Tamil Nadu Registration Department - In order to prevent the registration of lands with fake documents, the Tamil Nadu government has recently initiated the pre-mutation scrutiny of land records prior to the registration of landed properties that do not have 'online pattas'. In accordance with the new system, landowners who have not obtained online pattas must obtain a pre-mutation sketch before registering their property.

Latest Updates on Feb 2025:

TNREGINET Last updates were usually previously provided in 2025. The automatic transfer of patta ownership for properties without subdivision changes is now instantaneous, thanks to the integration of registration and revenue portals. When a property is purchased, the title is updated immediately on the online patta portal upon registration, and buyers can download the patta within minutes from the e-services website.

New land Owners’ names appear instantly on the encumbrance certificate, which can be viewed on the registration portal. Instant updates occur only when the seller has an individual patta and there is no change in the extent of the land. About 85,000 documents are registered monthly, with 33,000 not requiring subdivision.

Text alerts are sent to buyers during registration and upon title transfer. If the seller doesn’t have a patta, buyers can apply for one via e-Seva centers, which are processed within 15 days. For subdivision-related patta requests, the process is expected to be completed in 30 days.

What is TNREGI NET?

This initiative benefits buyers of properties like apartments or land from approved layouts, where no subdivision occurs. The system, fully implemented statewide, allows quicker title updates compared to the previous process, which required revenue authority approval. The patta document includes a QR code for verification and is legally valid without official attestation.

The Government of Tamil Nadu has developed an innovative online platform, TNREGI NET, designed to streamline access to government records and simplify property registration processes. As an initiative by the Tamil Nadu Registration Department, this online portal caters to property owners and citizens seeking efficient management of their property details.

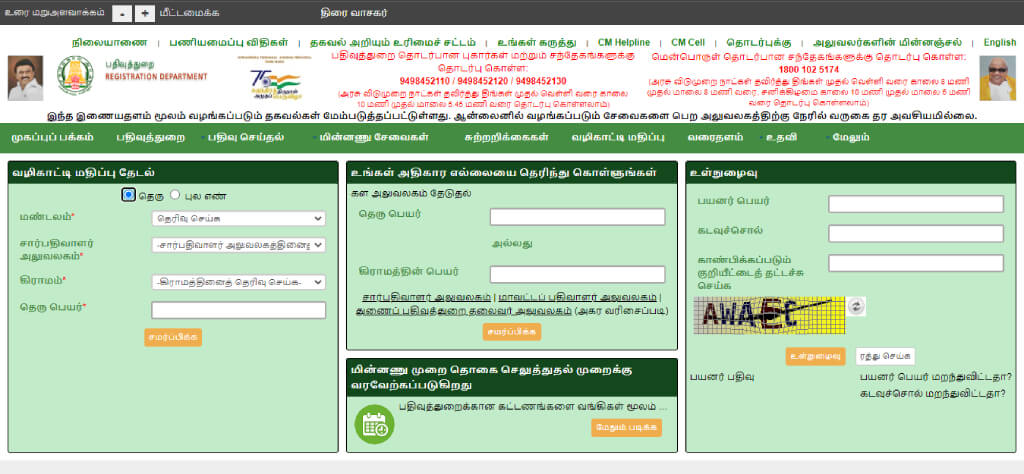

TNREGI NET Portal |

|

| Name Of Portal | TNREGINET IGRS (Inspector General Of Registration) |

| Portal For | TNREGINET Portal For Land, and Marriage Registration |

| Launched By | Department Of Registration |

| Beneficiaries | Residents Of Tamil Nadu |

| Major Benefit | Various Online Services |

| Portal Objective | Providing Online Services |

| Portal Under | State Government |

| Name Of State | Tamil Nadu |

| Post Category | Portal / Yojana / Scheme |

| Official Website | https://tnreginet.gov.in |

Features and Services on TNREGINET

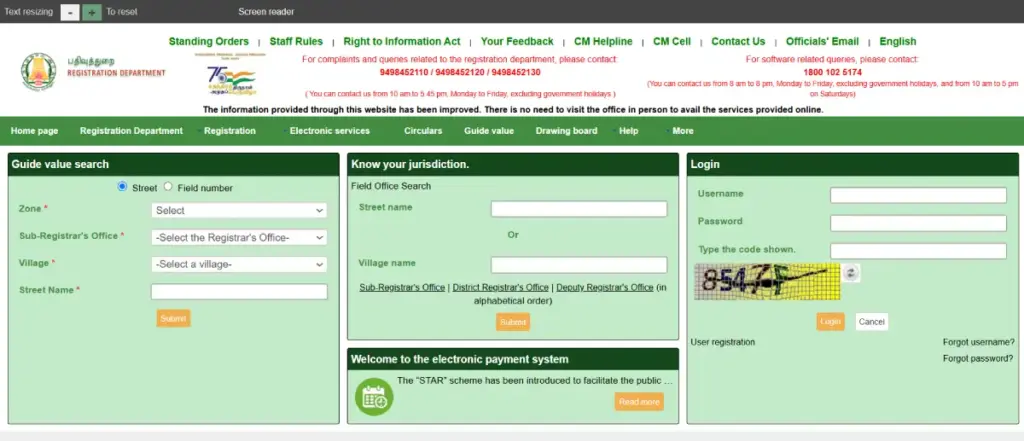

The TNREGI NET portal is a user-friendly resource for residents of Tamil Nadu, offering various services such as property registration, View Patta, and checking Encumbrance Certificate Online. By providing easy access to important documents like property documents and enabling users to verify their property ownership, TNREGINET ensures transparency and efficiency.

Key Functionalities Include:

- TNREGI NET Login: A simple process to access personalized dashboards for managing property-related information.

- Check Guideline Value: Enables users to determine the Tamil Nadu guideline value of land and properties.

- Apply Online: Facilitates applications for services like View EC or property valuation.

TNREGINET Accessibility and Navigation

Designed with inclusivity in mind, the portal includes options for High Contrast mode, Normal Contrast—Selected, and Font Size Decrease, ensuring an accessible interface for all users. The intuitive menu toggle further enhances the user experience.

Property Transactions and Legal Support

TNREGI NET – For seamless property transactions, users can rely on the portal to fetch a reference number, verify a document number, and check registration fees or loan amounts with tools like the Home Loan EMI Calculator. Additionally, the platform offers insights into legal advice, ensuring compliance with the registration process managed by the Sub Registrar Office.

TNREGI NET: Enhanced Utility and Additional Features

Users can retrieve contact details of the Inspector General of Registration, navigate to the sub-registrar’s office, and verify survey details or a Sub-Division Number effortlessly. Links to social media ensure that updates and additional information are readily available, making TNREGINET a comprehensive solution for property owners.

TNREGI NET: Empowering Users with Financial Clarity

The EMI Calculator and tools for calculating maximum of Rs help users plan their financial commitments effectively. This aids in determining feasible loan amounts or understanding Building Value, ensuring an informed approach to property investments.

TNREGI NET Portal Services 2025

There are many services available on the TNREGINET portal. These include:

- Access to (villangam)

- Stamp duty valuation

- Application tracking status

- Landowner details

- Jurisdiction information

- Guideline Value

- Tamil Nadu e-Distinct Services

- Social Document Application

- Application for Online Certified Documents

- Application for Online Encumbrance Certificate (EC)

- TNREGINET Guideline Value View

- Removal of Guideline Value Online

- Birth Certificate

- Marriage Certificate

- Death Certificate

- Land Registration

- Check Property Ownership Details in India

- Business Registration

- Checking TNREGINET EC Registration

- Property Tax Payment

- Patta and Chitta Transfers

- Certified Copy of Documents

- Document Verification

- Registration Fee Calculator

- Online Mutation of Land Records

- Document Retrieval

- Property Valuation

- Land Ownership Certificate

- Property Title Search

- Rural Land Record Services

- Online Filing of Sale Deed

- Non-Encumbrance Certificate

- Fee Payment for Registration

- Land Acquisition Services

- E-Stamping Services

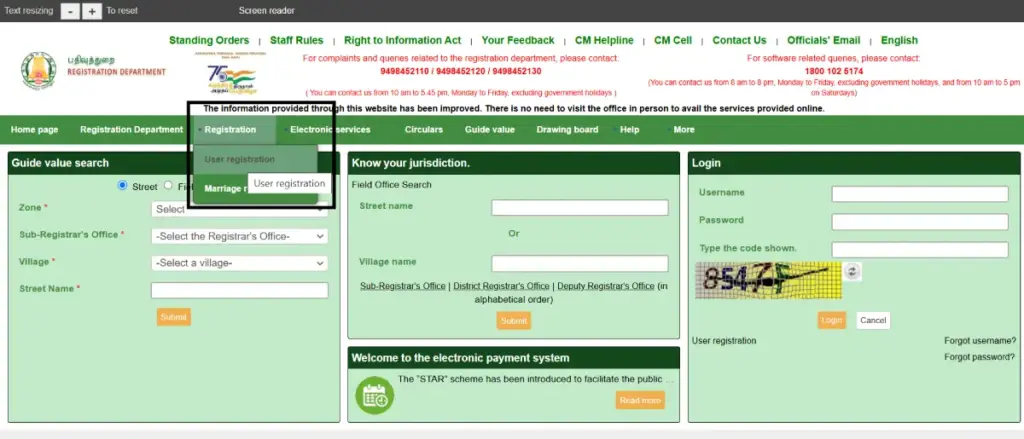

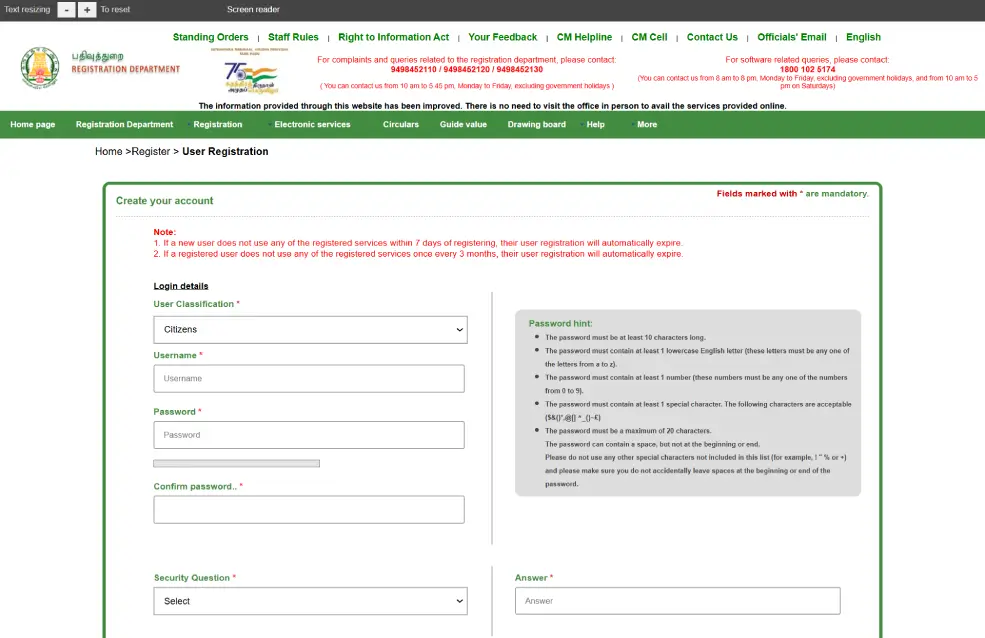

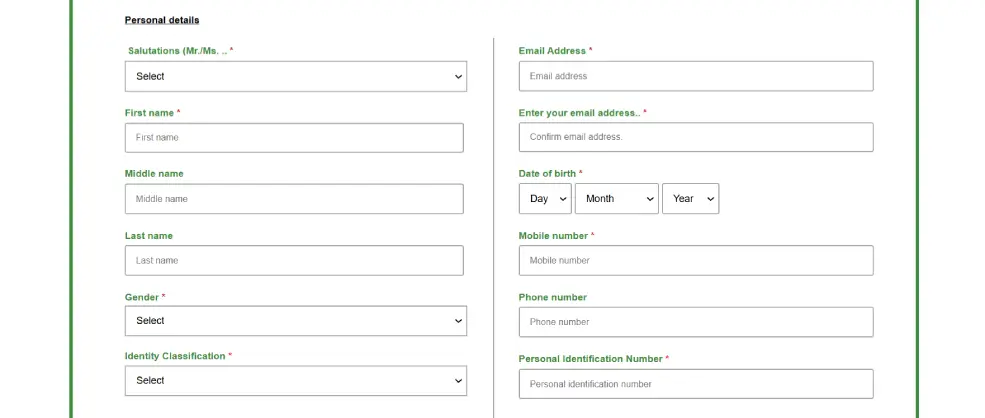

How to Register at TNREGI NET?

Follow these Steps to Register as a User on TNREGI NET

- Visit TNREGINET’s official website

- Click on ‘Registration’ and then choose ‘User Registration’.

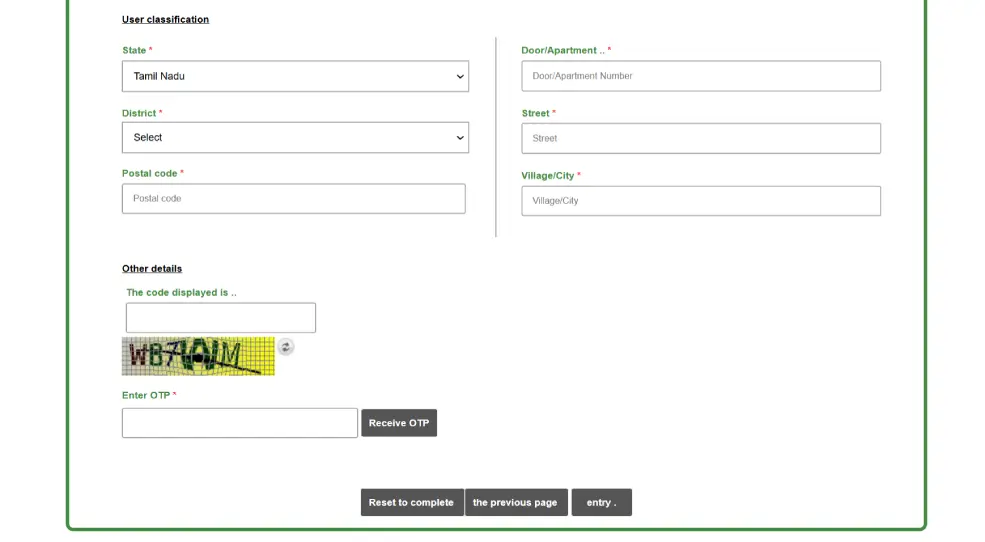

- Enter the required information, including your username, account type and password. Confirm the password, and choose a security question.

- Name, Gender, Identification Number/Type, DOB etc. Email and Mobile no

- Enter your address, fill in the captcha code and click on Send OTP to the phone number.

- You will then need to enter the OTP and click ‘Complete Registration’.

After this, your user registration is successfully created. You can next select “Login” to enter the TNREGINET portal.

TNREGI NET Document Writer Registration

Please provide us with additional registration information about your business.

- Step 1: Choose “Document Writer” as a user type and complete all the blank required/testify fields.

- STEP 2: Address your document writing services (business address)

- Step 3: Fill out the registration details, such as the notary district and sub-registrar office associated. Fill in your license type and number.

- Step 4: Fill in the captcha code that appears on-screen and press ‘Get OTP.’ Now just type the OTP sent to your registered mobile number.

- Step 5: Press on ‘complete registration.’

Land (or) Property Registration in TNREGI NET 2025

- Valuation of Stamp: Through the TNREGINET portal, you can check online stamp duty and registration charges valuation. Just put in the basic details of the property you are interested in, and your valuation will be delivered on screen. It helps to calculate the value of a building by entering details like type, region, calculation period, insertion unit name/area/building age/floor, name, total area, and most importantly, whether amenities are available or not, etc.

- Encumbrance Certificate (EC): The encumbrance status of your property can be generated by applying online. Go to the official site (choose the relevant section). Type the zone, district, and sub-registrar office name(s) in the respective fields as well as the EC start date and end date and other survey details, if any.

- New Application: You must be logged in to the TNREGI NET portal to do New Registration. You can create a draft deed abstract, an encumbrance certificate, and certified copies of title deeds when you are logged in. This makes the process easier to get property registration documents faster.

Documents needed for Property Registration in TNREGINET

- Encumbrance Certificate (EC)

- Original Documents with signatures of all parties involved in the property transaction

- Demand draft or challan of the registration fee and stamp duty charges based on the guideline value or property valuation

- Property Card

- Identification proof of the buyer, seller, and witnesses involved in the property transaction

- Power of attorney, if applicable

- PAN Card

- Aadhaar Card

- Proof of Address and identification to present at the registrar’s office.

Advantages of TNREGINET for TN Property Registration

Below are the advantages of using TNREGI NET for Tamil Nadu property registration:

- TNREGINET simplifies the property registration process to make it easy for people to use.

- You don’t have to go to the sub-registrar’s office to complete your registration tasks.

- It promotes digitization by using technologies like web cameras, biometrics, and retinal recognition, which make transactions more secure and efficient.

- Through the portal, users can conduct real-time market valuations of properties, making it easier to make informed decisions.

- Monitoring registration progress and verifying information submitted is easy with TNREGINET’s application tracking tools.

- You can get real-time updates on your applications via SMS, enhancing transparency and reducing uncertainty.

- It’s got an integrated accounting and reporting system, so you can keep accurate records and manage your money transparently.

TNREGI NET Property Registration Fees in Tamil Nadu

Land registration fees in Tamil Nadu vary by document type and transaction, ranging from fixed amounts like ₹20 for a selling agreement to percentages of property values and loan amounts, ensuring comprehensive financial transparency in property transactions.

| Document Classification | Stamp Duty Charges | Registration Fee |

| Sale deed document or purchase document | 7% of market value | 4% of market value |

| Donation document | 7% of market value | 4% of market value |

| Transaction | 7% of maximum property value | 4% of maximum property value |

| Compensation mortgage | 1% (for loan amount) maximum ₹40,000 | 1% (for loan amount) maximum ₹10,000 |

| Mortgage (Independent) | 4% (for loan amount) | 1% (for loan amount) up to a maximum of ₹2,00,000 |

| Selling agreement | ₹20 | 1% (upfront) of the transaction amount if independent |

| Building contract agreement | 1% for the contract amount or specified amount in the document | 1% for the contract amount or specified amount in the document |

| Cancellation document | ₹50 | ₹50 |

| Partition documents between family members | 1% of market value for each component (maximum ₹25,000) | 1% of market value per component (maximum ₹4,000) |

| Partition documents amongst non-family members | 4% of the market value of the split component | 1% of the market value of the split component |

| Document of public authority for the sale of public power | ₹100 | ₹10,000 |

| Document of public authority for the sale (per family member) | ₹100 | ₹1,000 |

| Document of public authority (purposes other than sale) | ₹100 | ₹50 |

| Document of public authority (with transfer amount) | 4% per transaction | 1% of the transfer amount or ₹10,000, whichever is higher |

| Handing over of title documents | Maximum ₹30,000 for 0.5% loan amount | Maximum ₹6,000 for 1% loan amount |

| Release deed between family members | 1% of market value (maximum ₹25,000) | 1% of market value (maximum ₹4,000) |

| Release deed amongst non-family members | 7% of market value | 1% of market value |

| Leasing within 30 years | 1% for an additional lease amount | Maximum ₹20,000 for 1% lease amount |

| Leasing within 99 years | 4% for an additional lease amount | Maximum ₹20,000 for 1% lease amount |

| Leasing over 99 years | 7% for an additional lease amount | Maximum ₹20,000 for 1% lease amount |

| Document of trust (no immovable property) | ₹180 | 1% Corpus Fund |

TNREGI NET Encumbrance Certificate (EC)

In TNREGINET EC certificates, all required information regarding the property transaction initiated is included in order to ensure the property is free of encumbrances, whether financial or legal. A report will tell you if there are any mortgages or loans that haven’t been fully repaid. The certificate shows you’re not encumbered by anything, so you can relax.

Is TNREGINET EC Necessary for Loans?

Banks and financial institutions typically require a 10-15 year encumbrance when you apply for a home loan/loan against property, so it is very crucial to get the EC whereas keywords. This means that homebuyers are required to take an EC not just for them to get their legal title assured but also so they can secure the financing. It means free title/ownership confirmation and is compulsory for sellers and buyers in all real estate transactions. Another security from legal dues and marketable title guarantees that the property you bought is legally unbounded and can be sold.

TNREGI NET: Apply for EC Online in Tamil Nadu

- Visit TNREGINET.gov.in and log in with your username, password, and captcha.

- Select ‘Encumbrance Certificate’ > ‘Apply Online.’

- Complete the form, upload documents, and submit.

- Print the application for reference.

TNREGINET—EC View Online

Earlier, users could find encumbrance certificates or Villangam certificates under the ‘eServices’ section on tnreginet.gov.in. Yet, now, they must log in to access this option. You have two options for searching for an encumbrance certificate (EC): using the document number or house number. Before searching for the EC document on TNREGINET, make sure to have the zone details and district handles ready.

Follow these steps:

- Visit TNREGINET.gov.in and log in using your credentials.

- Click on ‘EC Search.’ There are two options available: ‘Document-wise’ and ‘EC.’

- If you choose the ‘EC’ option, provide the necessary information, such as district, zone, EC start date, sub-registrar office (SRO), village, EC end date, subdivision number, and survey number.

- If you choose the ‘Document-wise’ option, fill in information such as the document number, SRO, code, and year.

- Click on ‘EC Search,’ and you can view EC.

TNREGI NET Encumbrance Certificate Fees 2025

|

Type of Search |

Fees |

| E.C. Application Fee | Re.1/- |

| EC Search Fee for the one year | Rs.30/- |

| EC Search fee for every additional year | Rs. 10/- |

| Additional fees for the computerized period (from 1987) | Rs.100/- |

TNREGI NET 2025: Tamil Nadu Guideline Value

The TNREGI NET Guideline Value is the minimum value fixed by the government for property transactions to prevent under-reporting and tax evasion. It serves as the benchmark for calculating stamp duty and registration fees for properties. In Tamil Nadu, the guideline values are updated periodically to reflect market trends, with 2025 expected to see revised rates in alignment with real estate growth.

Importance of Guideline Value in Tamil Nadu

The TNREGI NET guideline value serves multiple purposes:

- Assists in evaluating the advantages and disadvantages of purchasing a house.

- It plays an important role in determining the registration and stamp duty charges. It also aids registration authorities and buyers in identifying instances of undervaluation in property transactions.

- It helps prevent fraud by enabling the tracking of individuals who try to evade registration charges, thereby reducing scams and corruption related to land transactions.

- It serves as an indicator for buyers to understand the value of land, allowing them to price their properties competitively.

How to Check TNREGI NET Guideline Value?

If you are looking to determine the guideline value for properties in Tamil Nadu using the TNREGINET portal, follow this updated step-by-step guide:

- Step 1: Visit the TNREGINET Portal

- Step 2: Select the Relevant Option

- Step 3: Provide Required Details

- Step 4: Click on ‘Search’

How to Check Jurisdiction for Guideline Value on TNREGINET?

Checking the jurisdiction for guideline value is another vital feature of the TNREGI NET portal. Here’s how you can do it:

- Step 1: Access the TNREGINET Portal

- Visit the official tnreginet.gov.in portal.

- Step 2: Navigate to the ‘Help’ Section

- On the homepage, click the ‘Help’ tab.

- Choose ‘Web Home Application Services’ from the dropdown menu.

- Step 3: Select ‘Know Your Jurisdiction’

- Click on the ‘Know Your Jurisdiction’ option.

- Step 4: Enter Location Details

- Enter the Street Name or Village Name in the Field Office Search section.

- Click ‘Search’.

- Step 5: View Jurisdiction Details

- The system will display details such as:

- District Name

- Zone

- Sub Registrar’s Office (SRO) Name and Address

- Sub Registrar’s Email Address

- The system will display details such as:

How to Calculate Building Value on TNREGINET?

The TNREGI NET portal offers a valuable tool for estimating a building’s value, utilising government-determined guideline values to assist users with property tax assessments. Its user-friendly design includes accessibility features like clear, step-by-step guidance, ensuring seamless navigation. The TNREGINET EC View feature further enhances efficiency by enabling quick verification of encumbrance certificates. With the integration of social media links, the portal keeps users informed and engaged, establishing itself as a benchmark for e-governance in Tamil Nadu.

- Step 1: Visit the Portal

- Open the official website: TNREGINET.gov.in.

- Step 2: Choose ‘Building Value Calculation’

- Select the ‘Building Value Calculation’ option under the ‘Services’ menu.

- Step 3: Fill in Required Information

- Provide details such as:

- Building’s age

- Property location

- Building size and type

- Provide details such as:

- Step 4: Submit and Calculate

- Click ‘Submit’ after filling in the details.

- The portal will calculate and display the estimated building value.

Important Note:

- The building value calculation provided by the portal is an estimate and may differ from the actual market value of the property.

- For legal transactions, always confirm details with the relevant authorities or through professional appraisals.

This user-friendly portal simplifies property-related queries, making processes more transparent and accessible to the public.

TNREGI NET Patta / Chitta 2025

- In the Tnreginet Registration system, Patta is a land record document. Tamil Nadu’s REGINET Patta Chitta is a land record. The TNREG Patta Chiita provides information on a property, such as the size of the land and the surrounding area, as well as proof of ownership. Owner’s name, address, and date of ownership.

- Patta: Pattas contain information about land ownership, acreage, location, and survey information. Before acquiring a property from the owner, Patta documentation must be verified. The seller must have a legal Patta for the land to have a clear title to the property. For a clear title, the buyer must transfer the Patta to his name at the Taluka office after acquiring the land.

- Chitta: According to Chitta, land ownership, size, and area are all pertinent details. The appropriate Village Administration Officer (VAO) and Taluka office issue an immovable property tax document. There are two types of land: Nanjai (wetland) and Punjai (dry land). Nanjai refers to land or regions with water bodies such as canals, rivers, ponds, etc. “Punjai” describes the relationship between smaller water bodies and the land.

How to Get Patta/Chitta Online on TNREGINET?

You cannot find Patta Chitta online on TNREGI NET. This portal specifically offers services related to searching guideline values, calculating stamp duty, and other property registration-related tasks.

TNREGI NET: Jurisdiction Check Process

REGINET (Tamil Nadu Real Estate Regulatory Authority Information Network) is an online portal that provides various real estate services in Tamil Nadu, India. One of the services provided on the portal is the jurisdiction check process, which allows users to check the jurisdiction of a specific property.

What Is the Process of Checking the TNREGINET Jurisdiction?

There are two main ways to check your jurisdiction on the TNREGI NET website:

- Using the “Know Your Jurisdiction” option:

- Head over to the TNREGINET website: [tnreginet.gov.in].

- Look for a section labeled “More,” “Help,” or “Portal Utility Services” on the homepage. This section usually houses various citizen services.

- Within that section, find the option titled “Know Your Jurisdiction” or something similar.

- Enter the name of your street or village in the designated field.

- Click “Search” or “Submit.”

- The website will then display the relevant jurisdiction details, including:

-

- District Name: This helps identify the broader geographical area.

- Zone: This provides a more specific location within the district.

- Sub-registrar Office (SRO) Name and Address: This is the crucial information, as the SRO is the government office responsible for land records in your area. They handle tasks like processing property registrations and issuing Encumbrance Certificates (ECs). The EC is a vital document that reveals any legal claims or encumbrances on a property.

- Sub-registrar’s Email Address (optional): This can be helpful for contacting the SRO directly if you have any questions.

Process: Search Birth and Death of the Person in TNREGINET

- Visit to TNREGI NET

- Click on More

- Navigate your search to drop-down menu

- Choose Birth/death

- Select your search type

- Fill in the certificate number, Child Name, Gender, Date of Birth, Father’s Name, Mother’s Name, and captcha code

- Hit the search button.

Conclusion

TNREGINET, an initiative by the Tamil Nadu Government, is a transformative platform designed to digitize and simplify property and land registration processes. By integrating services offered by the revenue department, the portal provides detailed information about property transactions, making it invaluable for individuals in well-developed residential areas and beyond.

Disclaimer

The information provided in this blog is intended solely for general informational purposes. While we strive to ensure the accuracy, reliability, and completeness of the content presented, no representations or warranties, express or implied, are made regarding its validity or applicability.

We expressly disclaim any liability for any loss, damage, or injury resulting from the use of or reliance on this information. This includes, but is not limited to, direct, indirect, incidental, consequential, or punitive damages.

Additionally, we reserve the right to update, modify, or remove any content at our discretion and without prior notice.

For advice tailored to your specific circumstances, we strongly encourage you to consult an expert. You can reach out to the professionals at Vakilsearch for expert guidance and personalized solutions.