Discover the pros and cons of investing in EPF, a low-risk, long-term savings scheme with guaranteed returns and tax benefits. Learn whether it's worth your money and how to make informed investment decisions.

The Employees’ Provident Fund (EPF) is a retirement savings scheme that is mandatory for employees working in India. Under this scheme, both the employer and employee make contributions towards the employee’s EPF account, which earns interest over time. While EPF offers several benefits, it also has its drawbacks. In this blog, we will explore the pros and cons of EPF and help you decide if it is worth your money.

What Is Employees’ Provident Fund (EPF)?

The Employees’ Provident Fund (EPF) is a social security scheme in India designed to provide retirement benefits to salaried employees. It’s a mandatory scheme for all establishments employing 20 or more employees. Here’s a breakdown of the critical aspects of EPF:

Contribution

- Both employer and employee contribute 12% of the employee’s basic salary and dearness allowance towards the EPF scheme.

- The employer’s contribution is further divided into:

- 8.33% towards the Employees’ Pension Scheme (EPS), providing a monthly pension upon retirement.

- 3.67% towards the employee’s EPF account.

Benefits

- Accumulation of Corpus: The contributions and accumulated interest build a corpus over the employee’s working life.

- Maturity Benefit: Upon retirement or when leaving the organization after completing ten years of service, the employee receives the accumulated corpus and interest.

- Partial Withdrawals: Partial withdrawals for certain specific reasons like medical emergencies, housing loan down payment, and children’s education are allowed under specific conditions.

- Life Insurance: The scheme offers life insurance coverage up to 15 times the monthly salary in case of the employee’s unfortunate demise during the service period.

Management

- The scheme is administered by the Employees’ Provident Fund Organisation (EPFO), a statutory body under the Ministry of Labour and Employment, Government of India.

- All employers covered under the scheme must register with the EPFO and maintain employee accounts for contributions and withdrawals.

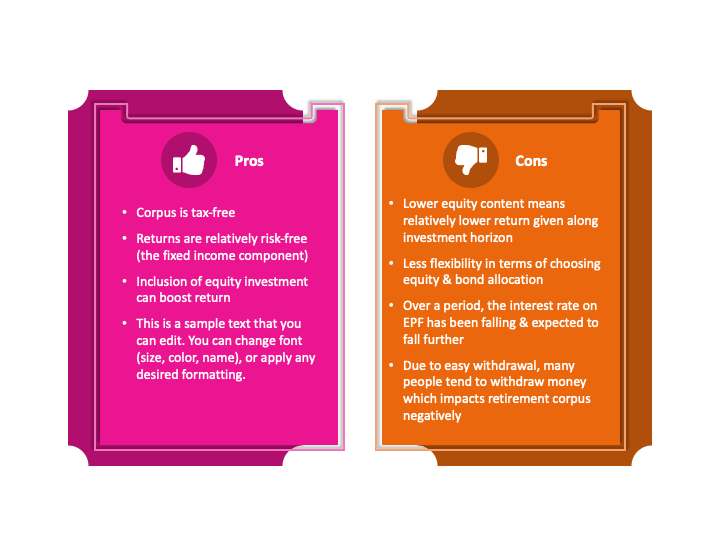

Pros of Investing in EPF

- Guaranteed Returns: One of the biggest advantages of investing in EPF is the guaranteed returns. The interest rate on EPF is set by the government and is currently at 8.5% per annum. This means that your EPF account will earn a fixed interest rate, regardless of the market conditions.

- Tax Benefits: EPF contributions made by the employer are tax-free, and the employee’s contributions are eligible for tax benefits under Section 80C of the Income Tax Act, 1961. This means that you can save on taxes by investing in EPF.

- Long-Term Savings: EPF is a long-term savings scheme that helps you build a corpus for your retirement. The contributions made towards your EPF account are locked in until you retire or leave your job, which helps you build a significant corpus over time.

- Compounding: The interest earned on your EPF corpus is compounded annually. This means that the interest earned on your EPF corpus is added to the principal amount, and the interest is then calculated on the new principal amount. This helps you earn more interest over time and build a larger corpus.

- Sense of Financial Security: Investing in EPF provides a sense of financial security, as the corpus can be used to provide for your retirement. In case of emergencies, you can also withdraw a portion of your EPF corpus without any tax implications.

Cons of Investing in EPF

- Limited Investment Options: EPF is a low-risk investment option, which means that the returns are limited. If you are looking for higher returns, you may need to explore other investment options.

- Early Withdrawal Penalties: If you withdraw your EPF corpus before completing five years of continuous service, you will be penalised. This means that you will lose out on the benefits of compounding, and the withdrawal amount will be taxable.

- Lock-in Period: The contributions made towards your EPF account are locked in until you retire or leave your job. This means that you cannot access your money until then, which can be a drawback if you need the money for emergencies.

- Inflation: Inflation can erode the value of your EPF corpus over time. While the interest earned on your EPF corpus can help you earn more money, the real value of your corpus may decrease over time due to inflation.

- Taxation: The interest earned on your EPF corpus is taxable as per your tax slab rate. If you withdraw your EPF corpus before completing five years of continuous service, the withdrawal amount will also be taxable.

EPF vs Other Investment Options

EPF is not the only investment option available in the market. There are several other investment options, such as mutual funds, stocks, real estate, and fixed deposits, that offer different returns and risks. Here are some comparisons between EPF and other investment options:

- Mutual Funds: Mutual funds offer higher returns compared to EPF. However, they also come with higher risks. Mutual funds are subject to market volatility, and the returns are not guaranteed. EPF, on the other hand, provides guaranteed returns and is a low-risk investment option.

- Stocks: Stocks offer the potential for high returns, but they also come with high risks. The stock market is subject to volatility, and the returns are not guaranteed. EPF, on the other hand, provides guaranteed returns and is a low-risk investment option.

- Real Estate: Real estate is a good investment option for those looking for long-term appreciation. However, it requires a large capital investment and comes with several risks, such as property value depreciation and tenant issues. EPF is a low-risk investment option that provides guaranteed returns.

- Fixed Deposits: Fixed deposits offer guaranteed returns, but the returns are relatively low compared to EPF. Fixed deposits also have a shorter lock-in period, which means that you can access your money sooner. EPF, on the other hand, is a long-term investment option that provides higher returns over time.

Use the EPF calculator 2025 for the latest interest rates. Our PF calculator provides accurate savings estimates.

Pros and Cons of EPF – EPF and Inflation

Inflation is a major concern for any investment option. Inflation erodes the value of money over time, which means that the purchasing power of your money decreases. EPF provides guaranteed returns, but the returns may not keep pace with inflation. For instance, if the inflation rate is higher than the interest rate on EPF, the real value of your corpus may decrease over time. Therefore, it is advisable to consider other investment options that provide higher returns that can beat inflation.

EPF Withdrawals

EPF Registration provides partial and full withdrawal options. Partial withdrawals are allowed for certain purposes, such as marriage, education, medical treatment, and home renovation. However, there are certain conditions that need to be met for partial withdrawals, such as completing a certain number of years in service. Full withdrawals are allowed only after retirement or leaving your job. EPF withdrawals before completing five years of continuous service are subject to taxation.

Pros and Cons of EPF

EPF allows you to nominate one or more individuals to receive the benefits of your EPF account in case of your death. It is advisable to nominate a beneficiary to ensure that your hard-earned money goes to your loved ones in case of your untimely demise.

Conclusion

In conclusion, EPF is a low-risk, long-term savings scheme that provides guaranteed returns and tax benefits. While EPF has its drawbacks, such as the Pros and Cons of EPF, early withdrawal penalties, and a lock-in period, it is a good investment option for those looking for long-term savings and financial security. It is advisable to consult a financial planner or a tax expert to understand the tax implications of EPF and to plan for a secure retirement. Ultimately, whether EPF is worth your money depends on your individual financial goals and risk appetite.

In addition, Vakilsearch can provide expert financial planning and tax consulting services to help you understand the tax implications of EPF and plan for a secure retirement. With our assistance, you can make informed investment decisions and ensure that your hard-earned money works for you in the long run.

FAQs on Pros and Cons of EPF

What are the disadvantages of EPF?

While the Employees' Provident Fund (EPF) has numerous benefits, it also comes with some disadvantages, such as:

Fixed Returns: The interest rates on EPF are set by the government and may vary annually. This fixed return may only sometimes keep up with inflation.

Lack of Liquidity: EPF is a long-term savings instrument, and premature withdrawals may be restricted or subject to penalties. This lack of liquidity can be a disadvantage in urgent financial situations.

Tax on Interest: While the EPF contributions are tax-exempt, the interest earned is taxable if withdrawn before completing five years of continuous service.

Is it reasonable to keep money in EPF?

Yes, keeping money in EPF can be beneficial for several reasons:

Safe Investment: EPF is a safe and government-backed investment option that provides a guaranteed return on contributions.

Tax Benefits: EPF contributions are eligible for tax deductions under Section 80C of the Income Tax Act, making it a tax-efficient savings avenue.

Long-Term Savings: EPF encourages disciplined and long-term savings, helping individuals build a substantial retirement corpus.

Is it worth contributing to EPF?

Contributing to EPF is often worth it due to the following reasons:

Employer Matching: Many employers match employee contributions, effectively doubling the savings.

Interest Accrual: EPF offers competitive interest rates, providing an opportunity for wealth accumulation over time.

Retirement Security: EPF is a retirement savings tool that ensures financial security during post-employment years.

What are the cons of EPF withdrawal?

EPF withdrawals, especially premature ones, may have certain drawbacks:

Tax Implications: Withdrawals before completing five years of continuous service are subject to tax on the interest earned.

Reduced Retirement Corpus: Premature withdrawals can substantially lessen the retirement corpus, impacting long-term financial security.

Lack of Compounding: Leaving the funds untouched allows them to compound over the years, leading to higher returns upon retirement.

Is it wise to withdraw EPF?

The decision to withdraw EPF depends on individual circumstances. However, it may be wise to avoid premature withdrawals unless necessary, as:

Tax Implications: Premature withdrawals may lead to tax liabilities on the interest earned.

Retirement Planning: Leaving the funds untouched allows for continued compounding, contributing to a more substantial retirement corpus.

Can I keep money in EPF after leaving the job?

Yes, you can keep the money in EPF even after leaving a job. The EPF account remains active, and the funds continue to earn interest. Individuals can transfer the EPF account to the new employer or keep it busy, ensuring a seamless continuation of retirement savings.