‘Update KYC’ option

- Step 4: Enter your profile password and click ‘Submit’

- Step 5: Fill out the information to be updated, upload the relevant documents, and submit

- Step 6: Enter the OTP sent to your registered mobile number and click ‘Submit’.

If successful, you will receive a message confirming that your KYC has been updated in the bank records through YONO.

SBI Net Banking Registration Guidance

Because of the increasing popularity of net banking all over the world, especially in India, multiple banks have introduced the facility of Net Banking and online banking. This is convenient for the users and also saves a lot of time. If you have an account in SBI and you want to start your net banking account we have mentioned the steps below to register for SBI net banking.

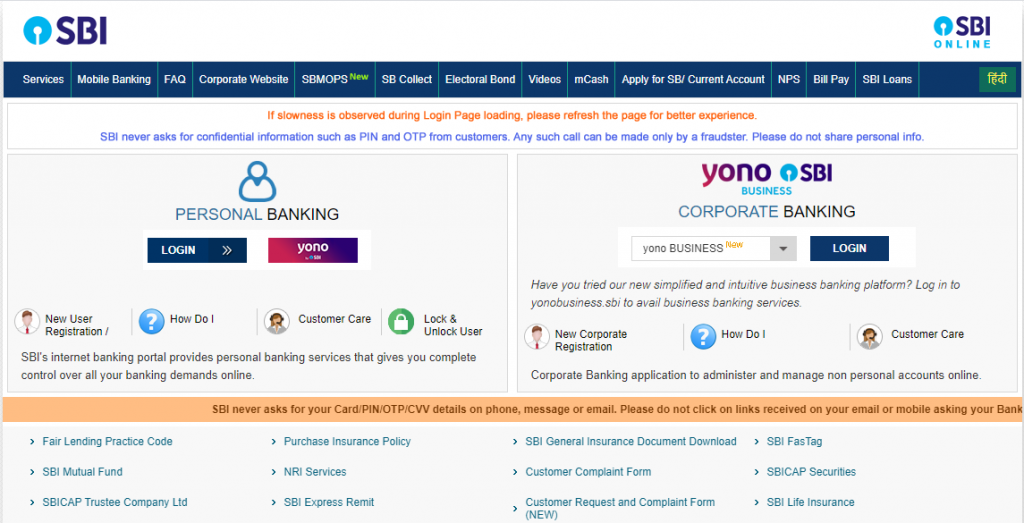

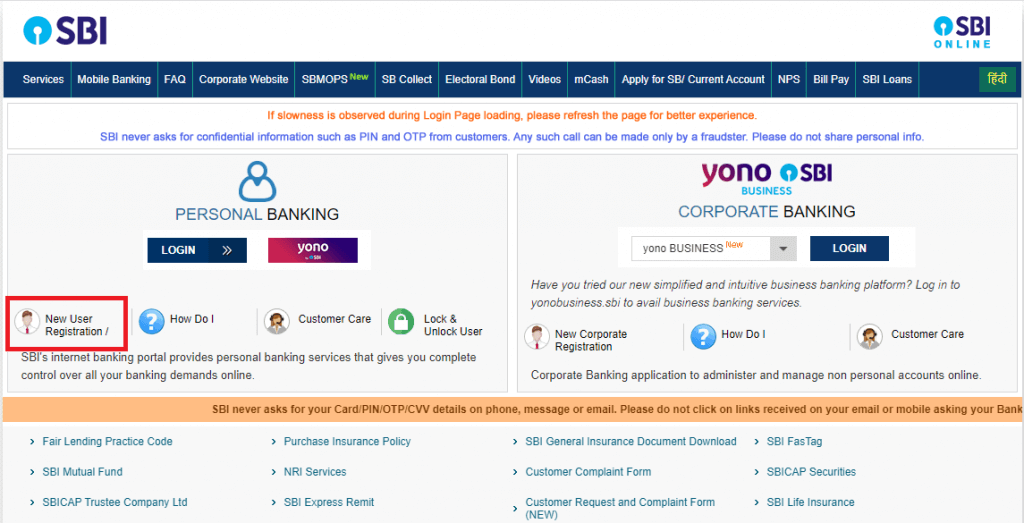

- Visit the SBI website.

