Starting a jewelry business involves market research, legal compliance, branding, and inventory management. This guide covers key steps for success. Read ahead

Jewelry Business

A jewellery business involves designing, crafting, or selling jewellery. It encompasses a wide range of products, from fine jewellery to costume pieces. Key aspects include market research, design, sourcing materials, pricing, marketing, sales channels, and customer service. Success in this industry requires a strong brand, quality craftsmanship, and an understanding of customer preferences and market trends.

Legal and regulatory compliance, along with ethical sourcing and sustainable practices, are also important considerations. Whether you’re a designer, artisan, or retailer, a well-thought-out business plan and a focus on aesthetics and customer experience are essential for thriving in the jewellery business.

Tips on How to Start a Jewelry Business

Here are some tips on how to start a jewellery business:

- Choose a niche: What type of jewellery do you want to sell? Will you focus on fine jewellery, fashion jewellery, or both? It is important to choose a niche so that you can focus your marketing and sales efforts on a specific target market.

- Develop a business plan: This document should outline your business goals, strategies, and financial projections.

- Secure funding: You will need to secure funding to start your business. This may involve personal savings, loans, or investors.

- Find suppliers: You will need to find suppliers who can provide you with high-quality jewellery at competitive prices.

- Market your business: Once you have secured funding and found suppliers, you need to start marketing your business. This may involve creating a website, social media accounts, and print advertising.

- Provide excellent customer service: Customer service is essential in any business, but it is especially important in the jewellery industry. Customers want to feel confident that they are buying high-quality jewellery from a reputable company. Start your entrepreneurial journey with ease! Make Now your hassle-free online company registration in india

How to Start an Online Jewellery Business in 2023?

To start an online jewellery business in 2023, you will need to:

- Choose an e-commerce platform: There are many different e-commerce platforms available, such as Shopify, WooCommerce, and Magento. Choose a platform that is easy to use and that offers the features you need, such as payment processing and shipping integration.

- Set up your online store: Once you have chosen an e-commerce platform, you need to set up your online store. This includes adding your products, setting your prices, and creating shipping and payment policies.

- Promote your online store: Once your online store is set up, you need to start promoting it. This may involve creating social media accounts, running paid advertising campaigns, and writing blog posts about jewelry.

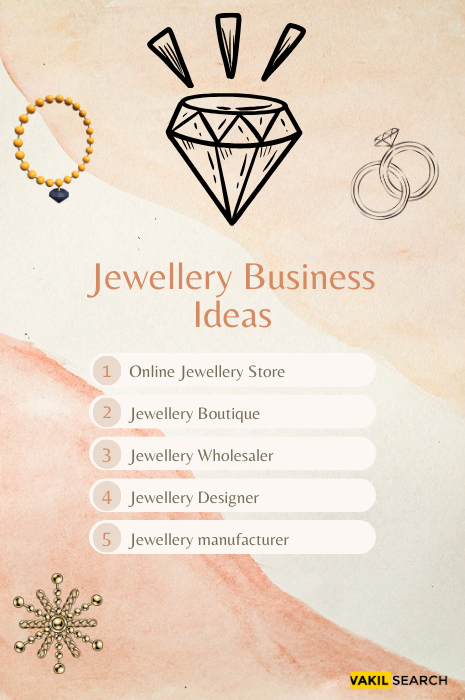

Jewellery Business Ideas

Here are some jewellery business ideas that as business you can make pvt ltd company registration:

- Online jewellery store: This is a great option for entrepreneurs who want to start a jewellery business without having to open a physical store.

- Jewellery boutique: This is a good option for entrepreneurs who want to offer a more personalized shopping experience to their customers.

- Jewellery wholesaler: This is a good option for entrepreneurs who want to sell jewellery to other businesses, such as retailers and gift shops.

- Jewellery designer: This is a good option for entrepreneurs who are creative and have a passion for jewellery design.

- Jewellery manufacturer: This is a good option for entrepreneurs who have the skills and resources to manufacture their own jewellery.

Jewelry Business FAQs

How much does it cost to start a jewellery business?

The cost of starting a jewellery business can vary widely depending on various factors, including the scale of your operation, the type of jewellery you plan to sell, and your location. A small, home-based jewellery business may require a relatively low initial investment, while a brick-and-mortar store or high-end jewellery line could require a significant amount of capital. Costs may include materials, equipment, licensing, marketing, and inventory. A rough estimate for a small home-based jewellery business might range from a few hundred to a few thousand dollars, whereas a traditional store could require tens of thousands or more.

How to start a jewellery business at home?

Starting a jewellery business at home involves several steps:

- Market Research: Research your target audience and niche within the jewellery industry.

- Business Plan: Create a detailed business plan outlining your goals, budget, and strategies.

- Legal Considerations: Register your business, obtain any necessary permits or licenses, and adhere to local regulations.

- Design and Create Jewelry: Develop or source your jewellery designs and create inventory.

- Online Presence: Set up an e-commerce website or use online marketplaces to sell your jewellery.

- Marketing: Promote your jewellery business through social media, online advertising, and networking.

- Inventory Management: Keep track of your inventory, pricing, and customer orders.

- Customer Service: Provide excellent customer service and build relationships with your customers.

How do I start a small jewellery business?

Starting a small jewellery business involves similar steps as starting one at home, but you may also consider selling your jewellery at craft fairs, local markets, or through consignment in local boutiques. Networking with other jewellery designers and artists can help you gain exposure for your small jewellery business.

Is the jewellery business profitable?

The profitability of a jewellery business depends on various factors, including the quality of your jewellery, your marketing efforts, competition, pricing, and target market. Many successful jewellery businesses are profitable, especially those that offer unique and high-quality designs. However, it's important to conduct thorough market research, manage costs, and continuously adapt to changing market trends to increase the likelihood of profitability.

Why is the diamond resale value low?

Diamond resale value is often lower than the initial purchase price due to several factors:

- Market Markup: When buying from a retailer, you typically pay a markup that covers their overhead and profit margin. When reselling, you may not recoup that markup.

- Depreciation: Like many luxury items, diamonds can depreciate over time, particularly if styles change or the diamond is heavily used and worn.

- Limited Buyer Pool: The resale market for diamonds is more limited than the retail market, which can affect prices.

- Quality and Certification: The resale value depends on the quality of the diamond and whether it comes with recognized certifications.

- Economic Factors: Economic conditions and market demand can also influence resale prices.

Is antique gold jewellery a good investment?

Antique gold jewellery can be a good investment under certain conditions:

- Quality and Rarity: The value of antique gold jewellery often depends on its quality, craftsmanship, and rarity. Pieces from renowned designers or historical periods can command higher prices.

- Collector's Market: Some collectors are willing to pay a premium for antique and vintage jewellery.

- Gold Prices: Gold is a commodity, and its price can fluctuate. Investing in antique gold jewellery can be a way to hold physical gold, which may appreciate over time.