Chartered Accountants are crucial in managing and ensuring compliance with the Foreign Contribution Regulation Act (FCRA). They handle auditing, financial reporting, and advisory services to help organisations adhere to legal requirements and maintain transparency in managing foreign funds. Here is a detailed guide for the same

The Foreign Contribution (Regulation) Act, 2010 is a pivotal law in ensuring a nation is secure and safe. As per the law, an association should handle foreign contributions with due care and diligence right from the time the money or asset is received to its ultimate use. The roles of chartered accountants under FCRA are to assign auditing associations’ accounts, certifying them to ensure they are correct, and then submitting them to the relevant government departments for compliance purposes. It is their responsibility to advise associations correctly and adequately on all aspects pertaining to obtaining prior permission or registration under FCRA, 2010, as well as to the associations that have already been granted such permissions or registrations. The Chartered Accountants have to acquaint themselves in-depth with the provisions of FCRA, 2010, together with FCRA, 2011, and amendments/notifications issued from time to time, for discharging this role. Their knowledge and facilitate the possibility of accounting professionals assisting associations in adhering to the requirements of the law, hence adequately managing and utilising foreign contributions in consonance with national security standards.

Charter for Chartered Accountants

Chartered Accountants provide all-inclusive assistance to associations seeking prior permission/registration or already registered/granted under FCRA, 2010, by assisting the associations effectively in the following matters, amongst others:

- Determining eligibility to accept foreign contribution

- Assisting in the registration/prior permission application process

- Foreign contribution is received and spent from a sole exclusive bank account open for the purpose, separate from domestic funds, as per FCRA, 2010 and FCRR, 2011

- To assist in maintaining the prescribed books of accounts as per FCRA, 2010, and FCRR, 2011

- To ensure that Annual Returns are prepared as per FCRA, 2010, and FCRR, 2011, along with all its amendments.

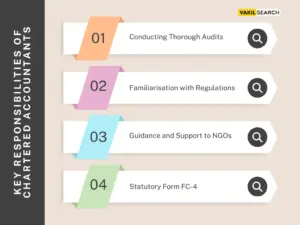

Key Responsibilities of Chartered Accountants Under FCRA

The Chartered Accountants play a very important role in ensuring compliance under the Foreign Contribution Regulation Act, 2010 (FCRA, 2010). Various responsibilities of chartered accountants in regard to FCRA 2010 are listed below:

-

Conducting Thorough Audits

Auditing is the process of checking the financial statements and books for their validity and conformance with standards and regulations at large. There are several types of audits that chartered accountants perform: statutory audits required by legislation; tax audits, used to check if one is in compliance with the regulations concerning taxes; and internal audits, which help in the assessment and enhancement of internal controls and processes.

-

Familiarisation with Regulations

Chartered accountants are expected to maintain stringent regulatory compliance standards, as stipulated by relevant accounting and auditing organisations. This includes a commitment to professional integrity, confidentiality, and transparency in dealings with clients.

-

Guidance and Support to NGOs

The chartered accountants advise the clients on financial matters apart from NGOs. They act as a link between the business and client, offering essential information of a financial nature and advice to the clients while mentoring junior accountants on ethical practices.

-

Statutory Form FC-4

The FC-4 form is a statutory form that has to be submitted by the NGOs in India to the Ministry of Home Affairs under the Foreign Contribution (Regulation) Act. This may not relate to the direct activities of chartered accountants as described in your earlier list.

Best Practices for Chartered Accountants Under FCRA

Best practices have to be followed to ensure that the Chartered Accountants are in compliance with the Foreign Contribution (Regulation) Act, 2010. This entails a continuous update on related regulations and compliance, eligibility checking, and facilitating proper receipt and documentation of foreign contributions. Here are three key tips for CA’s:

1. Stay Updated

Being a Chartered Accountant requires lots of updates on the latest laws, rules, and regulations. Added skills through certification courses and crash courses will definitely add to your professional skills. Besides, seminars, workshops, and webinars are also quite a good way to learn more about the latest happenings in the industry that helps in your career growth and gives you the edge over others.

2. Stringent Audit Processes

Ensure that all the financial documents are thoroughly checked for completeness and accuracy, which includes invoices, receipts, contracts, and other supporting documents. Also, to prevent frauds and errors, suitable internal controls should be instituted, such as segregation of duties, second signatories for significant transactions, and reconciliations on a timely basis.

3. Educate Associations

Allow your clients to improve their financial literacy and tax planning, allowing them to have all the necessary tools at their command to make informed financial decisions. This is not only a question of support concerning the client’s personal and business concerns, but equally a matter of trust in the expert’s competence.

Conclusion

Chartered Accountants play a vital role under the FCRA, 2010 by ensuring accurate audits, adherence to regulations, and offering crucial guidance to NGOs. By staying informed on legal updates, implementing rigorous audit processes, and educating clients, they help maintain compliance and build trust in their expertise. Connect with an expert CA right away and resolve all your queries on FCRA.