LIC Kanyadan Policy is a unique LIC of India scheme specially designed to take care of your daughter's future. Read this article to get all the information you need on features, benefits, eligibility criteria and how to apply for it right here.

The Life Insurance Company of India launched the LIC Kanyadan Policy Scheme to raise money for daughters’ weddings and schooling. Anyone can contribute to this plan for his daughter’s wedding. This strategy has a 25-year duration. By saving ₹ 121 every day, participants in this scheme would be required to pay a premium of ₹ 3600 per month, but only for 22 years. After the tenure of 25 years, he would receive ₹27 lakhs.

VakilSearch has actively collaborated with the government on its initiative to help the poor by offering its ever-helpful hand in assisting individuals to complete different forms and applications and providing support in the face of legalese issues. So connect with the experts at VakilSearch for any issues related to this scheme.

LIC Kanyadan Policy Scheme

This insurance plan is available for 13 to 25 years. You would only be required to pay the premium for the first 3 years of the period you choose under this LIC Kanyadan Policy Scheme. Anyone can get insurance for no less than ₹ 1 lakh. The father must be at least 18 years old, and the daughter must be at least 1 year old to purchase insurance under the LIC Kanyadan policy plan. The duration of this strategy is 25 years. You may also get this LIC Kanyadan Policy based on the age difference between you and your daughter. This policy’s duration will be shortened as per the daughter’s age. A person can join this insurance plan and use its advantages whether he wishes to pay a lower or higher price.

Purpose of LIC Kanyadan Policy

The LIC Kanyadan Yojana’s primary goal is to ensure the future of Indian daughters by giving them financial security for their education and marriage.

It is really difficult to save for a daughter’s wedding after meeting the daily needs of the family. So for the societal upliftment of the girl child, this scheme was launched. The Life Insurance Corporation of India Company developed a policy to invest in a daughter’s wedding and can also accumulate funds for the daughter’s successful future. The father will be able to meet all of his daughter’s aspirations with this LIC Kanyadan Policy, without any financial burden on his shoulders.

Eligibility Criteria of LIC Kanyadan Policy

| Parameters | Key highlights |

| Entry age of the policyholder |

Minimum – 18 years Maximum – 50 years |

| The entry age of the daughter | Minimum 1 year |

| Sum assured |

Minimum – Rs. 1 lakh Maximum – No upper limit (The Basic Sum Assured shall be in multiples of 10,000) |

