Explore the Pradhan Mantri Jan Dhan Yojana (PMJDY) and its transformative impact on financial inclusion. Learn about the scheme, PMJDY accounts, and the benefits of having a Jan Dhan account.

Pradhan Mantri Jan Dhan Yojana (PMDJY) – Overview

The Pradhan Mantri Jan Dhan Yojana (PMJDY) is a national mission for financial inclusion launched by the Government of India in August 2014. The scheme aims to ensure access to financial services, including banking, savings and deposit accounts, remittance, credit, insurance, and pension in an affordable manner. PMJDY is a comprehensive financial inclusion program that provides access to various financial services to Indian citizens, promoting financial literacy and inclusion.

Banking is one of the most important facilities in terms of securing one’s wealth. But not everyone has access to these facilities, especially in the rural areas. Give that the majority of the Indian population still lives in rural areas, it can be said that most of the country has no access to financial and banking services.

The government has launched the Jan Dhan Yojana to solve this problem. Besides, even the government has found it easier to implement welfare schemes and ensure their benefits are reached to the intended beneficiary if the said beneficiary possesses a bank account. And also, if all monetary transactions take place through banking networks, then there is more transparency. So with that in mind, the government is on a drive to ensure that every single citizen of the country has a bank account through the Pradhan Mantri Jan Dhan Yojana. In this article we shall take a look at this scheme and its various features.

PMJDY Scheme Benefits

The PMJDY scheme offers several benefits, including:

- No minimum balance requirement

- Access to government schemes

- Insurance coverage

- Overdraft facility

- Mobile banking facilities

- Rupay debit card

- Financial literacy for unbanked individuals

These benefits are aimed at promoting financial inclusion and providing access to essential financial services to unbanked individuals.

PMJDY Scheme Amount

Under the PMJDY scheme, account holders are eligible for accident insurance coverage of ₹1 lakh which has been further enhanced to ₹2 lakh, providing financial security to the account holders and their families in case of unforeseen events.

Who is Eligible for Jan Dhan Yojana Scheme?

The PMJDY scheme is open to individuals planning to open an account under PMJDY. The scheme aims to promote financial inclusion and provides access to various financial services, including Direct Benefit Transfer (DBT) and other financial transactions.

The basic eligibility criteria to avail benefits under this account are as follows:

- The account should be opened by the applicant for the first time in the bank.

- This account has been opened between January 15, 2014 to January 26, 2015 under Pradhan Mantri Jan Dhan Yojana.

- The benefits of this scheme can be availed by the applicant only when he is the head of the family or an earning member of the family and his age is between 18 to 59 years.

- Central or state government employees cannot take advantage of this scheme.

- Retired central or state government employees also cannot avail the benefits of this scheme.

- Citizens falling under the taxable bracket cannot participate in this scheme.

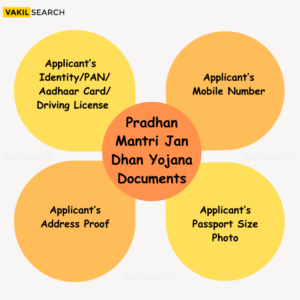

The applicant has to provide the following documents while applying for the scheme:

- Applicant’s Aadhaar Card / Identity Card / Driving License / PAN Card

- Mobile number

- Passport size photo

- Address proof

Pradhan Mantri Jan Dhan Yojana Documents Required

The documents required for opening an account under the PMJDY scheme include an Aadhaar card, PAN card, voter ID card, passport, driver’s license, NREGA job card, utility bills, ration card, pension card and identity card issued by government departments. These documents are essential for the Know Your Customer (KYC) process and account verification.

Jan Dhan Account Opening Online

Individuals can apply for a Jan Dhan account online by filling out the application form and providing the necessary details. The online application process allows individuals to open an account conveniently and access the benefits of the PMJDY scheme.

PMJDY Scheme Age Limit

The PMJDY scheme is open to individuals aged between 18 and 59 years, providing access to financial services and benefits to a wide range of individuals within this age group.

List of Banks Offering Jan Dhan Account Benefits

Several banks across India offer Jan Dhan account benefits, providing individuals with access to financial services and benefits under the PMJDY scheme. The scheme aims to promote financial inclusion and provide access to essential financial services to unbanked individuals.

Banks that provide the PMJDY scheme

|

PMJDY Scheme Launch Date

The PMJDY scheme was launched on 28th August 2014 by Prime Minister Narendra Modi as a financial inclusion initiative to bring comprehensive financial inclusion to all households in the country. The scheme aims to provide universal access to banking facilities and promote financial literacy, access to credit, insurance, and pension facilities.

Pradhan Mantri Jan Dhan Yojana Online Apply

Individuals can apply for the Pradhan Mantri Jan Dhan Yojana online through the official website or designated banking portals. The online application process allows individuals to open an account conveniently and access the benefits of the PMJDY scheme.

PM Jan Dhan Yojana Account Check Online

Account holders can check their PM Jan Dhan Yojana account balance online through designated banking portals and mobile banking applications. The online account check facility provides account holders with convenient access to their account information and balance details.

Pradhan Mantri Jan Dhan Yojana (PMDJY) – 10-Point Checklist

- PMJDY is a national mission for financial inclusion launched by the Government of India in 2014.

- The scheme aims to provide access to financial services such as bank accounts, deposits, remittances, credit, insurance, and pension to all Indian citizens.

- The scheme is a zero-balance account, and no minimum balance is required to open an account.

- PMJDY account holders are eligible for an accident insurance cover of Rs. 1 lakh and an overdraft facility of up to Rs. 10,000.

- The scheme provides mobile banking facilities and a Rupay debit card to account holders.

- PMJDY also focuses on financial literacy and aims to educate unbanked persons about financial services.

- Indian citizens, public sector enterprises, private sector companies, micro, small, and medium enterprises (MSMEs), and state and central government departments are eligible for PMJDY.

- Documents required for opening a PMJDY account include identification proof, address proof, bank account details, business registration certificate, project proposal, land ownership documents, and financial statements.

- PMJDY accounts can be opened online through the PMJDY website or offline by visiting a bank branch.

- PMJDY account holders can check their account balance online through the Know Your Customer (KYC) process. Direct Benefit Transfer (DBT) transactions made within 90 days of the accident are considered.

The PMJDY scheme consists of 6 pillars which are as follows.

- Accessible Banking Facilities – With this, they are trying to put each district in SSA which means sub service area under which at least one to two thousand households will be covered within a 5 km radius.

- Basic Banking Facility – He targeted at least one bank account in every unbanked household, so that it can inculcate the culture of banking habits in every household and convince them to save their hard earned money in a bank account.

- Financial Literacy Program – To educate them about financial literacy, so that they can operate ATM cards and know its benefits.

- Micro Credit – Once you have opened the account and operated it satisfactorily for the next six months, you are eligible for a credit facility of ₹ 5000 and against this the bank will ask you for any type of security, purpose or use of the credit Will not ask for.

- Micro Insurance Facility – With this all BSBD (Basic Savings Bank Deposit) account holders are eligible for micro insurance and there are two insurance schemes for the same.

- Pradhan Mantri Jeevan Bima Yojana (PMJBY) – Under this, the beneficiary will get a life insurance cover of ₹ 2 lakh and for this he will have to pay only a premium of ₹ 330 per year

- Pradhan Mantri Suraksha Bima Yojana (PMSBY) – Pradhan Mantri Suraksha Bima Yojana will give you an accidental cover of ₹ 2 lakh and for this you will have to pay only a premium of ₹ 12 per year.

- RuPay Debit Card – Once you open the account you will get a RuPay Card (ATM Card) which includes Accidental Insurance of ₹ 2 lakh.

