An official document known as a Procedure for Issue of Debentures serves as a safe way for a creditor to make a loan to the debtor.

Procedure for issue of debentures by a company are legally binding instruments that allow creditors to lend to debtors in a safe manner. In this article, we examine the steps that must be followed by a company that has been registered in India in order to issue debt securities.

Debentures

In accordance with Section 2 (30) of the Companies Act of 2013, a “Debenture” is any instrument of a corporation that serves as proof of a debt, regardless of whether it has resulted in a charge against assets. This includes debenture stock, bonds, and other similar instruments. Debenture is one of the following types:

- Secured Debenture

- Unsecured Debenture

Requirements for Issue of Debentures

Before a debenture can be issued, the following requirements must be met:

- There will be no debentures issued by any company that has voting rights.

- No company may publish a prospectus, make offers or admittance towards the general populace or to its members numbering more than 500 for the purpose of soliciting subscriptions for its debentures, until the company selects one or even more debenture trustees and it has complied with the requirements for the referral of such trustees prior to such publication, offer, invitation, offer, or invitation.

- Without establishing a debenture trust, it is prohibited to issue of debentures to groups of further than 5000 people or to any other group of the general populace that is free from government clarification.

- To protect the rights of the holders of debentures and address their complaints, a debenture trustee would then take action.

- Every director of a company who is now in default upon making any default in accordance with the specifications of the Tribunal under such a segment shall be subject to the term of imprisonment which might also extend to a period of three years or a fine which shall not be less than ₹2 but which may broaden to ₹5 lakh or both.

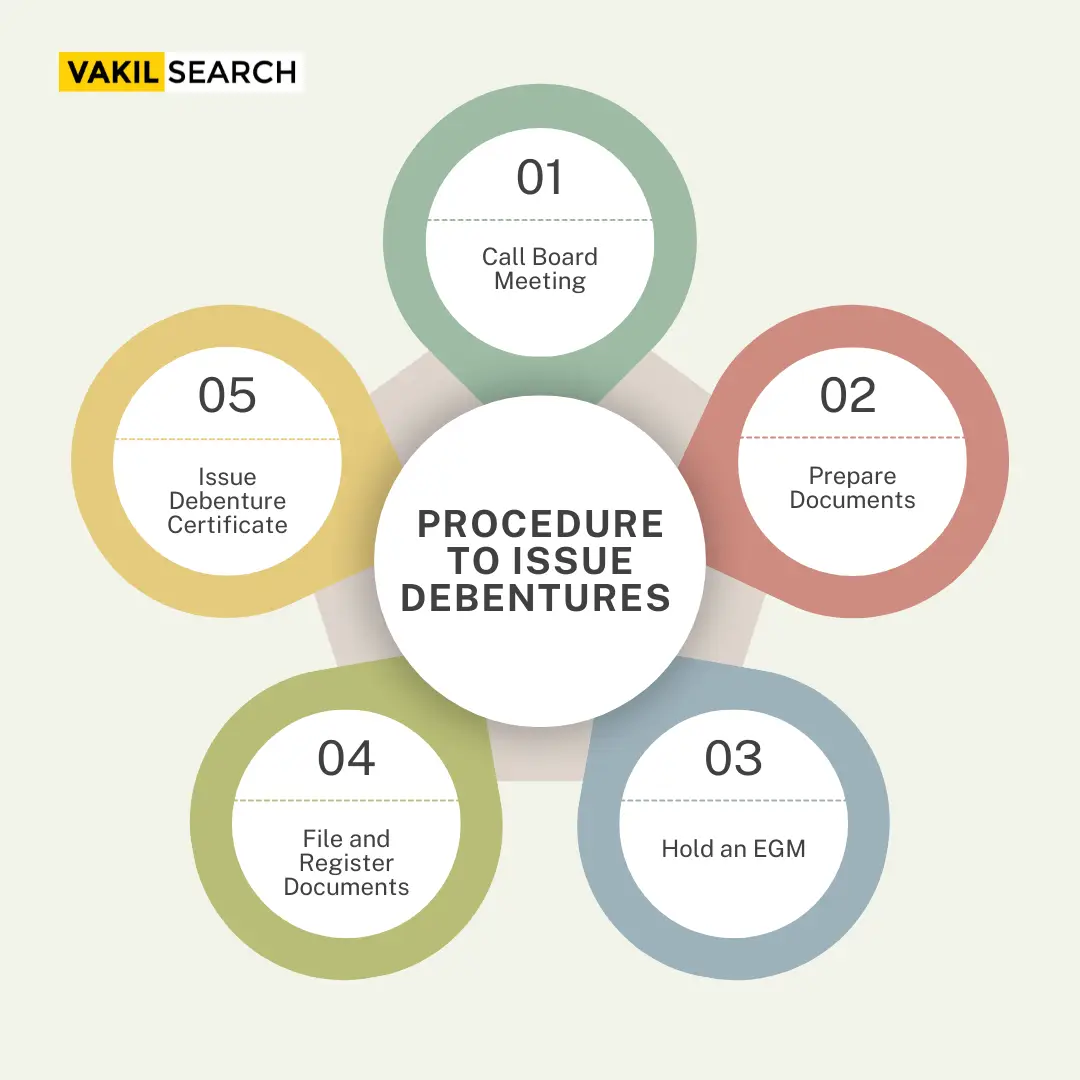

Procedure to Issue of Debentures

1. Call the Board Meeting

Call a board meeting, at which the board will decide what kinds of debentures the company will issue. Pass the following resolutions for approval at the Board meeting.

- Form No. PAS – 4 and Application Forms Offer Letter for Private Placement

- PAS- 5 Form No. Approval

- Appointing a debt trustee and approving the debt trustee agreement

- appointment of a specialist to approve an increase in borrowing authority, if necessary

- To permit the establishment of a charge against the company’s assets

- Accept the debt instrument subscription agreement

- To set the day, time, and date for the special meeting of shareholders.

2. Get the Following Documents Ready

Prepare the following paperwork and send out notices for an extraordinary general meeting based on the decisions made at the board meeting.

- Subscription Agreement for Debentures

- Private placement offer letter in Form No. Applications and PAS – 4

- Private placement offers records in Form No. PAS- 5

- Agreement with a Debenture Trustee

- Agreement establishing a charge against the company’s assets through a mortgage

Release the explanation statement and notices of the extraordinary general meeting, then.

3. Extraordinary General Meeting

Hold an extraordinary general meeting to allow for the passage of a special resolution authorizing the issuance of convertible secured debentures, increasing the company’s borrowing capacity, and approving the Board’s creation of charges against its assets.

4. Prepare and File Documents

Prepare and submit the aforementioned documents once the issue of debentures has been approved.

- To register a company, submit Forms PAS-4 and PAS-5 in Form GNL-2.

- Offer Letter should be submitted to the Companies Registrar in Form No. MGT-14.

- Fill out Form No. MGT-14 and submit it to the Registrar of Companies along with a copy of any board resolutions, special resolutions, debt trustee agreements, and so forth.

- Send in Form No. Following the allocation of debentures, PAS – 3 addressed the return of allocation to the Registrar of Companies (ROC).

- Create a charge on assets connected to the company by filing Form No. CHG-9.

5. Certified Debenture Certificate

In the event of any allotment of debentures, the certificate of debenture must be issued within six months of the date of allocation.

Features of Debentures:

Debentures, as financial instruments, exhibit distinct characteristics:

-

Fixed Interest Payments:

Debenture holders receive predetermined interest payments, offering stability in returns.

-

Maturity Date:

They have a specified maturity date, indicating when the principal amount will be repaid.

-

Non-Ownership Status:

Unlike equity, debenture holders do not possess ownership rights or voting privileges in the company.

-

Creditor Position:

Debenture holders hold the status of creditors, prioritised over equity shareholders during liquidation.

-

Secured or Unsecured:

Debentures can be secured by company assets or unsecured, relying on the company’s creditworthiness.

-

Transferability:

Often, debentures are transferable, allowing investors to buy or sell them in the secondary market.

-

Types Variation:

Various types exist, including convertible debentures that can be converted into equity shares.

Conditions for Issue of Debentures:

1. Asset Backing:

Secured debentures necessitate specific assets to be pledged, providing collateral for debenture holders.

2. Trust Deed:

A trust deed outlines terms, including pledged assets and rights of secured debenture holders.

3. Charge on Assets:

A charge is created on company assets, ensuring they can be sold to repay debenture holders in case of default.

4. Credit Rating:

Companies issuing secured debentures often undergo credit rating assessments to determine creditworthiness.

5. Regulatory Compliance:

Adherence to regulatory requirements is essential, ensuring legal compliance in debenture issuances.

6. Debenture Trustee:

Appointment of a debenture trustee safeguards debenture holder interests and ensures company compliance.

7. Prior Approval:

Companies may need regulatory approval before issuing secured debentures to protect investor interests.

Understanding these features and conditions is vital for both investors and companies involved in debenture transactions, providing clarity on terms and safeguards associated with these financial instruments.

Conclusion

Our legal professionals at Vakilsearch can make the entire issue of debentures by a Company completely hassle-free for your business if you have any questions about it.