| Maximum maturity age | 65 years |

| Policy term | 13 years to 25 years |

| Premium paying term | Policy term minus 3 years |

| Premium payment options | Monthly, quarterly, half-yearly, and yearly |

| Who can buy the policy | Only the father/mother, not the daughter herself. |

| Riders benefit | Available |

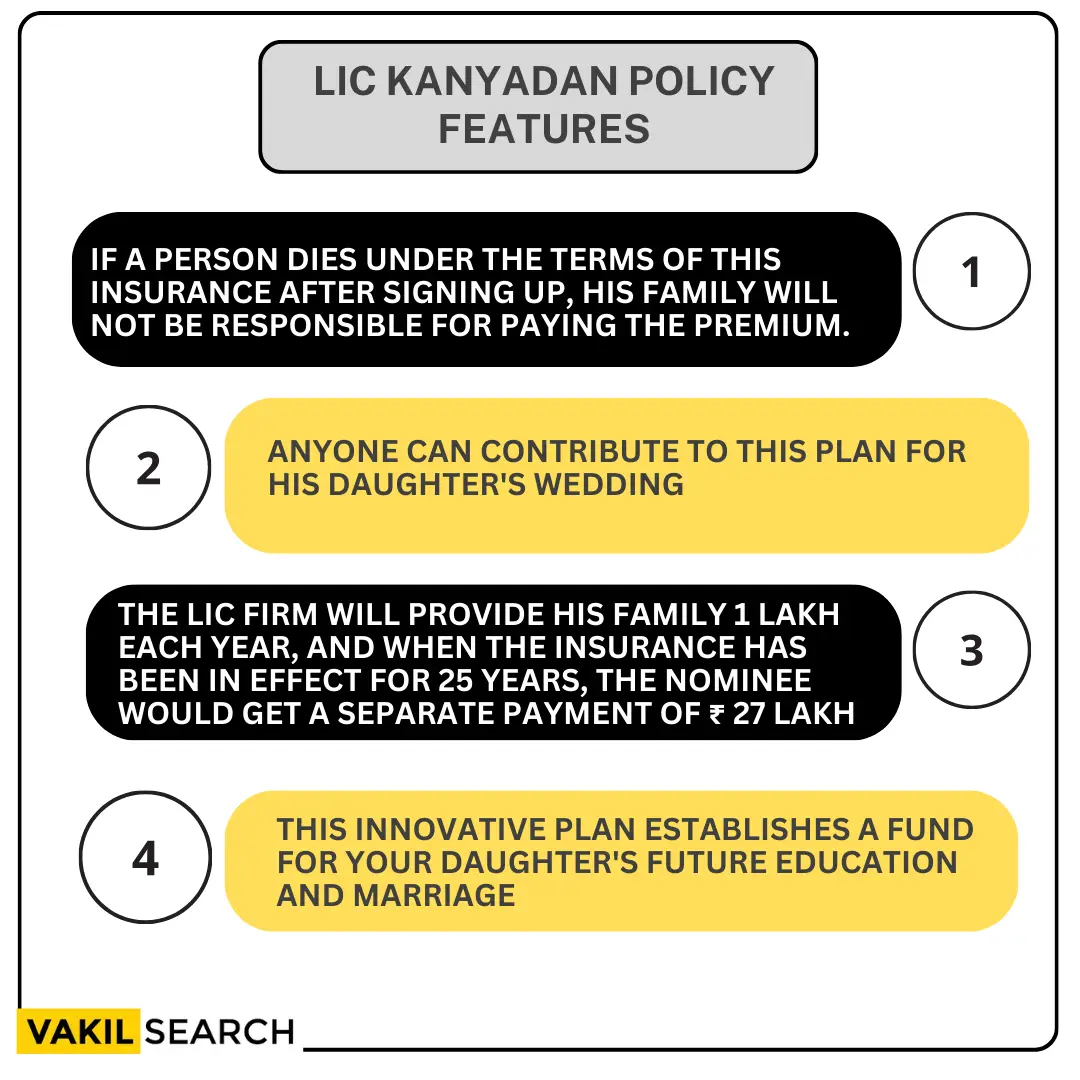

Features of the LIC Kanyadan Policy

- If a person dies under the terms of this insurance after signing up, his family will not be responsible for paying the premium

- Anyone can contribute to this plan for his daughter’s wedding

- Additionally, the LIC firm will provide his family ₹1 lakh each year, and when the insurance has been in effect for 25 years, the nominee will get a separate payment of ₹ 27 lakh

- This innovative plan establishes a fund for your daughter’s future education and marriage.

Benefits of LIC Kanyadan Policy

- You may ensure your daughter’s future financial independence with the LIC Kanyadan Policy

- Before the maturity date, this policy will offer life-risk coverage for a maximum of three years

- The life guaranteed under this insurance will receive a lump sum payment at maturity

- If the father passes away, the LIC Kanyadan Policy does not require the premium to be paid

- The beneficiary’s relatives will receive ₹ 1,000,000 in the event of his accidental death

- Up to the maturity date, a premium of ₹ 50,000 will be paid annually

- The LIC Kanyadan policy’s advantages are also available to Indian people who reside outside of India

- If the recipient passes away due to a natural cause, then ₹ 5,00, 000 will be given.

- Under the LIC Kanyadan Yojana, the payment period for the premium is constrained

- The LIC Kanyadan Yojana offers savings opportunities, insurance, and an insurance plan that generates profits

- Under the LIC Kanyadan Yojana, the premium payment period is fewer than three years

- There are several ways to pay the premium under the LIC Kanyadan Yojana, including monthly, semi-annually, quarterly, and yearly

- If an applicant passes away before the policy’s maturity date, 10 percent of the sum insured will be paid each year up to that point

- To make the LIC Kanyadan Scheme easier for policyholders to understand, it is also accessible in Hindi

- If the policyholder has paid his or her premium for three consecutive holders, he or she may request a loan against the value of the policy

- According to the Tax Exemption Laws of India, 1961, the LIC Kanyadan Scheme is free from paying taxes

- The LIC Kanyadan Yojana offers policies with terms ranging from 13 to 25 years

- The policyholder is given the choice of making a payment for a period of 6, 10, 15, or 20 years

- Additional benefits will be given to the family members of such policyholders if the father of the daughter passes away during the policy term

- The policyholder will receive the disability rider benefit if they have been paying their premiums for at least 5 years

- The Life Insurance Corporation of India would cover 80% of the premium cost if the policyholder dies by suicide within a year of the application date.

Key Highlights of LIC of India

Life Insurance Corporation of India (LIC) is one of the largest providers of insurance and related insurance products in India, offering a wide range of policies to cater to different needs and preferences since 1956.

Some of the key highlights of LIC policies include:

- Wide Range of Policies: LIC offers various types of life insurance plans, such as term insurance, whole life, endowment, and money-back plans.

- Financial Security: LIC life insurance policies provide financial security to the family of the insured in case of an unforeseen demise of the insured during the policy tenure.

- Variety of Life Insurance Plans: LIC of India offers a variety of life insurance plans to choose from, allowing individuals to select a plan according to their requirements and budget.

Why Opt for LIC Life Insurance Plans?

There are several reasons to opt for LIC life insurance plans:

- Security: LIC is a government-run insurance company, which provides a sense of security and reliability to policyholders.

- Wide Range of Plans: LIC offers a diverse range of life insurance plans, catering to different needs and preferences.

- Customizable Options: LIC policies come with various riders and options, allowing policyholders to customize their coverage according to their requirements.

- Maturity Benefits: LIC endowment plans offer maturity benefits along with death benefits, providing policyholders with long-term savings and financial security.

- Surrender Benefit: In case of an emergency, policyholders have the option to surrender the policy and receive the surrender benefit.

- Regular Income Benefit: Some LIC policies offer regular income benefits after a deferment period, providing policyholders with a steady source of income during retirement or other financial needs.

- Flexi Income Benefit: Some LIC policies allow policyholders to accumulate and withdraw their savings, subject to the terms and conditions of the policy.

Overall, LIC life insurance plans offer a comprehensive range of coverage, savings, and investment options, making them an attractive choice for individuals seeking financial security and long-term savings.

How to Avail of the Benefits of the Scheme?

You must go to your local LIC office or LIC agent and mention that you wish to invest in the LIC Kanyadan policy if you are one of the interested beneficiaries who want to apply under this policy. After giving the LIC agent all of your information and supporting documentation, he will complete your form. He will then explain the terms of the LIC Kanyadan Policy, and you must pick one according to your income. You can sign up online for the LIC Kanyadan Policy through this method. You may go to the LIC’s official website to learn more about the program.

Visit VakilSearch if you have any queries regarding the scheme.

FAQs

When is the premium for the LIC Kanyadan Policy due?

With this plan, you may pay the premium whenever it's convenient for you. You can choose to pay the premium monthly, quarterly, half-yearly, and yearly. The premium can be paid whenever it's convenient for you.

What documents are required to apply for LIC Kanyadan Policy Scheme ?

Identification proof with a passport-size picture and an Aadhar Card, or address proof, or birth certificate, To pay the initial premium, use a check or cash, and complete and signed form for a scheme proposal

How old must a person be to purchase a LIC Kanyadan Policy?

Your daughter must be at least one year old and you must be at least thirty years old to get a LIC Kanyadan policy. You are granted this coverage for 25 years. This just requires you to pay the premium for 22 years.

What is the maturity period of the LIC Kanyadan Policy, and are there any options for early withdrawal or surrender?

The LIC Kanyadan Policy has a maturity period of 15 years. The policy can be surrendered at any time provided at least two full years' premiums have been paid. However, surrendering the policy before the maturity period may result in the policyholder losing out on a lot of benefits of the scheme, and the amount of premium is much higher than the value received.

Can the policy be customized to suit specific financial goals or requirements of the policyholder and their daughter?

The LIC Kanyadan Policy is a financial cushion for the parents of girl children who want to build a financial corpus to secure their daughters’ future. This protection and savings plan helps a parent to deposit the money at a lower premium rate to meet the educational needs and future needs, such as the marriage of the girl child. To determine if the policy can be customized to suit your specific financial goals or requirements, reach out to your closest LIC branch.

What is the premium payment frequency for the LIC Kanyadan Policy, and are there flexible payment options?

Premium payment frequency for the LIC Kanyadan Policy can be monthly, quarterly, half-yearly, or yearly. LIC offers flexible premium payment options like automatic debit from the bank account.

Are there any tax benefits associated with the LIC Kanyadan Policy for the policyholder?

Premiums paid qualify for tax deduction under Section 80C of the Income Tax Act. Maturity benefits are tax-free under Section 10 (10D).

In the event of the policyholder's demise, how does the policy ensure financial security for the daughter?

If the policyholder dies within the policy tenure, 10% of the Sum Assured is payable every year till 1 year before the maturity date.