Pradhan Mantri Jan Dhan Yojana : Benefits

- A basic savings bank account is opened for individuals who have never had a bank account before. This initiative aims to extend banking services to those who were previously unbanked

- There is no mandatory requirement to maintain a minimum balance in PMJDY accounts. This means that individuals can open and operate these accounts without worrying about meeting a minimum balance threshold

- Deposits made in PMJDY accounts accrue interest. This means that individuals will earn interest on the money they have deposited in their PMJDY accounts, which can help their savings grow over time

- PMJDY account holders are provided with a Rupay Debit card. This debit card facilitates easy access to funds, allowing account holders to make transactions and withdrawals conveniently

- Account holders with PMJDY are eligible for Accident Insurance Cover of Rs. 1 lakh. For new PMJDY accounts opened after August 28, 2018, this coverage has been increased to Rs. 2 lakh. This insurance is linked to the RuPay card issued to PMJDY account holders and provides financial protection in case of accidents

- An overdraft (OD) facility of up to Rs. 10,000 is available to eligible PMJDY account holders. This overdraft feature allows account holders to withdraw extra funds when needed, offering financial flexibility

- PMJDY accounts are eligible for various government schemes, including Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), and the Micro Units Development & Refinance Agency Bank (MUDRA) scheme. This ensures that PMJDY account holders can access a range of financial benefits and support programs provided by the government.

Pradhan Mantri Jan Dhan Yojana: Documents Required

1. Aadhaar Card as a Primary Document:

If you possess an Aadhaar Card or Aadhaar Number, it serves as a primary document for opening a bank account, and no additional documents are required. In case your address has changed, you can simply provide a self-certification of your current address, which is sufficient to update your account information.

2. Alternative Officially Valid Documents (OVDs):

If you do not have an Aadhaar Card, you can use one of several Officially Valid Documents (OVDs) to establish your identity and address. The following documents are acceptable: Voter ID Card, Driving License, PAN Card, Passport, and NREGA Card. If any of these documents also display your current address, they can be used as both proof of identity and address.

3. Special Consideration for ‘Low Risk’ Applicants:

In situations where an individual does not possess any of the officially valid documents mentioned above but is categorised as ‘low risk’ by the bank, there is still a way to open a bank account. In such cases, the applicant can submit any one of the following documents:

- Identity Card with the applicant’s photograph issued by Central/State Government Departments

- Identity Card issued by Statutory/Regulatory Authorities

- Identity Card from Public Sector Undertakings

- Identity Card from Scheduled Commercial Banks

- Identity Card from Public Financial Institutions

- Additionally, a letter issued by a gazetted officer with a duly attested photograph of the person can also be presented as an alternative document for account opening. This flexibility ensures that individuals without the traditional set of documents have options to access banking services, especially when their risk profile is deemed low by the bank.

How To Apply?

- The interested beneficiaries of the country who want to open their account under this Pradhan Mantri Jan Dhan Yojana 2024, then they have to go to their nearest bank.

- After going to the bank, you will get the application form for opening a Jan Dhan account from there.

- After taking the application form, you will have to fill all the information asked in the application form.

- After filling all the information, you will have to attach all your necessary documents with the application form and submit the filled application form to the bank’s official. The account will be opened.

How To Check Jan Dhan Account Bank Balance?

There are two ways to check the balance in the Jan Dhan account.

Through the Jan Dhan portal

- First of all, you have to go to the official website of PFMS. After visiting the official website, the home page will open in front of you.

- On this home page you will see the option of Know Your Payment. You have to click on this option. After clicking on the option, the next page will open in front of you.

- Pradhan Mantri Jan Dhan Yojana

- On this page you have to fill in your Bank Name, Account Number. Here you have to enter the account number twice. After filling the account number, you have to fill the Captcha Code.

- And then you have to click on Send OTP On Registered Mobile Number. After this OTP will come on your mobile number, then you can check your bank balance by entering OTP. Via missed call

- If you do not want to check Jan Dhan account balance through the portal, then you can also check your bank balance through a missed call.

- If your Jan Dhan account is in State Bank of India, then you can give a missed call on 1800 425 380 or 1800 112 211.

- Ensure that the missed call is made from the same mobile number which is registered in your bank account.

The Takeaway

In conclusion, the Pradhan Mantri Jan Dhan Yojana (PMJDY) is a significant initiative by the Government of India to promote financial inclusion and provide access to essential financial services to unbanked individuals. The scheme offers several benefits and aims to provide financial security and access to various financial services to Indian citizens, promoting financial literacy and inclusion.

