Skill Loan Scheme: Get institutional credit for skill development courses aligned with NSQF. Loan up to ₹1.5 lakh, no collateral required.

Details

In July 2015, the Skill Loan Scheme was introduced to offer institutional credit to individuals pursuing skill development courses aligned with National Occupations Standards and Qualification Packs. These courses are conducted by training institutes following the National Skill Qualification Framework (NSQF) and lead to certifications, diplomas, or degrees.

The Skill Loan Scheme applies to all member banks of the Indian Banks’ Association (IBA) and other banks and financial institutions as advised by the RBI. It offers comprehensive guidelines to banks for implementing the skilling loan scheme.

Salient Features of the Guidelines to Banks For OperationaliSing the Scheme

Eligibility:

- Individuals with admission in courses by ITIs, Polytechnics, recognized schools/colleges, or NSDC/Sector Skill Council-affiliated training partners.

- Courses: Aligned with NSQF.

- Quantum of Finance: ₹ 5,000-1,50,000.

- Duration of Course: No minimum duration.

- Rate of Interest: Base rate (MCLR) + add-on up to 1.5%.

- Moratorium: Duration of the course.

- Repayment Period:

-

- Loans up to ₹ 50,000: Up to 3 years.

- Loans between ₹ 50,000 to ₹1 lakh: Up to 5 years.

- Loans above ₹ 1 lakh: Up to 7 years.

- Coverage: Course fees and expenses for assessment, examination, study material, etc.

- Collateral: Not required.

-

- Credit Guarantee Fund for Skill Development (CGFSSD):

- Administered by NCGTC.

- Banks can apply for credit guarantee against defaults.

- Fee capped at 0.5% of outstanding amount.

- Maximum guarantee cover: 75% of outstanding loan amount (including interest).

- Total skill loan disbursed (as of September 2018): ₹29.06 crore (21 Banks, 2018-19).

How the Skill Loan Scheme Works

The program may be offered by banks affiliated with the Indian Banks’ Association (IBA) and other financial organizations authorized by the Reserve Bank of India (RBI).

Documents Required to Apply For the Skill Loan Scheme

The required documents for the Skill Loan Scheme application include:

- Proof of admission: Admission or offer letter and ID card (if available).

- Scholarship or free-ship letter copies.

- Schedule of course expenses.

- Mark sheets of 10th, 12th, graduation (if applicable), and entrance exam results.

- Gap certificate (if applicable), self-declaration for study gaps.

- Asset-Liability Statement of co-applicant or guarantor (for loans above ₹ 7.5 lakh).

- Passport-size photographs of student, parent, co-borrower, or guarantor.

Proof of Income Requires the Following Documents:

- Bank account statements of the parent, guarantor, or guardian for the past six months.

- Permanent Account Number (PAN) of the student, parent, guarantor, or co-borrower.

- Aadhaar card (if eligible for government interest subsidy schemes).

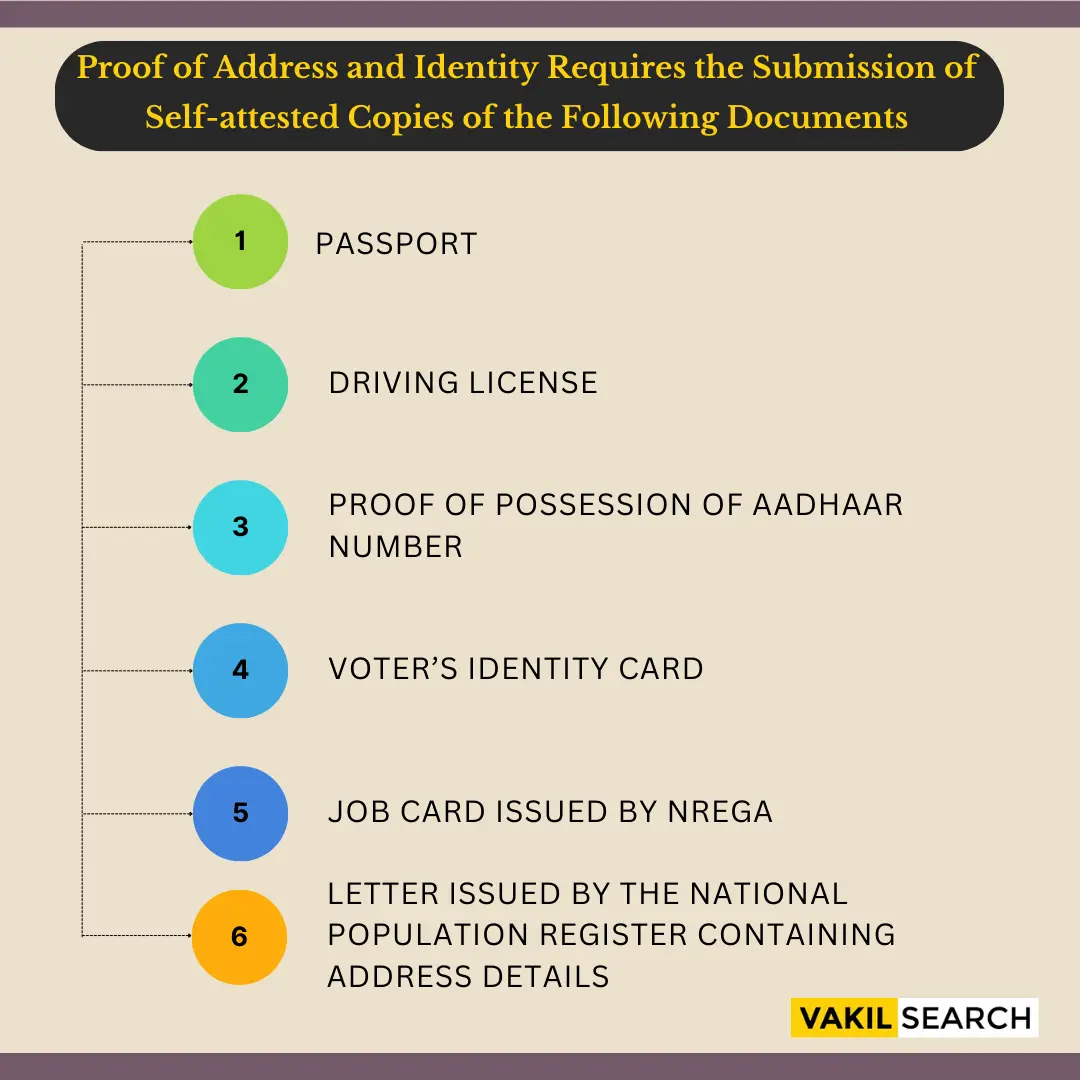

Proof of Address and Identity Requires the Submission of Self-attested Copies of the Following Documents:

- Passport

- Driving license

- Proof of possession of Aadhaar Number

- Voter’s Identity Card

- Job card issued by NREGA

- Letter issued by the National Population Register containing address details

Benefits For the Skill Loan Scheme

- Courses: Aligned with the National Skill Qualification Framework (NSQF).

- Quantum of Finance: Loan amounts range from ₹ 5,000 to ₹ 1,50,000.

- Duration of Course: No minimum duration requirement.

- Rate of Interest: Base rate (MCLR) plus an add-on, typically up to 1.5%.

- Moratorium: Loan repayment is deferred during the duration of the course.

- Repayment Period:

- Loans up to ₹ 50,000: Up to 3 years.

- Loans between ₹ 50,000 to ₹1 lakh: Up to 5 years.

- Loans above ₹ 1 lakh: Up to 7 years.

- Coverage: Course fees, including expenses related to assessments, examinations, study materials, etc., are paid directly to the training institute.

- Collateral: The beneficiary is not required to provide collateral for the loan.

In November 2015, the Ministry of Skill Development and Entrepreneurship (MSDE) implemented the Credit Guarantee Fund for Skill Development (CGFSSD) through a notification. This fund is administered by the National Credit Guarantee Trust Company (NCGTC) and applies to all skill loans sanctioned on or after July 15, 2015.

Banks have the option to seek credit guarantee from NCGTC to mitigate defaults, and NCGTC will offer this guarantee at a nominal fee not exceeding 0.5% of the outstanding amount. The guarantee cover extends up to a maximum of 75% of the outstanding loan amount, including interest if applicable.

Eligibility For Skill Loan Scheme

To qualify for the Skill Loan Scheme, individuals must have obtained admission to courses offered by the following institutions:

- Industrial Training Institutes (ITIs)

- Polytechnics

- Schools recognized by State or Central Boards of Education

- Colleges affiliated with recognised universities

- Training partners affiliated with Sector Skill Councils, National Skill Development Corporations (NSDC), State Skill Mission, or State Skill Corporation

Application Process

Online:

- Prospective candidates should register on the Vidya Kaushal portal.

- Required documents include proof of identity, proof of address, and proof of income (for self or guardian, if available).

- After successful registration, candidates can choose their preferred sector, role, and centre.

- Visit the chosen center for counseling.

- If needed, raise a loan request through the center.

- Evaluate and accept/reject loan offers based on preference.

- Upon confirmation, the loan amount will be disbursed directly to the partner/centre.

List of Expenses Covered

Within the Skill Loan Scheme, the educational institute will receive direct payment for various expenses, including:

- Course or tuition fees

- Caution deposit

- Study materials costs such as books, instruments, and equipment

- Examination fees

- Assessment fees

- Library fees

- Laboratory fees

FAQs :

What is skill India loan scheme?

The government launched Skill India in 2015 with a goal to train over 400 million Indians in diverse industry-related jobs. The vision is to empower the workforce through training courses and schemes, aiming to achieve this by 2022.

What is the moratorium period?

A moratorium period, akin to forbearance or deferment, refers to a situation where your lender permits you to temporarily suspend making payments for a specific duration and due to a specific reason, often related to financial difficulties.

What is the maximum amount of loan under skill loan scheme?

The loan amount ranges from ₹ 5,000 to ₹ 1,50,000, and the repayment period can extend up to 7 years, depending on the loan amount.

What is the minimum amount for a skill loan scheme?

The Skill Loan Scheme offers loans to students pursuing technical courses from training institutes, polytechnics, etc., with loan amounts ranging from ₹ 5,000 to ₹ 1,50,000.

What is MCLR under rate of interest?

The Marginal Cost of Lending Rate (MCLR) is the lowest lending rate set by a bank, below which lending is not allowed. The specific rate may vary among different banks.

Other Related Articles