- From the dropdown menu, Select the “New User Registration” option.

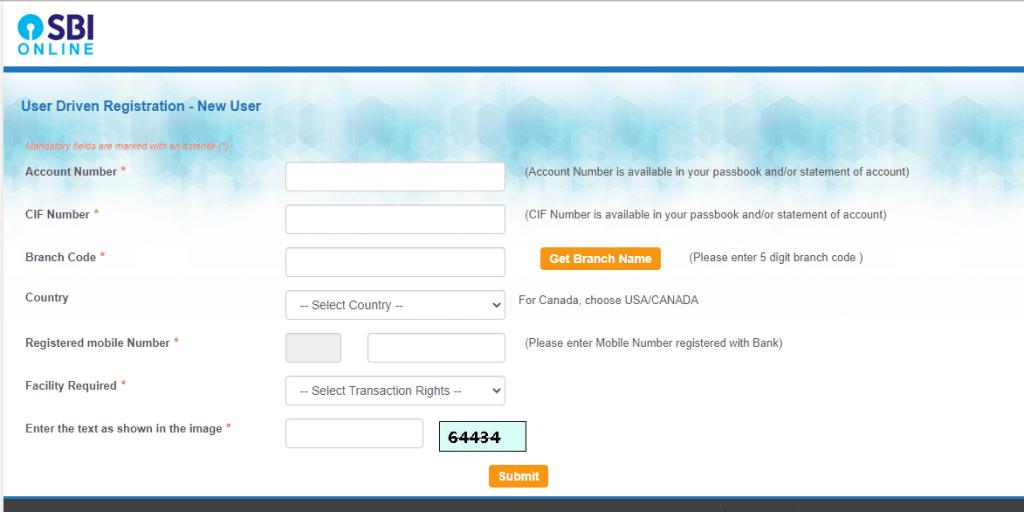

- Enter your SBI account number, CIF number, branch code, country, registered mobile number, and the captcha code and click on ‘Submit’.

- You will be sent an OTP on your registered mobile number. Enter the OTP and click on ‘Submit’.

- Now select the option ‘I Have my ATM card’ to continue the online registration process.

- Enter the ATM card details, the expiry date, and the ATM PIN, and click on ‘Proceed’.

- You will be asked to create the profile username and password. Enter the passwords of your choice and click on ‘Submit’.

- Your SBI net banking account is now ready to use.

How to Login into SBI Net Banking?

Next time when you visit the website of SBI you can directly log in to your net banking account and use the services. The steps to log in to your registered account or as follows.

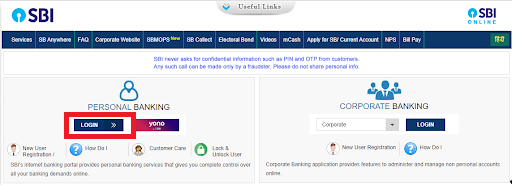

- Visit the website of SBI.

- Click on the ‘login’ option.

- An option of ‘continue to login’ will appear.

- Click on that and enter the username password and the capture given. Click on the ‘login’ option.

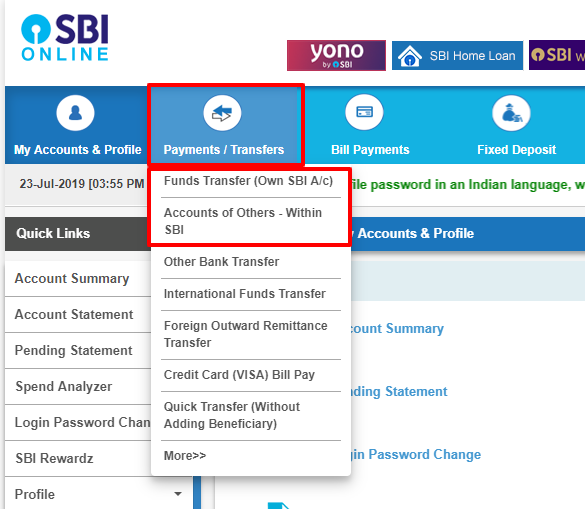

How to Transfer Funds Using SBI Net Banking?

Once you have registered with SBI net banking you can easily transfer points within SBI or to accounts in other banks. The steps to transfer funds to an account in another bank with net banking are

- Go to the website of SBI and log in using the password and username.

- A ‘payments/transfer’ tab will appear. Click on it.

- If you want to transfer funds to accounts in another bank click on the option of ‘other bank transfer’. This option is available under the ‘outside SBI’ option.

- Select that transaction type. Click on the ‘proceed’ option.

- Enter the amount that has to be transferred. Also, enter the purpose of the transfer of funds.

- Select the beneficiary.

- A page with terms and conditions will appear, accept them and click on submit.

- On the next page, your details will be visible, verify them and click on confirm.

- A password will be sent to your mobile number, enter it and click on confirm.

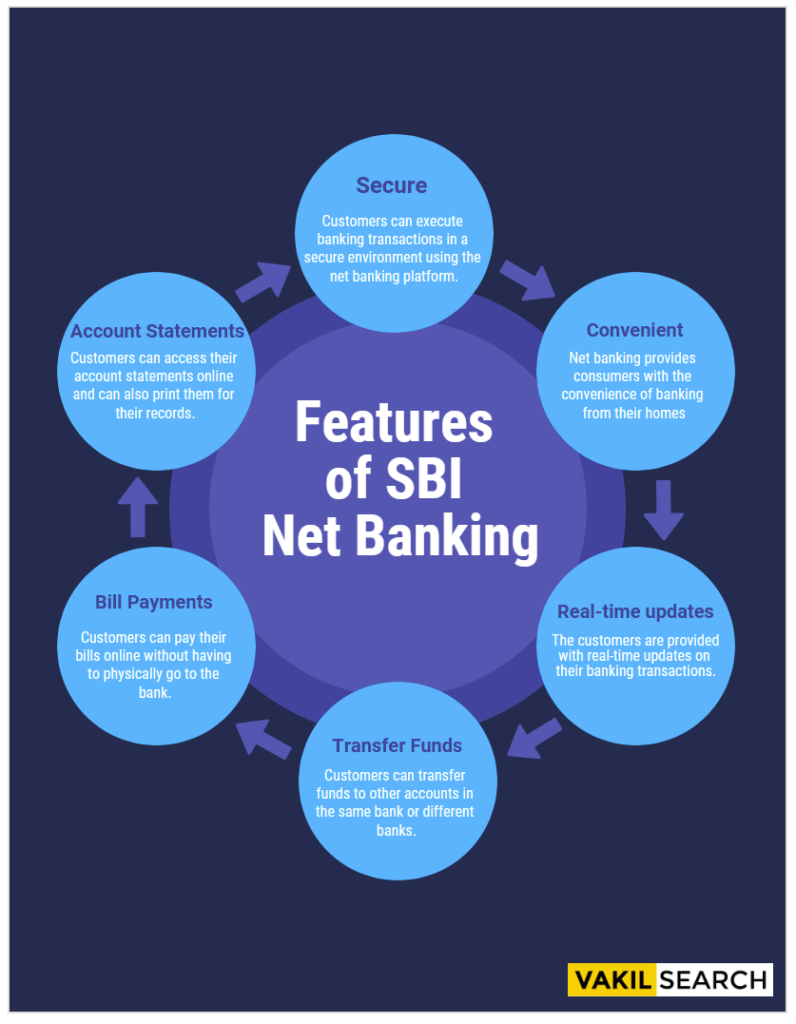

Features of SBI Net Banking

Net banking has seen tremendous growth over the past few years. This growth has been driven by increasing access to the Internet, improved security measures, and an overall shift in consumer preferences toward digital banking services.

Some Features of Net Banking are Mentioned Below:

- Secure: Net banking is a secure platform that provides customers with a secure environment to conduct banking transactions. Net banking is safe, as it uses encrypted technology to protect users’ data.

- Convenient: Net banking provides consumers with the convenience of banking from their homes or offices, at any time of the day or night. Transactions are completed quickly and securely, without the need for visits to the bank.

- Real-time Updates: The customers are provided with real-time updates on their banking transactions.

- Transfer Funds: Customers can transfer funds to other accounts in the same bank or different banks.

- Bill Payments: Customers can pay their bills online without having to physically go to the bank.

- Account Statements: Customers can access their account statements online and can also print them for their records.

- Investment Opportunities: Customers can invest in various mutual funds, stocks, bonds, and other investment options available through net banking.

- Loan Applications: Customers can apply for loans and other credit facilities through net banking.

- Fraud Detection: Banks have advanced fraud detection systems that can detect any suspicious activity in the customer’s account.

- 24/7 Availability: Net banking is available 24 hours a day, seven days a week.

Conclusion

SBI Net Banking (Online banking) in India has seen tremendous growth over the last decade. The number of online banking users in India has grown from around 9 million in 2008 to over 80 million in 2018. This clearly shows that net banking has been effective in India and it is important to learn how to use it. In this article, we have mentioned everything that you need to know to register into the net banking account of SBI and the services provided by it.

FAQ

How can I use IndusInd Net Banking?

To use IndusInd Bank net banking, you need to register for it on the bank's website or at a branch. Once registered, you can log in to the net banking portal using your user ID and password to access various banking services.

What is the Transaction Limit in IndusInd Bank?

The transaction limit in IndusInd Bank varies based on the type of transaction and your account type. You can check the transaction limit for your account by logging in to your net banking account or contacting the bank's customer service.

How can I get IndusInd Bank User ID and Password?

You can get your IndusInd Bank user ID and password by visiting the bank's website and selecting the Net Banking option. From there, you can select Forgot Password or Forgot User ID and follow the prompts to retrieve your login credentials.

How much can I Transfer after adding Beneficiary IndusInd Bank?

The transfer limit after adding a beneficiary in IndusInd Bank may vary depending on your account type and the type of transfer. You can check your transfer limit by logging in to your net banking account or contacting the bank's customer service.

What is the Maximum Transfer Limit per day?

The maximum transfer limit per day in IndusInd Bank varies based on your account type and the type of transaction. You can check your maximum transfer limit by logging in to your net banking account or contacting the bank's customer service.

Can we transfer money immediately after adding beneficiary?

The time it takes to transfer money after adding a beneficiary in IndusInd Bank may vary depending on the type of transaction and the bank's processing time. In some cases, you may be able to transfer money immediately, while in others, it may take some time.

How many attempts can I make while entering the login password?

The number of attempts you can make while entering your login password in IndusInd Bank may vary based on the bank's security policies. You can check the bank's policies on login attempts by contacting their customer service.

Can I see the transaction history from two years ago?

Yes, you can view your transaction history from up to two years ago in your IndusInd Bank net banking account. You can view your transaction history by logging in to your net banking account and selecting the Account Statements option.

What is the annual locker charge of SBI?

The locker charges for SBI Bank vary based on the size and location. For urban and metro areas, the charges are ₹1,500 + GST for small lockers,₹3,000 + GST for medium lockers, ₹6,000 + GST for large lockers, and ₹9,000 + GST for extra-large lockers. In rural and semi-urban areas, the charges are ₹1,000 + GST for small lockers,₹2,000 + GST for medium lockers, ₹5,000 + GST for large lockers, and ₹7,000 + GST for extra-large lockers. The locker charges mentioned for SBI Bank are indicative and subject to change. For the most accurate and up-to-date information, please refer to the official SBI Bank website or contact your local SBI branch. Additional terms and conditions may apply.