The Pradhan Mantri Jan Dhan Yojana is the first major scheme where public distribution of wealth is implemented. More and more people are signing up under this account with the passage of time and benefiting from it. It also creates awareness amongst the lower income groups regarding banking and financing facilities as they get more used to the banking system. So it is imperative that information regarding the same is spread and more and more people take advantage of the scheme. If you have any other queries regarding legal or regulatory matters, get in touch with us and we will ensure that you receive the right kind of professional help from our team of experts.

Pradhan Mantri Jan Dhan Yojana (PMDJY) FAQs

Why was the PMGSY introduced?

The PMGSY was introduced to promote financial inclusion and provide access to essential financial services to unbanked individuals, ensuring access to banking facilities and promoting financial literacy.

How will the common citizen benefit from PMGSY?

The common citizen will benefit from the PMGSY through access to financial services, insurance coverage, and various government schemes, promoting financial inclusion and access to essential financial services.

In what way does PMGSY plan to integrate the various transportation modes?

The PMGSY aims to integrate various transportation modes to promote multi-modal transportation and optimize logistics, reducing transportation costs and enhancing connectivity.

How will the PMGSY be funded?

The PMGSY is funded through the Union Budget and government allocations, ensuring the implementation and success of the financial inclusion initiative.

What is the Jan Dhan Yojana, and what is its primary objective?

The Pradhan Mantri Jan Dhan Yojana (PMJDY) is a government initiative aimed at achieving financial inclusion across India. Its primary objective is to ensure that every household in the country has access to basic banking services. PMJDY seeks to bring the unbanked and underbanked populations into the formal banking system, promoting financial stability and economic development.

Who is eligible to open a Jan Dhan account, and what documents are required for account opening?

Any citizen of India aged between 18 to 59 is eligible to open a Jan Dhan account. To open an account, you typically need proof of identity and proof of address. Accepted documents include Aadhar card, voter ID, passport, driving license, and more. In the absence of an Aadhar card, other officially valid documents (OVDs) can serve as proof of identity and address.

What are the key benefits of having a Jan Dhan account for account holders?

Key benefits of a Jan Dhan account include receiving direct financial assistance from the government, insurance coverage, no minimum balance requirement, issuance of a debit card, access to overdraft facilities, and easy conversion of existing accounts. These benefits enhance financial security and accessibility to banking services.

Is there a minimum age requirement to open a Jan Dhan account?

Yes, the minimum age requirement to open a Jan Dhan account is 18 years or older, ensuring that a broad range of individuals, including minors, can access this financial inclusion initiative.

What is the process for availing the overdraft (OD) facility in a Jan Dhan account?

To avail the overdraft facility in a Jan Dhan account, you need to meet the bank's specific criteria, which may vary from one bank to another. Banks typically evaluate an individual's creditworthiness and financial stability before granting an overdraft.

Can I link my existing bank account to the Jan Dhan Yojana to receive government subsidies?

Yes, you can convert your existing savings account into a Jan Dhan account to avail yourself of the benefits offered under the Jan Dhan Yojana, including receiving government subsidies directly into your account.

Are there any charges or fees associated with maintaining a Jan Dhan account?

Jan Dhan accounts are generally designed to be low-cost or no-frills accounts. As a result, there are typically no charges for maintaining these accounts. However, it's advisable to confirm with your specific bank or financial institution for any potential fees or charges.

What happens if I do not use my Jan Dhan account for an extended period?

If your Jan Dhan account remains dormant or unused for an extended period, you should inquire with your bank about its policy regarding dormant accounts. Banks may have specific rules for handling such accounts, so it's essential to stay informed.

How can I check the balance and transaction history of my Jan Dhan account?

You can conveniently check the balance and transaction history of your Jan Dhan account through various channels, including ATM machines, mobile banking apps, internet banking, or by visiting your bank branch. These options provide transparency in managing your account.

What steps should I take if I want to close my Jan Dhan account?

To close your Jan Dhan account, visit your bank branch and follow the bank's prescribed procedure for account closure. Make sure to withdraw any remaining balance before initiating the account closure process to ensure a smooth transition.