Read this blog to understand how you can efficiently apply for an MSME loan in India to get the required funds for your business.

There are certain MSME loan offered by the government of India. If you are soon going to start a business for which you are looking for funding, these MSME loan schemes can help. In this article, we will talk about the eligibility criteria, benefits, and everything you need to know about applying for a business loan for your small business.

The Indian government has been working for decades to improve the country’s small & mid industries. The MSME loan is a type of support provided by the Government of India and the Reserve Bank of India to boost micro, small, and medium-sized businesses. This relatively simple credit scheme ensures help for entrepreneurs’ money, infrastructure, or other areas, with the bonus of being a loan. An MSME company loan gets a business expansion, establishment, or meeting expenses with the proper documentation and action plan.

Because the scheme was created by the Indian government, SIDBI and the Ministry of MSME, considerations such as project viability are considered when financial institutions test loan applications. The availability of collateral-free loans secured by the assets financed has encouraged more MSMEs to take advantage of this programme. However, many institutions have created requirements that every business must follow to receive financial aid for their operation.

According to the new government guidelines, the investment ceiling increased, and a different rule of turnover has been added for MSME loans. Before, the Micro, Small and Big Enterprises Act (MSME Act) 2006 defined a micro-unit as one with a capital investment of ₹25 lac, a small enterprise as one with a capital investment of ₹5 crores, and a medium enterprise as one with a capital investment of ₹10 crores. There was a differentiation between manufacturing sectors, so in the case of services, the investment cap was ₹10 lakhs to ₹2 crores for micro, ₹10 lakhs to ₹2 crores for small, and ₹2 crores to ₹5 crores for medium.

The distinction between manufacturing sectors abolishes from the recently amended definition of MSMEs. This means that a micro firm has an investment of about 1 crore and a turnover of about ₹5 crores, a small firm has an investment of about ₹10 crores and a turnover of about ₹50 crores, and a medium-firm has an investment of more than ₹20 crore and retention of about ₹100 crores. This new change helps a startup or an existing business grow and helps them develop more benefits by increasing classification transparency. The government would also be able to verify a company’s turnover using GST data rather than machinery investment. If you’re looking for an MSME loan, follow this step-by-step approach to applying for one online. MSME Loan also come with several government schemes and subsidies to support the growth and development of MSMEs.

MSME Loans Types

- The Pradhan Mantri Mudra Yojana – PMMY offers up to ₹10 lakh to quasi and semi-small or micro-enterprises. Loans class MUDRA (Micro Units Development and Refinance Agency Limited) loans under this plan. Borrowers can approach commercial banks, MFIs, and NBFCs for loans or apply online. The loans are awarded based on the ‘Shishu, ‘Kishore, and ‘Tarun’.

- The Credit Guarantee Trust Fund for Micro and Small Enterprises – CGT MSE was established to provide financial support to small and medium-sized businesses without a third-party guarantee or collateral. Entrepreneurs can approach chosen rural financial institutions for financial help, with guarantees ranging from 50% for retail activities to over 85% for micro-companies. In the event of default, the trust will cover up to 75% of the debt.

- The Khadi and Village Industries Commission – KVIC offer a loan for the Prime Minister’s Employment Generation Programme (PMEGP). The loan is given to designated groups to develop businesses as a lending subsidy system, with 15-35% of the project cost covered upfront and the rest disbursed at periodic intervals.

- The Credit Linked Capital Subsidy Scheme – CLCSS allows MSME to catch up to the rest of the world’s technology. The scheme offers a 15% subsidy for further expenditure up to ₹1 crore to incorporate cutting-edge technology into business practices.

- Fund of Funds Equity Infusion – This one is for MSMEs and is a scheme to assist MSMEs in their growth stage. An equity intervention provides cash to underprivileged MSMEs with growth potential.

- SIDBI Make In India Loan For Enterprises – SMILE was created to help MSME promote the Indian government’s “Make in India” drive. It assists eligible businesses in meeting their debt-equity ratio by giving soft loans on quasi-equity. The primary purpose is to finance smaller businesses, and the payback period is up to ten years, with a 36-month moratorium.

- MSME Loan can be used for various purposes such as working capital, expansion, machinery purchase, and infrastructure development.

MSME Loan – Highlights – 2023

- Loan Amount – No Minimum limit to borrow & Maximum Limit of up to Rs. 2 crores (Unsecured Business Loan), which can exceed as per business requirements

- Repayment Tenure From – 12 months to 5 years, may exceed, as per the business requirements

- Processing Fee – Nil to 4% of the sanctioned loan amount

- Foreclosure Charges – 0 to 5% of the outstanding principal amount

- Part-payment Charges – 0 to 4% of the outstanding principal amount

- Credit Facilities -Working Capital Loan, Bill discounting, Overdraft, Term Loan, Cash Credit, Letter of Credit, Bill of Purchase, Merchant Cash Advance, Loans under Govt. Schemes, etc.

Purpose of MSME Loans

MSME loans, offered by financial institutions, are like a helping hand for businesses to realize their potential. These loans can be used for various business-related purposes, such as:

Starting or Expanding Business: Whether you’re a budding entrepreneur or an established business owner, MSME loans can provide the funds needed to start a new business or expand your existing one.

Acquiring Equipment and Machinery: From lab equipment to machinery and electrical appliances, MSME loans can help you purchase the tools you need to take your business to the next level.

Constructing Spaces: If you’re planning to build a new space or acquire a commercial property, MSME loans can provide the necessary funds for construction and acquisition.

Working Capital Needs: MSME loans can be a lifesaver when it comes to meeting your day-to-day expenses, paying salaries, purchasing raw materials, and managing inventory.

Introducing New Products: If you’re planning to launch a new product line, MSME loans can provide the financial backing to turn your ideas into reality.

Investing in Vehicles: Whether you need a fleet of vehicles for your logistics business or transportation needs, MSME loans can make it happen.

MSME Loan Schemes Initiated By the Govt. of India

The Indian Government, in collaboration with financial institutions, has introduced various MSME loan schemes to support Micro, Small, and Medium Enterprises (MSMEs). Some popular schemes include:

CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises): This scheme provides collateral-free credit to MSMEs and small businesses.

CLCSS (Credit Linked Capital Subsidy Scheme): It offers a subsidy for technology upgradation in MSMEs.

MUDRA Yojana under PMMY: Micro Units Development & Refinance Agency (MUDRA) scheme offers financial support to micro-enterprises.

PMEGP (Prime Minister Employment Generation Programme): This scheme promotes self-employment opportunities through micro-enterprises.

Other Loan Schemes available are – Prime Minister’s Rozgar Yojana, PSB Loans in 59 minutes under SIDBI, Standup India and Startup India.

Does MSME Loan comes with or without Collateral/Security

MSME loans come in both secured and unsecured forms. Many lenders offer unsecured loans, which means you don’t need to provide collateral. These loans come with various features:

- Collateral-free loans up to Rs. 2 crores

- Short-term loans repayable in 12 months to 5 years

- Offered by banks, NBFCs, RRBs, SFBs, and MFIs

- The loan amount depends on factors like credit score, business stability, and more

Factors Affecting MSME Loan Interest Rates

The interest rates of MSME loans are influenced by:

- Applicant’s profile, credit score, and financial history

- Desired loan amount and tenure

- Business turnover, profitability, and vintage

New MSME Categorisation

Recent changes in MSME categorization have made investment amounts and annual turnover similar for both manufacturing and services enterprises. This change aims to create a more balanced and inclusive landscape for MSMEs.

- For Manufacturing & Services Sectors, Both

Micro Enterprise – Investment less than Rs. 1 crore and Turnover less than Rs. 5 crore Small Enterprise – Investment less than Rs. 10 crore and Turnover up to Rs. 50 crore

Medium Enterprise – Investment less than Rs. 50 crore and Turnover up to Rs. 250 crore

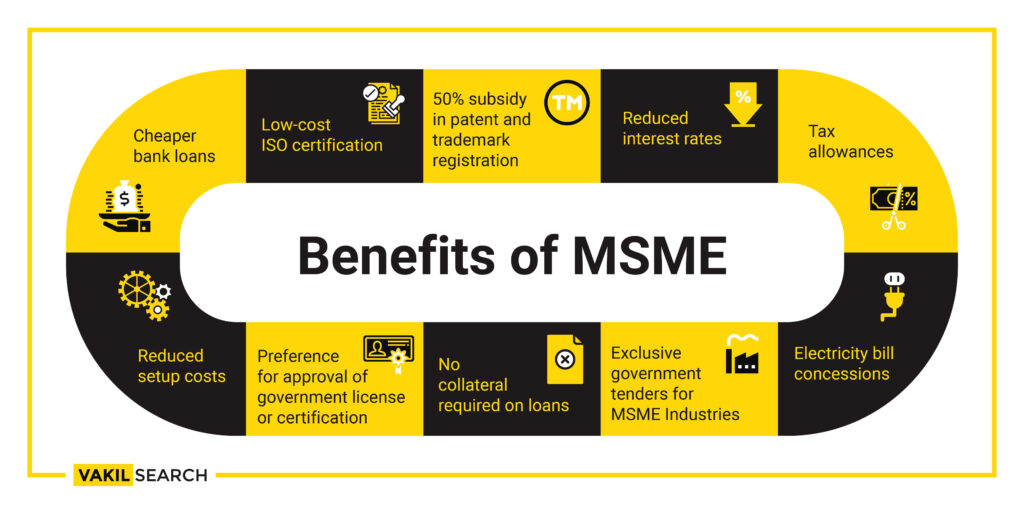

MSME Loan Benefits

By applying for loans under the scheme as an MSME registered business enterprise, you gain the following benefits:

- You can usually get loans with no collateral. Due to variances in banking institutions or the specifics of your business, minor policy modifications may occur

- MSME business loans approve fast using internet platforms and the funds’ deposit. You can also manage your loan through your financial provider’s net banking website

- Establishments receive a rebate on patent registrations as part of MSME programmes. This patent registration subsidy has proven beneficial because the Indian government is constantly pushing small firms to develop and work on new initiatives

- The majority of MSME plans provide interest rate exemption on overdrafts to protect businesses through market downturns. However, rates and tenure may differ from bank to bank and scheme to plan.

- MSME Loan are designed to meet the financial needs of micro, small, and medium enterprises.

MSME Loan Application Eligibility and Requirements

The MSME loan application procedure begins with determining your eligibility. You must be a resident of India between the ages of 25 and 65, and you must have operated a business for at least three years and filed income taxes for at least one year.

Basic identity information such as first and surname names, email addresses (optional), and phone numbers requires for eligibility. Firm-related information states the kind and type of business, as well as predicted returns over the next 12 months. MSME Loan can help businesses to overcome financial challenges and achieve their growth objectives.

MSME Loan Documents Required

Documents required for msme loan for new business

- Identity Proof: Passport, driving license, PAN card: https://www.pan.utiitsl.com/, Voter’s identity card;

- Residence Proof: Passport, leasing agreement, trade license, telephone and power bills, ration card and sales tax certificate;

- Age Proof: Passport, Voter’s identity card, PAN card.

How can I apply for an MSME Loan?

- Step 1: To begin, locate the MSME loan application form

- Step 2: After that, you’ll need to fill out some basic information. Your phone number and date of birth as shown on your PAN card. Filling out these details completes the first stage of your application

- Step 3: Fill in the business information and your earnings information. You need to provide information about your business and other statistics such as your income and turnover, as well as your annual income, for the bank to assess your eligibility

- Step 4: Your business PAN and relevant details needed by the bank or finance provider

- Step 5: Check the MSME loan offers. After you fill out the above information, you will be shown the maximum amount you can borrow from the finance service provider as an MSME loan. Here you may view your monthly EMI, including the interest rate and other minor information that needs your attention

- Step 6: Complete the MSME loan by selecting one of your finance provider’s offerings or packages and determining the repayment period

- Step 7: After receiving acknowledgement and verification, you have applied for an MSME loan. Make a careful review of the loan amount, payment term, and information with the financing partner. You should expect the loan money to reach your account within a few working days after receiving an online confirmation of your application’s approval.

Conclusion

It is important to choose the right lender and loan product to ensure that MSME Loan are suitable for your business needs and financial situation. India is a country with great potential for global expansion. Given the plenty of resources in India, the country’s entrepreneurs need the appropriate kind of encouragement and aid to thrive. The government’s MSME loan scheme is a terrific method to help the country’s up-and-coming enterprises.

FAQs

What is the maximum loan to MSME?

The loan amount offered to MSMEs depends on various factors, including business turnover, credit history, and repayment capability. It varies from one financial institution to another.

Which MSME is most profitable?

The profitability of an MSME sector depends on various market trends and business strategies.

What is the capital subsidy for MSME?

Capital subsidies for MSMEs are offered through schemes like CLCSS (Credit Linked Capital Subsidy Scheme). These subsidies aim to support MSMEs in upgrading their technology and enhancing their competitiveness.

Also, Read: