A business may benefit from going from a private limited company to a public limited company in order to develop and broaden its market reach. But because it's a complicated procedure, meticulous preparation and execution are needed.

Overview of Conversion Private Company to PLC

A private limited business becomes accessible to the general public by transforming into a public limited company. This allows the company to raise money by issuing shares to a wider audience of investors.

As a result, the business can expand its operations, engage in new initiatives, and acquire other companies with greater financial support. Overall, this change is a crucial step towards development and progress, offering significant opportunities for growth.

Requirements to Convert Private Limited to Public Limited

To change from a private limited company to a public limited company, you need permission from the Registrar of Companies and SEBI. You also need a minimum capital, seven shareholders, and three directors.

What are the Documents Needed for the Conversion of Private Limited to Public Limited?

You can Convert a Private Limited Company to a Public Limited Company, the following documents are needed:

- Memorandum of Association and Articles of Association

- Board resolution for conversion

- Shareholders’ resolution for conversion

- List of shareholders and directors

- List of creditors

- Audited financial statements for the past three years

Post-conversion Considerations

Business owners need to remember key factors when converting a private company to a public one. This means meeting legal requirements, practicing good governance, and reporting accurately and on time.

Appointing Advisors and Professionals

If you have a private limited company, you may need to turn it into a public limited company. This means you must know the rules and find the right experts to help you. They’ll make sure you follow the laws correctly. You can know about PVT Limited company registration process on our portal.

Conducting Due Diligence and Valuation

If you own a private limited company and want to make it a public limited company, you need to research its value and growth potential. This will help you make informed decisions about the conversion process and future growth plans.

Position your company for exponential growth by accessing capital markets and attracting a broader investor base. Our seamless process for Conversion of private company into public company ensures you’re ready to capitalize on new opportunities.

Considering Future Growth and Expansion Strategies

If you change to a public limited company, you can get more investors and help your business grow. To expand, like launching new products, entering new markets, and investing in R&D, owners must plan. This planning is crucial for long-term success and profits. But, changing requires careful thinking and expert advice to make it a smooth transition.

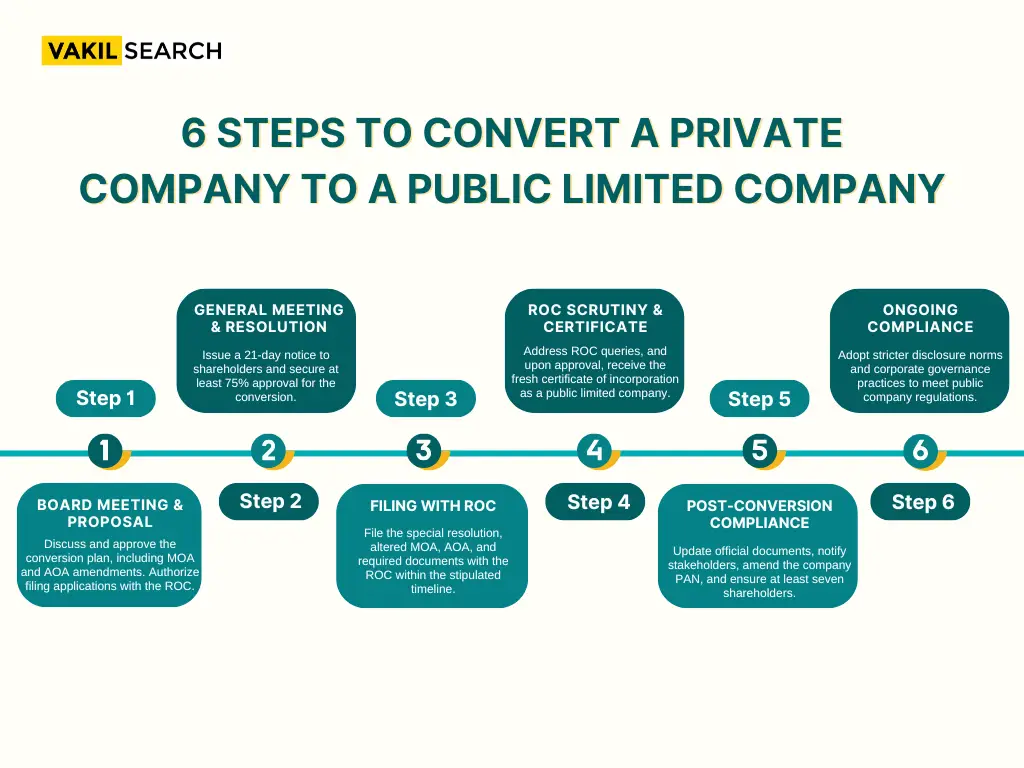

Procedure for Conversion into a Public Limited Company

Step 1: Board Meeting and Proposal

- Discuss the reasons for conversion and propose necessary alterations to the company’s Memorandum of Association (MOA) and Articles of Association (AOA) to reflect the changes brought by the conversion

- Approve the proposal for conversion and authorise the filing of necessary applications with the Registrar of Companies (ROC).

Step 2: General Meeting and Special Resolution

- Issue a notice to all shareholders at least 21 days before the meeting, specifying the agenda and the proposal for conversion

- At the meeting, shareholders must vote in favour of the conversion by a majority of at least 75% of the voting power present or represented by proxy.

Step 3: Filing with ROC

- Within 15 days of passing the special resolution, submit the form to the ROC along with required attachments like the notice of the general meeting, copy of the special resolution, altered MOA and AOA, and details of directors and promoters

- Within 30 days of passing the special resolution, file this form with the ROC, informing them about the changes in the company’s capital structure and shareholding pattern.

Step 4: ROC Scrutiny and Certificate of Incorporation

- The ROC will scrutinise the submitted documents and may raise queries or require clarifications. Address them promptly

- Upon successful verification, the ROC will issue a fresh certificate of incorporation, officially recognising the company as a public limited company.

Step 5: Post-conversion Compliances

- Amend all official documents, letterheads, and contracts to reflect the new company name and status

- Apply for a new PAN card for the company as a public limited company after company registration.

- Notify tax authorities, banks, and other relevant stakeholders about the company’s conversion

- Ensure that the company maintains at least seven shareholders, as mandated for public limited companies.

Step 6: Ongoing Compliances

- Public limited companies are subject to stricter regulations and disclosure requirements compared to private companies. Familiarise yourself and comply with these regulations

- Implement good corporate governance practices, including transparency, accountability, and ethical conduct.

Conclusion:

Converting a private company to public can help you grow, but you need to plan and execute it carefully. To do this, you must follow legal rules, hire experts, do research, and plan for future growth. After conversion, you should also prepare for more regulations and transparency.

FAQs

What is the minimum number of shareholders required for a public limited company?

A minimum of seven shareholders is required for a public limited company.

What are the minimum capital requirements for a public limited company?

A public limited company must have a minimum paid-up capital of five lakhs.

How long does the process of converting a private limited company to a public limited company take?

The process of conversion can take anywhere between three to six months, depending on various factors.

Can a private limited company issue shares to the public?

No, a private limited company cannot issue shares to the public. Only a public limited company can issue shares to the public.

Is it mandatory to appoint a company secretary for a public limited company?

Yes, it is mandatory for a public limited company to appoint a company secretary.