Choosing a skilful accountant is important for a firm. But many often, companies neglect this part of the organisation. This article provide the necessary information on what is accounting, states what potential loss you can suffer by eliminating accounting and why it is important?

A company or a business that grows to a certain level where the operations can’t be performed with the owner’s finance alone. Thus some sort of funding is always needed for the businesses that want to scale them, and that is where the importance of knowing the basics of accounting, including what is accounting comes into play. The person who invests their money or gives funding is an Investor.

So long story short, investors require proof of the company’s prior performance to determine if the business is investable. Thus, without accounting, it wouldn’t be possible to represent the stats and company data.

From the above example, it is quite clear how the accounting department of a firm can play a crucial in the success of the company. Before upgrading or hiring an accounts team, it is necessary to know what accounting is and its benefits?

What Is Accounting?

Accounting, in general, it is referred to as managing and monitoring a company’s financial information and data. The ultimate goal of accounting is to conclude to report the profits and losses, total cash flow and performance of the company in a financial year.

It is important to summarise the data and analyse it. This way, a meaningful piece of information can be presented to stakeholders and investors. Also, it is useful to provide the government with the right amount of tax. Accounting is a summary of transactions that the company had in past periods.

Apart from that, accounting is compulsory for every size of business. These facts and data collected after accounting can be used to take future decisions on behalf of analytics and trends. Moreover, cost planning of new projects and scaling the company’s economic achievement are other reasons accounting should be performed in every company.

As in any other field, accounting also has two employment types. The ‘Bookkeeper’ and Certified Public Accountant. Bookkeepers are usually called to fix domestic financial problems or microbusiness accounts. At the same time, Certified Public Administration (CPA) are highly trained to work under load and pressure. Additionally, they are taught to examine, solve and conclude financial achievement and target of the company.

How Does Accounting Works?

Accounting ratio is an essential aspect of any business operation, regardless of its size. It is a process that involves the recording, summarizing, analyzing, and reporting of financial transactions that occur within an organization. In smaller businesses, a bookkeeper or accountant may handle the accounting tasks, whereas in larger organizations, there may be a team of people working in the finance department to handle it.

There are different types of accounting, such as cost accounting, financial accounting, and managerial accounting, which serve various purposes. Cost accounting focuses on the costs associated with production, while financial accounting deals with the preparation of financial statements that provide an overview of an organization’s financial status and cash flows over a specific period. Managerial accounting is used for internal purposes, like decision-making and forecasting.

Financial statements are critical to accounting as they provide a summary of an organization’s operations and financial performance. These statements are compiled from hundreds of individual financial transactions, and they serve as short reports that can provide useful insights into an organization’s financial health.

To become a qualified accountant, one must undergo years of schooling, rigorous testing, and real-world experience. In the United States, a bookkeeper can handle simple accounting tasks, while more complex tasks may require additional qualifications like the CMA or CPA. In Canada, the CPA manages complex tasks, while in India, the CA (Chartered Accountant) is the recognized qualification for accountants. Becoming a CA requires passing a competitive exam, and CAs are considered knowledgeable sources for tax and accounting-related queries.

Types Of Accounting

Accounting-Types

1) Financial Accounting

This mode includes monetary transactions and the generation of annual financial statements. The conclusion of the accounting is then presented on the balance sheet, the income statement, and the cash flow statement. These are complex data and require a professional CPA to handle the case. These CPA has a great team of auditors to perform the tasks more efficiently.

As already mentioned, stakeholders and investors have the full right to track the financial progress of the business, which is the importance. Financial accounting also helps to retrieve the data regarding progress. For this, some principles and standards are followed; International Financial Reporting Standard is one of them.

2) Cost Accounting

Cost accounting is an essential aspect of business decision-making that takes into account all costs involved in producing a product. Cost accountants provide valuable insights into the different costs of production, which helps relevant managers determine the viability of a product and improve their costing decisions.

By analyzing the costs of production, cost accountants help managers determine the most cost-effective approach to producing a product. This information is crucial in making pricing decisions and helps managers determine the appropriate level of production to maximize profits.

Cost accounting also helps identify areas where costs can be reduced, such as by implementing new cost-saving measures or by reducing waste. By providing insights into the costs associated with each aspect of production, this helps organizations optimize their operations and make informed decisions that lead to increased profitability.

