Have you retired in the state of Rajasthan and would like to know more about the Rajasthan old age pension scheme introduced by the Indian Government? Read all about it here.

The old age pension in Rajasthan scheme is a social safety net program that provides financial assistance to senior citizens in the state of Rajasthan. The old age pension in Rajasthan scheme covers all citizens of Rajasthan who are above the age of 60 years and provides them with a monthly pension. The old age pension Rajasthan scheme has been successful in reducing poverty among the elderly population of Rajasthan and has helped improve their quality of life.

Rajasthan Old Age Pension Scheme Highlights

Under the Chief Minister old age pension in Rajasthan Scheme, the Rajasthan Government will provide a monthly pension of ₹1,000 to eligible individuals. This financial assistance aims to support senior citizens in meeting their basic needs and ensuring a dignified livelihood during their old age. Other Highlights are listed below :

- Under the scheme, senior citizens aged 60 years and above are entitled to a monthly pension

- The scheme is implemented through Direct Bank Transfer (DBT) mode

- Eligible pensioners can receive the pension in their bank account on the 11th of every month

- The scheme is currently operational in all the districts of Rajasthan.

The Objective of the Rajasthan Old Age Pension Scheme

The old age pension in Rajasthan is a social security scheme introduced by the Government of Rajasthan for senior citizens aged 60 years and above. The objective of the old age pension scheme is to provide financial assistance to the elderly citizens of the state who are not in a position to support themselves financially.

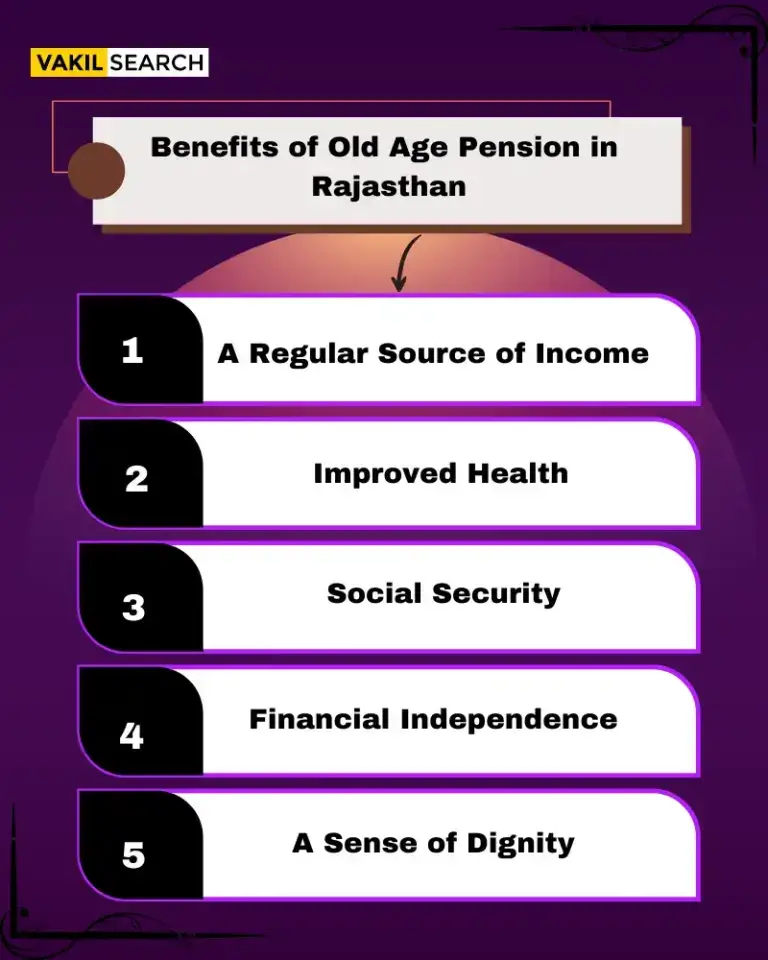

Benefits of Old Age Pension in Rajasthan

- A Regular Source of Income: The monthly pension helps senior citizens to meet their basic needs and improves their quality of life.

