This post addresses the most common reasons for a cheque bounce in India, as well as the consequences associated with the same. Continue reading to learn more.

Cheque bounce is a violation of the 1881 Negotiable Instruments Act under Section 138, which entails a fine of up to double the amount of the cheque, two years in jail, or both. When the client presents the cheque to the bank for a claim, the bank rejects it as unpaid and displays a warning suggesting financial troubles. As a result, it is known as a bounced check. And let is discuss What Happens if a Cheque Bounces?

A cheque may bounce for a variety of reasons, but it’s an Act violation if the cheque fails due to insufficient funds in the drawer’s account. The financial institution must decline the reimbursement cheque and issue a return letter of memorandum citing inadequate revenue as the reason for the refusal. In this case, the payee might issue a cheque bounce notification to the drawer of the cheque, asking for payment of the cheque amount.

Do you know?

Cheque bounce is stated to be one of the most prevalent financial offences in India, and it can have severe implications for the issuer, such as a bank penalty, a bad influence on CIBIL Score, the filing of criminal and civil accusations by the aggrieved party and several other risks.

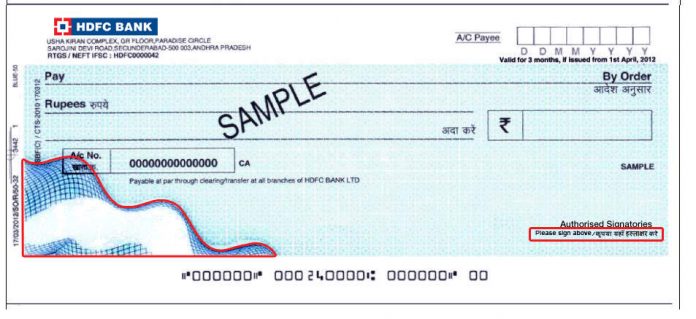

Cheque: What Is It?

Well, a cheque is basically a bill of exchange wherein one party asks the bank to transfer money to the bank account of another party. The 1881 Negotiable Instruments Act protects it as a negotiable instrument.

Cheque Dishonoured or Cheque Bounce

A “cheque bounce” occurs when a bank is unable to process a cheque for a variety of reasons. Before we go into the fines that most Indian banks impose, let’s take a look at the most common reasons for cheque bounce case and why you must never pen a cheque casually.

What Causes Cheque Bounce?

Listed below are some of the most common reasons for cheque bounce in India:

- Insufficient Account Balance

If the drawing party’s current balance is insufficient to cover the cheque’s pay, the financial institution should reject the cheque. The financial institution must transfer it to the payee together with a memorandum noting that the credit limit of the drawer is inadequate to cover the cheque payment.

- Overlapping

The cheque is void or invalid if the signature of the drawer, the cheque sum, or any other indication has been changed or modified.

- Expired Cheque Validity

The drawing party should resubmit for payment three months after jotting the cheque, and the cheque will be invalid if not submitted to the financial institution within 3 months. When a bank receives an expired cheque, it returns it to the sender.

- Contrasting Signature

If the drawer’s signature is non-existent or unclear, or if it doesn’t match the database of the bank, the cheque might fail.

- Distorted Cheque

A cheque may bounce if it is warped or destroyed, the information is illegible, and there are stains or marks on it.

- Mismatch of Numbers and Texts

Well, the cheque will be refused if the numbers and texts on the cheque do not correspond.

Other possibilities include a problem with the date of the cheque, an error in the amount or account number, an expired cheque, or the account of the drawer being locked. Other concerns may include payment issues. The company’s seed isn’t accessible on the cheque, suspicious cheque, drawers’ insanity or death, scribbling on the cheque, and so on.

What Happens if a Cheque Bounce or Is Dishonoured?

The issuer will be liable for the penalty on the dishonoured cheque, based on the reason for the bounce. Dishonouring a cheque owing to insufficient funds is a criminal offence under the 1881 Negotiable Instruments Act. Charges for issuing a cheque against a bank account with insufficient money must be paid by the payer.

The payee has 3 months from the date of payment to sue the payer or enable the payer in order to reissue a cheque. For granting a dishonourable check, the payer may face a maximum of two years in jail. Banks will also charge you a penalty fee if a cheque is returned to you unpaid. The penalty is different depending on the bank. For the sums of the issued dishonoured check, banks may have multiple penalty categories.

The Latest Cheque Bounce Rule

According to an article issued by the RBI (Reserve Bank of India) at the beginning of August 2021, customers whose financial activities rely heavily on cheques or who intend to use cheques would be obliged to maintain a minimum bank balance. If this minimum balance is not maintained, the cheque will bounce. Furthermore, the client who gave the cheque may face monetary penalties. Aside from these enhancements, the RBI announced that the NACH (National Automated Clearing House) will be operating 24/7.

These reforms affect all banks, whether private or national. They made regular changes in order to smooth out and expedite the clearance of cheques. Since the new rule requires the National Automated Clearing House to function seven days a week, Sundays will be considered a workday when the institution submits and clears a cheque.

Legal Ramifications of Cheque Bounce in India

Well, if the payee decides to litigate the drawing party has the chance to pay the amount right away. To accomplish this, the payee must wait 30 days after receiving a cheque return notice from the financial institution. The payee should send a notice to the drawing party from the date of payment, stating that the amount should be paid to the payee within fifteen days of getting the notification.

If the drawing party is unable to pay the money to the payee within a month of receiving the notification, the payee has the complete right to file a criminal complaint under the 1881 Negotiable Instruments Act. Nonetheless, the payee should finish the accusation or inquiry within 30 days of the expiration notice period.

Cheque Bounce Remedies

The following are some of the proven remedies for cheque bounce in India:

- Cheque Resubmission

When a cheque fails to owe erasure, inconsistent signatures, a discrepancy between the numerical numbers and the text of the paid amount, or a damaged cheque, the payee might request that the drawer reprint the cheque. Assume the drawer refuses to accept another cheque. Instead of a cheque bounce, the payee can take legal action or file criminal charges against the drawer to retrieve the money owed to her or him.

- Cheque Bounce Notice

The 1881 Negotiable Instruments Act (under Section 138) requires the payee to provide the notification.

A cheque bounce is issued under the 1881 Negotiable Instruments Act when a cheque fails because of insufficient funds in the drawers’ fund to pay the cheque generous amounts. If a cheque bounces for any reason other than a lack of cash, no warning is issued, and the payee should request that the cheque be reprinted.

What Should You Do after a Notice Regarding Cheque Bounce is Issued?

Within 15 days of receiving the cheque bounce notification, the payee may launch a lawsuit against the drawing party. The payee is required to file a grievance under the 1881 Negotiable Instruments Act (under Section 138). Cheque bounce is an out-and-out crime that the payee may pursue under the Act. The payee has a month from the notification release date to file or register a complaint with the Magistrate concerning the cheque bounce.

Conclusion

Cheque bounce cases have surged drastically, as per the Supreme Court of India, with a maximum of 40 lakh cases pending before the courts. However, the changes introduced in 2015 and 2018 included a pledge to expedite the resolution of cases and guarantee that victims receive reparation.

The improvements have increased system transparency by forbidding people from falling behind on their payments. As a consequence, because customers now feel safer, the Section 138 procedure has benefited the facilitation of business transactions. It’s also helped maintain the current financial system.

To prevent receiving a legal notice, keep the following primary reasons for a cheque bounce into account. Nonetheless, if you’re in legal difficulties as a result of a cheque bounce case, you may seek the assistance of a legal expert of Vakilsearch to smooth out the process. For more information regarding cheque bounce, you can contact us at any time of the day.

FAQs

What is the punishment for a bounced cheque?

In India, a bounced cheque can lead to legal consequences. As per Section 138 of the Negotiable Instruments Act, the punishment includes imprisonment for up to two years or a fine, or both. The payee has the right to initiate legal proceedings against the drawer for the dishonoured cheque.

Who gets charged if a check bounces?

The person who issues the cheque and is responsible for its validity, known as the drawer, faces charges when a cheque bounces. It is the drawer's duty to ensure sufficient funds are available and that the cheque complies with legal requirements to avoid legal consequences.

Why is cheque bounce a crime?

Cheque bounce is considered a crime because it involves a breach of trust and affects the smooth functioning of financial transactions. Issuing a cheque without adequate funds undermines the credibility of the payment system, and legal consequences are in place to deter such practices and safeguard the interests of the payee.

How many cheque bounces are allowed?

There is no specific limit on the number of cheque bounces allowed. However, each instance of a bounced cheque can lead to legal action under Section 138 of the Negotiable Instruments Act. It is crucial for individuals and businesses to exercise diligence in ensuring fund availability for issued cheques.

How can I settle my cheque bounce case in India?

Settling a cheque bounce case in India typically involves negotiating with the payee to make the necessary payment, including the dishonoured amount and any additional penalties. If a settlement is reached, the payee can withdraw the legal proceedings. Alternatively, the drawer can contest the case in court.

How much time does it take to solve a cheque bounce case?

The time it takes to resolve a cheque bounce case in India varies. Factors such as court backlog, legal complexities, and the willingness of parties to settle can influence the duration. Generally, it is advisable to address the matter promptly through negotiation or legal channels to expedite the resolution process.