3) Managerial Accounting

Once all the data is retrieved from the records, these are then presented in a systematic manner using Managerial Accounting. This means setting the data so useful information can be derived from it. Thus, the main goal in such accounting is to provide reports, charts, graphs, etc., to the management team. Later, these can be used to make decisions, prepare strategies, and other tactical planning for the next period.

This branch of accounting holds great importance to the company as it can be used as a tool to enhance efficiency. Moreover, studying the data can help back the decision and formulate a more reliable projection. One such example of Managerial accounting is cost accounting, in which an in-depth analysis of expenses is done to reduce costs while keeping the same quality.

Accounting – Standards to be Followed

Adhering to specific conditions and regulations is crucial in ensuring accurate financial reporting. In the United States, accountants generally follow the Generally Accepted Accounting Principles (GAAP) when preparing financial statements. The GAAP is a set of guidelines and standards designed to make it easier for businesses to compare and share their financial reports.

In most other countries, the International Financial Reporting Standards (IFRS) developed by the International Accounting Standards Board is used.

The primary responsibility of an accountant is to help businesses maintain accurate financial records. Accountants record and summarize all financial transactions in various financial statements, such as balance sheets, income statements, and cash flow statements. These financial statements provide an overview of the company’s financial status and performance over a specific period.

In addition to preparing financial statements, accountants are responsible for analyzing financial data and preparing actionable reports for top management. They help managers make informed business decisions by providing insights into the financial health of the organization, identifying areas where costs can be reduced, and recommending strategies to improve profitability.

Key Things that Accounting Helps With

Accounting is a crucial aspect of any business, and there are seven key things that an accounting department must do exceptionally well. These include managing accounts receivable and payable, handling payroll, efficiently managing inventory, creating and sticking to a budget, preparing accurate reports and financial statements, ensuring legal compliance and financial control, and keeping precise records.

Ledger – Meaning

One of the essential tools used in accounting is a ledger. A ledger is a book of accounts that contains a summarized and categorized record of financial transactions. It records these transactions in the form of debits and credits, and it is often referred to as the second entry book. The information contained in a ledger is used to prepare financial statements.

Basics of Accounting

The basics of accounting involve monitoring and keeping track of money flowing in and out of a business. It is essential to evaluate, summarize, and report on these transactions to regulators, watchdog groups, and tax collection agencies accurately. An accounting journal is a comprehensive record that documents how a business handles its finances. It is also known as the book of original entry because it is the first place where all transactions are recorded and this is helpful in keeping track on the money.

Benefits Of Accounting

1) Enables Analyzing of Records

To analyze or inspect a company’s performance, it is necessary to have accurate and appropriately calculated records. This comparable information can be a great source for determining weak points and finding room for improvements. On the other hand, helping with decision-making remains an enduring benefit.

2) Extracts Results

Results or any proof of performance are compulsory for the organization. It motivates the employee to push their limit and attracts investors. A good performance report derived using accounting improves the firm’s credibility and smoothens the process of borrowing or taking a loan. At the same time, an unsatisfactory report can highlight the sector that needs more attention.

3) Proof Of Legal Functioning

Providing legal accounting reports to Government bodies is the rule that every organisation having financial transactions should follow. this is, thus, required to prepare these files and calculate the total tax to be paid. Moreover, authorities also used these reports to know the total value of the company, its net income, any malpractices performed by the organisation etc. Not submitting these legal documents, GST returns, or filing may cause trouble.

