Benefits of Private Limited Company Registration

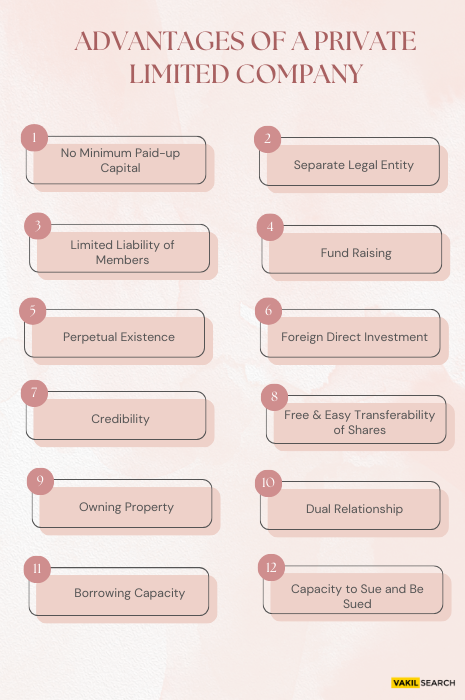

Incorporating a Private Limited Company offers significant benefits for businesses looking to establish credibility, growth potential, and operational efficiency. It provides a separate legal identity, limited liability for owners, and enhanced access to funding, making it a preferred choice for entrepreneurs and investors alike.

A Private Limited Company is a distinct legal entity, separate from its shareholders, which ensures that the personal assets of its owners are protected. This structure fosters trust among stakeholders, including customers, partners, and financial institutions. Additionally, it enables smoother business operations with clear ownership and governance frameworks.

Beyond legal protection, incorporating a Private Limited Company opens doors to greater opportunities for funding. Businesses can attract investors, raise capital through equity, and build sustainable growth. The entity’s structured compliance enhances credibility and long-term viability, making it easier to secure loans and partnerships.

Whether you’re starting a new venture or scaling an existing business, a Private Limited Company empowers you with the tools to manage risks, improve financial stability, and unlock growth opportunities. By combining limited liability, ease of ownership transfer, and improved market reputation, this business model sets the foundation for success.

This article explores the key benefits of forming a private limited company in India and explains why it is a preferred business structure.

1. Limited Liability Protection

The first advantage of a private limited company in India is limited liability protection. Here, the shareholders would not be liable for the debt of the company beyond the value of their shareholding. This will protect their personal assets. In this way, the overall level of financial risk stays relatively low if such troubles arise with the company in legal or financial terms.

Example:

A private limited company in India, if it earns INR 1 crore in debt, but one of the shareholders has put only ₹5 lakhs. Then his liability is to that extent INR 5 lakhs only. His savings and assets are not at stake.

2. Separate Legal Entity

A private limited company is considered to be an entity that is separate and distinct from its owners and shareholders. This means a company has a legal identity independent of its shareholders or directors. It can:

- Enter into contracts in its own name

- Own assets such as property and intellectual property

- Sue and be sued independently of its owners.

This statutory separation safeguards the personal resources of shareowners and enables the company to acquire property and contract or undertake other legal transactions.

3. Ease of Fundraising and Access to Capital

Indian private limited companies have better access to capital than sole proprietorships or partnerships. They can mobilise capital through:

- Share issuance: The company can issue the equity shares to close friends or relatives or can sell them to people outside of its network.

- Private Equity and Venture Capital: Venture capital and private equity funds frequently come to Indian startups and SMEs in exchange for equity stakes in the business.

This flexibility allows businesses to obtain all the money they want for scaling up with no burden of repaying big loans.

4. Perpetual Succession

The perpetuity of success assures that, even if any shareholder or director resigns, leaves the company, or dies, existence in the private limited company would never be disturbed. Such is because the company legally continues its existence without being disturbed by changes in ownership.

Benefits

- To Business Continuity: The existence of the company continues despite changes in leadership or ownership.

- Easily Transferred: Shares are transferred to heirs, new shareholders, or investors without disturbing the operations of the company.

5. Tax Advantages for Indian Pvt. Ltd. Companies

Indian Pvt. Ltd. companies enjoy several tax advantages. Perhaps the tax rates are much higher than a sole proprietorship, but then there are a number of deductions and exemptions available, for example:

- Expenses Allowable as Deduction: Salaries, rent, utilities.

- Depreciation Allowable on Assets: The company can deduct depreciation on its fixed assets like machinery and buildings.

- Startup tax exemptions: The eligible startups under the Startup India Scheme shall be provided a tax holiday for three successive years within ten years from the year of incorporation.

