A form of insurance scheme called the YSR Bima Scheme offers Andhra Pradesh's underprivileged workers' families protection in the case of an accident. This blog provides numerous information regarding this scheme and it is requested from readers to read this blog thoroughly for gaining proper information.

The YSR Bima Scheme is a type of insurance scheme that provides protection in the event of an accident to the families of impoverished and unorganised employees in Andhra Pradesh. The beneficiary’s family member will get the insurance sum if the beneficiary dies in any accident or suffers a terminal disability under this programme. Around 1.14 crore Andhra Pradesh residents would benefit from this initiative. The government has allocated ₹510 crore to this initiative.

Under the YSR Bima Scheme, an insurance cover ranging from ₹1.5 lakh to ₹5 lakh would be put into the eligible family member’s bank account within 15 days. In addition to this sum, the government of Andhra Pradesh will provide ₹10,000 in urgent cash assistance. The policyholder must pay an annual premium of ₹15 under the plan.

Objectives of YSR Bhima Scheme

The primary goal of the YSR Bima programme is to offer insurance coverage to the families of impoverished and unorganised state workers. The insurance amount will be provided to the beneficiary’s nominee in the event of permanent incapacity or death under this programme. The recipient family member will receive financial assistance if this strategy is successfully implemented.

Key Highlights Of YSR Bima Scheme

| Name of Scheme | YSR Bima scheme |

| Launched by | Government of Andhra Pradesh |

| Beneficiary | Citizens of Andhra Pradesh |

| Objective | To provide insurance cover |

| Premium amount | Rs 15 per annum |

| Year | 2023 |

The Advantages and Features of the YSR Bima Scheme

- The YSR Bima programme is a type of insurance policy that offers protection in the event of an accident to the families of those poor and unorganised employees.

- If the beneficiary dies, the insurance cover amount is transferred to the nominee.

- Around 1.14 crore Andhra Pradesh residents would benefit from this initiative.

- The government of Andhra Pradesh has set aside ₹510 crores for the proper execution of this project.

- Insurance coverage ranging from ₹1.5 lakh to ₹5 lakh would be put into the bank account of the beneficiary’s family member under the plan.

- The amount claimed will be paid within 15 days of the claim being filed.

- The recipient family member will also receive ₹10,000 in urgent cash assistance.

- The recipient must pay a premium of ₹15 each year under this programme.

- The recipient will be given an identity card with a unique identifying number and policy number.

- The claim money will be sent straight to the bank account through direct bank transfer.

- If a beneficiary has an issue, they can contact PD DRDA to file a complaint about an insurance claim or enrollment payment.

YSR Bima Scheme Insurance Coverage

- First, from the age of 18 to 50, there is ₹5 lakh insurance coverage for any accidental death and complete permanent disability.

- Second, from the age of 51 to 70, insurance will cover an amount of ₹3 lakh for accidental death and total permanent disability is available.

- Third, between the ages of 18 and 50, there is a ₹2 lakh insurance coverage in the event of natural death.

- Fourth, between the ages of 18 and 70, insurance coverage of ₹1.5 lakh in the event of a partial permanent disability caused by an accident.

- It should be noted that the claim sum will be put into the nominee’s bank account within 15 days of the claim being submitted.

YSR Bhima Scheme Nominee

The following persons are eligible to be nominated under the YSR Bhima scheme:

- The beneficiary’s wife

- Son, 21 years old

- Daughter who is unmarried

- Daughter who is widowed

- Parents who are reliant

- Daughter-in-law widowed or her children

Note: As part of the YSR Bhima system, the recipient will get an identity card with a unique identification number and policy number.

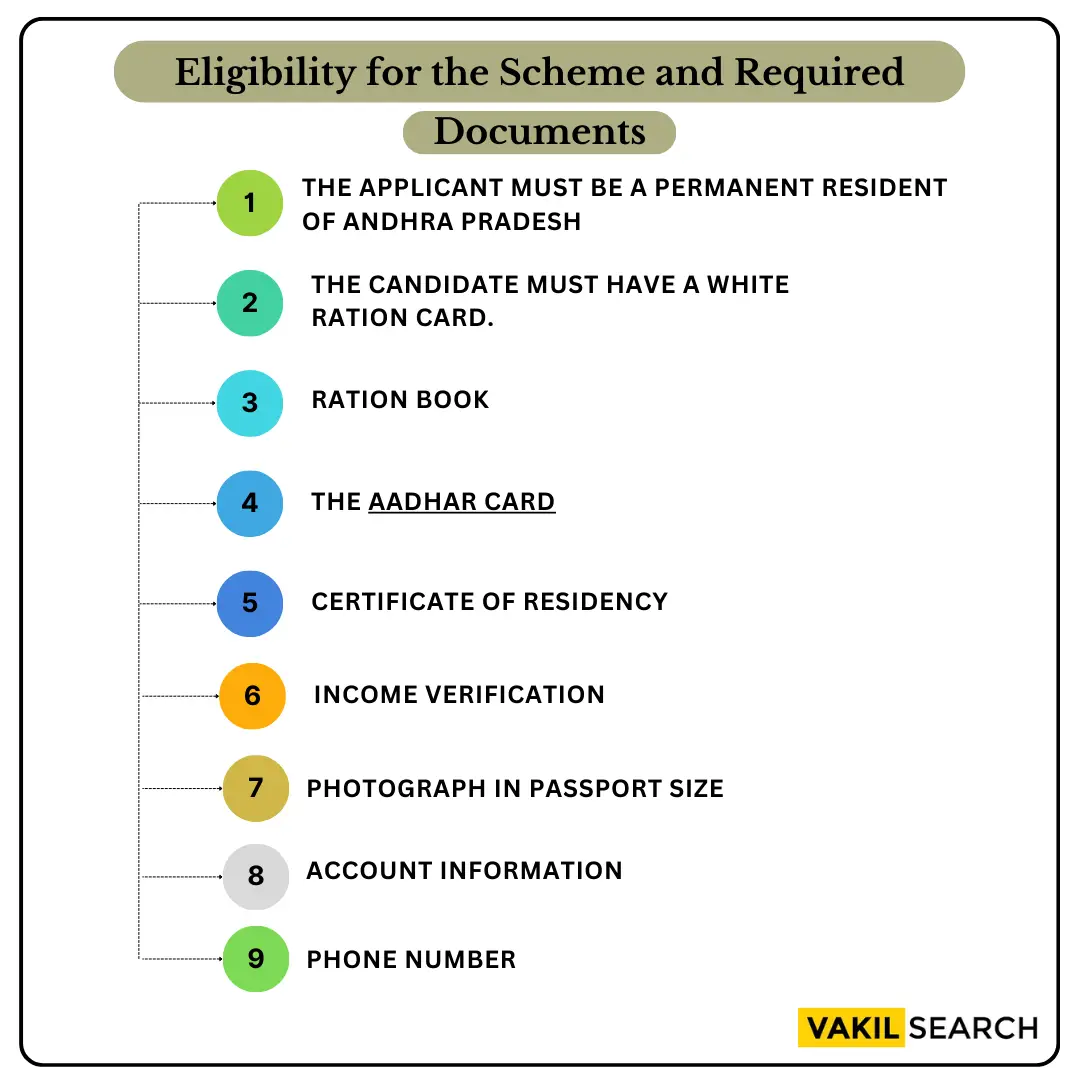

Eligibility for the Scheme and Required Documents

- The applicant must be a permanent resident of Andhra Pradesh

- The candidate must have a white ration card.

- Ration book

- The Aadhar card

- Certificate of Residency

- Income verification

- Photograph in passport size

- Account information

- Phone number

YSR Bima Scheme Application Procedure

Beneficiaries do not need to register to apply for the YSR Bima Scheme. The volunteers will conduct door-to-door surveys and check white ration cards. The information gathered from the survey will then be checked by the secretary of welfare, and the recipients will be chosen. Following that, the chosen beneficiaries would be requested to register a bank account, including the nominee, and the beneficiary will be required to pay a ₹15 per annual fee. Visit the official website for additional information.

We have included the simple steps you may take to finish the online application procedure for the YSR Bhima Scheme below.

- To begin, go to the official website of the YSR Bima Scheme.

- Your screen will be filled with the home page.

- Here you must input the requested information, such as the father’s name, spouse’s name, gender, date of birth, and other details.

- After that, upload the requested papers and click the “Submit” button.

- The claim payment will then be promptly paid into the beneficiary’s bank account within 15 days of the claim date.

Conclusion

In order to avail the benefit of the above scheme, the applicant needs to fulfill the prescribed requirement. If you need any extra help, don’t hesitate to contact Vakilsearch. Our Vakilsearch legal experts would be happy to guide you through.