- Improved Health: With a regular source of income, senior citizens are able to afford better healthcare and live healthier lives.

- Social security: The pension scheme provides a safety net for senior citizens, who are often the most vulnerable members of society.

- Financial independence: The scheme gives senior citizens more financial independence, allowing them to live without depending on family or friends for support.

- A sense of dignity: The pension scheme allows senior citizens to maintain their dignity and self-respect, as they are no longer dependent on others for financial support.

Eligibility of Rajasthan Old Age Pension Scheme

The old age pension in Rajasthan Scheme is available to all residents of Rajasthan who are above the age of 60 years. There is no upper age limit for this scheme. However, applicants must be below the poverty line as defined by the government in order to be eligible for this scheme.

Documents of Old Age Pension Scheme

- A completed application form.

- Proof of age, such as a birth certificate, passport, or other government-issued ID.

- Proof of residency in Rajasthan, such as a utility bill or other government-issued ID.

- An attested copy of your bank passbook or other proof of financial status.

Offline: How to Apply for Rajasthan Old Age Pension Scheme

To apply for the old age pension in Rajasthan, senior citizens can visit their nearest gram panchayat or social welfare department office and submit the following documents:

- Aadhaar card

- Proof of age (such as a birth certificate, school leaving certificate, or passport)

- Proof of residence in Rajasthan (such as a ration card or utility bill)

- Income proof (such as a bank statement or pension slip)

- After submission of these documents, the qualified applicants will receive a monthly pension.

Online: How to Apply for Rajasthan Old Age Pension Scheme

- Step 1: Visit https://sso.rajasthan.gov.in/signin to apply for the scheme

- Step 2: Register using Jan Aadhar and then log in

- Step 3: Select RAJSSP on the SSO portal and access the application form for the pension scheme

- Step 4: Provide personal information and upload necessary documents

- Step 5: Submit the online application

- Step 6: The application will be verified by Tehsildar / Naib Tehsildar / Nagar Palika / Municipal Corporation office

- Step 7: Upon verification, the application will be forwarded to the Sub Divisional Officer or Block Development Officer for approval

- Step 8: Once approved, the pension amount will be transferred to the applicant’s bank account every month.

Myth Busters

- Old Age Pension Scheme is not a government scheme: Myth

- The scheme is not means-tested: Myth

- It is not necessary to be a resident of Rajasthan to be eligible for the scheme: Myth

- There is no minimum age limit for eligibility for the scheme: Myth

- The pension amount is not fixed and may increase or decrease depending on the financial position of the state government: Myth

Conclusion

There are several reasons why Vakilsearch is the best choice to know about this scheme. First, we have a team of experienced and knowledgeable lawyers who can provide you with all the information you need about the scheme. Second, we have a dedicated Business consultant team who can answer any of your queries related to the scheme. Third, we have a comprehensive database of all the relevant laws and regulations governing the scheme, which makes it easy for you to find the information you need. Finally, we offer a money-back guarantee if you are not satisfied with our services.

FAQs

What is the Rajasthan Old Age Pension Scheme?

The old age pension in Rajasthan is a social security scheme that provides financial assistance to senior citizens in the state of Rajasthan. The scheme is open to all residents of Rajasthan who are aged 60 years or above.

How much financial assistance can I get under the scheme?

Under the scheme, eligible senior citizens can receive a monthly pension of ₹1,000/-.

How can I apply for the scheme?

If you wish to apply for the scheme, you can do so by visiting your nearest gram panchayat office or old age home. Alternatively, you can also apply online through the official website.

What documents do I need to submit while applying for the scheme?

While applying for the scheme, you will need to submit your proof of identity and age (such as your Aadhar Card, Pan Card, Birth Certificate etc.), along with your bank account details.