This article explains TDS on property sale in India, detailing the 1% deduction for properties above ₹50 lakh. It covers the process of paying TDS using Form 26QB and generating a TDS certificate through TRACES. It also highlights the importance of providing the seller's PAN details.

How TDS Works on Property Sale

TDS on property sale is a crucial aspect of real estate transactions in India. As per Section 194-IA of the Income Tax Act, the buyer is required to deduct Tax Deducted at Source (TDS) when purchasing property for ₹50 lakh or more. This regulation ensures tax compliance and prevents tax evasion in high-value real estate transactions. Understanding the TDS process, including the applicable rate, calculation methods, and payment steps, is essential for both buyers and sellers. In this article, we will guide you through the rules, helping you navigate the necessary procedures for a smooth transaction.

TDS Applicability on Property Sales Under Section 194-IA

As of 2025, the TDS on property sale regulations under Section 194-IA of the Income Tax Act remain unchanged. Buyers are required to deduct TDS at 1% on the total sale consideration if it exceeds ₹50 lakh. This TDS deduction applies to all types of immovable properties, including residential property, commercial property, and land, except agricultural land.

It’s important to note that TDS is calculated on the entire sale amount, not just the portion exceeding ₹50 lakh. For instance, if a property is sold for ₹60 lakh, TDS must be deducted on the full amount, resulting in a deduction of ₹60,000.

The buyer must deposit TDS online using Form 26QB within 30 days from the end of the month in which the deduction was made. After the TDS payment, the buyer should provide the seller with Form 16B as a TDS certificate to validate the deduction.

Simplify TDS calculation on salary with our TDS calculator. Calculate TDS online with just a few clicks.

Consider the following example to understand how TDS on property sale is deducted:

| Sale Amount | TDS (Before 31.03.2025 – 0.75%) | TDS (From 1.04.2025 – 1%) |

| ₹45,00,000 | 0 | 0 |

| ₹50,00,000 | 0 | 0 |

| ₹50,01,000 | ₹37,508 | ₹50,010 |

| ₹55,00,000 | ₹41,250 | ₹55,000 |

It’s also critical for the buyer to obtain the seller’s PAN details. A TDS of 20% of the selling amount is applicable if the seller’s PAN details are not furnished.

Paying TDS Amount: How to Do it?

TDS payment consists of two primary steps:

- TDS payment using Application Form No. 26QB

- Using TRACES to generate a TDS Certificate (Application Form No. 16B)

How to Pay TDS Under Section 194-IA Using Form 26QB

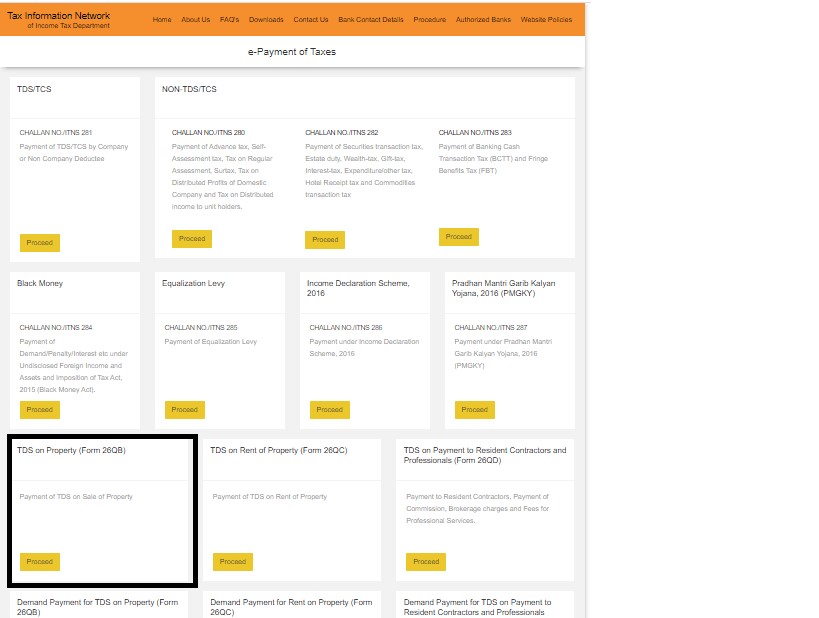

Listed below is the procedure for paying the TDS amount via Application Form No. 26QB:

Step 1:

- Navigate to the TIN (Tax Information Network) official website.

- Look for the “TDS in Property” option.

- Be prepared with the following information before selecting “Proceed”, as the next stages are time-limited for 30 minutes:

- PAN Card information for both the buyer and the seller

- Contact information for both the buyer and the seller

- Specifics about the property being purchased

- The TDS amount that is deducted

- Proceed by clicking the button.

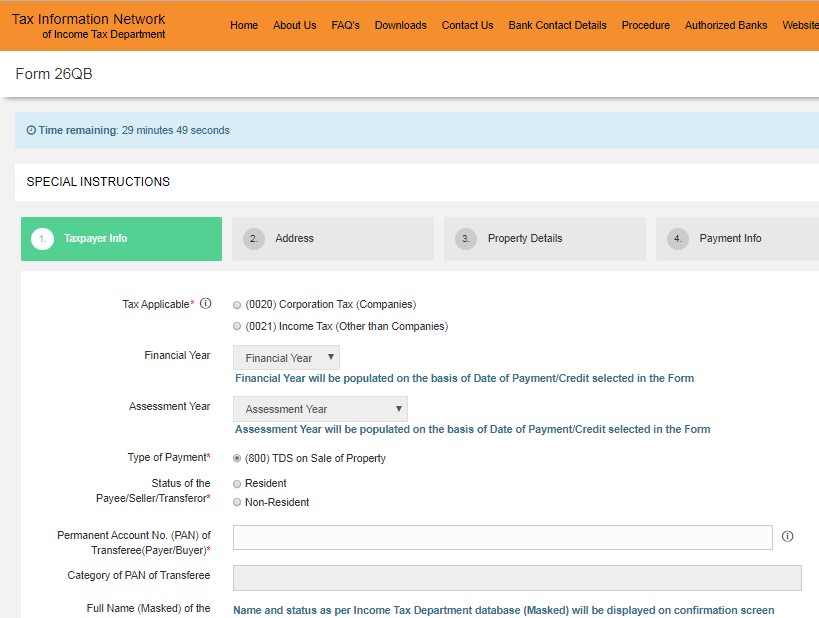

Step 2:

Fill out the information requested in each tab. After you’ve completed all of the fields, click Next.

Step 3:

- Pay the TDS amount.

The TDS amount payment can be made both offline and online.

Paying TDS Amount Online

Listed below is the procedure for paying TDS on Property Sale online using Form 26QB:

- Choose the “e-tax payment” option. Pick between Debit Card and Net Banking as your payment method.

- Make the payment by clicking the “Proceed” button.

- You must first choose the bank from which you wish to make the payment. If your bank isn’t on the list, you must make an offline payment.

- After you have completed your online payment, select the option “Print Challan 280”. This acknowledgement can be printed or downloaded.

- If online banking is not accessible, you must pay the sum by visiting the selected bank’s nearest branch.

- Choose the option of “e-tax payment” at a later date. Proceed by clicking the button.

- Select “Print Form 26QB”.

- It’s a transaction acknowledgement. Print this and bring it to the bank from where you made the payment. Pay the sum via demand draft or cheque at the bank branch and collect the payment counterfoil. This particular foil would serve as the receipt of the payment.

- Payment must be made in person at the bank branch within ten days of printing Application Form No. 26QB.

Generating Application Form No. 16B (TDS Certificate) via TRACES

Listed below is the procedure for paying the TDS amount via Application Form No. 16B (TRACES):

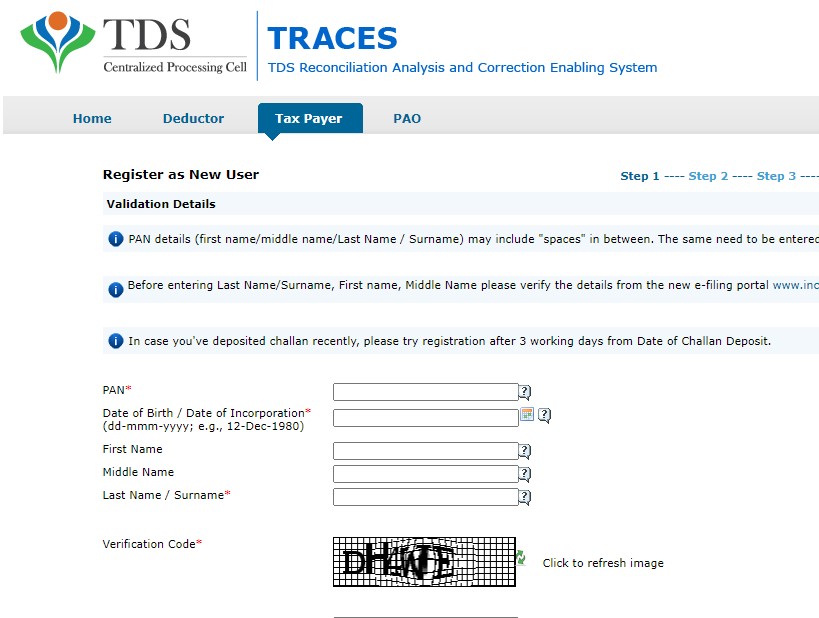

Step 1:

- Visit the TRACES web portal: https://contents.tdscpc.gov.in/

- You can register after 3 days post submission of the Challan with the bank.

- Input the buyer’s PAN details.

- Select the “Proceed” option.

Additionally, you need to register as a new user by filling out Option Nos. 1,2,3, or 4.

- Select the “Next” button.

- After inputting your information and establishing your password, you will be sent an OTP to confirm. Enter the OTP you got.

- You would then receive two additional OTPs, one through email and one via the registered cellphone number. Type in both OTPs and confirm your account.

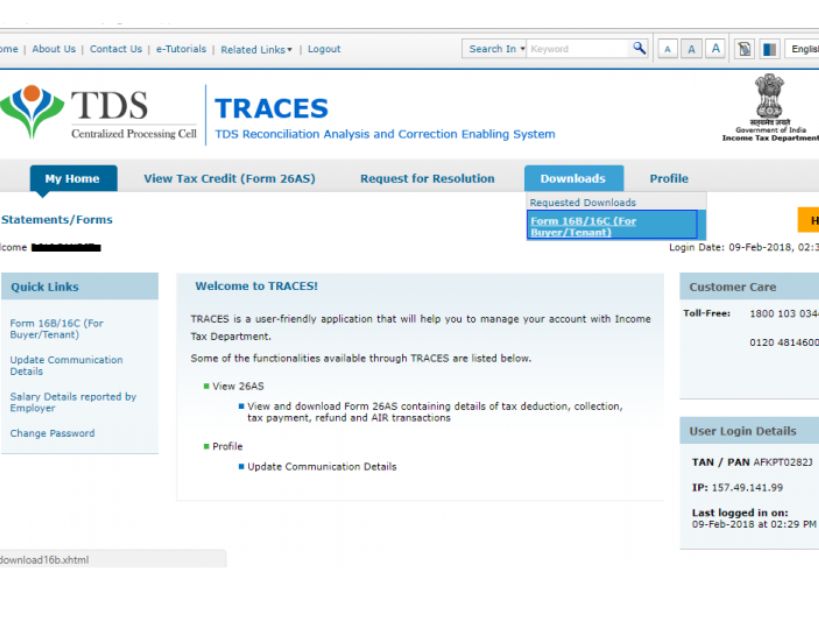

Step 2:

- Download Application Form No. 16B from your registered TRACES account.

- Once registered, go into your user profile and see if the TDS payment is recorded on Application Form No 26AS. It might take a maximum of 7 business days from the payment date.

- You need to sign in with your username (as per PAN) and the password you generated.

- Select Form No. 16B/16C/16D (buyer/tenant/payer)

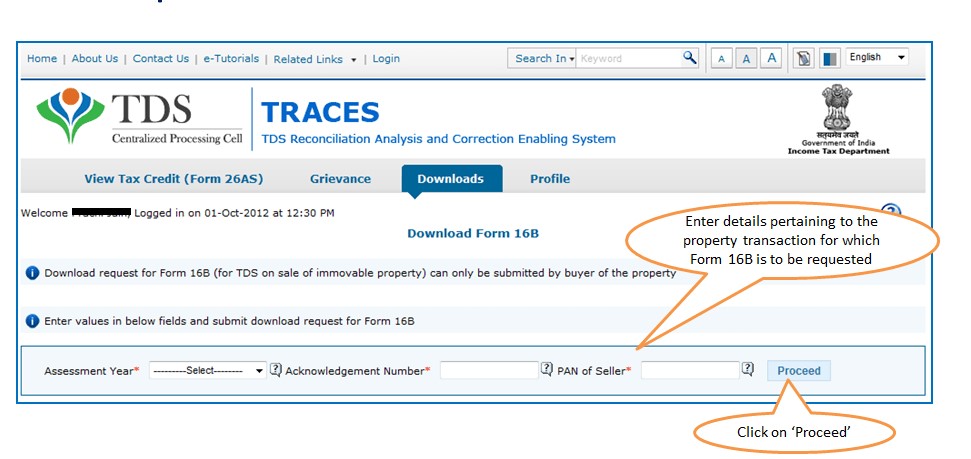

- Input the Form Type, the year of assessment, the Acknowledgement number obtained by Application Form No. 26AS), as well as the seller’s PAN.

- Select the “Proceed” option after successfully completing the steps above.

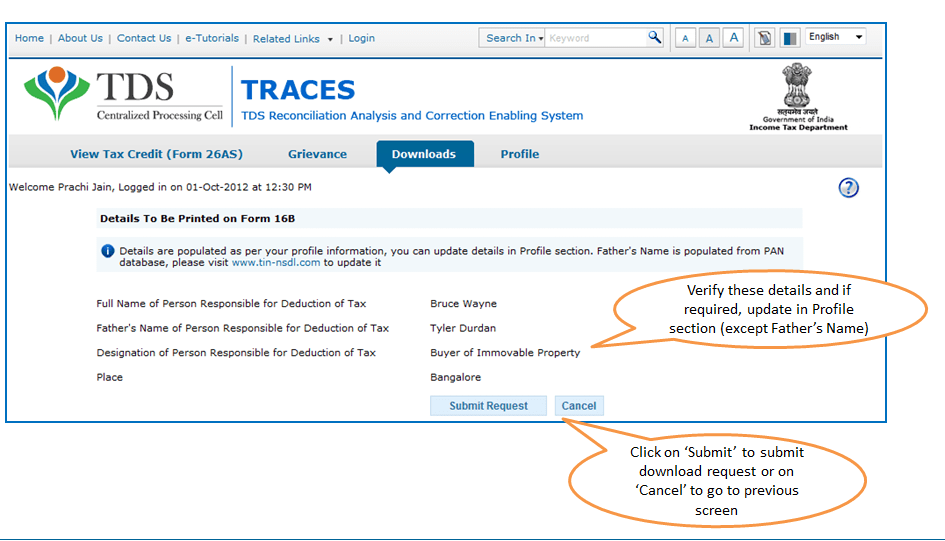

- When you click Proceed, a new tab will appear with the title Details to be Printed on Form 16B. Check the buyer, seller, and location information. Click the Submit Request button.

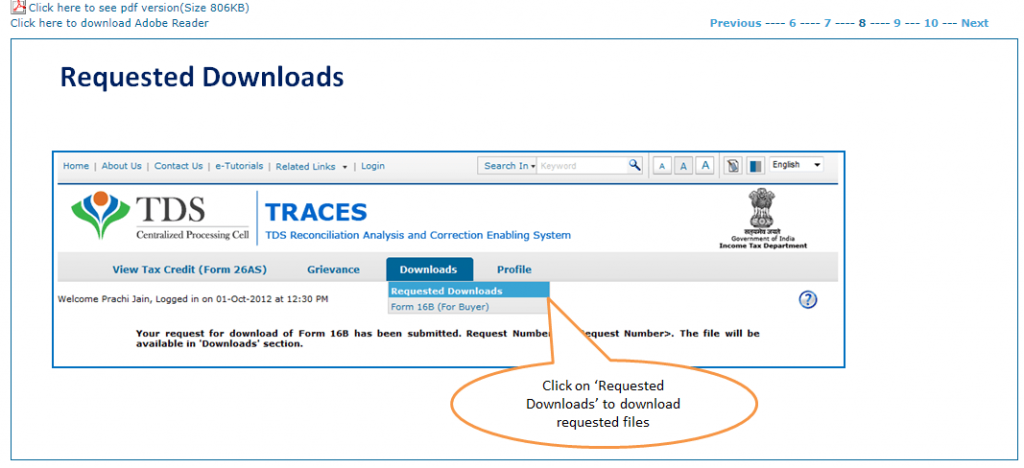

- TRACES would handle this Form 16B request within a few hours. Application Form 16B would be accessible for download under the Requested Downloads page once completed.

- Fill out Form 16B and provide it to the selling party.

Conclusion

The TDS deducted, which is indicated on Buyer’s Form-26AS, an individual can claim a refund or amend their tax due when completing his return. The government has placed a responsibility to deduct on buyers in order to trace high-value transactions and restrict the movement of illegal money. The budget 2022 adjustment is meant to achieve equivalence between sections 50C, 43CA, as well as 194IA. This will result in a bigger tax collection, but it will have to be reimbursed if the buyer claims exemptions.

For more information regarding TDS on property sale, purchase, or rent, you can consult the legal matter experts of Vakilsearch to get a more clear view and understanding of the overall process and subject matter. We are always ready to assist you in all such legal matters.