A relinquishment deed would be registered to allow the co-owners to formally transfer their portion of the property to the other co-owner. More details about the relinquishment deed are provided in this article.

What is Relinquishment Deeds?

If you’re unsure of the significance of relinquishment deeds, it would be best to give an example if a person without a will leaves three sons the inheritance of a sizable home in their hometown.

The rights can be transferred in the name of the third brother, who lives close to the family property and can manage the estate if two of the three sons work in distant places and find it challenging to manage the estate in their hometown.

Assuming this, a relinquishment deed would be created and recorded to confirm if the first two brothers wanted to transfer their rights to the third brother. If the two brothers decide to accept money as payment for the transfer, a similar deed would be drafted to establish the transfer’s legal validity. To effectively complete this process and create a relinquishment deed, one must carefully comprehend the many regulations involved.

Objective of Relinquishment Deeds

The purpose of a relinquishment deed is to transfer ownership rights from one person to another. It is often used when a co-owner or heir chooses to give up their share in a property or asset. This allows the remaining owner(s) to have full ownership and control. The relinquishment deed is a legal document that confirms the transfer of rights. It also ensures clear and transparent property ownership.

Points to Remember When Drafting a Relinquishment Deeds

Remember these points when you draft a deed:

- Clearly identify the people involved, including their names and addresses.

- Describe the property or asset being relinquished in detail.

- State that the person giving up their rights does so willingly.

- If there’s any payment involved, mention the details.

- Make sure the deed follows the legal requirements and rules.

- Get witnesses to sign the document and consider notarisation.

- Write the date and have everyone involved sign it.

- Specify the governing law that applies.

- Check if the deed needs to be registered with authorities.

- Seek advice from legal professionals when needed.

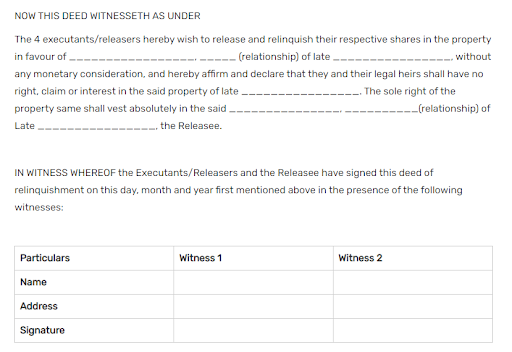

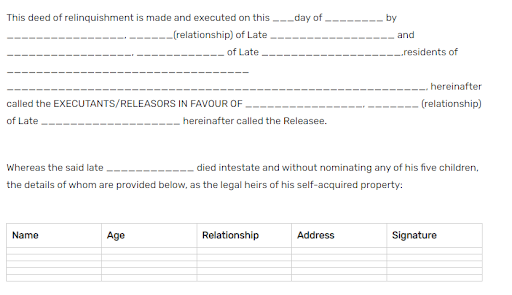

Relinquishment Deeds Format

Relinquishment Deed: Can it be Challenged?

Relinquishment deeds can be contested if there is fraud, undue influence, coercion, or misrepresentation involved in the process. However, cancelling the deed requires the consent of all parties involved, or it can be cancelled by a court order.

Relinquishment Deeds: Can it be Revoked?

If the individual who relinquished the claim changes his mind, the relinquishment document cannot be revoked. However, in the following situations, the co-owner who transferred the property may revoke it:

- if the co-owner’s creation of the deed was coerced or under duress

- If the deed was fabricated in error

- If the document incorrectly interpreted the co-owner’s intentions

The cancellation of the deed requires the agreement of all persons involved in its signing. The party that feels wronged must file a civil court lawsuit if the recipient won’t comply. Relinquishment deeds can be revoked within three years of their execution, it should be noted.

Supreme Court Judgments on Relinquishment Deed

The Supreme Court ruled that a relinquishment deed cannot transfer property ownership to another person. The renunciations in such deeds should be in favour of someone who already has a legal title to the property. Renunciations cannot be used to create a new legal title if one didn’t exist before.

Time Limit for Revocation of Relinquishment Deed?

A relinquishment deed can be cancelled or revoked within three years from the date when the rights were transferred. This means that if someone wants to undo the relinquishment, they have a three-year window to do so from the date the rights were given up. After this three-year period, revoking the relinquishment becomes more challenging, and legal recourse may be required.

Difference Between Relinquishment Deeds and Gift Deeds

| Relinquishment Deed | Gift Deed |

| Involves giving up or relinquishing one’s rights | Involves voluntarily transferring ownership of a property or asset as a gift |

| Typically used when co-owners or heirs give up their share in a property or asset | Used when someone wants to gift a property or asset to another person |

| Does not involve any consideration or payment | Can involve consideration or payment, although it can also be a voluntary transfer without any payment |

| The person relinquishing rights gives up their legal claims and interests in the property or asset | The person making the gift transfers their complete ownership and rights to the recipient |

| Can be revoked or cancelled within a certain period of time, subject to legal provisions | Generally irrevocable once the gift is made unless specific legal conditions or agreements allow for the revocation |

| Requires legal documentation and compliance with relevant laws | Requires legal documentation and registration to establish the transfer of ownership |

| Helps in clarifying and transferring property rights among co-owners or heirs | Facilitates the lawful transfer of property or assets as a gift from one person to another |

| It is always better to ask expert advice or seek legal help to understand the differences better. Vakilsearch experts are always ready to assist you with drafting to make you understand about relinquishment deeds. |

Who Has The Right To Release A Property?

The person is legally entitled to the property; nevertheless, if there are multiple legal heirs, either one may execute the relinquishment document. The requirements of a legitimate contract, except consideration, must be met for a property relinquishment to be deemed valid.

Is Registering The Relinquishment Deeds Required?

An instrument used to create or transfer a right relating to real property must be registered according to Section 17(1)(b) of the Registration Act of 1908. Therefore, to provide the necessary legal legitimacy, a relinquishment document should be required to be recorded.

Documents that are not registered are not acceptable in the court if there is a disagreement about them, according to Section 49 of the Registration Act, 1908.

According to the Gujarat High Court, the relinquishment deed must be recorded to be legitimate legally. The Gujarat High Court declared on 7 July 2021 that any document transferring real estate owners must be legitimately registered under the Registration Act, 1908.

A document is not a relinquishment deed, in accordance with the Gujarat High Court, until it is written. In August 2010, one Roshanben Deraiya and her sister Hanisaben Deraiya, who brought the petition that resulted in the High Court’s ruling, renounced their claim to their father, Hajibhai Deraiya’s, agricultural land in Shihor village in Bhavnagar. The three brothers split up after their father died in October 2010. Then, in 2016, Roshanben decided to appeal this judgment.

The High Court declared that the petitioner’s consent affidavit would not be regarded as a legally valid relinquishment document and set aside the decisions made by the deputy collector, a collector, and the special secretary of the tax department (appeals). As a result, the petitioner’s entitlement based on this specific document cannot be regarded as having expired.

Relinquishment Deed : Benefits

- With a relinquishment deeds in place, property transfer is simple

- In the event that there is no will, ensure transfer: The relinquishment deed facilitates the straightforward transfer of property in the event that a deceased person drafted a no will

- More heirs: If a relinquishment deed is in place, a legal heir can transfer the property to additional legal heirs.

When Should A Relinquishment Deeds Be Drafted?

A property owner may assign their ownership interest by a will, a gift, or another type of legal instrument. So, when is it necessary to draft a release document, and how does this differ from the other ways to transfer property?

Only when a property is inherited can its rights be transferred through a relinquishment deed. These include all inherited possessions you are entitled to by birth under Hindu Succession Law and your father’s self-acquired property in situations where he passes away intestate (without a will).

Steps Must Be Taken To Register A Relinquishment Deeds

The following steps must be taken sequentially by the parties involved to record a relinquishment deed:

Step 1: To begin, you must first draft on ₹100 stamp paper every element that should be included in a relinquishment deed. You must ensure that every detail in this particular draught is accurate and free of grammatical or typing errors. The draft’s language should be written to make the agreement highly plain and transparent to all parties involved.