These provisions can help the Pvt. Ltd. companies manage their tax liabilities and reinvest in profit-making in the business for growth.

6. Ease of Transfer of Ownership

The structure of an India private limited company allows easy transferability. Ownership shares can be transferred from one shareholder to another, be it due to sale, inheritance, or investor exit.

Key Benefits:

- Easy Transferability: Easy transferability facilitates selling or giving up the stake in the business by shareholders without affecting the company operations.

- Easy investment attraction: Potential investors will more likely be attracted to companies whose ownership can easily be transferred.

This flexibility in transfer of ownership induces an element of growth in business and makes it easier to bring in new partners or investors.

7. Greater Credibility and Business Perception

Private limited companies are perceived as more trustworthy and credible as compared to sole proprietorships or partnerships. Several clients, suppliers and financial institutions in India prefer private limited companies for the following reasons:

- Legitimate registration with MCA: Givens legal operational structures legitimacy.

- Transparency: Pvt. Ltd. companies file annual financial statements and even follow auditing, hence more transparent.

- Brand reputation: Being a registered company provides a level of professionalism adding credibility on top of brand.

This credibility enhances business relationships and may even get better deals, contracts, and financing.

8. Growth Opportunities and Attracting Investors

In India, private limited companies have more opportunities for growth compared to other business structures. Investors, including venture capitalists and angel investors, often favor investing in private limited companies due to the following reasons:

- Corporate governance: The fact that such a company gives legal and financial reporting, which is structured, gives the investor much confidence in the stability of the company.

- Shares in exchange for investment: Investors can buy shares and receive equity, where there is a clear pathway for the return on investment.

These growth opportunities are further accentuated by the scope of partnerships, joint ventures, or mergers with other companies located within or outside of India.

9. Compliance with Startup India Initiative

India launched a program called Startup India in 2016 which has numerous welfare schemes for eligible private limited companies.

- Tax holiday: The tax exempted is permissible for three successive years on a start-up.

- Simplified regulatory compliance: The regulatory norms are relaxed in favor of the startups, which will make compliance simpler with labor and tax laws.

- Access to funding: The initiative grants government-approved funds for the support of startups and innovation and enhancement of quality products and services being offered.

For availing the benefits of the Start-up India scheme, it often proves to be the best option to be registered as a private limited company for the startups.

Conclusion

Setting up a private limited company in India has more benefits for entrepreneurs, including limited liability protection and easier access to capital, among other opportunities. It may also help to establish greater credibility with growth potential. The Pvt. Ltd. structure provides entrepreneurs, regardless of whether they are at the startup stage or have an established business, with flexible, professional, and scalable frameworks for ensuring long-term success. Further, compliance with the Startup India Initiative may provide tax benefits and alleviate several regulatory burdens, and therefore, incorporation as a private limited company may become even more attractive.

Ready to incorporate your business and enjoy the benefits of a Private Limited Company? At Vakilsearch, we simplify the process of company registration with expert guidance, hassle-free paperwork, and quick turnaround. Start your journey today with our comprehensive Company Incorporation Services.

Explore how a Pvt Ltd Company benefits startups in different cities:

FAQs for Private Limited Company

Private companies are often considered better than public companies in certain respects due to their distinct characteristics. Some advantages of private companies over public companies include: However, the choice between a private and public company depends on specific business goals and circumstances.

Yes, in many countries, including India, one person can own and operate a Private Limited Company, which is often referred to as a One Person Company (OPC). OPCs are legal entities designed to accommodate single entrepreneurs, providing limited liability and legal separation between the owner and the business.

Characteristics of a Private Limited Company typically include limited liability, a separate legal entity, a limited number of shareholders (often up to 200), restriction on share transfer, perpetual existence, and the ability to raise funds through equity shares.

Yes, one person can open a Private Limited Company in many countries, subject to compliance with legal requirements. This type of company is often known as a One Person Company (OPC).

Private companies operate similarly to public companies but have distinct differences, such as limited ownership, fewer regulatory obligations, and a focus on long-term goals. They are owned by individuals, a group of shareholders, or a single entity and can engage in various business activities based on their industry and business model.

A Private Limited Company is called so because it has restrictions on the number of shareholders it can have, typically limited to a maximum of 200 shareholders. The term limited implies that the liability of shareholders is limited to their capital contributions.

There is no specific requirement for the number of employees to establish a Private Limited Company. You can start a Private Limited Company with just one employee, such as the owner or director. How private company is better than public company?

Can one person own a private limited company?

What are the characteristics of a private limited company?

Can one person open a Pvt Ltd company?

How do private companies work?

Why is it called a private limited company?

How many employees are required for Pvt Ltd?