Explore the key aspects of buying, selling, and transferring shares, while gaining valuable insights into the intricacies of the stock market. Read right away

Share Transfer Meaning

Share transfer is the process of transferring ownership of shares in a company from one person to another. This can be done for a variety of reasons, such as to raise capital, to sell a business, or to transfer ownership to family members.

Advantages of Company Share Transfer

There are a number of advantages to transferring shares in a company, including:

- It can be a way to raise capital for the company.

- It can allow the company owner to sell their business or part of their business.

- It can be used to transfer ownership of shares to family members or other trusted individuals.

- It can be used to restructure the company’s ownership structure.

Persons involved in Transfer of Shares

The two main parties involved in a share transfer are:

- The transferor is the person selling the shares.

- The transferee is the person buying the shares.

In addition to the transferor and transferee, there may be other parties involved in a share transfer, such as:

- The company itself, is responsible for registering the transfer of shares.

- A stockbroker, who can help to facilitate the transfer of shares.

- A lawyer, who can advise on the legal aspects of the share transfer.

Who is involved in Share transfer?

The following are the people who are involved in the transfer of shares process:

- Transferor: The person who is selling the shares.

- Transferee: The person who is buying the shares.

- Company: The company whose shares are being transferred.

- Stockbroker: A broker who helps to facilitate the transfer of shares.

- Lawyer: A lawyer who advises on the legal aspects of the share transfer.

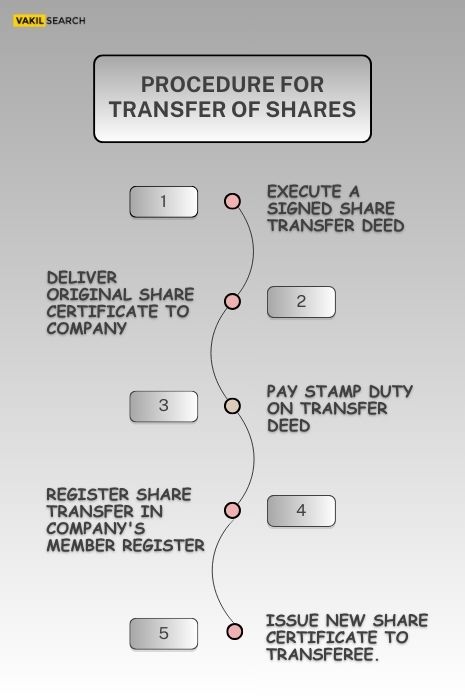

Procedure for Transfer of Shares under the Companies Act, 2013

The procedure for the transfer of shares under the Companies Act, 2013 is as follows:

- The transferor and transferee must sign and execute a transfer of shares deed.

- The transferor must deliver the original share certificate to the company.

- The transferee must pay the stamp duty on the share transfer deed.

- The company must register the transfer of shares in its register of members.

- The company must issue a new share certificate to the transferee.

Documents Required for Company Share Transfer

The following documents are required for company’s transfer of shares:

- Transfer of shares deed.

- Original share certificate.

- Stamp duty receipt.

- Identity proof of transferor and transferee.

Transfer of Shares Time Limit

The company must register the transfer of shares within 30 days of receiving the transfer of shares deed and all other required documents.

Penalties for Non-Compliance with Company Transfer of Shares

The private limited company may be penalized by the Registrar of Companies for failing to register the transfer of shares within the prescribed time limit. Such penalties may take the form of fines or imprisonment. It underscores the importance of pvt ltd company registration compliance.

Company Share Transfer Agreement Sample

A company share transfer agreement is a legal document that sets out the terms and conditions of the transfer of shares. It is important to have a well-drafted transfer of shares agreement in place to avoid any disputes in the future.

A sample company share transfer agreement can be found on the website of the Ministry of Corporate Affairs.

Tax Implications

The tax implications of a share transfer will depend on the tax status of the transferor and transferee, as well as the type of shares being transferred.

In general, the transferor will be liable to capital gains tax on the difference between the purchase price of the shares and the sale price. The transferee will be liable to stamp duty on the share transfer deed.

Provisions Regarding Transfer of Shares

The Companies Act, 2013 contains a number of provisions regarding the transfer of shares. These provisions include:

- Section 44: This section states that shares are transferable in the manner provided by the company’s articles of association.

- Section 45: This section provides that the company’s articles of association may contain restrictions on the transfer of shares.

- Section 46: This section sets out the procedure for transfer of shares.

- Section 47: This section states that the company must register the transfer of shares within 30 days of receiving the share transfer deed and all other required documents.

In addition to the provisions of the Companies Act, 2013, the company’s articles of association may also contain provisions regarding the transfer of shares. It is important to review the company’s articles of association before transferring any shares.

Transfer of Transfer of Shares FAQs

Can I transfer shares from one demat to another?

Yes, you can transfer shares from one demat account to another. This process is known as an inter-depository transfer. You need to initiate the transfer through a Delivery Instruction Slip (DIS) with your current demat account provider. The shares will be credited to your new demat account after due verification.

Who pays stamp duty on the transfer of shares?

In India, the stamp duty on the transfer of shares is generally paid by the buyer of the shares. The rate of stamp duty varies from state to state and is governed by the respective state's Stamp Act.

What is an off-market transfer of shares?

An off-market transfer of shares refers to the transfer of shares that takes place outside the stock exchange. In this type of transfer, shares are not bought or sold on the stock exchange; instead, they are transferred directly between two parties. It typically involves transactions like gifts, inheritance, or transfers between family members or associates.

How to transfer shares from one demat to another?

To transfer shares from one demat account to another, follow these steps:

- Fill out a Delivery Instruction Slip (DIS) provided by your current demat account provider.

- Mention the details of the shares to be transferred, including the ISIN (International Securities Identification Number) of the shares.

- Specify the target demat account's details, including the DP ID (Depository Participant ID).

- Sign the DIS form and submit it to your current demat account provider.

- The transfer will be processed, and the shares will be credited to your new demat account after verification.

Is a gift deed necessary for the transfer of shares?

Yes, a gift deed is often necessary when transferring shares as a gift to another person. A gift deed is a legal document that formalizes the transfer of ownership of shares without any monetary consideration. It serves as proof of the gift and helps avoid disputes in the future.

What are the rules for the transfer of shares in the Companies Act, 2013?

Under the Companies Act, 2013, shares can be transferred in accordance with the company's Articles of Association and the applicable rules and regulations. The Act specifies rules related to share transfer, including the procedure for share transfer and the rights of shareholders and companies in this regard.

What is the transmission of shares under the Companies Act, 2016?

The Companies Act, 2016, governs the transmission of shares, which occurs when a shareholder passes away, and the shares are transferred to the legal heirs or beneficiaries. The process involves the legal representatives of the deceased shareholder applying to the company for the transmission of shares.

What is the difference between share transfer and share transmission?

- Share Transfer: Share transfer refers to the voluntary transfer of shares from one shareholder to another, typically through sale, gift, or exchange. The transfer is initiated by the shareholder, and it involves both parties' active consent.

- Share Transmission: Share transmission occurs when shares are transferred due to circumstances beyond the shareholder's control, such as the death or insolvency of the shareholder. In such cases, the shares are transferred to the legal heirs or beneficiaries, and their consent is not required. It is initiated by the company or the legal representatives of the deceased or insolvent shareholder.

Conclusion

In conclusion, share transfer is a crucial process governed by legal frameworks such as the Companies Act, 2013. It involves the transfer of ownership from a transferor to a transferee, facilitated by a well-drafted transfer deed and compliance with stamp duty requirements. The company plays a pivotal role in registering these transfers within 30 days, ensuring compliance with regulatory obligations. Understanding these procedures and the associated tax implications is essential for all parties involved in company registration.