A rent receipt is a crucial document that serves as evidence of the rent that has been paid to the landlord. It should be gathered and stored safely because it is a crucial aspect of tax savings. To claim their House Rent Allowance, salaried employees must present rent receipts. Do you need detailed details on the rent receipts format? You can find all the information here presented correctly.

Download and generate your house rent receipt format online effortlessly! This essential document not only provides proof of rent payment but also supports HRA claims, tax-saving benefits, and ensures compliance. Find formats, guidelines, and key details here.

What is Rent Receipt?

A rent receipt is a document that verifies that rent has been paid for a particular property. It is usually provided by the landlord or property owner to the tenant and serves as proof of payment for the tenant’s records. Let’s discuss about the rent receipt format in detail in this blog.

For your employer to grant the HRA exemption, you must provide proof of rent payment. Before approving any exclusions or deductions, the employer is required to request documentation from you. According to the income tax statute, your employer is in charge of this. A rent receipt is just a note on a memorandum where the money or the bill of exchange check for any other promissory note would be acknowledged so that it has been received.

Any Person Who Receives:

- Money more than ₹500 as per the Indian Stamp Act or

- Any other bill of exchange cheque or promotional note for the amount exceeding the same or

- Saving in satisfaction or part of the satisfaction of adept or

- Any other movable Property Value more than ₹500 in value on demand by any person paying or

- Delivering such money is needed to give a stamped receipt that is stamped

- But if there is, it would create any interest in the immovable property with the value going beyond ₹100 or more, then registration is essential.

Importance of Rent Receipt Format

A Rent Receipt is one of the most important documents used as rent paid proof to your landlord. It is one of the most vital tax-saving instruments, so it must be collected and kept perfectly safe. If you are a salaried employee, you need this rent receipt to claim your house rent allowance.

This document plays a crucial role because it proves the payment of your rental property is a tenant, and you are paying it to the landlord. You must prove you are paying your rent to get the HRA exemption. But rent receipts are requested by employers to offer HRA exemption. You need to get the pan card from your landlord if the annual rent goes beyond ₹1,00,000, and it is essential to report the same to the employer to claim your HRA exemption.

How Can You Generate Rent Receipt Format Online?

- You must submit your rent receipt to the employer to claim your HRA exemptions

You can easily do it in the three steps mentioned here

- You have first to enter your rent amount paid and address

- You can also fill in all the details of your landlord and yourself

- You can choose the term you want to generate your rent receipt

- You can develop your rent receipt monthly, quarterly, or even annually.

Details Required For Rent Receipt Format

You need to enter the following details in your rent receipt Format–

- Tenant name. You have to fill in your name if you are the tenant

- Name of your landlord

- Payment amount

- Rental term

- Address of your house

- Signature of your landlord or manager

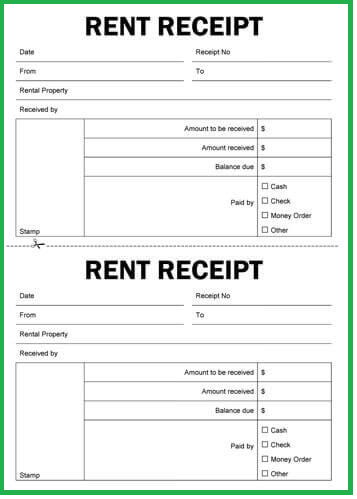

Rent Receipt Format

A rent receipt format in India typically includes the following information:

- Date: The day on which the entire rent was paid..

- Receipt Number: A unique receipt number for easy identification and record keeping.

- Landlord’s Name and Address: The name and address of the landlord or the person receiving the rent payment.

- Tenant’s Name and Address: The name and address of the tenant or the person making the rent payment.

- Property Address: The address of the property for which the rent is being paid.

- Rent Amount: The amount of rent being paid, including any additional charges such as utilities or maintenance fees.

- Payment Mode: The method of payment, such as cash, check, or online transfer.

- Signature: The signature of the landlord or authorized representative, confirming receipt of the rent payment.

It’s important to note that a rent receipt serves as proof of payment and is useful for tax purposes. Landlords are required by law to provide tenants with a rent receipt upon request.

Is It Essential for Affixing the Revenue Stamp on Rent Receipt?

It is important for affixing the revenue stamp on the rent receipts if the cash payment goes beyond ₹5000 per receipt. The revenue stamp is totally unnecessary if you pay your rent through a cheque.

You can avail yourself of a text benefit by submitting your rent receipt to the employers. Your tax savings on the rent are generally equal to the house rent allowance exemptions you are usually eligible to claim.

Things to Know About Rent Receipts

A revenue stamp must get affixed on the rent receipt if your cash payment goes beyond ₹5000 per receipt. The revenue receipts are not needed if the rent does not pay via cheque. You need to offer the rent receipt for all the months you claim your HRA.

Why Rent Receipt Needed to the HR Department?

Every person or the individual who is bound to pay the salary is also required to deduct some tax as per the income tax law of India. It is important to deposit with the government and then spend the remaining amount on the concerned employee. If the employee makes the tax saving expense, the person would be responsible for deducting tax.

They also have to consider and give benefits to the expenditure and then deduct the tax on the net amount. Additionally, it has been seen that people also submit fake rent receipt format even though they are not living in any rented accommodation. The HR department has started taking some action, like asking for a rental agreement to get the HRA Benefits to encounter this.

Things to Check in the Rent Agreement

- The rent agreement must always be on ₹500 stamp or as per the stamp rate valid in your state

- It should be entered for 11 months only

- The rent agreement should not be entered. Instead, the lease deed is preferred for registration if it is for more than 12 months. The rent agreement gets renewed post every 11 months as the rent is increased

- The notice period has to be served by both the tenant and the landlord as per the agreement statements.

What Can You Do When the Landlord Refuses to Give Their Pan?

First, you don’t have to ask for the entire pan card copy. You need to have the pan card number. You need to have a declaration from the landlord if the landlord does not have the pan card and submit the same to HR. Above all, you should always go for prevention, so whenever you are taking the house for rent, you need to connect with the landlord so that they can share the number.

How Can You Claim The HR Exemption While Filing Your Income Tax Return?

Firstly you need to calculate the amount on HRA exemption properly. You can use the exemption calculator to avoid any stress.

- Once you have calculated the amount, you need to deduct that same amount from the income chargeable given under the salary head column first of

- You can enter the amount calculated in Step 2 as per the income from salary or pension

- Even though HRA is a part of your salary, it is not your basic salary that can be completely taxable. HRA gets exempted as per section 10 of our Income Tax Act The amount exempted under HRA is deductible from the complete income before reaching the taxable income point.

Conclusion

While submitting your rent receipt for your HRA deduction, don’t forget to follow the rent receipt format in India. To know more about rent receipts, you need the guidance of an expert, and this is where Vakilsearch can be of good help here.

Frequently Asked Questions

Why do I need to get a receipt from my landlord?

Getting a receipt from your landlord is essential for maintaining a clear record of your rental payments. This documentation can protect you in case of disputes, proving that you've paid rent on time.

Do I need a lease agreement with my landlord?

A lease agreement is crucial as it outlines the terms and conditions of your rental arrangement. This contract helps prevent misunderstandings by clearly specifying rent amounts, payment dates, and responsibilities for both parties. It provides legal protection, ensuring that your rights and obligations are explicitly defined and enforceable.

Why does my company ask me to submit rent receipt proofs?

Companies often require rent receipt proofs to verify housing expenses for tax benefits or reimbursement purposes. These receipts confirm the legitimacy of your claimed expenses, ensuring compliance with tax laws and company policies. By submitting rent receipts, you can potentially reduce your taxable income or receive allowances, benefiting both you and your employer.

Do I need a receipt for every month?

Yes, you need a receipt for every month to maintain a complete and accurate record of your rental payments. Monthly receipts provide continuous proof of payment, ensuring that you can document each transaction. This consistency is important for both personal record-keeping and for any financial audits or tax purposes.

Do I need the PAN number of my landlord?

You need your landlord's PAN number if your annual rent exceeds ₹1 lakh. This requirement is crucial for claiming House Rent Allowance (HRA) tax benefits. Providing the PAN helps the tax authorities verify the legitimacy of your claim and ensures compliance with income tax regulations.

Do I need a scanned copy of my landlord’s PAN card?

: You typically do not need a scanned copy of your landlord’s PAN card; the PAN number alone is sufficient. However, some companies may request additional documentation for verification. Always check your company's specific requirements for HRA claims to ensure you submit the necessary documents correctly.

I was not able to claim HRA from my company. Can I claim it myself?

If you were unable to claim HRA through your company, you can claim it when filing your income tax return. Ensure you have all necessary documentation, including rent receipts and your landlord's PAN number if applicable, to substantiate your claim and receive the appropriate tax deduction.

I have changed jobs this year. Should I share my old rent receipts with the new company?

You generally do not need to share old rent receipts with your new company. However, if your new employer requires documentation for the period covered in your previous job for HRA calculation, you may need to provide them. Check your company's specific requirements for HRA claims.

Do I need a hard-copy of rent receipts or is a soft copy OK?

A soft copy of rent receipts is usually acceptable for most companies and tax authorities, provided it is clear and legible. Digital records are often preferred for ease of submission and storage. However, confirm with your employer or relevant authority to ensure compliance with their documentation standards.

Is a generated receipt legally valid?

A generated receipt is legally valid if it contains all necessary details such as the landlord's name, tenant's name, rental amount, rental period, and landlord's signature. It should also include the landlord’s PAN number if applicable. Ensuring these elements are present will make the receipt acceptable for legal and tax purposes.