Step 2: Next, you and all other parties engaged in the transaction must go to the sub-registrar’s office at the appropriate location. There must be two witnesses as well. Everyone should always have a copy of their passport-sized photo, original identity, and address proofs.

Step 3: To register a nominal charge of between ₹100 and ₹ 250

Step 4: If the official accepts the deed in its final form, it will be registered, and a registered relinquishment deed will be produced within a week. You can then go to the sub-registrar’s office and pick up the paperwork for future use.

These deeds must be drafted with the assistance of a professional knowledgeable about including all pertinent information. The deed must include details such as who receives the property from whom, how the item is described, when it was transferred, etc.

It must be registered before the Sub-registrar in the jurisdiction where the property is located by Section 17 of the Registration Act, 1908, and payment of the registration fee will depend on which state law is relevant. For the deed to be legally binding, both the party and witnesses must sign it. For verification, all pertinent documents must be produced by the parties in addition to the deed.

What Happens If One Interested Party Cannot Get To The Sub-Registrar’s Office?

One of the applicants must apply to the sub-registrar if they cannot visit owing to a disability or an ongoing illness.

In such cases, a sub-registrar’s representative would go to that party’s residence to finish the registration. The registering officer is permitted to visit the premises of such a party under Section 31 of the Registration Act,1908.

Benefits Relinquishment Deed

A relinquishment deed provides a legal framework for the seamless transfer of rights, ensuring clarity and peace of mind for all parties involved. Here is a list of benefits outlined:

Streamlining Property Transfer

Simplifying the property transfer process between family members, a relinquishment deed eliminates the necessity for a sale deed

Mitigating Legal Conflicts

Family members can prevent legal disputes over property ownership and inheritance by relinquishing their rights through a relinquishment deed

Efficient Succession Planning

Incorporated into succession planning, a relinquishment deed facilitates the seamless transition of property from one generation to the next

Expedited Processing

With swift processing capabilities, a relinquishment deed proves advantageous in urgent scenarios requiring prompt property ownership transfer

Establishing Legal Safeguards

Offering legal protection, a relinquishment deed creates a transparent record, solidifying the transfer of ownership for all involved parties

Economical Property Transfer

Serving as a cost-effective alternative, a relinquishment deed facilitates property rights transfer without the complexities of an extended legal procedure.

When to Create a Relinquishment Deed?

A relinquishment deed is necessary in various scenarios such as death without a Will or during divorce settlements, ensuring a legal and smooth transfer of property ownership. Here are a few ways a relinquishment deed comes handy:

Urgent Financial Requirements

If a co-owner urgently needs to liquidate their property share to generate immediate funds, the execution of a relinquishment deed is indispensable.

Minor Legal Heir’s Estate

In cases where the legal guardian of a minor legal heir wishes to surrender the estate on behalf of the minor to another legal heir, a relinquishment deed is mandated, subject to court approval.

In the Event of Death

Following an interstate death, where an individual passes away without a Will, a relinquishment deed becomes essential for the seamless transfer of property ownership. It aids in delineating the portions owned by specific legal heirs and designating responsibilities, such as property maintenance.

Amidst Divorce Proceedings

When a spouse seeks to renounce their share in a property as part of a divorce settlement, a relinquishment deed is necessary for the lawful transfer to the other spouse.

Act of Generosity

When a legal heir or co-owner desires to relinquish their share in the property altruistically to another co-owner, a relinquishment deed is the formal means to facilitate such a generous gesture.

Relinquishment Deed: Documents Required

The following documents are required for drafting a relinquishment deed:

- Legal documents of the property

- Registered documents of the property

- Written intention

- Details of co-owners

- Name, age, and address of the releasor

- Name, age, and address of the releasee

- Description of the property

- Identity proofs (Aadhar Card, Driver’s License, Passport)

- PAN card of both parties.

How to Register a Relinquishment Deed?

In general the process for registering a relinquishment deed is done effectively using the following process:

Step 1: Draft a relinquishment deed on stamp paper of ₹100 mentioning every particular – like details of the releasor, release, property, statement of purpose, list of heirs, relinquishment, signatures and conclusion. Ensure there are no spelling errors

Step 2: Visit the Sub-Registrar’s office of the concerned locality along with the parties involved and two witnesses. Everyone involved must carry originals, photocopies of their identity, address proofs and passport-size photos.

Step 3: You have to pay a nominal fee ranging between ₹100 and ₹.250 for registration of the relinquishment deed.

Step 4: If the Sub-Registrar finds the details provided in the document and the proofs to be valid, they will create a registered relinquishment deed within a week. You can then visit the office and collect your deed.

Conclusion

A relinquishment deeds is necessary when a co-owner wishes to release or transfer their part to another owner. After reading the information above, you should now understand what is a relinquishment deed, how to prepare one, and how to format one. Vakilsearch offers an easy solution for drafting your relinquishment deed. We will deliver the initial draft within 3-4 working days. Once you share the required details, our dedicated lawyers promptly work to cater to the specific needs. Our team also provides two subsequent iterations, tailored to your schedule, following the delivery of the first draft.

Frequently Asked Questions

What is the time limit for revoking a relinquishment deed?

The time limit for revoking a relinquishment deed is typically within three years from the date of conferring the rights.

In which kind of property can a relinquishment deed possibly be done?

A relinquishment deed can be done for any kind of property, including land, buildings, or other assets.

Who can relinquish their share in a property?

Any co-owner or heir of a property can voluntarily relinquish their share in it.

Is it possible to revoke a relinquishment deed?

Revoking a relinquishment deed becomes challenging after the specified time limit, and legal recourse may be required.

What are the grounds on which a person can revoke a relinquishment deed?

A person can potentially revoke a relinquishment deed on grounds such as fraud, undue influence, coercion, or misrepresentation in the act.

Which is better: relinquishment deed or gift deed?

Both relinquishment deeds and gift deeds serve different purposes. A relinquishment deed transfers one's share in a property to another co-owner, ensuring clarity in ownership. A gift deed transfers ownership without monetary exchange, typically between family members, but may have tax implications. The choice depends on individual circumstances and legal advice.

What happens after relinquishment deed?

After a relinquishment deed is executed, the relinquishing party officially gives up their claim or share in a property, transferring it to another co-owner. This clarifies ownership and can prevent disputes in the future. The relinquished share becomes the sole property of the remaining co-owners

What is the stamp duty on a relinquishment deed?

Stamp duty on a relinquishment deed varies based on the state and the value of the relinquished share. It's typically calculated as a percentage of the market value of the relinquished share, with rates varying across different states in India. Consult our legal experts for accurate prices.

Is relinquishment transfer of property taxable?

The relinquishment transfer of property itself is not taxable, as it involves giving up one's share voluntarily without monetary exchange. However, capital gains tax may apply if the relinquished share has appreciated in value since acquisition, depending on the specific circumstances and tax regulations.

Is relinquishment deed proof of ownership?

A relinquishment deed serves as evidence of the transfer of ownership rights from one party to another. Legally documents the voluntary surrender of one's share in a property, ensuring clarity and preventing disputes regarding ownership in the future.

What are the benefits of a relinquishment deed?

Benefits of a relinquishment deed include clarifying ownership rights, preventing future disputes among co-owners, and simplifying property division. It facilitates smoother property transactions, ensures legal compliance, and can help maintain family harmony by providing a clear framework for property distribution among co-owners.

Can a relinquishment deed be cancelled?

Yes, a relinquishment deed can be cancelled through a legal process if both parties involved agree to revoke it. The cancellation typically requires mutual consent and may involve legal procedures such as filing a petition in court to nullify the deed.

What is a relinquishment deed by legal heirs?

A relinquishment deed by legal heirs occurs when heirs voluntarily surrender their rights to inherit a deceased person's property. It is a legal document signed by heirs, relinquishing their entitlement to the deceased's estate, often done to simplify property distribution or avoid disputes among heirs.

Is relinquishment deed required in case of registered will?

A relinquishment deed may not be required if a registered will exists, as the will typically dictates the distribution of the deceased's property. However, if the co-owners wish to amend the distribution outlined in the will or if there are disputes, a relinquishment deed may be necessary to clarify ownership rights and facilitate property transfer.

Helpful Links