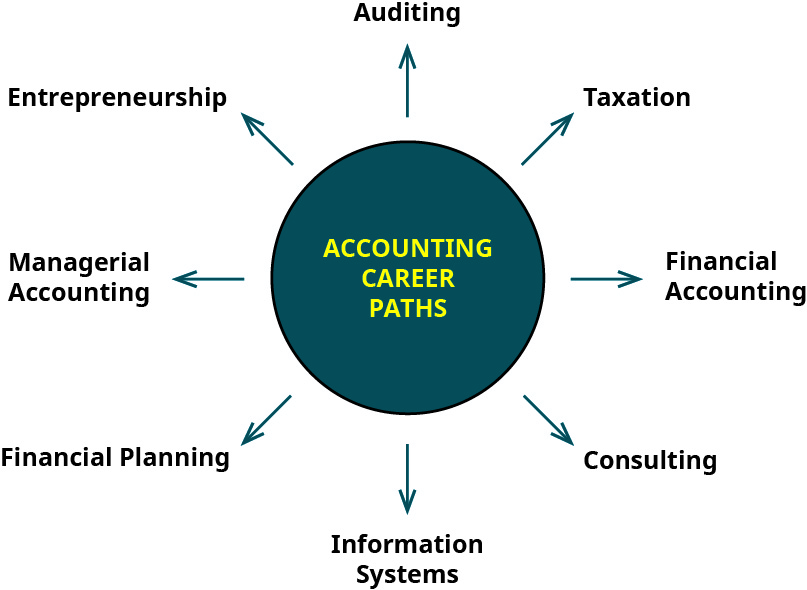

Career Path

From the above discussion, it is quite clear that the significance of accounting and an accountant in a legal firm is huge. Without these saved records, imagining a company is next to impossible. The role of accountants is of great responsibility. They have to perform all the necessary calculations and create reports accordingly.

While MSMEs hire only one or two accountants, business giants have a whole department that requires a complete building floor. One can estimate how important it is to have a skillful accountant. Their major roles and duties include bookkeeping, tax planning, auditing, etc.

In India, there is a huge demand for accountants. It is believed to be a prestigious job. Accountants are counted as the highest paying professionals. With the increase of firms and startups and with the increase is awareness about what is accounting, the demand for qualified accountants and CAs (Charted Accountants) is increasing.

But, of course, being a Chartered Accountant is not a cakewalk. An aspirant must spend 4-6 years practising and studying, and the success rate is still uncertain. But working and struggling for this position is worth it. A recognised CA can earn up to ₹ 6-7 LPA initially, excluding the Bonus, incentive and commissions. In comparison, the annual pay outside India can even go up to ₹ 75 LPA.

Various Jobs

Auditor

They track accounts and insure information is recorded directly.

Forensic Accountant

Forensic accountants probe fiscal information to find areas of fraud or misconduct, generally for law enforcement agencies.

Duty Accountant

Duty accountants prepare and file duty attestation for a business and insure it’s following all original, state, and civil regulations.

Budget Analyst

A budget critic, or cost critic, reviews a company’s spending habits and determines ways to make the budget more effective. To be a better budget analyst, one needs to be aware of what is accounting and its types.

Controller or Financial Manager

Controller or Financial Manager regulators or fiscal directors are high- ranked finance professionals who develop long- term fiscal plans and insure a company stays in good fiscal health.

Chief Financial Officer

The principal fiscal officer( CFO) is the top- ranked person regarding a company’s finances, so they oversee finances for the entire association and help other directors make opinions.

Accounting Industries

Practically every organization needs to know what is accounting. Accountants, and other related professions within the calculating world, can work in nearly any industry, including:

- Banking

- Health care

- Technology

- Transportation

- Retail

- Nonprofit

- Government (local, state, and federal)

Wealth Management

Wealth operation is a branch of fiscal services dealing with the investment requirements of rich guests.

Fiscal Statements

The fiscal statements give a summary of the accounts of a business enterprise, the balance distance reflecting means and arrears, and the income statement showing the results of operations during a certain period. These fiscal statements could be better understood when one is clear on basics of accounting, including what is accounting.

Financial Analysis

Financial analysis is a procedure which is used to estimate businesses, budgets, systems, and other deals related to finance for determining their felicity and performance.

Commercial Finance

An organisation needs finance for its colorful conditioning, operations and systems.

Financial Ratios

Financial rates are connections determined from a company’s fiscal information and used for comparison purposes.

Conclusion

So these were some important benefits from owners’, creditors’ and lenders’ perspectives, which verifies the importance. This makes hiring an accountant a definite task; for an accountant, polishing their skills and improving expertise is the only key to achieving big.

We hope that this article answered your question, what is accounting in detail. Apart from this, law advice and service are also required in an organisation. Vakilsearch is a website that helps you meet all your law-related requirements and connects you with professional and experienced lawyers. Their services are highly affordable and come with active customer support. To check out more, login into our website or mobile application to make the best investment of your life.

Also Read: