The stock market is one of the most significant components of a country's financial system, allowing businesses to raise capital and investors to participate in the growth of the economy. As with any investment, the stock market has its share of advantages and disadvantages. In this article, we will discuss the merits and demerits of the stock market.

Stocks represent ownership in a company, and when a company wants to raise funds, it can issue shares of stock to the public. These shares are then traded on the stock market, where investors can buy and sell them. The stock market provides a platform for companies to raise capital by issuing shares and allows investors to buy and sell those shares to benefit from the growth of the company.

The stock market operates through stock exchanges, which are regulated by government bodies such as the Securities and Exchange Board of India (SEBI) in India. The exchanges provide a platform for buyers and sellers to meet and conduct transactions. Some of the popular stock exchanges in India are the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

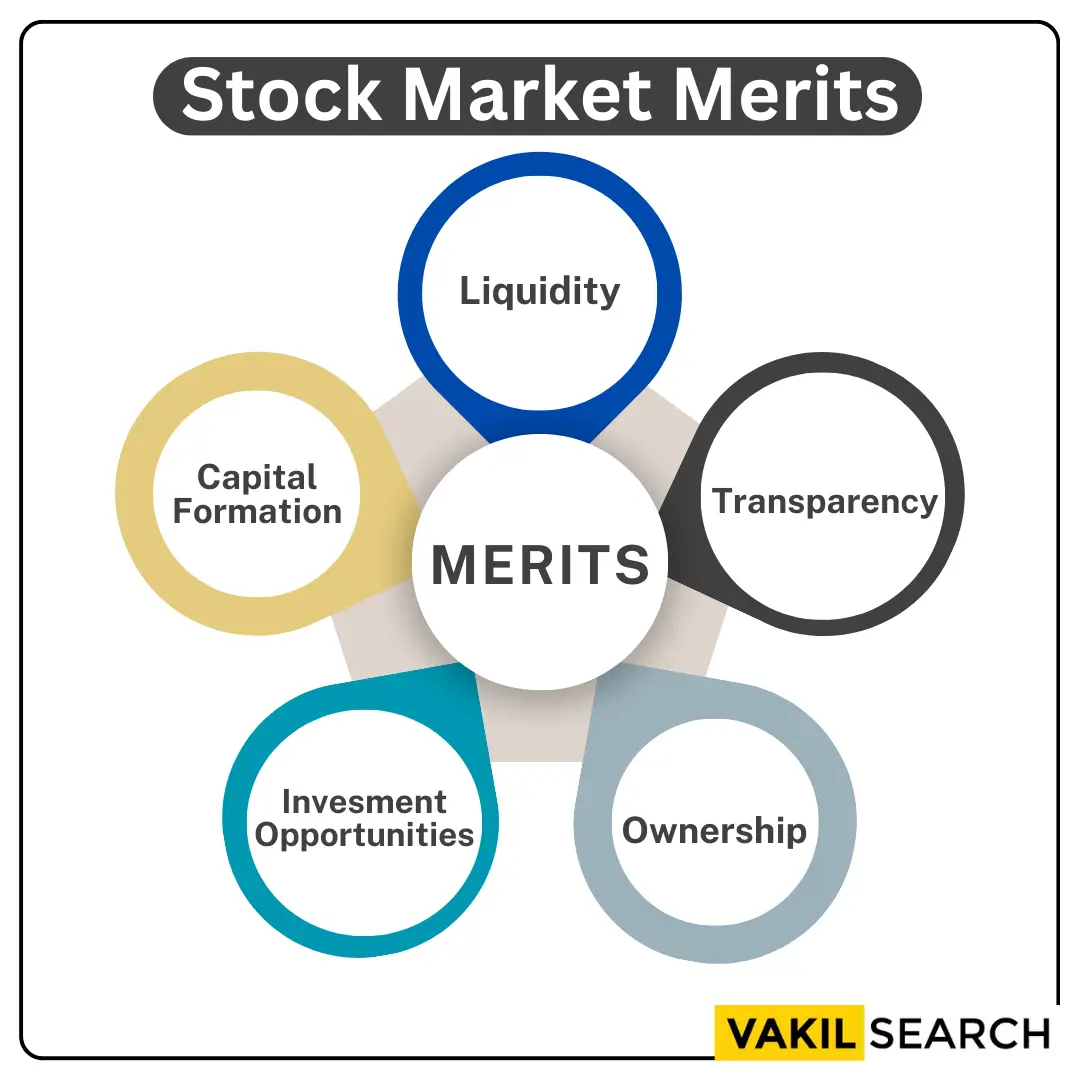

Stock Market Merits

Investment Opportunities:

The stock market offers a wide range of investment opportunities for investors to choose from. Investors can invest in different sectors of the economy, such as technology, healthcare, energy, and finance, and invest in stocks of companies that they believe will grow in the future. This diversification allows investors to manage risk and maximize returns.

Capital Formation

The stock market plays a crucial role in the capital formation of a country. By allowing companies to issue shares and raise capital, the stock market provides businesses with the funds they need to expand their operations and create jobs. This capital formation is essential for economic growth and development.

Liquidity

The stock market is highly liquid, allowing investors to buy and sell securities at any time during market hours. This liquidity provides investors with the flexibility to exit their investments when needed and manage their portfolios efficiently.

Transparency

The stock market is highly regulated, ensuring that investors have access to accurate information about the companies they are investing in. This transparency provides investors with the information they need to make informed investment decisions.

Ownership

By investing in stocks, investors become owners of the company they are investing in. This ownership provides investors with the opportunity to participate in the growth of the company and benefit from its success.

Demerits of the Stock Market

Volatility

The stock market is a highly volatile market, with prices fluctuating frequently based on a variety of factors such as global events, economic indicators, and company news. These fluctuations can result in significant losses for investors who have invested in the wrong stocks.

Risk

The stock market is a risky investment option as the value of the securities can be affected by a variety of factors, including market trends, company performance, and global events. There is always the risk of losing money, and investors should only invest what they can afford to lose.

Fraud

While the stock market is highly regulated, there are still instances of fraud and insider trading, which can result in significant losses for investors. Investors should be aware of the risks involved and only invest in regulated markets and companies.

Time-Consuming

Investing in the stock market requires a significant amount of time and effort to research and analyze the companies you are investing in. Investors must stay informed about market trends and company news to make informed investment decisions.

Emotional Investing

The Stock market capital can be emotional, with investors often making investment decisions based on emotions rather than logic. This emotional investing can lead to poor investment decisions and significant losses.

Conclusion

The stock market has its share of merits and demerits, and investors should carefully evaluate these factors before making any investment decisions. While the stock market offers investors investment opportunities, capital formation, liquidity, transparency, and ownership, it also carries risks such as volatility, fraud, and emotional investing.

Investors should consult with financial advisors and experts, stay informed about market trends and news, and only invest what they can afford to lose. Further, get in touch with our experts in Vakilsearch to know more about the stock market. With the right approach and risk management, the stock market can be a profitable investment option for investors looking to grow their wealth in the long term.

FAQs

How can I leverage the merits of the stock market for optimal financial growth?

To optimize financial growth in the stock market, conduct thorough research, diversify investments, and adopt a long-term perspective. Stay informed, embrace a disciplined approach, and consider consulting financial experts to capitalize on the market's growth potential.

What are the potential risks associated with investing in the stock market?

Investing in the stock market involves risks such as market volatility, economic downturns, and company-specific challenges. Understanding and managing risks through careful research, diversification, and well-defined risk tolerance can help investors navigate uncertainties.

Is diversification an effective strategy to mitigate demerits in the stock market?

Yes, diversification is an effective strategy to mitigate demerits in the stock market. By spreading investments across different assets and sectors, investors can reduce risk exposure and enhance the potential for stable returns, safeguarding against downturns in any single area.

How do economic factors impact the merits and demerits of the stock market?

Economic factors profoundly influence the stock market. Positive economic indicators often correlate with market merits, while economic downturns can lead to demerits. Factors like interest rates, inflation, and GDP growth play crucial roles in shaping the overall market landscape.

Are there specific industries or sectors more susceptible to the demerits of stock market fluctuations?

Certain industries or sectors, such as technology and finance, are more susceptible to stock market fluctuations due to their sensitivity to economic cycles and market trends. Understanding the dynamics of specific sectors and managing exposure accordingly can help investors navigate potential demerits.